There is a pressing need for greater connectivity between businesses, financiers and the wider community. Businesses need to recognise that the products and services they sell have effects on society. For Syed Shahzad social enterprises are the way forward with their high ethical principles and Islamic finance can and should play a key role in their establishment.

“Give unto orphans their wealth. Exchange not the good for the bad (in your management thereof) nor absorb their wealth into your own wealth. Lo! That would be great sin.” Al Quran – 4:2

In the last two decades the results of globalisation have become stark. Many countries throughout the world have benefited through global free market policies, facilitating the ease in which goods and services can be traded. China, India and Brazil, once shackled by underdevelopment and poverty are today considered to be economic powerhouses. However, the rapid growth of these nations has come at a hefty price, with the aggregation of social and environmental problems.

Recent research by The World Bank on six cities in developing countries found that the social costs of all environmental damage amount to a total of US$3.8 billion, of which the impact on human health accounts for 68%. Similarly, the global income distribution statistics sketch the same picture but from a different angle: 94% of world income goes to 40% of the people, and the other 60% live on only 6% – a clear indication of social disparity. One should be mindful of the words of Dr.Muhammad Yunus, Winner of the Nobel Peace Prize in 2006, “Poverty is a threat to peace”. Such sentiments should not go unheeded.

The global financial crisis has once again highlighted the failure, fragility and corruption of an unbridled laissez faire, “Free-Market-Free-Enterprises”, philosophy, where the ultimate goal is selective prosperity. It leads to a vicious circle in which the prosperous, in order to maintain their affluence, seek higher profits but in doing so, engage in morally dubious practices The latest example of malfunctioning of free enterprises in the form of corruption, pollution, and social injustice is the $3 billion fine that GlaxoSmithKline has to pay for bribing doctors to increase drugs sales.

Such impropriety raises fundamental questions: how do we solve the financial social injustice? How do we justifiably spread the income? How do we reduce poverty? Can governments with all their might and tools be able to address these social and economical issues or should private enterprises also engage in the transformation of economic relationships by adopting the framework of ownership distribution? From experience and anecdotal evidence, the government apparatus can often become bloated, and essential humanity issues could be left on the wayside in favour of meeting vested interests. Governments can only do so much in addressing social issues. They are good at creating policies and making regulatory regimes but they aren’t good at managing business (for example the fall of the Soviet Union and the fiasco of state-owned business theory). In comparison, the framework of the Islamic economy is based on a social consciousness that forbids isolated wealth creation. Some of the salient principles of Islamic society are unity, justice, and social and economic equality. Although, Islam permits, even encourages, a person to enrich oneself, it nevertheless places great emphasis on the social responsibilities due from entrepreneurs. Examples from the lives of the companions of the Prophet Muhammad (peace be upon him), his own life and excerpts from the Quran establish the expectations pertaining to social responsibilities of a commercial business.

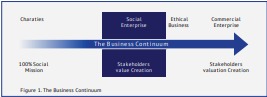

As Islam promotes social equality and harmony, any business would be considered closer to Islamic principles if its operations and practices are socially, commercially, and environmentally sustainable. In a modern context, these businesses are known as “social enterprises”. These enterprises are social- mission-driven, market-oriented, profit-making, services or product-based, management-controlled organisations that adhere to the contemporary stakeholder view of ownership benefits and governance.

Social enterprises

According to the UK Institute for Employment Studies, there are 62,000 social enterprises operating in the country representing 5% of all UK businesses and, generating a combined turnover of £32 billion. They contribute £8.4 billion to the UK economy each year. Despite this, the supply of financial instruments available for social enterprises has been inadequate.

The following are examples of social enterprise:

- Social journalism: The Big Issue Foundation, selling magazines to low-income people. They sell on margin.

- Social healthcare: Riders for Health providing motorcycle ambulances in North Africa. They train locals to become mechanics to maintain and manage the vehicles.

- Social franchise: Jamie Oliver’s restaurant Fifteen gives unemployed, young people a chance become chefs and to have a better future.

- Social food companies: Grameen Danone providing nutrition for poor children.

- Social bank: Grameen Bank is a community development bank, owned by the poor (94% owned by the borrower) that makes small loans available without collateral at a reasonable price to help underprivileged and underutilised people.

To put the above argument in context, the size of the current global social investment market and worldwide initiatives to support ethical enterprises provide the justification for dedicated mechanisms and a financial platform. It is a tremendous opportunity for IFIs to tap into a sector that naturally coheres to its core values of the socially-just business. To be able to understand and address the real challenge of architecting

these new instruments and develop the new financial platform, Jeff Gates, in his book The Ownership Solution, proposes a new financial paradigm: an ownership-right, equity finance structure that is rather compatible with the values and objectives of Islamic socio-economic practices. He suggests that stakeholder rights are the building blocks to setup a social enterprise inhered with equity, justice and social harmony. Gates catagorises ownership into two distinct power groups; one ensures financial freedom while the other creates the controlling power for the stakeholders.

