With the humble beginning in the early 70s, Islamic finance has now become a trillion-dollar industry with its footprint across many non-Islamic jurisprudences as well. While Islamic finance witnessed a significantly lower growth between 2017 and 2018 as compared to previous years, the industry still recorded continuous improvement for the third consecutive year. The industry is estimated to be worth USD2.19 trillion as of the second quarter of 2018.

Given the longstanding criticism and the question mark on the value proposition of Islamic finance, it is high time that the industry positions itself as something of value to society. In other words, it should operate with a dual aim of maximisation of shareholders’ wealth and the fulfilment of Maqasid Al-Shari’a (objectives of Shari’a).

One of the ways of achieving the dual objective is to adopt practices that are more sustainable and promote real economic activities. The business models are evolving towards a more inclusive approach and the increasing interest in the “Triple Bottom Line” (TBL) framework.

THE TRIPLE BOTTOM LINE IS A SUSTAINABILITY FRAMEWORK THAT EXAMINES A COMPANY’S SOCIAL, ENVIRONMENTAL, AND ECONOMIC IMPACT. SO WHY RECALL IT NOW? AFTER ALL, SINCE THE 1990S, THE SUSTAINABILITY SECTOR HAS GROWN RAPIDLY, THOUGH AT AROUND $1 BILLION IN ANNUAL REVENUES GLOBALLY IT IS NO GIANT. STILL, MARKET RESEARCH SUGGESTS THAT FUTURE MARKETS FOR ITS PRODUCTS AND SERVICES COULD BE HUGE — WITH THE U.N. SUSTAINABLE DEVELOPMENT GOALS FORECAST TO GENERATE MARKET OPPORTUNITIES OF OVER USD12 TRILLION A YEAR BY 2030 (AND THAT’S CONSIDERED A CONSERVATIVE ESTIMATE).- JOHN ELKINGTON – HARVARD BUSINESS REVIEW (JUNE 25, 2018)

The increasing importance given to the more inclusive approach of TBL has led to a sudden surge in sustainability investing that is geared towards TBL’s investment philosophy.

The above figure depicts different screening criteria used for sustainability investing and the most common of them all is negative screening. The negative approach is similar to the Islamic screening criteria whereby the businesses/industries are screened based on the prohibition mentioned in the Quran and other primary or secondary sources. Some of the initiatives that are taken at the global level to make banking more sustainable are Principles for Responsible Banking from UNEP, Equator Principle etc.

However, the scope of sustainable form of finance is not limited to banking only. It has been incorporated in the investment strategies as well. The figures 5 and 6 shows the global sustainable investment universe and its distribution across five countries/regions. As we notice, most of these assets are in the developed region and therefore it provides a huge opportunity for the developing markets to tap into these investment prospects. Additionally, it opens up enormous avenues for Islamic finance to tap into the market, given the fact that total the SDG funding gap in OIC countries is close to USD1 trillion annually.

ROLE OF ISLAMIC FINANCE

Given the strong criticism that Islamic finance has received so far on doing enough for the community, the rise of sustainable investing and SDG funding gap of USD1 trillion (in OIC countries) are good opportunities for Islamic finance to support these goals and initiatives.

Given the fact that the banking and Sukuk industry is the dominant sector of the Islamic financial industry, I believe this is where Islamic finance can have huge contributions. For instance, there is growing interest among the investors in subscribing to green investments or bonds and this can be met by matching the USD1 trillion annual funding gap needed for clean energy alone. On a similar front, Islamic banks can address many pressing issues and add value to the overall community, such as;

Addressing global warming is no more an option; it has become a necessity to leave a healthier place for our next generation. The effects of global warming on the environment are devastating, as glaciers are shrinking, the water level is rising, and there are frequent floods & drought. The total cost of disasters, caused by ecosystem disruption and global warming, is estimated to be USD300 billion.

Another pressing issue, which the whole world is grappling with, be it the developing or developed market is affordable housing. About 330 million households are residing in second-grade accommodation. These numbers are expected to grow to 1.6 billion by 2025 and 2.5 billion by 2050.

The global inequality has been increasing for several decades now and nothing concrete has been done so far to address it. Thomas Piketty in his most celebrated work “Capital in the Twenty-First Century” argue that inequality is not a coincidence but an important element of capitalism and can only be addressed through government intervention. Although some countries have managed to pull people out from extreme poverty but the income gap continue to widen as the rich class amass an unparalleled amount of personal wealth.

Islamic finance in general, and banking & Sukuk in particular, can address this by playing an efficient intermediation function between the surplus sector and the deficit sector. Islamic banks can offer a deposit product and name it “Maqasid Driven Deposit (MDD)” and it should be made available to both retail and corporate customers. These products should be aimed at funding any of the identified sectors such as affordable housing, clean energy, SMEs etc.

Islamic finance contracts such as Mudharabah, Musharakah and Service Ijarah have an inbuilt design to address some of the major issues highlighted in Sustainable Development Goals (SDGs). As mentioned above, the annual SDG funding gap in OIC countries itself is USD1 trillion so deploying the funds is not an issue anymore.

Recently, Standard Chartered launched the first sustainable deposit product to European investors and there are no prizes for guessing that it was received with an overwhelming response. More recently, Standard Chartered Singapore announced that they will also offer the sustainable deposit and the money will be used for infrastructure financing in Asia, Africa and the Middle East.

