Global Islamic Finance Awards 2020 held amidst the pandemic

The global Islamic financial services industry had assets under management worth around USD2.733 trillion at the end of 2019 (Global Islamic Finance Report 2020). It experienced a strong performance in 2019, but 2020 told a different story. The growth of the Islamic finance industry slowed down owning to the COVID-19 pandemic, which spread rapidly around the world, literally shutting it down. However, despite the grim outlook, this also presented unprecedented opportunities for Islamic finance to mature as an alternative financial system.

Islamic banking and finance has received the maximum focus and commitment of any government in Pakistan during the last two decades. Starting with the intellectual leadership of Pakistan in the 1970s, the industry was led to global recognition in the 1980s by a couple of groups originating from

Saudi Arabia, namely Dar Al Maal Al Islami Trust (then domiciled in Geneva) and Dalla Al Baraka Group (domiciled in Bahrain). Moving forward in 2020, Pakistan needs to take more role in promoting Islamic banking and finance, in line with the standards of the Islamic Financial Services Board (IFSB). In an attempt to further increase the share and awareness of Islamic banking and finance in the country, Edbiz International Advisors successfully held its twin-event, the Global Islamic Finance Awards (GIFA) and the Global Islamic Finance Summit (GIFS) in the capital city of Pakistan, Islamabad, which was attended by a large number of Islamic bankers, regulators, government officials and, most importantly, by Dr Arif Alvi, President of the Islamic Republic of Pakistan.

The Global Islamic Finance Awards (GIFA) were founded in 2011 in as an endeavour to celebrate the achievements of governments, institutions and individuals in IBF, with an ultimate objective to promote commitment to Islamic finance, with adherence to Shari’a authenticity and the promotion of social responsibility. The recipients of our top award – the Global Islamic Finance Leadership Award – known as GIFA Laureates have included: HE Tun Abdullah Badawi, Former Prime Minister of Malaysia (2011); HRH Sultan Nazrin Shah of Perak (2012); HE Shaukat Aziz, Former Prime Minister of Pakistan (2013); HE Nursultan Nazarbayev, First President of Kazakhstan (2014); His Highness Muhammadu Sanusi II, Emir of Kano, Nigeria (2015); HE Joko Widodo, President of Indonesia (2016); HE Ismail Omar Guelleh, President of Djibouti (2017); HE Bakir Izetbegovic, Former Chairman of Presidency of Bosnia-Herzegovina (2018); and HE Cyril Ramaphosa, President of the Republic of South Africa (2019).

Other GIFA winners come from around the world and are selected based on a proprietary methodology, making GIFA the most objectively administered awards in the Islamic financial services industry. This year there were more than 70 awards presented to individuals and institutions for their contribution to the development of Islamic banking and finance.

Since its debut, over 550 awards have been presented to exceptional individuals and institutions drawn from more than 60 countries in different continents. These include public sector individuals and organisations, businesses from the financial services, manufacturing, education and technology; and social sector organisations serving different causes in health, education, women empowerment and children welfare.

Professor Humayon Dar, Chairman Global Islamic Finance Awards, remarked in his welcome speech, “I am profoundly overwhelmed with pleasure and pride to present the 10th edition of the Global Islamic Finance Awards. In the wake of COVID-19, our Awards Ceremony is being held for the first time physically and virtually concurrently.

I must congratulate all the winners today and thank them for their dedicated efforts to promote Islamic banking and finance in their countries, respective institutions and of course for their commitment to continue to make Islamic banking and finance relevant to the global financial markets.”

Professor Dar, commended all the winners on their achievements. In particular, he highlighted the role of the State Bank of Pakistan for laying foundations of a robust and sustainable Islamic banking sector in the country. Dr Reza Baqir, Governor of the State Bank of Pakistan, who received the Best Central Bank of the Year award, reiterated the commitment of the central bank to facilitate Islamic banking in the country.

The winners of the GIFA awards present in the physical ceremony included Meezan Bank, Faysal Bank, Dubai Islamic Bank Pakistan, HBL Islamic Banking, HabibMetro SIRAT, and Bank Alfalah Islamic and others. In the concurrent virtual GIFA awards ceremony, further 60 awards were announced for the players in the global Islamic financial services industry. The winners included Islamic banks, asset management firms, universities, charitable organisations, technology providers and many more from around the world.

Notable winners came from Malaysia, Indonesia, Brunei Darussalam, Bangladesh, Pakistan, the UAE, Oman, Bahrain, Saudi Arabia, Sudan, the Russian Federation, Kazakhstan, Nigeria, South Africa, Tunisia, and the UK.

The objective of the Global Islamic Finance Awards (GIFA) is to highlight the best practices in Islamic banking and finance and celebrate the success of institutions and individuals, with an ultimate objective of promoting social responsibility, Shari’a authenticity and commitment to Islamic banking and finance. The GIFA winners are decided by a proprietary methodology.

