The phenomenon of philanthropy is dynamic and complex involving different values and activities brought together to produce such a system. Waqf is one example of Islamic philanthropies. Trust, emanating from the belief system in Islam, as social capital has remained as an important working mechanism for waqf to work efficiently.

The static perpetuity, rigidity, and mismanagement of awqaf with the decline in trust between individuals, and between individuals and institutions in the recent past had created inefficiencies and ineffectiveness. However, mismanagement and moral hazard can be avoided by a good governance system based on religion with the enhanced notion of trust among all stakeholders of a waqf. For this, in addition to the form-oriented understanding of fiqh, ethical norms of Islam should reemerge to provide substance, such as through ethics, in making sure that the high objectives of Shari’a are achieved through activities of waqf based on the articulation of trust and good governance.

ALTRUISM – CONCEPT AND REALITY

Altruism, as a universal concept, refers to the willingness to do things which benefits other people as part of human nature. In other words, altruism refers to selfless acts that put others welfare before one’s own. If the ultimate goal of benefiting another is to increase their welfare, then the motivation is altruistic. If the ultimate goal is to increase one’s own welfare, then the motivation is egoistic.

A FRAMEWORK OF WAQF MANAGEMENT

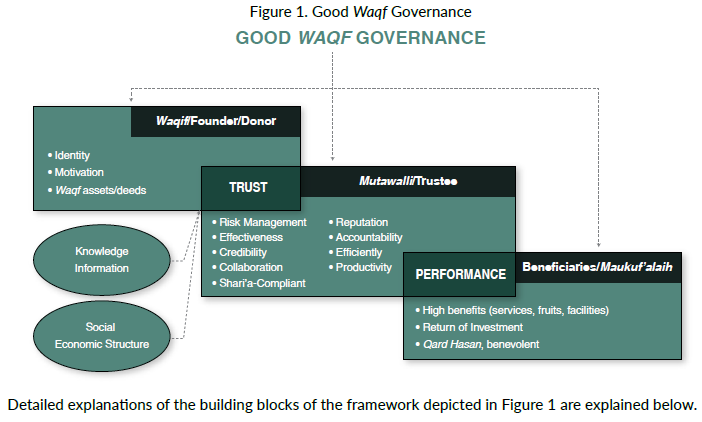

Good waqf governance is purposed as an integrated system (figure 1). Every element in this system is supposed to support each other in order to achieve efficient waqf management

Detailed explanations of the building blocks of the framework depicted in Figure 1 are explained below.

Trust as Social Capital and Transparency

Trust is recently considered as a social capital and also recognised as an important aspect of facilitating financial and economic transactions by reducing the transaction costs. In particular, due to the charitable nature of the waqf system, trust remains key to achieving the ultimate goal in the voluntary sectors. Trust between individuals, and between individuals and institutions is developed according to a general framework of the larger environment, including ethics and religion. Thus, religious values can help develop and perpetuate trust in a society, which then can develop into social capital.

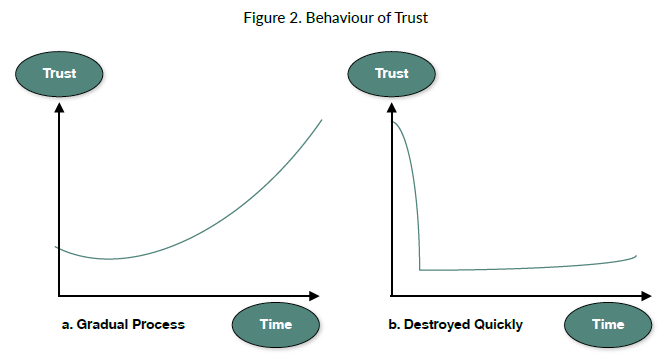

Akkermans states that when the modeller maps trust in a stocks-and-flows format, it makes sense that trust is an accumulation that grows slowly over time as seen in Figure 2. Interestingly, during the initial stages of a relationship, trust is more easily depleted than grown.

Higher trust levels lead to lower costs. Trust is an important indicator of customer satisfaction within the Islamic financial institutions in general, and waqf institution in particular. Understanding the dynamics of trust in Islamic finance such as waqf seems pivotal for determining the ways to create managerial actions leading to adequate performances of waqf institutions. Creating a framework for understanding the dynamics of trust in an institution and how these influence the policy scheme is essential.

