In the midst of the ongoing crisis emanating from the Global COVID-19 pandemic, we asked some of the leading experts of Islamic banking and finance to share their views on the need for reforming Islamic banking and finance. These experts come from different backgrounds, i.e., academia, practice and research; but there is a loud and clear message. There is a definite need for the industry to take the COVID-19 pause as an opportunity to

redefine its value proposition. While the practitioners like Asfand Zubair Malik take a sympathetic view on the practice of Islamic banking and finance, others like Faizan Ahmed are not optimistic about the change in direction of Islamic banking without a deliberate intervention by the stakeholders to do so. There are others who take a philosophical view of the whole matter. Pauline Vaz shares her perspective based on the experience she accumulated working in one of the most reputed product development teams.

DR HYLMUN IZHAR

Senior Economist, Islamic Research & Training Institute

Islamic Development Bank

Amidst the current global pandemic, compassion, shared solidarity and selflessness have stood out to become novel values that unite all humanity across the globe irrespective of nations, ethnic backgrounds and religions. And the principles of Islamic economics and finance have the natural ingredients to be at the vanguard to put those values in place. Although, on the level of implementation Islamic finance has been perceived to have failed in delivering its promises on fairness, equity and inclusion; it shouldn’t come as a surprise though since the industry is built upon the traditional model of finance.

Nevertheless, prior to the COVID-19 pandemic, Islamic finance had demonstrated a changing trend towards the propagation of Environmental, Social and Governance (ESG), which refers to the three central factors in measuring the sustainability and ethical impact of an investment in a company or business; combined with the proliferation of the immense potential of Islamic social finance.

Malaysia’s movement of Value-Based Intermediation in Islamic finance can be considered as evidence of such a change. Another one is the issuance of the Khazanah Sustainable and Responsible Investment (SRI) Sukuk. Waqf-linked Sukuk is another breakthrough championed by the Ministry of Finance Indonesia, in partnership with Badan Wakaf Indonesia (BWI) and Bank Indonesia.

“ALTHOUGH, ON THE LEVEL OF IMPLEMENTATION ISLAMIC FINANCE HAS BEEN PERCEIVED TO HAVE FAILED IN DELIVERING ITS PROMISES ON FAIRNESS, EQUITY AND INCLUSION, IT IS BECOMING APPARENT THAT THE DRIVERS OF THE CHANGE ARE NOW NO LONGER INFLUENCED BY AN ENTIRELY PROFIT GEARED MOTIVE; RATHER ARE EMPHASISING ON CREATING SOCIAL AND ENVIRONMENTAL IMPACT.”

It is becoming apparent that the drivers of the change are now no longer influenced by an entirely profit geared motive; rather are emphasising on creating social and environmental impact.

However, given the current pandemic, which has multifaceted casualties permeating into social and economic spectrums of life, is it still realistic to expect the same kind of Islamic finance? It may be premature to have an affirmative answer right now.

But there are five dimensions, which I think, can play a role in shaping the portrayal of Islamic finance post-COVID-19:

- Social norms and values may evolve; which can bring about entirely different preferences, and perception about life in general, in which social, economic and financial interactions are a part. Heavy reliance on the traditional model of finance and financial system that has resulted in what El-Erian calls inequality trifecta1 – inequality of income, wealth, and opportunity – needs a reality check. This could ignite the global community to question the relevance of the existing institutional set up of financial intermediaries.

- Changing methods of conducting business coupled with the pervasiveness of digitalisation: As social interactions may shift to a new equilibrium, coupled with the pervasiveness of digitalisation, the way of doing business, work methods and financial dealings may drastically change as well. Automation of processes will unsurprisingly be just a matter of a split second. For Islamic financial transactions, this will surely pose a new territory of challenge. Countless traditional fiqh rulings may then be challenged as a result.

- New Assets Classification may likely emerge: The new digital reality may likely alter the notions of assets. For an asset to qualify as ‘mutaqawwam’ or lawful under Shari’a may also change as a result. A different characterisation of asset types that can constitute a debt is a sheer possibility. If this materialises, the set of Shari’a parameters as guiding principles for Shari’a-compliant products will inevitably shift to a new equilibrium. Consequently, the building blocks of contracts and the landscape of Islamic financial transactions are expected to be different from what we have now.