On top of our Selection Criteria, we have:

- Social Responsibility

- Shari’a Authenticity

- Commitment to Islamic Banking and Finance

The above-mentioned criteria are then augmented with:

- Innovation

- Quantity and Quality

- Cross Border

- Promotion of the Growth of Industry

Every year, a head of state or government is chosen to receive the Global Islamic Finance Leadership Award for their advocacy of Islamic banking and finance. This year, this coveted award was presented to Dr Arif Alvi for Pakistan’s leadership in the global Islamic financial services industry.

“I, on behalf of the GIFA Awards Committee extend my heartiest congratulations to His Excellency Dr Arif Alvi, President of the Islamic Republic of Pakistan, for becoming the 10th GIFA Laureate. He is being presented the Global Islamic Finance Leadership Award 2020 for Pakistan government’s full commitment to make the country as a contemporary example of a state governed by the glorious principles of the first Islamic state of Medina.” Professor Humayon Dar, remarked on the occasion.

Dr Shamshad Akhtar served as the Federal Finance Minister of Pakistan holding multiple economic portfolios in the caretaker government and as the former Governor of the State Bank of Pakistan. During her career Dr Akhtar has strongly advocated and promoted Islamic finance both its mainstreaming in banking, capital markets and insurance sector. She supported Islamic finance to be an integral part of Sustainable Finance Stream within the Addis Ababa Accord, 2015.

In view of her innumerable services, she was awarded the GIFA Lifetime Achievement Award 2020.

The GIFA Excellence Award (Leadership Role) 2020 was presented to Justice (Rtd) Mufti Muhammad Taqi Usmani for his pioneering research work and his leadership role in the global Islamic financial services industry. He is one of the leading Shari’a scholars in the field of Islamic finance. He has been passionately serving the cause of Islamic finance for more than 20 years all over the world either as the chairman or a member of Shari’a supervisory boards of many Islamic banks and financial institutions. He has also been awarded with Sitara-i-Imtiaz by the Government of Pakistan.

Junaid Ahmed, Chief Executive Officer, Dubai Islamic Bank Pakistan, with over thirty years’ experience in the diversified areas of General Banking, Foreign Exchange, Treasury, Corporate and Investment Banking with leading banks in Pakistan and in the Middle East, has been recognised as the Islamic Banker of the Year 2020.

“It gives me immense pleasure to be chosen as the GIFA Islamic Banker of the Year 2020. I would like to congratulate GIFA (Global Islamic Finance Awards) for successfully hosting the GIFA Award 2020 in Islamabad, Pakistan.”

The GIFA Excellence Award (Islamic Financial Innovation) 2020 was presented to the Dubai Islamic Bank, Pakistan. Dubai Islamic Bank Pakistan Limited (DIBPL), a wholly-owned subsidiary of Dubai Islamic Bank UAE (DIB), has maintained its position as an innovative solution provider to all the financial needs of its customers, in accordance with Shari’a. The bank continues to play an active role in developing the market of Islamic commercial paper in Pakistan by participating in all major Sovereign Islamic Sukuk issued from the Government of Pakistan as well as the Sukuk issuance from the private sector.

“We owe our success to the strategic vision given by the DIB Group & our hardworking staff. We remain steadfast to make inroads in the Islamic banking industry of Pakistan in supporting the economic growth of the country”.

Faysal Bank Limited, a leading financial institution in Pakistan with a legacy of service and innovation, has been awarded a GIFA for the Best Emerging Islamic Bank 2020. The overall vision of Faysal Bank is to be the leading Islamic bank in Pakistan with customer care, technology, and employee focus at the heart of its business ethos. The bank believes in developing innovative and technology-centric.

Shari’a-compliant products and services, which together with a culture of teamwork, respect, professionalism and integrity will ensure that the bank is able to serve their clients’ needs.

Yousaf Hussain, President & Chief Executive Officer of Faysal Bank, with around 25 years of diverse professional experience, has been presented the GIFA Excellence Award (Transformation & Market Strategy) 2020. Under his leadership, the bank has embarked upon a well-structured plan to convert into a full-fledged Islamic bank from a conventional bank.

“The fact that Faysal Bank has received not only the GIFA Excellence Award for Transformation & Market Strategy but also the award for Best Emerging Islamic Bank is a monumental moment of celebration for us. With Allah’s blessings, continued support from our Board of Directors, and facilitation by the State Bank of Pakistan we are clearly heading towards our destination of becoming the best and the most progressive Islamic bank in Pakistan, InshaAllah. I would like to thank the GIFA team for acknowledging our efforts.’’