Trust is produced through reputation acquired on the basis of consistent behaviour in terms of value and product of human actions over time. Trust as social capital creates efficiency and effectiveness thereby reducing transaction costs. If people can trust the other party, there is no need for additional energy and time to calculate the outcomes of the process due to non trustable nature of the parties. There is then simple administrative work without the need for extensive contracts and guarantees. Thus, trust as a social capital further facilitates transparency and accountability, which are prerequisites to the success of the trust/endowment fund management. Lack of transparency results in non-trustable charitable organisations and hence produces an outcome where institutions are not trusted.

This lack of transparency may also contribute to the attitude that directs donations are better, as compared to donations to an institution. For example, in Turkey, nearly 87% of donations are direct donations. This bypasses philanthropic organisation and thereby excludes aid to the neighbourhood in which the donor resides. This model of giving stagnates capacity building.

The effective collaboration among parties involve a great deal of openness and hence transparency needs trust. Transparency results in well-informed individuals and stakeholders who want to know what benefits they bring to the community, implying the formation of trust between different stakeholders in the society.

The real cost of lack of trust is the inability to share information openly. Therefore, the greater the trust among the parties, the higher their openness towards each other and the greater the focus on getting the work done. From a system dynamics perspective, trust and transparency are causally linked into a reinforcing cycle, which may operate as either a virtuous or a vicious cycle, depending on what directions things are moving.

If a non-profit organisation, charity, waqf, trust fund or endowment fund is not transparent in its dealings with the sources and uses of fund, the donors will not trust them. Consequently, it will be difficult for them to donate their money to those institutions. Hence, building mutual trust and openness takes time, as Akkermans states trust “comes by foot but leaves on horseback.”

There is another asymmetry to take into account in the development of trust, namely the differences between the processes of building trust versus destroying it (creating distrust). Empirical and theoretical analyses of trust are consistent in pointing out that while building trust is a gradual process, it can be destroyed quickly by a single event or a minor inconsistency in the trustee’s behaviour.

Dynamics of Trust

Trust is dynamic by nature; and therefore, some researchers have endeavoured to classify the factors that influence how trust develops or changes over time, how it relates to the social processes, and how it links to the organisational and inter-organisational relationships.

Trust is derived from various dimensions that are multi-aspects, cross-cultural, and range at different times. Thus, trust encompasses a full range of social sciences from the economic models of transaction costs and negotiation to sociological theories of group and inter-organisational behaviour to psychological and culture-based models of interpersonal interactions.

The enhancement and maintenance of trust have been identified as an important element in human relationships, whether at the interpersonal, business, or organisational level. These are challenging questions for researchers and practitioners. An increasing number of multidisciplinary researchers in the fields of philanthropy, endowment fund policy and trust firm strategy shows that the performance of non-profit organisations cannot be viewed as an isolated phenomenon but has to be analysed as a part of a larger system. These fields inevitably deal with trust management. Trust is also described as a mental strategy that reduces the complexity of our environment and that allows us to make decisions even though their outcomes may potentially be harmful. These dynamic approaches to trust typically involve some form of learning or knowledge accumulation, or change as an important part of the trust dynamics.

In transaction cost analyses, varying levels of trusts or hazards resulting from untrustworthiness influence the structure of inter-organisational relationships. Higher trust levels lead to lower costs resulting from the need to protect against opportunism. Political approaches and institutional analyses have also shown that trust is an important factor in governance mechanisms across organisations. But these structural approaches do not account for how trust develops.

Collaboration and Knowledge Create Trust

Ostrom, as the Nobel laureate, emphasises that “Learning to trust others is central to cooperation”.4 Hence, trust is considered as a fundamental factor in cooperation among economic actors and institution-building processes. However, in order to develop trust, knowledge and information on social and economic structures is essential to reduce uncertainty and reduce transaction cost. In other words, trust is difficult to gain without transparent information. As several studies have demonstrated, collaboration and knowledge are important factors, which influence the decision-making process. Collaboration and knowledge sharing can solve problems of trust, conflict, and risk among different parties. These are largely matters of perception and beliefs, about other participants in a network that can influence interactions and decision-making.