- The birth of a new global currency is not to be ruled out: The hype of cryptocurrency and the use of blockchain technology over the past few years coupled with the increasing prominence of the digital economy should not go unnoticed. Going forward, the use of means of payment other than fiat money may find its utmost momentum.

- Moving from globalisation to regionalisation: The pandemic has unravelled the world’s precarious dependence on China as it controls one-third share of global supply chains2. This can trigger a massive restructuring as production and sourcing move closer to end-users and companies localise or regionalise their supply chains. And in the context of Islamic finance and halal industry, this can pave the way for the effective realisation of South-South cooperation among OIC member countries.

FAIZAN AHMED

Chief Finance Officer

Islamic Bank of Afghanistan

COVID-19 is changing the dynamics of the world. Islamic banking and finance is not an exception. I believe it is time that all the stakeholders of the industry come again on the drawing board and appraise the implementation of Islamic banking that is governed by the principles of Shari’a.

I remember the time when Islamic banking was in the initial phase and it was emphasised by everyone that it is essential that a lenient view is taken while giving Shari’a-compliant solutions similar to conventional transactions. The reason was to give simplicity to the transactions and most importantly to get acceptance by the market.

During the last two decades, many innovative Islamic banking transactions have been structured to satisfy the needs of the market. Unfortunately, in my personal opinion, we have been trying our best to make transactions Shari’a-compliant but lacking a focus on Maqasid al-Shari’a (or Higher Objectives of Shari’a also abbreviated as HOS) to establish equality and ultimately making Muslim Ummah prosperous.

There is no argument on the Shari’a compliance of the industry, as Shari’a experts and scholars are undoubtedly following Shari’a principles and laws. In my humble view, Islamic banking is still lacking in fulfilling the HOS as we are still serving the same market segments as conventional banks rather than the masses.

To elaborate my point, let us look at the balance sheet of any conventional bank, which has deposits mainly made up of retail, and individuals either directly or indirectly, however, on the asset side major investments and advances are to the government and corporate sectors. Similarly, if we now have a look at the balance sheet of an Islamic bank, there hardly is any difference in the composition of financing.

“ISLAMIC BANKING IS STILL LACKING IN FULFILLING THE HOS AS WE ARE STILL SERVING TO THE SAME MARKET SEGMENTS AS CONVENTIONAL BANKS RATHER THAN THE MASSES.”

In my personal experience, while structuring big-ticket transactions, the focus is generally towards ensuring that the transaction is Shari’a-compliant at its minimum level. I would like to illustrate this with an example. During the structuring of Sale and Lease-back transactions with big corporate clients, the major issue is always the transfer of assets from the books of the seller (corporate) to the buyer’s book. In many transactions, the fair disclosure of assets is not available as corporates generally are not ready to transfer their assets and transactions are merely executed on documents. The main reason for this unfavourable arrangement is that corporates have strong bargaining power due to their business size and

the availability of conventional alternative.

In the current pandemic situation faced by the world, it is time for Islamic banking to promote small and medium-sized businesses of the society who are contributing towards 50% of the employment worldwide.

Therefore, stakeholders should focus on securing and promoting small and medium-sized enterprises (SME) sector with Shari’a-compliant solutions; as it will not only help the Islamic banking industry to increase profitability but also fulfil the spirit of Shari’a. There are many challenges in catering widely to the SME segment, however, if all stakeholders with conviction are willing to start from scratch and seek alternative ways than they will definitely find concrete solutions, which will be able to protect many businesses hit by the COVID-19.

Once this pandemic situation is over, several businesses will not be able to reinstate themselves easily. To resolve the issue, Islamic banks may come up with some propositions on both Depository and Asset sides of the balance sheet.

As we know many Muslim countries are generally contributing funds for charitable causes, additionally, in the current pandemic situation, individuals are also contributing generously in charities to feed people. This is an opportunity for Islamic banks to play a positive role and offer a solution driven by Maqasid al-Shari’a. I propose an arrangement in this regard.

As per my proposal, Islamic banks should introduce an innovative investment product on the balance sheet whereby investment account holders can deposit money that they are already contributing towards charity. That deposit is placed in the Investment Account Holders’ Funds that will be allocated to a high-risk pool. Subsequently, that deposit can be deployed to SMEs as financing without collateral (as many of them may not have collaterals available).