Faysal Bank Limited has been recognised as the Best Emerging Islamic Bank for the year 2020. Faysal Bank Limited is a leading financial institution in Pakistan with a legacy of service and innovation, which spans over three decades. The bank is engaged in Retail, Corporate and Commercial banking activities and over the past few years has become one of the fastest-growing banks in the country due to its significant growth from a size and scale perspective. The bank is currently in the process of converting into a full-fledged Islamic Bank – the largest such conversion of any conventional bank into an Islamic bank ever to have been initiated anywhere in the world. The overall vision of Faysal Bank is to be the leading Islamic bank in Pakistan with customer care, technology, and employee focus at the heart of its business ethos.

“We have been diligently working on converting the bank into a full-fledged Islamic Bank for the past few years. This conversion is one of the largest of its kind in the world. The recognition by a prestigious label such as GIFA is truly a cause for celebration for our organisation.”

Dr Rizwan Malik has over 10 years’ experience in investment allocation, advisory, research, strategy, and business development. Presently, he heads the Standards Implementation and Strategic Developments department at the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) – the global Islamic finance standards-setter within the Islamic finance industry. He is a member of the Senior Management Team (SMT), an Associate Editor of the peer-reviewed technical bulletin – Journal for Islamic Finance Accountancy (JOIFA) and a member of working group for a standard on Investment Funds at AAOIFI. Dr Rizwan Malik has been named as the Upcoming Personality in Global Islamic Finance (Advocacy & Standardisation) 2020.

“Back in 2011, when I witnessed the launch of the Global Islamic Finance Awards (GIFA) with the first event held in Muscat, Oman, I did not expect that one day I will become a recipient of it as well. I am thrilled to receive the GIFA award and pleased to see my humble contributions recognised within the industry. I thank the GIFA Awards Committee and the GIFA Secretariat for their support.’’

The Best Islamic Banking Brand 2020 was presented to HabibMetro SIRAT. HabibMetro Bank has been providing customers with Shari’a-Compliant Banking products and services since 2004. SIRAT, the Bank’s Islamic banking brand, was launched in 2014 in Pakistan. ‘SIRAT’ is an Arabic word meaning ‘path’/’direction’. SIRAT signifies a path to success. The brand represents a commitment to the basic values of security, integrity, respect, responsibility, integrity, and trust, and as such, is a reaction of the Group’s core values and vision.

“Through strategic focus and concentrated efforts, we at HABIBMETRO SIRAT aim to increase the contribution of our Islamic banking brand to HABIBMETRO Bank in Pakistan and strengthen the positioning of SIRAT Islamic Banking in the other countries where Habib Bank AG Zurich enjoys a footprint.’’

HBL Islamic Banking has been recognised as the Best Islamic Bank for Trade Finance 2020. HBL-Islamic Banking (HBL-IB) is a leading provider of Shari’a-compliant solutions to its customers. It has one of the largest distribution networks in Pakistan comprising of 541 outlets including 48 branches and 493 windows. HBL-IB has also strengthened its product range to offer complete and end-to-end Shari’a-compliant solutions for its varied and diversified customer base.

“Trade finance is at the heart of Pakistan’s economic activity and is also closest to Shari’a principles. HBL Islamic Banking is committed to playing its role in strengthening Pakistan’s Islamic banking industry, by introducing innovative product offerings and setting new standards for digitising the trade business in Pakistan.”

The Shari’a Authenticity Award 2020, the Shari’a Auditor of the Year 2020 and the Sukuk House of the Year 2020 was presented to the only bank in the history to have received three awards in a given year. Meezan Bank is Pakistan’s first and the largest Islamic bank with a paid-up capital of PKR10 billion. It is the only full-fledged Islamic bank with AA+ credit rating in the Islamic banking industry in the country. Meezan Bank operates strictly under the principles of Islamic Shari’a and is well recognised for its product development capability and Islamic banking research and advisory services.

“Meezan Bank was set up with a Vision of establishing ‘Islamic banking as banking of first choice…’ and Alhamdulillah over a period of time, with sheer determination and commitment to our goals, Meezan Bank has become a gold standard for Islamic Banking in Pakistan.”

The GIFA Special Award (Advocacy and Facilitation) 2020 was awarded to the Ministry of Finance, Government of Pakistan. The Ministry of Finance has been instrumental in raising the level of financial inclusion in Pakistan, through the National Financial Inclusion Strategy (NFIS) developed and adopted by the Government in 2015. The government raised, for the first time, a Sukuk of PKR200 billion, which is a strong indicator of the potential and feasibility of Islamic finance and promises immense potential for delivering big-ticket deals to the government for the benefit of the economy. This will also be a step in moving away from interest-based borrowing and shifting towards Shari’a-compliant financing as per the constitution of Pakistan.

