Cagamas has been instrumental in developing liquidity to primary lenders in the housing market in Malaysia. It purchases housing loans, hire purchase and leasing debts, industrial property loans, credit card receivables, through raising funds by the issuance of debt securities such as bonds and sukuk. Mr Chung Chee Leong, CEO of Cagamas, walks us through Cagamas Berhad’s RM3.8 billion (USD1.2 billion) Islamic Medium Term Notes, a structure noted for its innovative properties.

Cagamas Berhad (“Cagamas”) successfully completed the issuance of RM3.8 billion (in nominal value) Islamic Medium Term Notes (IMTN) on 28 October 2013 in the form of sukuk commodity murabaha, pursuant to Cagamas’ RM40 billion.

Islamic/Conventional Medium Term Notes Programme (MTN). The proceeds of the issuance were utilised to fund the purchase of Islamic finance assets from the financial system.

The MTN Programme is rated AAA by RAM Rating Services Berhad (“RAM”) and Malaysian Rating Corporation Berhad (“MARC”), reflecting Cagamas’ systemically important position within the domestic capital markets, robust asset quality and strong capitalisation.

Amidst the challenging market environment, the transaction was announced on 16 October 2013 and the book opened in the afternoon trading session of the same day with an initial size of RM2.5 billion with an option to upsize. Robust demand saw the book approach a subscription rate of more than 3.2 times at close of trading session on 16 October 2013. This led to an upsized amount of RM3.8 billion, which represents the single largest Ringgit book-building exercise to date.

The RM3.8 billion book was closed at the end of the morning trading session on 17 October 2013. Cagamas’ strong credit and the overwhelming support of investors resulted in most of the tranches being priced at the low end of the price guidance. The notably accelerated 1-day duration of the book-building exercise serves as a testament to investors’ high confidence with Cagamas’ credit and continued strong appetite from investors for issuers with sound credit fundamentals such as Cagamas.

The deal, which marked the largest issuance to date by Cagamas since its incorporation in 1986 attracted interest from a diverse group of domestic and international investors, with a strong order book of approximately RM8.0 billion comprising more than 50 investors.

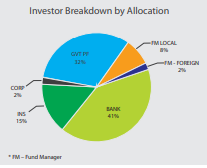

The RM3.8 billion issuance size consists of a total of eight (8) tranches as shown in Table 5. The investors’ breakdown is shown in Diagram 1.

Who are Cagamas?

Cagamas Berhad (Cagamas), the National Mortgage Corporation, was established in 1986 to promote the broader spread of house ownership and growth of the secondary mortgage market in Malaysia. It issues debt securities to finance the purchase of housing loans from financial institutions and non-financial institutions. The provision of liquidity to financial institutions at a reasonable cost to the primary lenders of housing loans encourages further expansion of financing for houses at an affordable cost. The Cagamas model is well regarded by the World Bank as a successful secondary mortgage liquidity facility. Cagamas is the leading issuer of AAA debt securities in Malaysia as well as one of the top sukuk issuers in the world.

| Table 5 : Cagamas’ RM3.8 billion Sukuk Commodity Murabaha | |||

| Tranche | Issue Size (Nominal Value) (RM million) | Tenure (Year) | Profit Rate (%) |

| 1 | 360 | 1 | 3.40 |

| 2 | 275 | 3 | 3.65 |

| 3 | 330 | 5 | 3.95 |

| 4 | 390 | 7 | 4.15 |

| 5 | 645 | 10 | 4.30 |

| 6 | 450 | 12 | 4.55 |

| 7 | 675 | 15 | 4.75 |

| 8 | 675 | 20 | 5.00 |

| Total | 3,800 |

In addition to being successfully priced at competitive levels, the notable “firsts”, which deal achieved includes:

- Single largest issuance in Cagamas’ 26-year history;

- Single largest issuance from Cagamas via a book-building exercise;

- Single largest AAA-rated sukuk Commodity Murabaha issuance for the year; and

- Single largest Ringgit book-building exercise done for the year.

Background of the sukuk commodity murabaha

Cagamas obtained approval for its RM60 billion MTN and CP programme in June 2007. The programme was available to Cagamas under both Islamic and conventional and was the largest funding programme established not only in Malaysia but also in Asia.

The programme allowed Cagamas to utilise multiple Shari’a concepts: murabaha, ijara, musharaka, mudaraba (profit-sharing partnership) and istina’a (order sale).

One month after the approval, Cagamas entered into a memorandum of participation with Bursa Malaysia’s Bursa Suq Al-Sila, enabling Cagamas to use this platform for future sukuk murabaha issuances. Since then, Cagamas has moved towards issuing sukuk murabaha in line with global Shari’a standards.

In August 2008, Cagamas issued its first sukuk murabaha amounting to RM2 billion under the IMTN programme, representing the largest domestic deal for 2008. The sukuk were offered in multiple tranches representing the different tenures of one, two, three, five, seven, ten, twelve, fifteen and twenty years. In addition, Cagamas also issued RM540 million of one, two, three, five, seven, twelve and twenty-year conventional MTNs at the same time. Diagram 3 illustrates the mechanics of Cagamas’ sukuk Commodity Murabaha.

Description of the Sukuk Structure

(1) Cagamas, as Agent (“Wakeel”) of Sukuk Investors, purchases commodity (Crude Palm Oil) on a spot basis from Vendor A at Purchase Price.