Following will be the benefits of this proposed model to the economy.

- The charity given otherwise can feed a family once or twice but will not contribute towards the economic development of the family nor the society. However, if the business of the same family is reestablished from Islamic financing, it will be a continuous source of income to them.

- Further, by starting one business several employment opportunities can be created as well as independent industries, which will create more employment thus becoming responsible for the income of many families.

- The major benefit will be the achievement of higher objectives of Shari’a by entering into true Mudaraba model whereby the investors are willing to take a high risk on their investment.

- Although there is a higher rate of default in such financing, the amount contributed was already for charity so it will not affect the investors’ expectations.

- In case the recovery rate is good, then the Islamic banking industry can change their business models permanently to satisfy the requirements of shareholders and improving the perception of Islamic banking.

In the wake of COVID-19, many organisations are receiving a lot of funding to feed people. However, in my view, efforts should be concentrated on utilising funding to re-ignite the engine of economy. Therefore, if we channellise the same funding as per the aforementioned proposed model it may help kick-start the economy as well as fulfilling the higher objectives of Shari’a. It might be a game-changer for the Islamic industry!

ASFAND ZUBAIR MALIK

Head of Product Development & Shari’a Support

Askari Bank Ltd. – Ikhlas Islamic Banking

The world has witnessed an unprecedented challenge due to COVID-19 – the mayhem we could not have even imagined before. Loss of loved ones and precious lives, economic meltdown, closure of large conglomerates as well as small and medium-sized businesses, ports, transport, pay-cuts and lay-offs have seriously tested and put a question mark on the morality and ethics of the civilised world. Islamic financial industry, being part of the same socio-economic environment, is no exception. The industry, despite relatively small in size, felt shocks in a similar way as its conventional counterpart.

Islamic banking and finance is acclaimed to be a system that claims to deem profit maximisation as a legitimate objective only along with values such as justice, equitable distribution of wealth, transparency and fair treatment of all stakeholders. COVID-19 is a litmus test for this notion.

If you ask me, I would rather say that from my vantage point, forming an opinion as to “if there is a need for going back to basics to reform Islamic banking and finance as an industry driven by Maqasid al-Shari’a in the wake of COVID-19”, would not be prudent amidst the pandemic, and we would need to wait a little more to reach a conclusion by the time the pandemic capitulates to human life. However, I would not hesitate from appreciating the collective response of the Islamic banking and financial services industry, the top management, Shari’a personnel and those charged with governance in upholding the true-spirit of Shari’a specifically with regard to dealing with debtors in financial difficulty.

There are several verses in the Quran, supported by the sayings of the Prophet Muhammad (peace be upon him), which instruct the believers to be kind to debtors who are in financial difficulty. For example, Verse 280 of Chapter ‘The Cow’ states, “And if someone is in hardship, then (let there be) postponement until (a time of) ease. But if you give (from your right as) charity, then it’s better for you if you knew”. Similarly, Prophet Muhammad (peace be upon him) said, “He who gives respite to someone who is in straitened circumstances, or grants him remission, Allah will shelter him in the shade of His Throne, on the Day of Resurrection, when there will be no shade except its shade.” (Al-Tirmidhi).

The modus operandi of Islamic banks is that on the liability side, they collect deposits from the general public primarily on the basis of profit and loss sharing (Mudaraba & Musharaka). The funds thus generated are thereby invested, on the asset side, in different Shari’a-compliant transactions such as Murabaha, Salam, Ijara and Istisna’.

The statement is eloquent of the fact that the Islamic banks work under a fiduciary relationship whereby the protection of investment account holders’ funds is their foremost duty while ensuring equitable treatment of all stakeholders. This implies that Islamic banks cannot make a donation out of investment account holders’ wealth or waive an earned profit since it does not have the right to do so.

“WHILE THERE IS NOTHING WRONG IN MAXIMISING PROFITS IN A HALAL WAY, THE INDUSTRY SHOULD STRIVE AND COME UP WITH UNIQUE AND ROBUST PERFORMANCE APPRAISAL MODELS WHERE “PROFIT INCREASE ON A YEAR TO YEAR BASIS” IS NOT THE ONLY MEASURE TO GAUGE PERFORMANCE.”