The State Bank of Pakistan plays an important role in the development of the country by enhancing the scope of financial intermediation to the underserved sectors of the economy. The dual role of State Bank of Pakistan as regulator and facilitator for priority sectors like Islamic banking, SMEs, agriculture and low-cost housing demonstrates its commitment towards developing the required infrastructure for sustainable growth and inclusive growth. Parallel to the conventional financial system, it has laid the foundations of Islamic banking in the country by introducing dynamic legal and regulatory measures and a comprehensive Shari’a Governance Framework. The State Bank of Pakistan received the GIFA for the Best Central Bank of the Year 2020.

Bank Alfalah Islamic was awarded the Most Innovative Islamic Banking Window award for 2020, and its product, Alfalah Islamic Recurring Value Deposit was recognised as the Best Islamic Savings Product 2020. The bank has a network of over 700 branches including 170 Islamic branches spanning across more than 200 cities with a presence in Afghanistan, Bangladesh, Bahrain, and UAE. The bank provides financial solutions to consumers, corporations, institutions, and governments through a broad spectrum of products and services, including corporate and investment banking, consumer banking and credit, securities brokerage, commercial, SME, agri-finance, Islamic, and asset financing solutions.

“At Bank Alfalah, we pride ourselves on keeping our customers and their financial needs as our key priority. We continue to find new and innovative ways of providing our customers a seamless banking experience with the best possible Islamic products while remaining fully compliant with Shariah principles.”

M Shahidul Islam, Managing Director and Chief Executive Officer (MD & CEO) of Shahjalal Islami Bank Limited (SJIBL), was rightfully acknowledged as the Islamic Finance Personality of the Year 2020. During his 35 years long banking career, he has gathered vast experience in almost every key area of banking like Corporate, SME, Foreign Trade, Consumer Banking, Credit Risk Management, Syndication and Structured Finance, Foreign Investment, Finance as well as Treasury.

“My sincerest appreciation goes to the GIFA Award committee for recognising our efforts at this global level. This award makes me more responsible to deliver the best. I can assure that SJIBL shall remain on the forefront for the development of Islamic finance within the mainstream global financial system.’’

Mohd Muazzam Mohamed, the Chief Executive Officer (“CEO”) of Bank Islam Malaysia Berhad (“Bank Islam”) and BIMB Holdings Berhad (“BHB”), has been named as the GIFA Transformational Leader of the Year 2020. He plays a strategic role in the bank’s strategic direction, business development, robust risk management, corporate branding & positioning, human capital development, capital & balance sheet management and sound credit management.

“This award acknowledges the bank’s progress in our transformation journey as the bank that advances prosperity for all. I am proud to lead the team that has worked hard in promoting responsible finance and inclusive growth, and continue to lead the development of the Islamic banking industry for Malaysia.”

Khalid Al Kayed, the Chief Executive Officer of Bank Nizwa, has been named as the GIFA CEO of the Year 2020. Khalid Al Kayed has steered the bank to a new era, positioning Bank Nizwa as a strong, innovative, and relationship-oriented Shari’a-compliant financial institution with the largest market share as a full-fledged Islamic bank. He is also leading the bank’s ongoing and new initiatives and programmes to raise awareness on the benefits of Islamic finance to the wider public across Oman.

“I am truly delighted to receive the CEO of the Year 2020 Award from one of the world’s most respected forums for Islamic banking. I consider this recognition from GIFA 2020 as a testament to the support of our chairman and board members as well as the dedication and hard work of my colleagues at Bank Nizwa. This can only be the result of teamwork.”

Prof Dr Bambang Sudibyo MBA. CA., Chairman of BAZNAS, the Republic of Indonesia, was presented the GIFA Special Award (Leadership Role) 2020. During his leadership, BAZNAS developed into a zakat institution that is trusted by people, has innovative programmes, and has succeeded in increasing zakat collection by an average of 33.7 per cent per year. During his tenure, BAZNAS has received several awards both at the national and international levels. Currently, he also serves as the Secretary-General of the World Zakat Forum.

“The awakening of zakat is a momentum to make zakat as a pillar of moderating social inequality, the revival of the people’s economy, a breakthrough in poverty alleviation, and the development of funding sources for the development of people’s welfare outside the state budget. I believe this award will strengthen our spirit to increase the pace of zakat movement in Indonesia and the world”.

The GIFA Special Award (Islamic Financial Advocacy) 2020 was presented to Datuk Chung Chee Leong, President/Chief Executive Officer and Executive Director of Cagamas Berhad. He spearheaded Cagamas’ entrance into the international bond market. He was instrumental in establishing the company’s USD5 billion multicurrency EMTN Programme under

which Cagamas’ inaugural and South East Asia’s largest Offshore Renminbi bond was issued. Under his leadership, Cagamas also concluded the country’s largest Sukuk issuance in 2013.