- Financial Freedom

The rights to claim the residual assets (liquidation rights) to receive dividends (income rights) and profit and loss sharing (appreciation rights) are the fundamental principles of Islamic banking and finance. Gate’s ideology of financial freedom complies with the Islamic practice of participation in a transaction on sharing biases. Products based on musharaka and mudaraba offer the protection and preservation of both parties involved in a transaction

- Controlling Power

Voting rights: Conventional enterprises operate on the one-share-one-vote principle. That means entities with majority shares (majority risk) have the most votes. Arguably, this creates disproportional power between stakeholders and facilitates opportunities for private gain. IFIs can create an alternative approach such as restricting individual investment or developing multi-stakeholder structures to create an ethical and just corporate control model. Transfer rights: Transfer rights control the transfer or withdrawal of investments. This notion of freedom of choice is parallel to the rights that Islam grants to people by allowing them to transfer property rights to another via exchange, inheritance or the redemption of the rights of the less able. Therefore, a social enterprise can be defined by its financial structure and the way social objectives are embedded into its vision. At the core it also entails a business model with aims to maximise profit for all stakeholders, not just shareholders. This model offers huge potential in achieving a wide range of social and environmental goals whilst trading in the market like traditional businesses offering profits to its investors.

The current social finance market

The demand for social finance is growing, but conventional markets have failed to sufficiently offer the right products or attract investors. The products offered are mainly debt based with regular loans being the most common (an obligation to pay interest without any rebates). This requires the social business to make regular payments of principal and interest regardless of whether it is generating any cash flow.

In the conventional market, social entrepreneurs have access to the following source of financing:

Banks – The mainstream high street banks such as Barclays and HSBC, Co-operative banks, and charity banks.

Community Development Finance Institutions (CDFIs) – These are dedicated institutions providing finance to social enterprises, and even individuals, at affordable rates. The aim of CDFIs is to provide financial support to make a greater social impact.

Charities and Enterprises – Organisations that

have a strategic interest or synergies with their own CSR projects. As an example, Community Cleaning Services (CSS) is a social enterprise set up in Tower Hamlet to aid Muslim women who are socially and economically isolated (recent immigrants, domestic violence affected and single parents). CSS istraining these underprivileged ladies to become professional cleaners as well as teaching English to better communicate. The company is a registered social enterprise and is funded by a start-up grant (below market rates for social businesses) from Bromley- by-Bow Centre. Within two years the company now has an annual turnover of £40,000. Funds- These are set up to provide social lending (below market rates for social businesses).

Opportunity for Islamic financial institutions

The credit crisis revealed systematic weaknesses in the conventional financial system. Regulation has proven to be inadequate and corporate governance in banks has not been sufficient in mitigating excessive risk-taking. The gap creates a perfect playing field for IFIs to better position themselves in the emerging social business sector, at the same time complying with the social welfare system of Islam. The Islamic financial market operates in a manner that ensures returns by correctly considering the risk and the potential value generation. Consequently, setting up ‘business incubators’ by IFIs could take them to another level where risks are mitigated through involvement in the development, control and growth of the potential social businesses.

Setting up business incubators

This concept of a

business incubator isn’t new in the Islamic world; a recent example of such aninitiative is the joint venture between Islamic Development Bank and the Grameen social business foundation. These two organisations have started off with a fund of US$ 10 million to help potential social business initiatives. However, what is missing from that model is a structured, business-oriented, multi-investor-led, and repetitive approach.

| SOCIAL BUSINESS | INVESTORS ( Shares) | RISK |

| B1 | I1 (20%), I2 (50%), I3 (30%) | Low |

| B2 | I1 (50%), I2 (20%), I3 (20%) | Medium |

| B3 | I1 (30%), I2 (30%), I3 (50%) | High |

The business incubator’s prime goal is to support entrepreneurs during the vital, early stages. The aim is to increase the chances of success by giving them access to Islamic securities funding methods of loan, rent, profit, and dividends. Although the scope and choice of these products is quite wide, the mudaraba mode of financing can be used to deploy capital for social initiatives. On the other hand the business incubator does not have to be limited to the funds provided solely by the IFI. The combination of philanthropic grants and other Islamic financial capital market instruments can be used to seed fund social businesses. The following are some possible sources of funds: Philanthropic Grants: These grants can be an integral part of the initial investment strategy. The IFI can act as a fund manager and invest in social businesses whose work has the potential for large-scale community impact (environmental, health, security, human rights, and unemployment)

