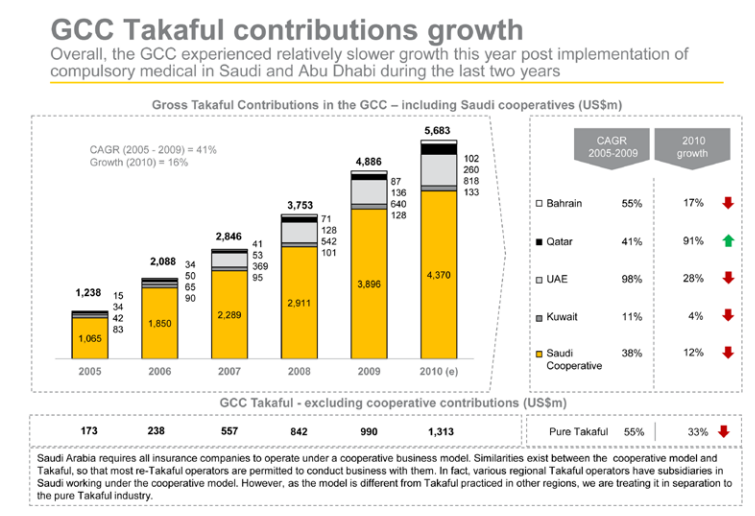

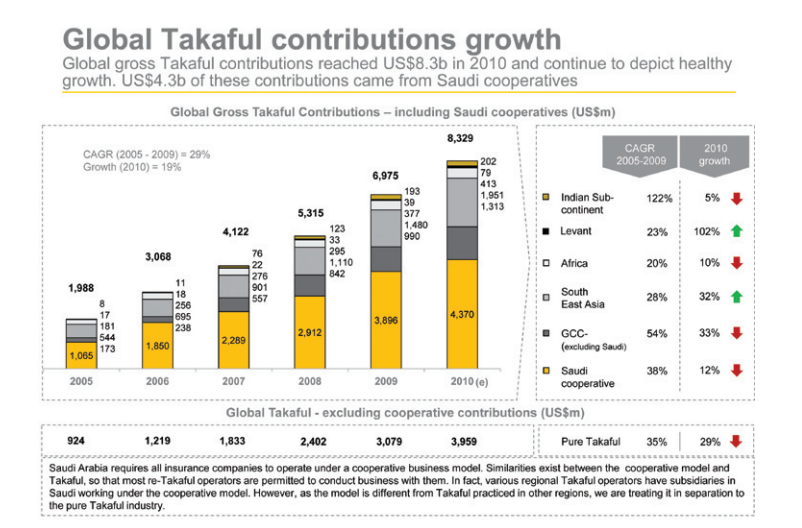

The GCC has been a popular market for takaful in the last few years due to the support of governments and the backing of regulators. The latest report from Ernst & Young shows the vibrancy of the GCC market in terms of contributions; however, this growth is slowing down, achieving less impressive rates as witnessed in the previous 7 years. The overall GCC market growth fell to 16% in 2010 compared to 41% CAGR (2005-2009) with Saudi Arabia accounting for 50% of the total USD8.3 bn. The trend is symptomatic of the global takaful industry in which growth in the industry has declined from an average 25% to 12% in 2011.

The GCC region still holds the highest number of takaful operators – 77 companies – but registered relatively low average contributions of USD63.5 million in 2010. This is poor when compared to the Malaysian takaful industry which registers contributions of USD115.8 million even though there are only 14 operators. In addition, the return on equity for GCC based- companies remain below average as compared to their conventional counterparts. The picture is one of stalled growth as opposed to dynamic growth but the horizon looks bright. An established takaful infrastructure, as the GCC can boast, provides the platform from which the industry can grow.

Exploring new lines of business

Opportunities for the market to grow abound. There is an underpenetrated life insurance market in the GCC and immense potential for family takaful products. Increasing awareness of financial planning and the protection of wealth creates a burgeoning pool of potential customers. Though the GCC family takaful share is still insignificant at 5% of total contributions, studies show that this market is growing steadily. More needs to be done to create a product portfolio that meets the desires of this growing population.

Consequently, there is optimism that the industry can rebound from its stagnancy. According to Alpen GCC Insurance Report 2011, life insurance density will grow at a CAGR of 22.2 percent (2011-2015) increasing to USD113.5 million from USD50.8 million. Increasing per capita income and favourable demographics are key contributory factors to this precipitous ascent. The region has a large young, working population with approximately 70 per cent in the 15-64 years bracket. Moreover, according to World Bank forecasts, the total population of the GCC will grow by an average of 2.4 per cent per year in the next 5 years taking it to 45.6 million by 2015. This seems promising for the takaful and the overall insurance market. As this young population in the region matures, the demand for takaful products should increase.

The Alpen report noted that family takaful products will comprise a significant share of life insurance policies especially since awareness of takaful products and Shari’a compliance has been on the rise. Takaful operators have to consider creating pension policies and wealth management solutions that are Shari’a compliant, priced competitively and is sensitive to individual requirements. Other insurance products such as investment-linked and annuities product categories are underdeveloped and require more attention. Takaful solutions for corporates and SME remain weak but there is much potential for takaful companies to work in parallel with Islamic banks in the area of project financing and micro takaful solutions.