“Over the past three decades, Cagamas has contributed to the country’s trailblazing efforts in Islamic finance. With the continued support of our stakeholders, we will remain focused in our determination to promote the adoption of new and evolving Islamic finance products and structures, within the mainstream financial system in Malaysia and beyond.’’

Masumi Hamahira, the Honorary Treasurer, Grand Council, Chartered Institute of Islamic Finance Professionals (CIIF), was awarded the GIFA Special Award (Islamic Blockchain Leadership) 2020. He has over 22 years of working experience in the banking and finance industry at the MUFG Bank and is currently the Executive Advisor for Islamic Finance Department of MUFG Bank (Malaysia). He aspires to contribute more significantly to the development of Islamic blockchain by sharing industry

firmly believe that the Islamic capital market is the future of the Indonesian capital market.”

knowledge with the public. Masumi is one of the distinguished panellists in the Islamic FinTech Conference to especially discuss the application of Blockchain to Islamic finance.

“I’m so grateful to have been involved in the development of Islamic Blockchain via collaboration with innovators in Bitcoin SV ecosystem. Special thanks to Bitcoin Association and nChain for giving me the opportunity to become a bridge between the Islamic finance industry and Blockchain developers.”

The Upcoming Personality in Global Islamic Finance (Islamic Capital Market) 2020 was bestowed upon Irwan Abdalloh, Head of Islamic Capital Market, Indonesia Stock Exchange.

“As a person who has focused on developing the Indonesian Islamic capital market for the last 10 years, it is an honour to receive the award as the “Upcoming Personality in Global Islamic Finance (Islamic Capital Market) 2020”. Although in the past ten years, there have been many achievements, they are still far from its true potential, as Islamic finance is still in the development stage. There are still many things that must be developed in Indonesia. Islamic capital market literacy and inclusion are still the homework that should be done continuously. I firmly believe that the Islamic capital market is the future of the Indonesian capital market.”

The National Committee for Islamic Economy and Finance (KNEKS) has been awarded the Islamic Finance Advocacy Award 2020. The KNEKS is a transformation of National Committee for Islamic Finance (KNKS) in order to enhance the development of Shari’a economic and financial ecosystem and making Indonesia the World’s Halal Centre. KNEKS aims to accelerate, expand, and advance the Shari’a economic and financial development in order to support the national economic resilience.

“Indeed, this GIFA is encouraging us to do more for the development of Islamic economic and finance in Indonesia. The government continues to be committed to realising Indonesia as an Islamic Economic Global Hub.’’

TAJBank Ltd was termed as the Best Islamic Bank for Marketing & Growth Strategy 2020. As a licensed Islamic bank with the intent of providing excellent service through technology and digital banking, the bank focuses on building a powerful brand as a deposit money bank with solutions and competences in Islamic banking, ethical conventional banking products and services by leveraging on mainstream and social media.

“Awards like this are an indicator that we are creating significant impact, it also encourages us to strive and achieve even more.”

The Best ESG Investor 2020 was awarded to BNP Paribas Asset Management Malaysia, an Islamic fund management company that works tirelessly for the financial stability of the Malaysian society.

The College of Banking and Financial Studies, Oman was acknowledged as the Best Islamic Finance Training Provider 2020. Over three decades, CBFS has been helping the financial services industry in Oman to meet its human resource development needs. Since the formal adoption of the same by the Sultanate, the college has been actively involved in providing both in-house and international trainings, short courses, diplomas, certifications, degree, R&D and other capacity building measures in Islamic finance.

“The College of Banking and Financial Studies feels both honoured and proud to receive the prestigious GIFA Award for the Best Islamic Finance Training Provider 2020. CBFS has been playing a pioneering role in the Sultanate, proactively catering the current needs of Islamic finance, and shaping future trends. The role and contributions are not only acknowledged locally but resonate globally. The award is a manifestation of the same.”

SALIHIN Publication Sdn Bhd has been named as the Best Islamic Finance Publishing House 2020. SALIHIN is the brand that provides various advisory professional services from fields of Shari’a, corporate finance, fintech and digital, taxation, audit and

assurance. The purpose of SALIHIN’s establishment is anchored on culturing Shari’a values towards a sustainable world. SALIHIN’s vision is to be the best global leader in providing Shari’a-value-based services and education by internalising and implementing human governance in accordance with the Shari’a values in delivering excellent services and quality education.

“The award is an evidence of the global recognition for SALIHIN Shariah Advisory in the field of Shari’a research and publication in Islamic finance. This award inspires.

us to keep growing and achieving more successes in the future with impactful industry-driven research papers and versatility of publication to serve different age groups, which will be one of our focuses in the near future.”

