Advancing Trade To Improve The Livelihoods Of Member Countries

Globally, the year 2019 was a year of trade tensions, sluggish growth, and volatile commodity prices. It was a challenging year for many economies around the world. For the International Islamic Trade Finance Corporation (ITFC), 2019 was a year of record operational and fiscal support extended to member countries, with trade financing approvals reaching USD5.8 billion of which, USD2.1 billion was extended to the least developed countries (LDCs). Crucially, USD3.9 billion was extended to support intra-OIC trade.

The year 2020 brought a sudden unprecedented change on a global scale. The advent of the COVID-19 global crisis created major challenges, leaving even the world’s economic leaders grappling to phantom its impact. For the developing world, however, the economic fallout could be felt even greater and for far longer as the world slides into recession. Multilateral development institutions such as ITFC have had to swiftly recalibrate operational plans and reprioritise what matters to mitigate the multifarious impacts of the pandemic in vulnerable member countries.

Without doubt, food security and medical preparedness have emerged as the areas where critical intervention is needed in LDCs. Amongst the immediate challenges resulting from the pandemic is the lack of availability of medical testing and personal protective equipment for front line doctors and nurses. In parallel, the collapse of international, regional and (especially) local supply chains during the spread of coronavirus has laid bare the extent of the lack of food security that many of these countries face. Without intervention, imports of basic raw commodities such as wheat and sugar could become inordinately expensive as supply falls. Many SMEs are in danger of being wiped out altogether.

To mitigate the socio-economic impact of the pandemic in member countries, the Islamic Development Bank (IsDB) pledged USD2.3 billion for the Group’s Strategic Preparedness and Response Programme for COVID-19 pandemic. The Programme adopted a 3-R approach, with each component focusing on Respond, Restore and Restart.

ITFC was appointed by IsDB to execute the trade finance operations for the prevention, containment, and mitigation of the impacts of the pandemic on member countries. In line with the Group’s strategy, ITFC has adopted a two- phase response to the COVID-19 crisis. The first phase, the Rapid Response Initiative (RRI), intends to sustain supply chains and enable the revival of trade. For this purpose, a USD300 million package has been allocated to member countries for the purchase of emergency medical equipment and supplies, as well as for strategic commodities, such as staple food.

The second phase, the Recovery Response Programme (RRP), earmarks another USD550 million for deployment over the next two years. The RRP is aimed at fixing the socio-economic damage, which is expected to last longer than the immediate impact of the virus.

PRIORITISING SAFETY AND FOOD SECURITY THROUGH TARGETED COUNTRY-SPECIFIC INTERVENTIONS

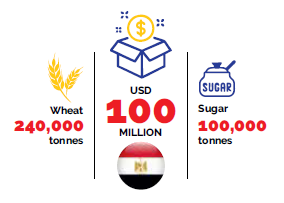

Since April 2020, ITFC continued to provide trade finance and trade development interventions to support emergency food and healthcare-related needs in the most vulnerable of member countries. In Egypt, ITFC approved a USD100 million financing package for the Government in favour of the General Authority for Supply Commodities (GASC) for essential strategic commodity needs. This package will directly fund up to 240,000 thousand tonnes of wheat, and 100,000 tonnes of sugar.

In Kyrgyzstan, an emergency food package relief programme has been provided in partnership with the Micro Credit Company M Bulak to support around 2,000 families who are most affected by the health and economic consequences of the pandemic.

ITFC also approved USD15 million for the Maldives’ State Trading Organization (STO), to facilitate the procurement of staple foods and medicines. In addition, ITFC is extending a grant to the Government for immediate emergency medical equipment including crucial personal protective equipment for use by medical professionals such as anti-fog face shields, safety goggles and protective uniform suits.

ITFC is actively engaging international, regional and local partners as a strategic means of scaling these interim financing measures to contribute to the critical needs of the member countries and where necessary, on the mobilisation of trade development support services during the pandemic. This includes helping OIC member countries with strategies for the control and production of healthcare facilities.

ENSURING MEDICAL PREPAREDNESS THROUGH SKILLS TRANSFER, RESEARCH, AND DEVELOPMENT

Whilst emergency financing is crucial in the short-term, it is not sustainable unless countries can stand on their own in the fight against the pandemic. Many member countries need to enhance medical capacity and know-how to effectively withstand the impact of COVID-19. In April 2020, IsDB and ITFC, in coordination with the Moroccan Society of Anesthesia, Analgesia and Resuscitation (SMAAR), launched an online platform to facilitate learning and knowledge sharing between medical teams from African member countries. The e-learning platform, which comes under the Reverse Linkage Mechanism and the Arab Africa Trade Bridges (AATB) Programme, was rolled out via the first of three webinars focusing on pandemic preparedness and response, whilst leveraging on international expertise in this field. The AATB programme, launched in 2017, aims to foster greater economic ties between the Arab African regions.

The e-platform aims to build the capacities of medical staff in African countries on their COVID-19 response protocols and approaches, whilst facilitating engagement between decision- makers and practitioners in participating countries, thus paving the way for increased global collaboration. The webinars are designed to encourage dialogue and scenario mapping to identify key challenges facing participating countries and to outline best practice approaches for successfully integrating response strategies in their respective countries.