For the purpose of brevity, a major challenge faced by an Islamic bank is striking out a balance for fair treatment of its stakeholders. I would emphasise the readers to clearly understand the foregoing statement since it would help analyse the performance of Islamic banks in light of the Higher Objectives of Shari’a (HOS), consequent to COVID-19.

On the assets side, a significant number of debtors of Islamic banks have had difficulty in timely repayment of their debts due to lack of business activity and seek rescheduling of their financings. Meanwhile, on the liabilities side, investment account holders continue to expect smooth profit payouts on their deposits in line with their profit expectations. In my opinion, Islamic banks have been quite successful in meeting their customer requirements while ensuring compliance with Shari’a values. For this, product structuring, Shari’a compliance and business teams deserve praise for enabling Shari’a-compliant debt rescheduling options, which not only help their debtors to manage their cash flows but also enable their depositors to earn Shari’a-compliant profits for these restructured debts.

Another commendable act by some Islamic banks is considering Qard Hasan-based financing at zero per cent for special segments such as hospitals and testing labs from their own equity. Moreover, channelling of charity funds for segments of society affected by COVID-19 is also observed at some Islamic banks.

In contrast, a debatable practice is observed whereby it is reported that few Islamic banks are unduly pressing the customers using Shirka al-Aqd based working capital financing (also known as Running Musharaka or RM in Pakistan) to provide consent to terminate RM contracts in order to avoid any potential loss to them as a result of loss to the client at gross level consequent to COVID-19. This is something that appears at least against the gist of Shirka al-Aqd.

Lastly, I would also like to point out the fact that there is still a lot of work required to be done in order to move towards a truly Shari’a-based system from a Shari’a-compliant one. While there is nothing wrong in maximising profits in a Halal way, the industry should strive and come up with unique and robust performance appraisal models where “profit increase on a year to year basis” is not the only measure to gauge performance but the higher Shari’a values are also permeated down the grid right from the top.

DR ALI RAZA NEMATI

Assistant Director

Riphah International University Islamabad

The development of Shari’a governance frameworks across the globe, particularly strong governing rules pertaining to Shari’a boards, have enabled Islamic banking to gain more trust amongst the current and prospective customers and all stakeholders. This has certainly contributed to the success of the industry . This success can further be extended if Islamic finance can be a part of the COVID-19 response through offering a range of financing instruments well-suited for each stage in this pandemic condition. This may only be possible if we revisit Islamic banking principals in light of the Maqasid al-Shari’a and fill the gaps that have arisen from continuing compromise on the fundamentals of Islamic banking and finance.

“IT IS IMPORTANT TO STRESS THAT REFORMING ISLAMIC BANKING AND FINANCE IN LIGHT OF THE MAQASID AL-SHARI’A MUST ENABLE US TO LEAD FROM A LINEAR ECONOMIC PARADIGM TO A CIRCULAR/ECOLOGICAL PARADIGM, AND CONSTRUCTION OF A GLOBAL FINANCIAL ARCHITECTURAL CONSISTENT WITH THE CHANGE.”

It is important to stress that reforming Islamic banking and finance in light of the Maqasid al-Shari’a must enable us to lead from a linear economic paradigm to a circular/ecological paradigm, and construction of a global financial architectural consistent with the change. This must also help us to synchronise local aspirations, national goals and Sustainable Development Goals (SDGs). Furthermore, it must remove the structural risks in the design of financial products to encourage integrated reporting, denominated by a commitment to Maqasid al-Shari’a.

However, restructuring complete Islamic financial industry may derail the focus on offering Shari’a-compliant products to cater to the current Islamic financial market suffering from COVID-19 and its effects. Rather a smooth cautious approach with a clear focus and objective may be introduced or developed by the key decision-makers and stakeholders for the achievement and recognition of Maqasid al-Shari’a. To summarise, a careful and candid consideration is needed as “in the midst of every crisis lies great opportunity” goes for the Islamic financial industry as well.

MUTIA SARI SYAMSUL

Founder and Chief Executive Officer

PT Magna Cita Marlin

Among the efforts that have been called for and carried out by the world to reduce the spread of this outbreak are social or physical distancing. Unfortunately, this has resulted in a decline in overall economic activity. This has far-reaching implications for the real economy, which at least in principle is the ultimate focus of Islamic banking and finance. The breakdown of the economic chain will not only cause shocks to the fundamentals of the real economy but will also damage the smooth functioning of the market mechanism between supply and demand in order to run normally and in balance. Hence, there will be a New Normal we all have already started talking about.