The Best Islamic Finance Qualification 2020 was presented to Islamic Finance Qualification (IFQ),

Chartered Institute for Securities & Investment. The IFQ has grown apace, as part of the CISI’s suite of qualifications covering the investment waterfront – capital markets and corporate finance, compliance and risk management, financial planning, operations, and wealth management.

“We are honoured and delighted to have received this Award and we would like to offer our thanks to the GIFA Secretariat and Committee. It is a tribute to the over 4,200 candidates who have sat our Islamic Finance Qualification, since its inception in 2007, in three languages, across five continents, the mark of a truly global qualification.”

Alinma Bank was named as the Best Islamic Bank 2020. The bank is fully Shari’a compliant, and strives to deliver forward-thinking, innovative, and exemplary products and services that meet customer needs and expectations. Alinma today owns one of the most advanced banking infrastructures with regard to technological capabilities, branch network, remote channels, and product and service innovation. This focus, along with a commitment to treat its customers as “partners”, has resulted in noteworthy, sustainable growth.

“This has been a year filled with both challenges and opportunities, and we are pleased to have maintained our level of performance during these trying times. Thanks to our commitment to customer-centricity and the digitisation of our customer experience, we have been able to provide seamless, exemplary customer service that has engendered trust and confidence despite the challenges we have all faced.”

The Best Takaful Company 2020 was presented to The Company for Cooperative Insurance (Tawuniya). The company provides more than 60 types of insurance. Tawuniya has a market share of 23% with gross written premiums amounted to SR8.6 billion in 2019 and total assets of SR14.2 billion.

“Tawuniya has several distinctive factors that qualify it to be the best Takaful company due to its pioneering position in the Saudi insurance market. It is the, first cooperative insurance company in the Kingdom, and the first Saudi company, which has successfully applied the cooperative insurance concept by sharing the insurance surplus with the clients for the first time in 1990.”

The Best Islamic Rating Agency 2020 was awarded to the Malaysian Rating Corporation Berhad (MARC). MARC’s overarching focus since the inception has been, and continues to be, on delivering information, insights, solutions and benchmarks to contribute towards more robust and sustainable capital markets. MARC recently ventured into new business segments, providing the market with up-to-date data analytic offerings, as well as risk framework solutions and advisory.

“We are truly honoured, and at the same time, humbled by this recognition from Global Islamic Finance Awards (GIFA), This accolade underscores our role as a leader in the sukuk rating space, and will spur us to further strengthen our commitment towards ensuring the sustainability of Islamic capital markets. The award also recognises MARC’s efforts to support the development of Islamic finance in Malaysia.”

The Best Islamic Microfinance Institution 2020 was presented to Waqaf An-Nur Corporation Berhad. As the corporate social responsibility arm of JCorp, WANCorp continues to dutifully manage the waqf assets and funds for more than 10 years. As a corporate Islamic endowment institution, WANCorp plays a pivotal role in demonstrating and promoting waqf as an economic driver to the Muslim community. WANCorp continues to introduce new initiatives through waqf innovation, which indicates WANCorp’s unwavering commitment in sustaining the waqf institution, effectively ensuring continuous virtues to more beneficiaries in the country.

“Alhamdulillah, this award is a recognition of our two-decade-long efforts to drive waqf as a vehicle towards equitable and sustainable Islamic wealth distribution. We are proud to pioneer corporate waqf management with the support from Johor State Islamic Religious Council and Johor Corporation Group of Companies. Going forward, in collaboration with strategic partners, we are committed to catalysing the development of corporate waqf and Islamic social finance while ensuring continuous virtues to our beneficiaries, in tandem with the UN Sustainable Development Goals 2030.’’

Bank of Khartoum (BOK) is Sudan’s oldest and largest Islamic financial institution. The bank is known to be a pioneer in the introduction and implementation of financial technology and alternative banking channels to the Sudanese market in a continuous aim to reach a larger segment of the beneficiaries, elevate and enhance its services and to continuously keep upgrading its banking products to meet the needs of the clients existing and potential. it offers Shari’a-compliant products and services covering trade finance, deposits, syndicated loans, treasury and correspondent banking services. This year the Bank of Khartoum has been awarded the Pioneer of Islamic Banking Award 2020 and the Best Islamic Bank for Social Responsibility Award 2020.

“Not only do we take pride in this achievement but we also feel motivated to keep working hard and innovating in the field of Islamic banking with the aim of delivering superior service to our clients & society and continue getting such recognitions. 2020 has been a difficult year globally and Sudan is going through a transitional period, which is posing its own challenges. Nevertheless, we have not been fazed by the environment and we continued with the same professionalism, integrity and hard work which we are confident will stand us in good stead.”

