WHAT IS MORE IMPORTANT: SHARI’A COMPLIANCE

OR CONSUMER PROTECTION?

When someone is hit hard on the head, they forget about rationality even if they don’t become completely insane. Admittedly, this is what a boxer would think like, while Shari’a scholars may not even understand it.

Muslims, like anyone else, forget about their religion and everything else, in the face of a loss. The users of Islamic financial services are not an exception. Hence, their rights must be protected, whether contractually or through regulations. In the context of the Mudaraba scandal in Pakistan, it was the failure on the part of the regulator to let a group of graduates of Islamic seminaries defraud thousands of Muslims and deprive them of billions of rupees in the name of Mudaraba.

Obviously, adherence to Shari’a principles is imperative for Muslims in all their dealings, financial or otherwise. However, it is even more important to protect Muslims and non-Muslims alike from anyone who claims to be offering Islamic financial services or doing business in a Shari’a-compliant way. This point must be explained to avoid any doubts.

If someone offers a Mudaraba-based investment opportunity to another person and if there is a widespread moral hazard problem in the market, is it permissible for the investor to demand fixed return on the Mudaraba business?

Most people involved in Islamic banking and finance would say, “No.” The question arises, “Why not?”

The simplest answer is that the Mudaraba contract does not allow guarantee of capital and/or return.

This is true.

However, there are a number of Islamic financial products (e.g., profit-sharing investment accounts (PSIAs) and Sukuk al-Mudaraba), which are structured in such a way that they offer fixed returns (and in effect guaranteed capital) despite being based on Mudaraba. These structures are affected with the help of undertakings to purchase, sell, or something similar. The ultimate objective of all these exercises is to ensure that the consumers’ or investors’ rights are properly protected.

In almost all cases where an Islamic financial transaction has gone to court, the judgements ensured the consumer or investor protection. This is an interesting phenomenon from where one may infer that while Islamic financial products are structured in compliance with Shari’a, consumer protection in almost all cases is ensured by a framework (legal, regulatory and compliance etc.) outside the Shari’a domain.

If true, then it is certainly strange, given that it is against the Higher Objectives of Shari’a (HOS No.3, namely, protection and preservation of wealth). Obviously, consumer protection cannot take precedence over Shari’a conformity. However, the product development and Shari’a departments at Islamic financial institutions must ensure that there is a balance between the two. This is not only desirable but can also be achieved easily.

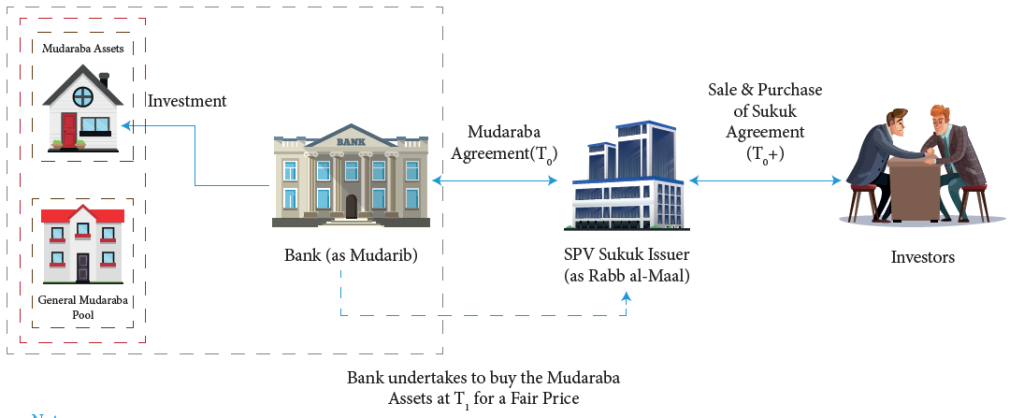

Let us explain this with the help of an example. The following diagram depicts a simplified structure of a Sukuk al-Mudaraba, which some Islamic banks have used to raise Tier-1 Capital as per Basel III.

Notes: Mudaraba Assets are identified assets, segregated within the General Mudaraba Pool T1 is a time when an Event of Default takes place or the end of Sukuk period, if no Event of Default takes place during the tenure of Sukuk Fair Price, is determined by a formula that must give rise to a unique & unambiguous value at any given point in time Fair Price can be calculated by the formula if, for example, an Event of Default takes place at t3 Fair Price = (1 + ) N0 – N0. were N0 is the National Amount of Sukuk, T is the Number of Disbursement Periods, ti is a speci_c Disbursement Period, ri is the relevant return rate in a given Disbursement Period (e.g., 3-month LIBOR + 100 bps)

In the above structure, the strict Shari’a requirement is to incorporate Purchase Undertaking by the Bank as an unbinding promise. As, without the Purchase Undertaking being binding, the structure doesn’t work for risk-averse investors, its bindingness is ensured either by a reference to the English law (in the event of the transaction going to a court after an Event of Default has occurred) or through regulatory coercion. In both cases, investor protection is a prime consideration to ensure that the promisor fulfils its promises and honours the undertakings. Shari’a pronouncements are deliberately kept vague on this issue. In other words, Shari’a pronouncements assume that the transactions like the above-depicted Sukuk al-Mudaraba behave as per expectations of the transacting parties. So, as long as the value of Mudaraba assets remain higher than the National proceeds plus the stipulated return, the Purchase Undertaking remains irrelevant during the tenure of the Sukuk. It is called upon only at the end when the transaction is wound up.

If, however, the value of Mudaraba assets fall below the value of the Sukuk investments and the stipulated return, an Event of Default may occur and the matter must go to the regulator and in some cases may end up in a court. In such instances, the matter is mostly decided without any meaningful reference to Shari’a. The law takes precedence or the regulatory stick kicks in.

If we focus on the PSIAs, the banks tend to prefer unrestricted PSIAs because it gives them a better opportunity to maximise return on equity rather than maximising return for the investors, which is the case if they offer restricted PSIAs. In certain jurisdictions where regulators don’t allow unrestricted PSIAs, customer protection is ensured by the regulators rather than the Shari’a assurance process.

It may not be entirely inappropriate for Shari’a assurance function within Islamic banks and financial institutions to start looking into consumer protection more seriously than what has been the case so far. Is it too much to ask to suggest preferring customer protection over Shari’a compliance?