Given that the vital aspects of the economy, namely supply, demand and supply-chain have been disrupted, the long-run impact of the crisis will be felt equally across all socio-economic levels. As the resilience of each layer or level is different, the middle to lower economic community, especially micro and informal workers earning daily wages, will be most vulnerable. Other segments will take their own hits. The crisis may get accentuated if the problems in the real sector then spread to the distressed financial sector, e.g., due to a large number of investees having difficulty in paying to investors.

Referring to my own country, Indonesia, which has the largest Muslim population in the world, maybe heading towards some challenging times. However, a vibrant social sector and philanthropic movement is expected to play a role in the crisis at hand, and this is where Islamic banking and finance should also focus during and the post-COVID-19 era.

The following could be some of the solutions that can be offered within the framework of Islamic social economics and finance. In my view, Islamic banks and financial institutions should start looking into what possible roles they can play in this respect.

Firstly, Zakat collection and disbursement. Islamic banks and financial institutions must negotiate a role in Zakat collection and disbursement. There are countries with well-established Zakat collection and disbursement systems. Islamic banks and financial institutions must learn from these systems to assess their possible role in this respect. This social role of Islamic banks will be vital for their relevance and sustainability in the post-COVID-19 era. In Indonesia, BAZNAS is the national Zakat management body. However, its effectiveness can be improved by greater institutional cooperation with Islamic banks and other social sector institutions.

Obviously, Islamic banks can only do limited things, given the regulatory and other constraints. Hence, there is a need to develop Islamic finance outside the banking sector. In Indonesia, Baitul Maal wa Tamweel (BMT) model is a good example in this respect. I would recommend making mosques as the centre of BMT for the surrounding community. This may necessarily involve registration of mosques as Zakat Collecting Units under the coordination of the Zakat Management Organization.

Secondly, strengthening of cash waqf either through cash waqf schemes or sukuk-linked waqf. The Indonesian Waqf Board needs to work with Islamic financial institutions to promote awqaf so that it can be used in part for the construction of various waqf-based infrastructures such as hospitals specifically for victims of COVID-19, personal protective equipment (PPE) like masks, polyclinic, isolation houses, ventilators, universities and others.

“IF DIRECT CASH ASSISTANCE, ALMS, DONATIONS, OR CSR, BOTH FOR THE COMMUNITY AND THE BUSINESS SECTOR OR MSME, CAN REALLY BE PROMOTED, THEN THESE EFFORTS ARE EXPECTED TO INCREASE AGGREGATE DEMAND AND AGGREGATE SUPPLY, FOLLOWED BY THE DEVELOPMENT OF AN ONLINE MARKET THAT FOCUSES ON MSMES THAT BRING TOGETHER DEMAND AND SUPPLY.”

Thirdly, provision of venture capital assistance during a crisis like COVID-19. In the midst of a crisis, Micro, Small and Medium Enterprises (MSMEs) struggle for continuity of their businesses. These businesses face a survival crisis due to their limited capital. Therefore, providing capital to such businesses is a means of reducing the impact of the crisis. Provision of capital can be done with several policy alternatives, such as providing additional stimuli in the form of relaxation of payments by way of restructuring or suspension of credit/financing payments. The provision of capital from banks/Islamic financial institutions needs to be supported and strengthened with assistance so that it can be accounted for.

Fourthly, the financing can simply be made as a Qard Hasan loan, which does not allow interest charging but may require repayment of loans. This may prove important in supporting recovery or sustaining the economy. Among the channelling options are: (1) Islamic microfinance institutions in financing nano businesses; and (2) direct loans without margins for both business and consumption distributed by companies (private or government) to employees or partners (such as online motorcycle taxi drivers). The funds can come from several sources: general public, private companies, and Corporate Social Responsibility (CSR) funds. To increase CSR funds, the government needs to reinforce CSR obligations and higher contributions from SOEs and private companies.