THOUGHT LEADERSHIP IN ISLAMIC FINANCE

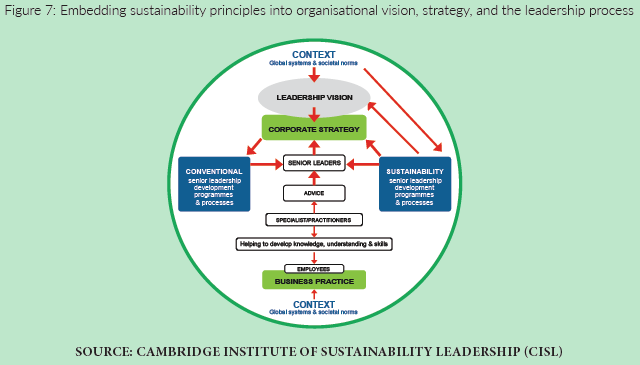

As the sustainability trend is still in its infancy, especially in the Islamic finance industry, we need a strong thought leadership. Thought leadership is very critical in pushing the case for the sustainability agenda as it allows the leaders to embed sustainability with long-term vision and align it with their strategic and operational objectives. However, the key to successful integration of sustainability agenda is the stakeholder engagement. In other words, we need sustainability-oriented leadership to bring effective change at an organisational level.

The below diagram (figure 7) depicts the proposed model of the Cambridge Institute of Sustainability Leadership (CISL) as to how the senior leadership can embed sustainability agenda into the long-term vision of an organisation.

Among the Islamic banks, CIMB Islamic has led the sustainable agenda and has made significant strides in achieving the ambitious targets. CIMB Islamic leadership argues that the sustainability agenda shall be adopted as a business strategy to contribute positively to society without compromising on the profits.

TASKS FOR STAKEHOLDERS

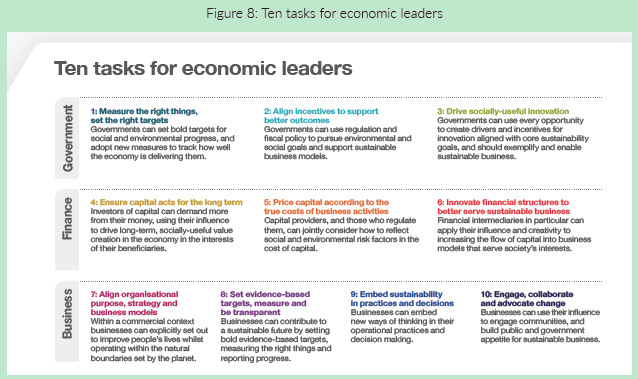

Sustainability leadership only at the organisational level would take very long to bring about change. To bring about effective change, key partnerships need to be formed. CISL spells out the role of key segments in supporting change.

“THE BANKS WHO ENGAGED IN SUSTAINABLE PRACTICES AND SUSTAINABLE FINANCE WERE ABLE TO GET BETTER TALENT, AND THEIR TALENT RETENTION WAS ALSO HIGHER. THEY HAD A BETTER SET OF CUSTOMERS WHO NATURALLY ARE BETTER CITIZENS. THE CUSTOMERS NOT ONLY COMPLIED WITH THE BEST ENVIRONMENTAL PRACTICES, BUT THEY PROVED TO BE BETTER OBLIGORS. THIS DROVE HOME THE POINT THAT INCREASING CUSTOMER QUALITY DRIVES FINANCIAL PERFORMANCE AND DELIVERS RESULTS TO SHAREHOLDERS.” –RAFE HANEEF, CEO, CIMB ISLAMIC BANK”

In the above figure, CISL segregates the whole sustainability ecosystem into three key segments: Government, Finance & Business. In each segment, it outlines the key tasks that need to be undertaken.

CONCLUSION

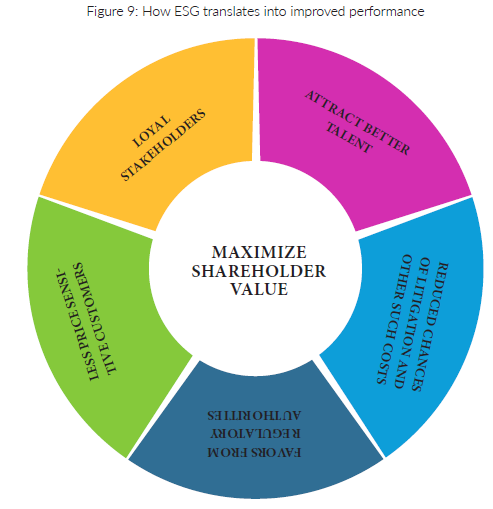

The idea of bringing sustainability in Islamic finance has two major advantages. First, it addresses the long-standing criticism of cloning conventional products and providing no additional value to what conventional form of intermediation is doing for ages. Second, there is not only anecdotal evidence but recent empirical and scholarly works also point to the fact that combining Islamic and sustainability criteria is a more rewarding strategy in terms of performance than Islamic or sustainability investing alone. However, as mentioned above, to bring these changes we need thought leadership or more specifically sustainability leadership to drive these initiatives. Moreover, we need key partnerships among economic leaders to provide strong incentive structures for the market participants to engage in more sustainable practices. As a start, Islamic banks can take cue from Standard Chartered and start offering deposit & financing products aimed at sectors that is linked with real economy and add value to the society & community.