Mutual understanding and collaboration in inter-organisation will create a trust that is related to transaction costs.6 Trust has consistently been found to be an essential feature in inter-organisational knowledge-sharing relationships. The collaboration of cross-organisational sharing of knowledge inevitably raises risks and furthermore brings potential conflicts. The strength and value of committed resources, including knowledge, influence those risks. Some level of trust is both an initial condition for the formation of relationships as well as a result of positive interactions over time.

Regarding the third sector management (trust/charity/endowment/waqf fund), the openness in sharing information between the trustee and donor or nazir/mutawalli and waqif/founder is crucial for flexibility. Openness, or transparency, requires a high level of trust among parties. Trust and transparency form a reinforcing loop, with either good or bad non-profit organisational performance as the link between them. Joint hard work, mapping out how things work out between parties, and an increased understanding of the other side, can over time lead to more trust. A long relationship among parties is an important thing in building trustworthy behaviour. Each party has to pass some kind of a trust barrier, for if there were mistakes in the beginning, relations would end. This also makes it clear that people who work well together manage to do so for considerable amounts of time. In the voluntary sector context, once donors trust a charity organisation, they do not give their money to other organisations. The credibility of a non-profit organisation is considered an important thing by donors. Credibility is not an easy thing to achieve, as it is built through expertise and trustworthiness.

Performance of Waqf Management

The inferior performance of an institution gives both sides all the more reason to distrust each other, which leads to less openness, more inferior performance and even less trust. However, reversing a vicious cycle into a virtuous one is always difficult in a business setting and especially so when such “soft” and cultural issues such as trust are involved. But, it can be done.

Trust and Risk

There is a close connection between trust and risk. If there is no risk, there is no need for trust and vice versa. However, “the willingness to take risks may be one of the few characteristics common to all trust situations”. Hence, trust can be seen as a mental mechanism that helps reduce complexity and uncertainty in order to foster development or maintenance of relationships even under risky conditions.

Indeed, the absence of risk indicates confidence, i.e. certainty in positive outcomes. On the other hand, risk such as unpredictable future events, require trust to overcome uncertainty and enable constructive interpersonal relations. In terms of non-profit organisations, the ability to manage risk becomes a pivota matter for being considered by donors. The more professional the investment manager is in managing the risk of waqf fund portfolios, the more beneficial it can be for achieving the goals of non-profit organisations and waqf institutions.

There are other dilemmas in the management of waqf institutions in order to create a waqf that has a huge impact to society, as a huge amount of money is required with a centralised way of mobilising waqf fund. Based on past experiences, the evidence shows that the centralisation of waqf institutions have created inefficiency and destruction of waqf assets. Mobilising a huge fund is only possible through the centralisation of waqf institutions by the government. On the other hand, it has been recognised that the government is a bad manager for the third sector.

The ability of small waqf institutions to gather waqf fund is quite small and even if there are a lot of waqf institutions established, it is still difficult to reach the scale of economy. In addition, many waqf institutions have their own objectives and beneficiaries portfolio which weakens their ability to mobilise a huge fund. However, the scale of the economy is very important to reduce costs, be competitive and create significant impact on society.

CONCLUSION: INTEGRATING TRUST INTO WAQF MANAGEMENT

Considering the historical experience in the Muslim world, one sees the impact of trust perpetuating in the Islamic civilisation. The very title given to Prophet Muhammad was Muhammad-ul Amin (the trustable Muhammad), which is considered as the cornerstone of the Muslim self.

The contemporary economy has two major issues: welfare and development needs in the Muslim society; and the mistrust that marks the market economy and the behavioural norms of individuals. The first problem can be alleviated by the regeneration of the waqf system in the Muslim world in the case where states have failed. This role is historically played well by the waqf, which could be repeated. However, trust in some Muslim societies and communities is terribly low; as individuals do not trust each other nor do they trust the institutions and the state. Thus, the integration of trust in waqf management in the welfare system can be alleviated in society, which rationalises the importance of trust as social capital.

Since transparency, reputation, accountability, credibility, good collaboration, productivity, risk management and Shari’a-compliance are the key-words for the sustainability of the waqf management, endogenising trust through the values and norms of Islamic economy can help develop an optimal outcome.