The platform has seen the participation of more than 130 doctors, reanimators, emergency physicians and members of national committees from 17 African countries including Algeria, Benin, Burkina Faso, Cameroon, Comoros, Djibouti, Gabon, Guinea, Cote d’Ivoire, Mali, Mauritania, Morocco, Niger, Senegal, Chad, Togo, and Tunisia.

SAFEGUARDING SMEs IS CRUCIAL TO ITFC’S COVID-19 STRATEGY

COVID-19 has already crippled countless SMEs across the world, forcing them into liquidity stress and closure in some cases. In the developing world especially, SMEs are a fundamental driver of job creation and economic development – a lynchpin for sustainable development and a crucial requirement on the road towards realising the United Nation’s Sustainable Development Goals (SDGs). SMEs deliver progress in key SDG targets, especially No Poverty, Zero Hunger, Good Health and Well-being, Decent Work and Economic Growth, Industry, Innovation and Infrastructure.

For these SDGs to be realised, it is imperative that SMEs survive the economic challenges of COVID-19. All relevant parties must come together to ensure that SMEs in OIC member countries continue to operate, employ, and trade amongst each other. In 2019, ITFC’s overall private sector approvals reached USD821 million with USD367.9 million disbursed to enhance SMEs’ access to trade finance. With the COVID-19 crisis, ITFC is actively repurposing trade financing and development efforts towards supporting SMEs where they are needed most – food and healthcare.

In the pre-COVID economy, the AATB programme had successfully implemented a series of business matching events for buyers and sellers in the agri-foods and pharmaceutical sectors in the African and Arab regions. These efforts led to USD150 million pharmaceutical and USD30 million agri-food trade transactions. With the crisis, these platforms will play an even more important role in terms of continuing to engage B2B companies in the two regions to become part of the crisis solution in member countries.

Just recently, ITFC approved a EUR8 million financing facility for the Senegalese bank, Banque Islamique du Sénégal (BIS), to support private sector development. With around 300,000 SMEs and micro-enterprises accounting for 90% of businesses in Senegal, the financing is aimed at supporting the country’s efforts to drive economic inclusion and ensure the continuity of intra-OIC trade. Furthermore, the facility is expected to support around 1,000 jobs within the private sector, including companies in food and distribution.

ISLAMIC TRADE FINANCE AND THE WAY FORWARD IN A POST- COVID ECONOMY

In 2019, ITFC’s strategy of impact investment as a means to advancing trade and improving living standards saw a total of USD3.7 billion for the import of energy products, USD755 million for food and agriculture and USD290 million worth of income redistributed to groundnuts and cotton farmers in OIC member countries. Around 500,000 farmers were uplifted through financing and capacity development training, and 13 million people were provided with access to energy.

In the same year, ITFC extended USD3.9 billion of financing to support Intra-OIC trade. Amongst the key initiatives was a USD500 million agreement with Afreximbank to create the Arab Africa Trade Finance and Promotion Programme (AATFPP) under the umbrella of AATB. This milestone was further complemented by ITFC’s.

MoU with the African Union (AU) in February 2020, to partner on joint activities to boost inter-regional trade between African and Arab OIC member countries and help enterprises tap into large-scale opportunities across the two regions.

These transformative developments have laid powerful structural and fiscal foundations for growth and, whilst COVID-19 was unexpected, the platforms that have been established can help OIC member countries to withstand the inevitable economic shocks that the pandemic brings.

Moving forward, and building on these robust foundations, a nuanced, targeted focus on providing what is needed, where it is needed right now and in the near term will take precedence. For ITFC so far, this will mean continuing to drive funds and operational support to those parts of the OIC regions that are most in need.

Emphasis will be placed on the OIC member countries’ continued engagement in the global agri-food value chains. In the best of times, it is challenging for LDCs to end hunger (SDG 2) because of a multitude of factors ranging from soaring population growth to climate change, inadequate natural resources, poor soil quality, low mechanisation and inadequate storage and processing facilities. Such factors disproportionately affect the many millions who live in rural, remote areas the subsistence farmers.

Efforts will continue to focus on improving access to agricultural inputs that contribute to better quality agri-food output, transport, and storage. Prioritising better market access for smallholder farmers is important for the quality of local food production (and consumption), job security and to reduce the burden of imported input costs. ITFC will act to repurpose its activities towards training farmers on improved agricultural techniques, raising the standards of their production and enhancing their access to markets in other OIC member states.

ITFC’s priorities will continue to include an ongoing assessment of OIC member states’ emergency commodity needs and the provision of capital to financial institutions that SMEs rely upon. ITFC will also double down on programmes that provide practical and operational support, including the West Africa SME Programme, a flagship programme designed to improve SME access to trade finance.

There will also be a continued focus on the training of partner banks and other financial institutions to promote and spread Islamic finance across OIC member countries – this will further enable the ITFC to reach deeper into business ecosystems and encourage intra-OIC trade. It is equally important over the coming period for ITFC to align its strategy and give its time to expanding the international ecosystem of impact investment – this is crucial because impact investment delivers sustainable socio-economic outputs and helps nations to make good progress on SDGs.

These developments mean that during the aftermath of COVID-19, ITFC can drill down to focus on what makes the best impact on the near-term and long-term livelihoods and quality of life for the hundreds of millions of people most affected by the pandemic.