Fifth, apart from the Islamic banking sector and Qard Hasan, some of the funds collected by Zakat collection units or organisations, especially those in the regions, can be used to strengthen MSME businesses. Saving MSMEs that are in crisis or threatened with bankruptcy because of the economic impact of the COVID-19 outbreak, can be categorised as asnaf (Zakat recipients).

Sixth, the development of Islamic financial technology to smoothen liquidity of online market participants, and an increase in focus on social finance must also help.

In the end, if the above programmes, especially direct cash assistance, alms, donations, or CSR, both for the community and the business sector or MSME, can really be promoted, then these efforts are expected to increase aggregate demand and aggregate supply to the right (in the demand and supply curve) is followed by the development of an online market that focuses on MSMEs that bring together demand and supply, so that the economic surplus is reshaped and helps accelerate economic recovery.

JOANN ENRIQUEZ

Chief Executive Officer

Investment Account Platform

Why do we do what we do? This is basic introversion that one must undergo. This question has been posed in the realm of Islamic finance, mainstreamed by Islamic banking, investments, and Takaful. The same question is highlighted in the midst of this global pandemic we are in. The Covid-19 virus that disrupted every corner of the globe takes us to the same question. What is Islamic finance and how do we utilise it?

The fundamentals of Islamic finance stem from the Quran. So much emphasis on the matter; highlighting its extreme importance and yet it has been taken lightly. Sometimes even excused under the guise of the promotion of the common good or because there was no choice but to engage in it. Quite a scary slope we are treading, detrimental precedence we are setting and above all, the consequences when we are held accountable.

Imam Abu Ishaq al-Shatibi (d.1388) wrote about Maqasid Al-Sharia in his work Al-Muwafaqaat fi Usul al-Shari’a. He defined Maqasid al-Shari’a as “the attainment of good, welfare, advantage, benefits and warding off evil, injury, loss of the creatures”.

We have a blueprint to success, a proven success blueprint, in it are contracts that have been tested for centuries. The shackles preventing us from re-living such prosperity seem so insurmountable. However, we may have reached a tipping point where the system that has corrupted it, is beginning to fail. We are beginning to see its decline. The superpowers of the west are not exempt and are being brought to pits they have never seen before: death, unemployment, hunger, unrest. This COVID-19 disruption and further disruptions that will cascade after it will force us to turn to the reliable Islamic ecosystem and its proven concepts.

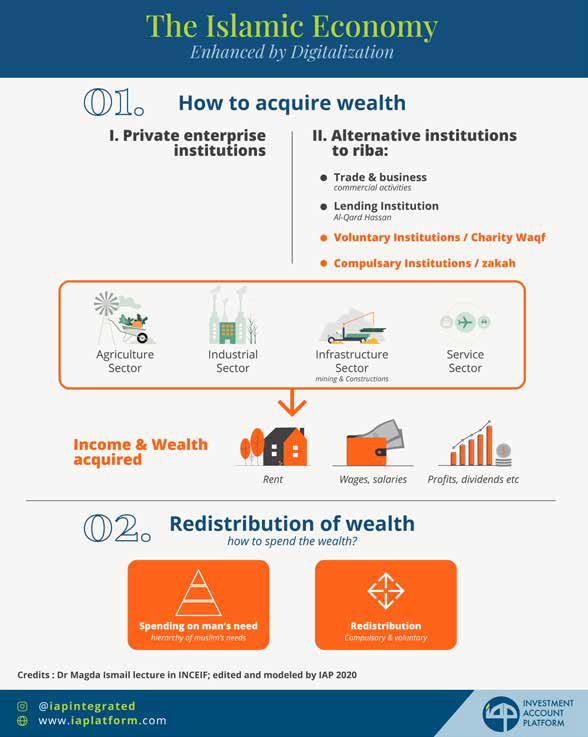

The scheme of things depicted in the accompanying diagram is the solution – the main raisin d’etre of Islamic finance. The role of technology in its implementation is key and allows it to reach far and wide. The streamlined process in the digital realm has allowed speed to market in record-breaking time. The youth that has awakened to the capacities of technology now have access to knowledge that was scarce to prior generations. It has opened their eyes to what is valuable and priority. All these coupled with the Islamic foundations both codified and passed on from traditions and ways of life may provide us the salvation we all long for, where we truly safeguard human necessities of faith, life, intellect, prosperity, and wealth.

