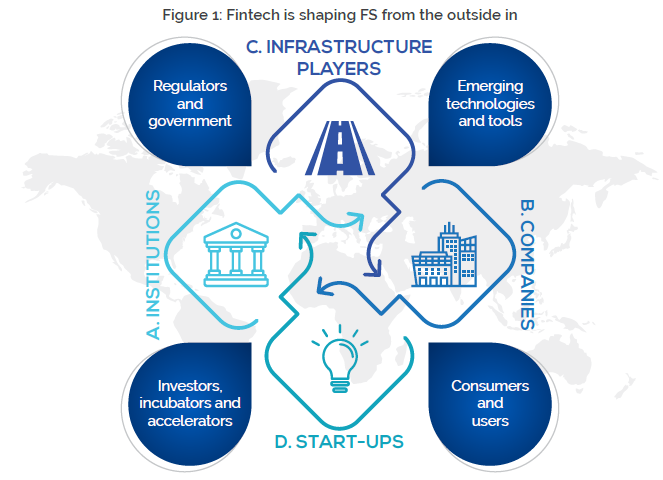

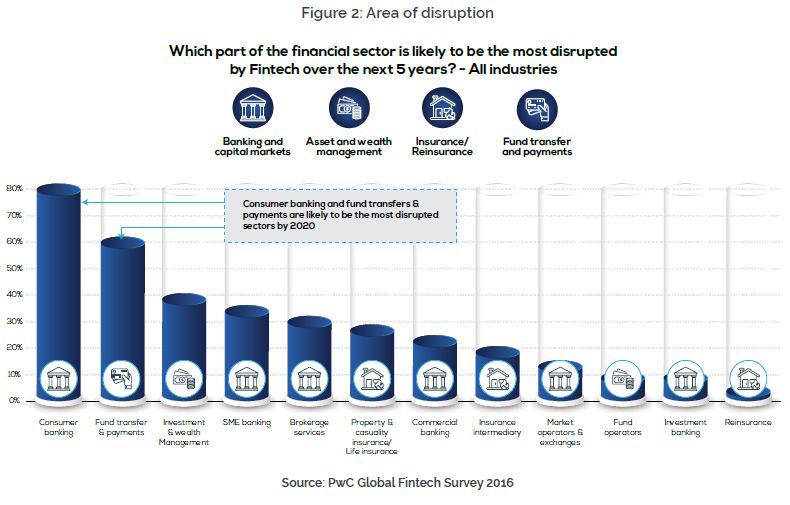

If technology-driven financial innovation is set to lead the fundamental transformations in economic behaviour and growth, resorting to novel and adaptive marketplaces becomes a crucial component. Figure 1 below highlights those segments of the financial sector that are facing financial disruption. The raison d’être for enhanced and affordable financial flexibilities is the possibility of transacting without intermediation.

Fintech and digital technology could allow Islamic finance to reach out further and quicker (and possibly cheaper) without having to build a physical presence and distribution channels. These are some of the reasons for IFIs to adopt Fintech aggressively.

What is crucially noteworthy is the fact that the Fintech-driven, new-age finance is in actuality, an application of Islamic Finance 101 i.e. resorting to Mudaraba and Musharaka financing. Driven by the Shari’a rules, the Islamic financial system is based on Al-Bai’ (risk sharing) based financing. The epistemological roots of Al-bai’ (risk sharing) as the essence of Islamic Finance can be traced from chapter 2, verse 275 of Al-Quran. In a typical risk-sharing arrangement such as equity finance, parties share the risk as well as the rewards of a contract. Assets are invested in remunerative trade and production activities. The return to assets is not known at the instance assets are invested, akin to Arrow-Debreu securities.

Moreover, based on Quran and Sunnah, the Islamic financial system is necessarily supported by a complementary institutional framework that further assures better growth and stability. A number of old and new studies have scientifically shown the efficacy of risk-sharing-based Islamic/halal finance3. Consequently, the utilisation of Islamic finance could create a valuable opportunity to help meet its economic diversification and new dimensional financial inclusion via the One Belt One Road (OBOR) initiative and the China-Pakistan Economic Corridor (CPEC). This could be framed and branded as a ‘New Age Fintech or Islamic/Halal Finance; that is oriented towards entrepreneurship, financial inclusion, research, technology and innovation.

The ‘magic sauce’ could be to rely on innovative capacities of pure experts via structural support to unbundle and re-bundle a SMART and automated version of Shari’a finance that is cost, user and efficiency friendly. The same could be linked to serve the UN’s Sustainable Development Goals through new Age Islamic finance. For example, the adoption of Blockchain and Mobile Technology in Oman’s infant Islamic financial industry could help provide and promote Smart Islamic Banking Contracts (SIBCs) solutions (adjustable to fine-tune with specificities of regions). It will also provide a smart data supply for customer risk profiling and investment risks. Concluding a transparent contract to finance Shari’a-based deposits/products could then be done through a mobile app, as the financial institutions would be smartly equipped to assess risks.

Until now, Islamic/halal finance is usually constrained by the problematic nature of gold and silver, which are difficult to transfer and hard to verify when tucked away in someone’s vault. However, with a digital alternative, like the novel application of “Bitcoins”, instantaneous real-time direct peer-to-peer payments and settlement of value happen together as a single event. Bitcoins along with SIBCs could be an attractive mode to ease international trade deals for Islamic banks via automated payment schemes.The value and mechanics of the same could be fully chiseled and endorsed by WTO, World Bank, IFSB, CIBAFI and AAOIFI. Islamic Wealth/Asset Management could be served through marketplaces, driven by Robo- Advisory/AI and Numerie. This would also transform Sukuk for public-private partnership, financings institutional investments, Crowdfunding, Angle investment, and P2P financings while promoting the same as Islamic finance 101.

Nevertheless, few crucial constraints need to be addressed. The first is the complementary and supplementary regulatory framework for the New age Fintech Islamic/ halal finance. This has to go in line with cementing public awareness and education about the usage and benefits of Islamic finance. Bigger problem, however, is the lack of a level playing field between Islamic and conventional finance. There is an edifice of structural, institutional, administrative, fiscal, monetary and legal means favoring debt finance.

Second, relates to well-trained human capital both in Islamic finance and Fintech. IFIs already lacks long-term, low-risk/Shari’a-compliant liquid instruments/product and service development. This imposes a liquidity and hedging constraint on the ability of IFI to compete. As a result, the Islamic financial industry is forced to replicate conventional instruments; polluting its perception. While Fintech would tend to smartly address the problem, the required intellect, skill and hence service creation needs focus.

Consequently, to implement the recommended new-age brand of Islamic finance and to reap the desired economic benefits, the above constraints need to be addressed through a cohesive and institutional strategy as a national priority. This could be sharply attuned for economic diversification with One Belt One Road (OBOR) initiative and China Pakistan Economic Corridor (CPEC).