Silverlake Axis creates technologies to enable the Digital Economy. Today, Silverlake Axis is the core system platform partner of choice for 3 of the 5 largest ASEAN super regional financial institutions. Silverlake Axis continues to offer innovative Digital Economy Propositions and Enterprise Solutions to its customers in Banking, Insurance, Retail, Payment and Logistics Ecosystems. Silverlake Axis’ solutions are delivering operational excellence and enabling business transformations at more than 380 enterprise customers in over 80 countries. Silverlake Axis won the Best Islamic Finance Solutions Provider 2020 for the fifth time in a row.

“By leveraging on Silverlake Axis flagship Straight Through Banking Platform, a proven, well-tested and currently, the de-facto standard for some of the largest banks in ASEAN, Silverlake Axis is well-positioned towards enabling the digitalisation of Islamic finance products and services in line with our mission to be the leading fintech company, highly valued by our customers and partners.’’

The Best Shari’a Compliant Commodity Broker 2020 has been presented to Eiger Trading Advisors Limited. Eiger is a leading technology-focused Shari’a-compliant commodity provider in the Islamic finance space. Over the past 10 years, Eiger has bridged the gap between the physical commodity markets and Islamic financial institutions with market-leading technology. The Eiger Trading Platform supports Islamic financial products across a variety of unique operational requirements such as liquidity management and treasury, Islamic capital markets, asset management, corporate and retail banking, derivatives, real estate financing, peer-to-peer financing and micro-financing.

“We are delighted to have been chosen to receive the GIFA award for Best Shari’a Compliant Commodity Broker 2020 and I wish to thank GIFA for recognising Eiger for such a prestigious award. Our team has worked hard over the past year to deliver a high-quality service to our customers and this award is a testament to these efforts.

Tazkia Islamic University College has been adjudged as the Best Islamic Finance Education Provider 2020. Tazkia has provided various trainings on Islamic banking to bankers and officials of the Bank Indonesia and is involved in the conversion of commercial banks to become Islamic banks. The name of Tazkia is imbued with T.A.Z.K.I.A. Values (Tauhid. Amanah. Zero Defect Quality. Knowledge Competence. Innovative Istiqomah. Achievement through Team Work). Tazkia has committed to implement TAZKIA values by maintaining the quality, innovation, global achievement, and contribution towards worldwide Islamic economics.

“We are motivated to continue to do our best to provide, learn and grow and to make better contributions for Indonesia and the world. Our present commitment is to achieve 2025 vision, which is to become ‘A UNIVERSITY OF CHOICE FOR FUTURE WORLD-CLASS BUSINESS LEADERS AND INTELLECTUALS IMBUED WITH

T.A.Z.K.I.A. CHARACTERS’. We are confident as The Best Islamic Finance Education Provider, we would achieve the vision, however we certainly also need your prayers and support to make it happen.”

Shariah Registered Financial Planner (Shariah RFP) of the Malaysian Financial Planning Council (MFPC) has been named as the Best Islamic Wealth Management Qualification 2020. MFPC is an independent body set up at the initiative of the Malaysian government with the noble objective of

promoting nationwide development and enhancement of the financial planning profession. MFPC provides an evolving set of Best Practice Standards and Code of Ethics that must be adhered to by Registered Financial Planner (RFP) and Shariah RFP designees.

“MFPC Shariah RFP programme is a professional programme for practitioners to equip themselves with Takaful and Islamic Financial Planning principles and knowledge. With the COVID-19 lockdown, we have since extended our learning programme through learning management system (LMS) so as to enable MFPC Shariah RFP programme to be accessible for anyone around the world.”

The Best Islamic Capital Market Award 2020 was presented to the Indonesia Stock Exchange (IDX).

The Indonesian Capital Market has always been closely tied to the Islamic Capital Market. This fact

is shown by the number of Shari’a-compliant stocks that make up to 65% of all listed stocks. Despite the crisis, there was an increase in the volume and value of Shari’a stock traded by Shari’a investors. Indonesia Sharia Capital Market is the only capital market in the world that has a special fatwa regarding Shari’a stock transactions on the Stock Exchange. Our excellent initiatives will not only increase the market share but will also make sure to keep them Shari’a-compliant.

“It is a privilege for us to receive the Best Islamic Capital Market Award for the second time amidst the COVID-19 pandemic that hit the Islamic Capital Market. We will take this award as a recognition of our effort and accomplishment, also as an encouragement to strive further in developing an innovative Shari’a-compliant products and services to keep the Islamic Capital Market growing and more inclusive for everyone.”

The Best Islamic REIT Award 2020 was presented to Alkhabeer REIT. Alkhabeer REIT is a publicly offered closed-ended Shari’a-compliant real estate investment traded fund Alkhabeer REIT’s initial real estate investment portfolio includes properties focusing on the retail, office and residential real estate segments, strategically distributed in Jeddah,

Riyadh and Tabuk. The total value of the targeted fund assets after the additional offering: SAR1,707,515,836.