The current pandemic has perhaps offered an opportunity to Islamic finance to go back to basics and implement what it has not done so with significance so far.

PAULINE VAZ

Product Development

Abu Dhabi Commercial Bank Islamic Banking Division

COVID-19 has redefined the paradigm of banking. We are privileged to practice our trade under a government as responsive and responsible as the United Arab Emirates: with Abu Dhabi Commercial Bank as an industry leader and one of the most trusted brands in the market. ADCB Islamic Banking has endeavoured to address the economic and social fallout that has naturally resulted from this pandemic; keeping in the forefront the health and safety of its employees, customers, business partners and community.

For practitioners, as we are defining Islamic Banking & Practice within the framework of Islamic Economics is a fundamental mission. It is fortunate indeed that we operate under the aegis of ADCB and in the UAE.

The response and relief measures rolled out due to COVID-19 is a demonstration of putting theory to practice.

“POST-PANDEMIC SOCIETY AND ESPECIALLY “GEN C” WILL EXPECT NOTHING LESS AND IT IS INCUMBENT UPON US TO DELIVER NOTHING SHORT.”

The UAE government through various groundbreaking economic and social schemes targeted at a cross-section of the economy set the tone for bankers to follow.

ADCB leveraged its financial strength and expertise and was the first bank in the UAE to roll out a comprehensive programme of relief measures for customers including:

- Deferment of facility payments,

- Fee reductions and waivers

- Rescheduling of working capital and

- Temporary Rate reduction for businesses.

- The bank in association with the Ministry of Education supported distance learning scheme for students and

- Invested in a programme to express gratitude and alleviate the burden of frontline healthcare professional.

- Banking services remain uninterrupted delivered through the bank’s highly committed frontline and those working remotely.

- The bank pledged to its employees that there would be no redundancies in 2020 on account of COVID-19.

- In line with our commitment to service excellence and continuity of operations select ADCB branches remained open; majority of ATMs remained operational and services enhanced and delivered through digital capabilities.

- Vendor relationships were honoured with zero disruptions.

Through the financial crisis a decade ago, mergers & integration and the response to the pandemic’s challenging macro-economic landscape the bank has emerged steadfast in adversity and more determined than ever to support all its stakeholders.

CONCLUSION

While the green shoots of economic activity re-emerge and promise cautious hope for a better tomorrow; we are tasked with applying Maqasid al-Shari’a to design thinking to tirelessly enhance the ever-evolving customer experience. An experience delivered through simple safe and practical technological solutions by sensitised and humane bankers.

Post pandemic society and especially “Gen C” will expect nothing less and it is incumbent upon us to deliver nothing short.

Stay safe, stay positive and be kind to yourself. Alles volat propris.

MUJTABA KHALID

Head of Islamic Finance Centre

The Bahrain Institute of Banking and Finance (BIBF)

The impact of the global Coronavirus disease (COVID-19) has been vast and will change the manner in which people live their lives as well as business operations. The pandemic is a reality for all organisations and will cause and reinforce new forms of transformation, far beyond those that may have already been envisioned in organisational strategies and forecasts.

It is probably safe to assume that this pandemic will eventually pass, but it is now also appropriate to assume that the financial services industry, be it Islamic or conventional, will go through a seismic shift. Regardless of the cause, a crisis requires immediate and appropriate actions to mitigate and prevent irreparable harm. In this opinion piece, however, I will not be discussing the policies or risk mitigation strategies the Islamic finance industry needs post-COVID-19, rather, I will be discussing what the potential new normal could be for the Islamic banking industry.