Programme Investment Certificates (PICs): The model of offering specific and general-purpose mudaraba certificates has already been successful in Pakistan (The Mudarabah Companies and Flotation and Control Ordinance, 1980). The PICs can be used to raise initial funding from the public and private sectors. These certificates can have a duration of investment of 1, 3 or 5 years. The IFI can act as the underwriter to facilitate the flotation and management of the certificates and individual investor accounts. The idea will also provide an opportunity to investors to spread the risk by investing in multiple programs.(Table 1) Stakeholder Share Ownership Plan (SSOP): In western economies, the employee stock ownership program (ESOP) allows an employee to participate in owning a part of the company. Fundamentally the idea is brilliant as it creates a vested interest for the shareholders in the success of the business. IFIs can setup a similar program allowing all stakeholders to be able to participate in the ownership. The stakeholders must also have the right to vote and transfer ownership.

| TYPE | EXAMPLES |

| Fund-led | Services under contract |

| Donation-led (Charities) | Fundraising charities |

| Customer-led | Counselling services |

| Member-led | Community groups |

| Beneficiary-led | Relief agencies |

| Investor-led | Un-served markets (consumer services) |

Equity Finance: Despite the criticisms on equity finance for being expensive and demanding, it is the only mechanism of raising capital from investors and sharing a stake in the business. The obvious and most viable benefit of equity finance is the participation and interest of the investors in the businesses they invest in. Many social enterprises operate in markets where “just-for-profit” is in conflict with their stated social objectives. However, the changing behaviour of investors in an uncertain economic climate requires a value-based strategy and a sustainable profit-generating business. It is in this notion where Islamic investment and finance market is already providing stakeholders with answers.

| CONVENTIONAL PRODUCTS | ISLAMIC PRODUCTS | ||

| Senior Term Loan | Long term, interest and principle must be paid over the period of loan | Bai’ bithaman ajil | Financing based on a deferred payment sale |

| Leasing | For fixed asset or financing equipment. No ownership until the agreed amount is paid in full | Ijara wa iqtina | Islamic bank provides equipment, building, and other assets, which are leased out and the lessee has the option of ownership at maturity |

| Working Capital Loan | ‘Revolving’ loan: agreed amount can be used over a fixed time. Interest must be paid | Mudaraba | Financier sells an asset to the party seeking finance for a disclosed profit, usually payable in easy instalments |

| Bond Issue | Debt capital raised by private investors; their return is capped by fixed interest they receive | Sukuk | Asset based structures where returns are derived f rom the principle value and usufruct of the asset |

| Mezzanine Funds | Also known as ‘participating loan’ it has a structure of both debt and equity financing. Lender receives fixed amount until the decision is made to share percentage of profit | Qard hasan + Murabaha | Debt based products without charging interest. Unlike qard, murabaha requires the buying and selling of a tangible good |

The current conventional providers of equity finance for smaller to medium social enterprises are:

Venture Capitalists – financial capital provided to early-stage, high-potential, high-risk, start-up companies. The venture capital fund makes money by owning equity in the companies it invests in. VCs earn dividends and provide expert advice on management.

Business Angels – individual entrepreneurs with capital and experience, who invest from their own funds.

Microfinancing– A Shari’a-compliant financing program for small social business initiatives. The most successful example is the National Bank for Development (NBD) Egypt who offered such loans.

Incubator lifecycle

The following 4-stages lifecycle incubation process is designed to provide the best business support and services. Ultimately the aim is to produce successful businesses.

STEP 1- Screening: Define a clear screening process. Select well-communicated, mission-specific and large-scale community impact projects. Identify spin-in business opportunities.

STEP 2- Facilities: Team up with local business parks or universities to setup shared work environments (office space including business services). It will create immense network opportunities and access to the latest industry trends.

STEP3- Management Services: Setup a dedicated and experienced team to facilitate these enterprises in:

- Strategy

- Accounting and Finance

- Marketing and Networking

- Technical and ICT support

- Training

STEP 4-Graduation: The IFI team’s

ongoing review can ensure the success of the incubator as a whole. The businesses that prove to complete specific goals or complete assessments can be graduated out of the incubator.

Islamic substitute of conventional products

Table 3 is an attempt to compare the current conventional products available for social enterprises with the Islamic substitute:

Conclusion

conclude, the underlying value of “Shared Economy” of social enterprises and Islamic social system are identical. The model of equal income distribution results in immense social justice, harmony and enables long-term growth. The social enterprises in collaboration with IFIs represent both a challenge and a promise of enrichment of its stakeholders. IFIs should establish innovative new financial platforms (business incubators), and instruments to cater new non-traditional markets. Last but not least, new economic challenges of today’s modern society require the doors of ‘ijtihad’ to be opened to ensure continuous discussions to develop new Islamic financial products and services.