The growth of the Islamic finance industry will depend on the effectiveness of institutions in creating the right product that meets consumer demand and adheres to the Shari’a. However, the process of creating the right product is complex. Irshad Ahmad Aijaz breaks down the product development process and the issues that teams structuring Islamic finance products face.

The subject of product development is very broad as it incorporates a variety of aspects. A particular issue is that due to the sophisticated, innovative and complex products in conventional finance, Islamic finance practitioners are under pressure to not only create products that fulfil needs of Shari’a-sensitive investors but are also as competitive and efficient as the panoply of products in the conventional finance industry. Islamic financial institutions are commercial in nature and their intermediary role requires access to a range of products for managers to meet the demands of potential consumers. Irrespective of the complexity of the product, compliance to the guidelines and injunctions of Shari’a is a core principle and a basic feature of Islamic institutions that should be ensured in all situations. Failure to achieve this may result in reputation risk, jeopardizing the entire business of the Islamic financial institution.

The product development function plays a pivotal role in Islamic financial institutions. A bank with a good product development team can present workable and competitive solutions to the market. A product manager is expected to bridge the gaps between theoretical requirements and practical applications of a specific Islamic mode of financing in order to create effective products and successful business solutions. The success of the product cannot be measured on the basis of business or operational feasibility only; all factors important to the creation of an Islamic product should be considered so that a solution, acceptable from economic and Shari’a standpoints, can be presented to the beneficiaries. Therefore, it is expected that an Islamic financial product must be developed with an Islamic orientation and growth objectives in mind.

Aspects of the product development process

The classical product life cycle theory describes inception, growth, maturity and decline as four major parts of the life of a product. As compared to other phases of the life cycle of a product, the inception phase requires the most attention and scrutiny as the development of the product is done in this phase.

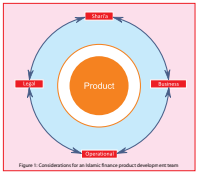

An Islamic financial product should be developed taking four major aspects into consideration in order to achieve a successful, practical and acceptable outcome. The product development team should consider all these prerequisites equally. These four aspects are:

a. Business

c. Shari’a

b. Legal

d. Operational

The success or failure of a product will result from one of these four points. We will consider each aspect separately.

Business: The product development team will have to consider the economic objectives of the Islamic financial institution in creating and distributing the product. They will also have to consider the economic consequences to the institution from both a profit and loss perspective. Attention has to be given to taxation, managerial incentives, product packaging, market focus, adverse and favourable selection, risk management, product administration and credit analysis. For business aspects of the product development process, excellent knowledge of the market, business affairs, prudential regulations, financial management, risks and customers’ demand would be necessary.

Legal: Consideration has to be given to regulatory requirements, general rules and regulations of business, and banking and financial laws in a country that affect the product directly or otherwise. The auditing, accounting and reporting requirements imposed by regulatory authorities, fall within the legal purview. The rules imposed by external agencies will place benchmarks on per-party exposure limits, debt burden ratio, collateral requirements, and other aspects that reduce the risk exposure of financial institutions.

The absence or ambiguity of a legal framework for Islamic products creates difficulties for a product manager in designing a product. If a contradictory situation emerges where a product structure that is developed according to Shari’a requirements is not accepted under the laws of the land, then the status of such a product becomes questionable. We see this problem in those legal systems where banks are not allowed to trade at all thereby causing problems for the Islamic banks that have to execute trade agreements with its customer. Bank ownership of assets such as houses is rarely allowed. Parallel documentation is therefore critical but needs the attention of scholars to resolve the obvious paradox.