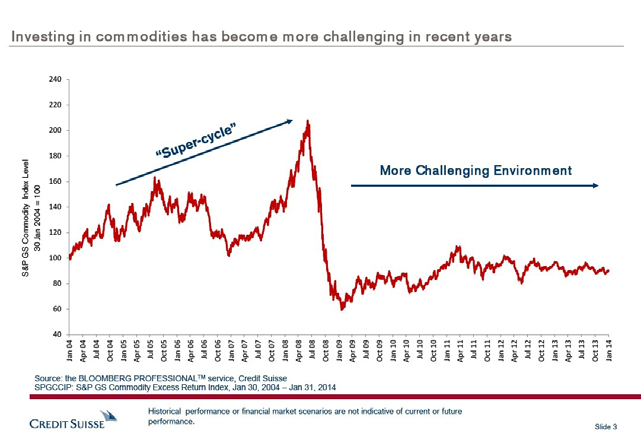

As a first step, we need to step back and assess what was normal pre-COVID-19 and more importantly, was it working. The Islamic finance industry was growing, yes, however, if we compare the growth rate from 2000 – 2009 and 2010 – 2019, we see that post-2009, the growth rate of the industry started to taper off. One of the reasons for this was the global commodities “super-cycle” that prevailed until the financial crises hit the globe. Affluent Muslim countries had exposure to commodities in terms of production, which had resulted in a positive spillover on the Islamic finance industry.

However, other underlying issues were facing the industry, such as the lack of innovation of products and services. Here I am not alluding to FinTech, rather new products (especially pertaining to retail banking); for example, the go-to product for the industry when it comes to financing activities has been Commodity Murabaha/Tawaruq. I will not go into a discussion on the legality of the product as per the Shari’a, given that AAOIFI standards allow it (albeit as a last resort). On top of

this, given that only two companies facilitate a majority of the Tawaruq transaction (mostly DDCAP but IGER as well), this poses an institutional risk to a USD3 trillion industry. It is baffling that, given the size of the industry as well as the number of research papers and conferences that are held, for 20 years we have been unable to find a viable alternative to Tawaruq

The promise of Islamic finance to address some of the shortcomings of the conventional financial system (especially post-2008) has largely been unfulfilled. Most countries where Islamic banking is relatively popular still have low levels of financial inclusion. Islamic financial institutions have also not leveraged on the fact that globally Muslims are the youngest demographic, and financial products and services should target young adults. Also, Muslim-majority countries have huge exposure to remittances (both outward and inward) and financial products aimed at these are again largely missing.

The Islamic finance industry was at the third inflexion point in its evolution when the COVID-19 pandemic, as well as low oil prices hit, which I believe will expedite the much-needed development.

The first stage of Islamic banking was in-fact answering the question if there could be a bank base on Islamic principles. This was answered by the founding figures of the Islamic finance industry (although what the industry would become, even they could not envision!). Then the torch was passed onto the second generation of Islamic finance leaders, who faced the challenge of scalability and expansion with much success. Currently, the leaders are faced with a new challenge: to prove that Islamic banking belongs at the world stage and has a global value proposition, rather than being limited to a Muslim or Shari’a-sensitive consumer base.

“CURRENTLY, THE LEADERS ARE FACED WITH A NEW CHALLENGE: TO PROVE THAT ISLAMIC BANKING BELONGS AT THE WORLD STAGE AND HAS A GLOBAL VALUE PROPOSITION, RATHER THAN BEING LIMITED TO A MUSLIM OR SHARI’A SENSITIVE CONSUMER BASE.”

This is where Maqasid al-Shari’a fits in perfectly. If we look at another sub-sector of finance that has taken off since the ‘90s, especially in the Western countries, it is ethical finance or Socially Responsible Investing (SRI). Given the basic tenants and objectives (Maqasid) of Islamic finance that are based on fairness, ethics etc. Islamic banking and finance should already be considered ethical finance in most cases. The challenge, however, is how to position the Islamic finance industry to truly be ethical as well as sending this signal globally. This is where the United Nations Sustainable Development Goals (UN SDGs) come into play; a collection of 17 global goals designed to be a “blueprint to achieve a better and more sustainable future for all”. The SDGs were set in 2015 by the United Nations General Assembly and are intended to be achieved by the year 2030, with 193 countries as signatories. Most of the SDGs are also in line with the ethos of Islamic teachings and multiple research papers have linked Maqasid al-Shari’a as being in line with the SDGs.

Therefore, if the global Islamic finance industry needs to evolve into something that is truly in-line with Islamic teachings while signalling to a wider consumer base that Islamic banking is indeed ethical and socially responsible, the new normal must be adherence to the SDGs. To this end, technology should be leveraged to find innovative and efficient ways for Islamic financial institutions to be in line with the SDGs. The BIBF Islamic Finance Centre in patronship with the UK- based technology provider Cogneum has started developing the first-ever software solution that will ensure a financial institution’s Shari’a governance as well as adherence to selected SDGs.