(2) Cagamas (“Issuer”) issues Sukuk to Investors to evidence their ownership of the commodity.

(3) & (4) Proceeds received from the Sukuk Investors are used or deemed to have been used to pay the purchase price of the commodity.

(5) Sukuk Trustee, on behalf of the Sukuk Investors, sells the commodity to Cagamas at Sale Price repayable on a deferred payment basis.

(6) & (7) Cagamas sells the commodity to Vendor B on a spot basis at Selling Price. Proceeds received from the sale of commodity are used to fund Cagamas’ Islamic operations.

(8) & (9) Cagamas makes periodic profit distribution (e.g. semi-annual basis) to the Sukuk Trustee on account of its obligation to pay the Deferred Sale Price Upon maturity, Cagamas will pay the Sukuk Trustee the principal to redeem the sukuk.

In August 2010, Cagamas issued a variable-rate sukuk murabaha for RM230 million. The sizeable AAA-rated variable-rate sukuk issuance provided a benchmark in the market and expanded the fixed-income product suite for investors. At the time of the issuance, it was the largest variable-rate ringgit sukuk in the market. Since the first issuance, Cagamas has continued to issue variable rate sukuk.

| Table 6: Conventional and Islamic IMTN issued in August 2008 | |||

| Tenure Years | Conventional (RM million) | Islamic (RM million) | Coupon/Yield (%) |

| 1 | 200 | 320 | 4.05 |

| 2 | 25 | 95 | 4.25 |

| 3 | 30 | 105 | 4.60 |

| 5 | 70 | 215 | 5.00 |

| 7 | 60 | 215 | 5.30 |

| 10 | 0 | 155 | 5.80 |

| 12 | 65 | 235 | 6.00 |

| 15 | 0 | 305 | 6.35 |

| 20 | 90 | 370 | 6.50 |

| 540 | 2,015 |

Variable-rate sukuk Murabaha is an Islamic instrument with an adjustable profit rate pegged to the KLIBOR. With the adjustable profit rate feature, Cagamas is required to undertake commodity murabaha transactions at each profit payment. The new commodity transaction is to facilitate the new deferred sale price for the next profit payment. Diagram 4 illustrates the variable-rate sukuk commodity murabaha structure at each profit payment before maturity.

At each profit payment date (before maturity),

1. Cagamas (as Agent) receives the Deferred Sale Price (Principal + Profit). The Profit portion will be distributed to the sukuk investors and when there is a request for a new commodity murabaha trading,

2. Cagamas (as Agent) will use the Principal portion to purchase new commodity from Vendor A on a spot basis; and

3. Subsequently sell the commodity to Cagamas (as Purchaser) at a new Deferred Sale Price

4. Cagamas will then sell the commodity to the Vendor B on a spot basis

Cagamas has since continued to issue sukuk commodity murabaha under the programme. As at 30 November 2013, Cagamas has RM12.01 billion sukuk commodity murabaha with different tenures outstanding.

Innovation

The sukuk murabaha issuance brought two different innovations in the market. First, it was the first large-scale sukuk commodity murabaha for the Malaysian market using the Bursa Suq Al-Sila platform. At the time of Cagamas’ issuance, sukuk murabaha was not as widely used in the Malaysian market as compared to BBA sukuk. Thus, Cagamas encouraged the market to move towards primary market structuring that meet global Shari’a standards. Since then, a substantial number of sukuk murabaha have been issued in the Malaysian market. Second, the transaction introduced a new underlying asset for the global commodity murabaha market: Crude Palm Oil. Prior to this, commodity murabaha transactions normally would use non-precious metals purchased from the London Metal Exchange or international commodities brokers.

ISFIRE Comment

It is accepted that Malaysia has the most comprehensive Islamic financial market in the world. No other country can boast of such a mature legal and regulatory infrastructure that accounts for all the various aspects of the Islamic financial industry. This is not to say that improvements cannot be made, but like any other sector, it is constantly evolving. The recent promulgation of the Islamic Finance Services Act shows a country assured, positive and committed to the industry. A stated aim of Cagamas is to develop the Islamic finance industry, which may perplex some. Cagamas’ model embraces the usage of bonds to buy household mortgages. But in the evolution of Islamic finance in any country which has entrenched within a strong and productive interest-based financial sector, removing oneself completely would be a costly mistake for the country. Instead, important domestic organisations such as Cagamas can be a bulwark through which Islamic financial principles and practices can spread through the system. One can see the importance of Freddie Mac and Fannie Mae in the USA and similarly, Cagamas can play an instrumental role. Malaysia’s own economic progress has been overshadowed by the spectacular success of China. It cannot be denied that Malaysia itself has been far more cautious in paving its own way forward, but this measured approach still has the trappings of economic change. Turning from an agrarian economy to a service-based one will lead to a change in culture and habitation. More ambitious individuals looking for prosperity within the city will inevitably lead to more nuclear families and individual habitation. This puts pressure on housing demand and stock leading to an increase in house prices. Therefore, linking investors with bank and then to buyer carefully recalibrates prices as banks will have the liquidity from which to deploy funds so making it cheaper and more price sensitive for buyers. The Cagamas sukuk helps to achieve this and indirectly allows Islamic _nance to support economic growth.