Innovation: the differentiating factor

Product Innovation: Takaful operators have realized that one size doesn’t fit all as far as product development is concerned. The emergence of new customer segments comprising of an informed population that have specific requirements and greater awareness of available products will require innovative approaches by takaful operations in building custom. This can be achieved by addressing the customer’s specific needs and preferences as well as building better corporate-client relationships through effective communication tools, such as customer profiling, comprehensive reports and regular updates on performance. Products need to be built around customer specifications, such as bundled protection coverage, travel insurance, credit, life insurance, female illness plans including covering specific diseases like breast cancer, and family plans that include critical illness cover, travel cover, and children protection. Subsequently, there is scope to create tailor-made plans.

Investment innovation: Innovation is also reaching investment strategies; takaful players are thinking ahead and starting to develop solutions for the rising number of risk-averse investors due to uncertain market conditions. A prime example is the creation of a dynamic principal equity growth strategy by FWU Group in conjunction with an international bank for takaful customers. The main benefit for the customer is that the new technology secures capital growth at maturity by locking in the highest net asset value (NAV) of the strategy measured on a monthly basis during the qualifying term of the investment. This product innovation is integral to FWU Group’s family takaful investment-linked plans.

Innovation for operational efficiency: Investing in technology to simplify the sales process and deliver high customer service standards is also becoming of paramount importance. Call centers, internet and mobile phone services can offer distinct advantages to elements of the sales process far above adopting a personal contact-only strategy. As the needs of wealth management and financial planning become more widespread throughout all customer segments, technological improvements that smooth the flow of information is expedient.

Expanding the Shari’a-compliant investment universe

A key challenge for takaful operators remains the lack of suitable Shari’a-compliant investment options, especially as the takaful sector’s growth rates and profitability is facing a downturn. The need for investment products with yields higher than cash is growing.

The Shari’a-compliant investment universe is slowly evolving and has expanded away from equity to new asset classes, including the Islamic money market, commodities, real estate and alternative investments. There has also has been significant growth in sukuk funds as investors are becoming more sophisticated in their asset allocation decisions, and are searching aggressively for higher returns. Consequently, assets of sukuk funds based in the Gulf grew to more than $500 million, a 31 percent increase in one year, according to Reuters calculations based on data from fund companies.

There has been a revival of the sukuk market in the Gulf, and issuance is anticipated to follow an upward trend. The growth in sukuk issued by Gulf countries surged in 2012 and reached $21.3 billion compared to $5.6 billion in 2011. While sukuk issuance has mainly been completed by the public sector, private companies have begun to issue Islamic bonds, including the $400 million sukuk announced in January 2011 by Majid Al Futtaim Holding, based in Dubai.

The increasing popularity of sukuk funds is also prompting major GCC banks to launch their own sukuk funds such as NBAD, HSBC, Al Hilal Bank and Rasmala Investment Bank.

Regulatory developments

Regulatory reform will be an ongoing process in these emerging markets and will need to be flexible to keep up with the massive growth that the industry is predicted to witness in the coming years, whether in premium volumes, complexity and sophistication of products or distribution channels. In the UAE, the Insurance Authority issued a circular in September 2011 to all insurance and takaful companies setting out guiding rules for their bancassurance business.

Another GCC regulatory development was witnessed in Saudi Arabia. SAMA, the Saudi Arabian Monetary Authority, had directed all operators to align with the cooperative insurance model by year-end 2011. Takaful operators had to adjust their internal accounting structures, remove the use of wakala and qard, and amend product terms and conditions. This shift away from the pure takaful model may have widescale effects on the industry especially since Saudi Arabia is the largest takaful market, globally.

Oman has recently opened up their takaful markets following government endorsement of Islamic banking in the country, the last Gulf state to do so. The Capital Market Authority (CMA) the national regulator has in principle issued Takaful licences to three companies. Only fully fledged takaful companies will be allowed to offer Shari’a-compliant products; Islamic windows for conventional insurance companies are not permitted in the Sultanate. The CMA has finalised the draft law which will go to the cabinet and then to the Ministry of Legal Affairs and other related institutions before it is issued.

While the new regulations are seen as a positive development, the increased variances in regulatory regimes across jurisdictions could make it difficult for takaful operators to function across regions. It may lead to confusion for customers and multinational insurers.

Towards consolidation

Recent political developments in the MENA region, triggered by the Arab Spring, are expected to create a favourable environment for Islamic finance in general: a prime example is the announcement of the interim head of Libya to incorporate Islamic finance in the post-Gaddafi era. This will result in opportunities for GCC operators to export their expertise and enter new markets, with a massive potential for cross-border expansion in high-potential markets such as Egypt, Morocco, Libya and Tunisia.

One of the major challenges for the GCC takaful market remains its fragmentation, with an increasing number of small local players competing against established conventional providers.

The market needs restructuring as it matures in order for takaful operators to benefit from economies of scale and large distribution networks. Takaful in the GCC is ripe for consolidation and many analysts predict more M&As. However, this is subject to other challenges, such as limited Islamic investment avenues, lack of re-takaful capacity, lack of standardization and shortage of qualified personnel, which seems to be particularly challenging in the case of the GCC.

Conclusion

Takaful will benefit further from the boom predicted for the GCC insurance industry. Its market share is set to grow as competition intensifies between takaful operators and their conventional counterparts. The increasing awareness and acceptance levels of the takaful concept and the business opportunities created by compulsory lines and corporate business are providing a sound foundation for the Islamic insurance to take a leap forward. However, recent deceleration in growth is a key indicator for takaful operators to rethink their strategies and deploy extensive efforts to ensure the sustainability of the Shari’a-compliant industry.