Shari’a: After determining the business needs and finding an appropriate mode of financing, the product manager will have to assess the possibility of mismatches between the

business and Shari’a requirements. One of the key concerns is whether, operationally, the product is Shari’a compliant and maintains Shari’a compliance. A product should be developed through discussions between the bankers and the Shari’a scholars. In the creation of the product, the use of controversial rulings for developing a product can attract a lot of criticism and create difficulties for Islamic institutions. Nevertheless, once the structure and the agreements underpinning the product have been approved, the product can be offered to customers and concerned departments of financial institutions should undertake an ex-post audit of the product. In the creation of Islamic products, there is extensive use of ancillary contracts in the

engineering and structuring of products. Supportive contracts like wakala (agency), we’d (promise) and hiba (gift) is used for many purposes including management of risk, smoothening the return and delegation of the bank’s role to an agent. There are concerns among Shari’a scholars about the manner in which these agreements are used, as some fear the contracts allow the creation of prohibited structures.

“The product development function plays a pivotal role in Islamic financial institutions. A bank with a good product development team can present workable and competitive solutions to the market. A product manager is expected to bridge the gaps between theoretical requirements and practical applications of a specific Islamic mode of financing in order to create effective products and successful business solutions.”

The AAOIFI Shari’a standards serve as guiding principles on Shari’a matters but the designing of products developed with the help of these standards may still require more attention towards legal and business issues.

Operational: This relates to the practical application of a product. Leaving aside Shari’a concerns, many suggested structures of products are acceptable in theory but are not implemented properly because of operational flaws in the structure. As an example, running musharaka (a working capital product) suffers from operational flaws in the structure as its application is extremely difficult. The same is true for murabaha of fast-moving goods, murabaha of JIT (just-in-time) based inventories, holding company structures and LME (London Metal Exchange) assets based on OTC transactions. All these transactions are operationally difficult and due care is required to assure Shari’a compliancy.

We see many proposals for liquidity management products, capital market products, an Islamic benchmark and public debt instruments, which are not welcomed by the market due to operational and business reasons. However, by putting the product into the market, it will be far easier to ascertain operational and practical difficulties allowing improvement of the product structure.

Need for product development

Good Islamic financial products can only be developed with improved product development skills. Conventional product development and structuring require excellence in business and legal understanding and knowledge of market behaviour and norms while Islamic financial product development also requires excellence in knowledge of Shari’a. Without having in-depth knowledge of Shari’a prerequisites of products, a product can be excellent from a business perspective but very poor from a Shari’a viewpoint.

On the other hand, a poorly developed product may cause a great deal of concern for the market because of its non-viability from a business perspective. A long-term murabaha sukuk could not be marketed in a volatile market because of business reasons (the sukuk is non-negotiable). Similarly, many offshore banking products or off-market instruments could not be put into practice because of legal obstacles.

Conclusion

Presenting “out of the box” solutions is the goal of financial engineering. Financially engineered structures are evaluated on Shari’a principles, and if they violate Shari’a principles then it would be impermissible to sell them. Products engineered and packaged, fulfilling all Shari’a prerequisites, are welcomed under Islamic financial principles.

A way of financial engineering that attracts criticism from Shari’a circles is the excessive use of ancillary contracts to create a particular financial outcome similar to that of a prohibited conventional product. This is done with the purpose of copying a conventional product prohibited in nature (like cash-settled trades) or to create links between independent financial contracts.

Finally, product development is a sensitive and important job and a good product development team is an asset for Islamic financial institutions. Every Islamic financial institution should have an excellent team of product developers who have good knowledge of Shari’a and can bridge the gaps between business, Shari’a, legal and operational aspects of a product and can present more practical and Shari’a-compliant products to the market.

It is also important for Islamic banks and other financial institutions to bring radical reforms to their economic objectives. Financial engineering on the product level is what most the Islamic financial institutions have done so far. There is a need to develop an innovative model of Islamic banking and finance, which should look different from its conventional counterpart, and indeed must employ a different approach to fulfilling the financial needs of its customers and clients. In its previous issue, ISFIRE emphasised the role of ethics and morality in developing a distinct value proposition for Islamic banking and finance, and this is something the shareholders of Islamic financial institutions must consider if they want to further develop their businesses on a more sustainable basis.