Collection of payments through technology-based vehicles like crowdfunding platforms have now allowed product developers to structure innovative financial solutions that were not possible before the current era of Financial Technology (FinTech). Processing of micropayments (even smaller payments called nano-payments) with affordable transaction costs offers an opportunity to achieve economies of scale by aggregating small/micropayments for a large number of contributors. This has relevance to applying some innovative ideas to the collection and disbursement of Zakat and even more to the management of Zakat funds.

THE IDEA

Every individual Zakat payer has to pay an annual amount as Zakat to fulfil their religious duty. These are small amounts for a vast majority of Zakat payers but may in fact be prohibitively large obligations for the mass affluent and the high and ultra-high net-worth individuals (HNWIs and UHNWIs). For example, an individual with the lifecycle income of US$1 million, and a lifecycle savings of US$200,000, may be obliged to annually pay US$140 as Zakat. This is with the assumption that the individual consumes 80% of their lifecycle income and that the lifecycle is 35 years of productive economic life.

For a billionaire, on the other hand, the minimum annual Zakat obligation could be US$25 million. True that Zakat is a religious obligation and the rightly-motivated wealthy people will only be pleased to contribute large sums of money in this respect. However, they must appreciate any help in discharging a religious duty of such importance.

Let us not focus on the HNWIs and UHNWIs for the time being. After introducing the principle of acceleration of Zakat, we shall revert to it.

ACCELERATION OF ZAKAT PAYMENTS

Zakat is an annual contribution by the Muslims who possess the minimum threshold of assets1. The question arises if it is permissible to pay Zakat ahead of the time when it becomes due. The juristic opinions vary. Although it is permissible to pay Zakat in advance, it is preferred to pay it when it becomes due.

The principle of acceleration suggests that it is permissible to pay Zakat in advance if it can be established that there are certain benefits associated with the acceleration, which cannot otherwise be realised. Thus the principle behind acceleration of Zakat demands a compelling need like meeting financial requirements in the wake of famine, war or any other catastrophe. I believe that there should be no serious objection to accelerating Zakat for any number of years, if the following conditions are met:

- The Zakat obligor must pay Zakat in advance with an acknowledgement and commitment that any discrepancies (surplus or deficit) will be taken care of when the exact annual Zakat obligation is determined;

- The accelerated amount of Zakat will be considered on account, payable only when it becomes due with certainty of its amount;

- In case of investment of the accelerated amount of Zakat, the Zakat obligor must be aware of risk of loss of the invested amount and that they commit to pay their Zakat in subsequent years, with an additional contribution in case of partial or total loss; and

- The acceleration of Zakat results in some material benefits that were otherwise not possible.

ECONOMIES OF SCALE

If there are one million Zakat payers with minimum annual Zakat obligation of US$100, the aggregated annual amount of Zakat will be US$100 million. Assuming no change in income and wealth of this generation over a lifecycle of 35 years, their lifecycle Zakat obligation will be US$3.5 billion.

How can this amount be accelerated such that the individual Zakat payers are willing to contribute US$3,500 now rather than spread over 35 years? More importantly, why is there a need to do so?

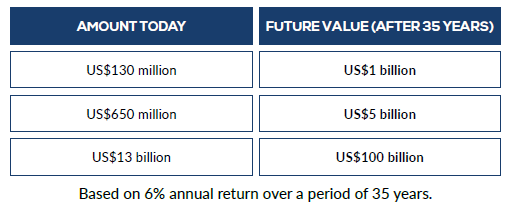

Let us answer the second question first. The table below is a direct and brief answer.

Applying the above formula, US$3.5 billion collected today will generate a future value of nearly US$27 billion, a mammoth total, which can not only be used for the welfare of the beneficiaries of Zakat but also be returned to the contributors or their nominated beneficiaries (children, relatives, etc.).

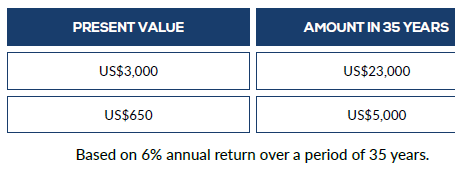

Now returning to the first question. There will be only a few who would like to pay US$3,500 in a lump-sum now rather than enjoying the facility of paying it annually over a period of 35 years. This is keeping aside the Shari’a complications. For someone to agree to accelerate Zakat payments the amount paid at present should be sufficiently less than the lifecycle Zakat obligations. Obviously, there are further Shari’a complications associated with assertion. Ignoring the Shari’a side for the time being, it is important that the Zakat payers are sufficiently incentivised to accelerate. The table below alludes to the required incentivization.

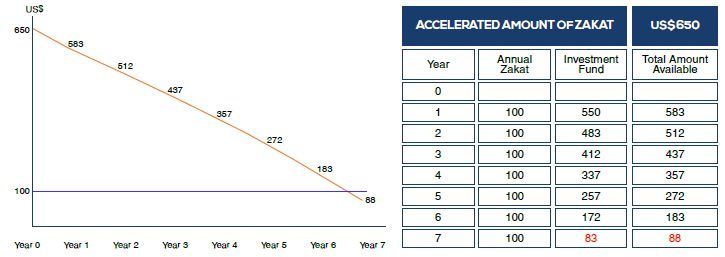

This means that US$650 paid today will generate a value of US$5,000 over a period of 35 years, if it is invested and the compound annual return is 6%. However, during this period the Zakat payer must meet their annual Zakat obligations. Assuming the annual Zakat obligations remain constant over the 35 years, an accelerated Zakat contribution of US$650 in Year 0 will last only for 7 years (see Figure below).

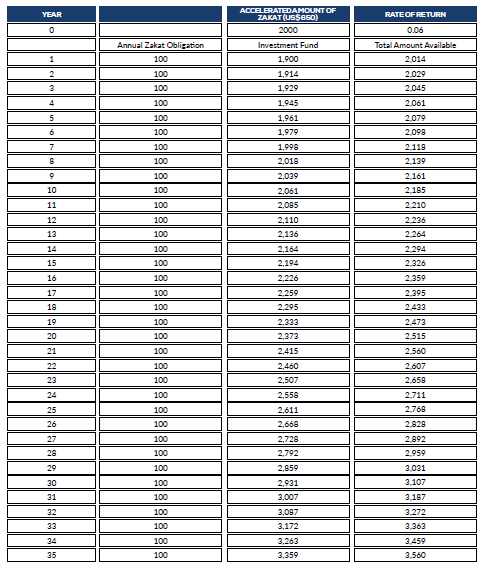

This implies that the accelerated amount of Zakat should be such that it allows annual Zakat obligations to be made in such a way that the invested funds keep on growing. We have simulated this with US$2,000 as the accelerated amount of Zakat paid in Year 0. This is produced below.

The above table is interesting, as the underlying model allows a Zakat payer to contributor US$2,000 as an accelerated amount of Zakat (which is less than their expected lifecycle Zakat obligation of US$3,500). During the 35 years period, the Zakat payer not only meets their annual Zakat obligations but also ends up receiving return on the excess amount invested.

The above is just a pause for thought for those who are involved in Zakat collection and distribution. The author intends to extend the analysis to write a more comprehensive note in a subsequent issue of ISFIRE.