“The selection of Alkhabeer REIT as the Best Islamic REIT of 2020 comes in recognition of the Fund’s differentiating factors, competitive advantages and Alkhabeer Capital’s commitment towards providing its clients with premium investment products and opportunities.”

Oasis Crescent Capital (Pty) Ltd was presented the Best Islamic Fund Manager 2020. Oasis is a diversified wealth management company that provides services relating to asset management and financial advice. The unequivocal objective of the Oasis investment methodology is to protect clients’ assets through the implementation of a low-volatility fund management philosophy. This approach to wealth creation is based on a long-term investment horizon that incorporates elements of Environmental, Social and Governance (ESG) considerations in its share selection process.

“We are delighted to receive the award for Best Islamic Fund Manager for 2020. This is the third consecutive year that Oasis has received this accolade, which reflects our focus on delivering investment excellence to our investors. Throughout our history, our approach has been underpinned by a simple yet powerful investment philosophy that is based on growing and protecting our clients’ wealth over time.”

The award for the Most Sustainable Islamic Bank 2020 was presented to Bank Rakyat. Bank Rakyat has always maintained its position as a progressive, dynamic and Islamic cooperative bank that ensures the well-being and prosperity of the community and nation. Its commitment as a cooperative bank has always been about raising the living standards of its people by meeting their financial needs and delivering exemplary services.

Gatehouse Bank Plc was named the Best Islamic Bank for Property & Real Estate Finance 2020.

Gatehouse Bank is a Shari’a-compliant UK bank authorised with operations spanning residential and commercial property financing and Build to Rent, as well as retail savings and real estate investment advice. A key part of Gatehouse Bank’s strategy is to offer products to the underserved markets; this includes members of the expat and international communities who want to buy UK property for rental investment, but often struggle to find lenders because of more rigid application criteria. The bank is also able to finance both single and property portfolio acquisitions and refinancing.

“Despite barriers in the market during the lockdown, our team performed above expectations by completing a new investment transaction. This award is a huge testament to the team and their hard work. Gatehouse Bank has a growing presence in the UK banking market, with our ethical, Shari’a-compliant approach.”

FNB is the oldest bank in South Africa and its roots can be traced back to 1838. This is evident in the fact that FNB was the first of the four large banks in South Africa to open an Islamic banking window and offer Islamic banking to South Africa’s minority Muslim population, which roughly constitutes just 2% of the total population. In order to keep pace with the

industry, FNB Islamic Banking is continually innovating its product and services to remain competitive and to manage customer expectation. FNB Islamic banking’s expansion into the rest of Africa is a key priority for the Group. A large majority of the countries that FNB currently operates in have large Muslim populations and are well poised to offer Islamic financial services. FNB Islamic Banking has been named as the Best Islamic Banking Window 2020.

“This award, under exceptionally challenging circumstances, augments FNB Islamic Banking’s leadership status in a country that has emerged as a gateway to the African Islamic finance and a leader in the Southern Hemisphere as a predominant Islamic financial services provider.”

Standard Bank Shari’ah Banking is the proud winner of two awards, the Best Emerging Islamic Banking Window 2020 and the GIFA Excellence Award (Premier Islamic Banking Services) 2020. The Standard Bank Group is a financial institution that offers banking and financial services to individuals, businesses, institutions and corporations in Africa and abroad. We are the largest bank in Africa by assets. Our business activities have social, economic and environmental (SEE) impact on the economies and communities in which we operate. In 2016, we began our journey to bring Shari’a-compliant financial services and products to our clients across our operations and while we are still early on in this journey, great strides have already been made.

“Out of these challenges will emerge new opportunities for all of us. As you change and grow in this new and complex environment, we will ensure that we travel that journey with you.”

DDCAP Group™ is once again the proud winner of two awards, GIFA Market Leadership Award (Facilitation & Support) 2020 and the Best Islamic Finance Technology Product 2020 for ETHOS Asset Facilitation Platform™ (ETHOS AFP™). DDCAP Group™ (“DDCAP”) was the first Islamic wholesale market intermediary established specifically to support the growth and development of the Islamic finance industry. Since then, it has been a market leader in this sector. DDCAP has an extensive track record within the Islamic financial services, employing over 40 professionals with broad and complementary skill sets drawn from diverse financial industry backgrounds. DDCAP’s multi-award-winning Asset Facilitation Technology Platform, ETHOS AFP™, is a bespoke real-time trading platform with 24-hour coverage and full Straight Through Processing (“STP”) functionality, enabling clients worldwide to purchase commodities and other assets via a secure, web-based portal as an alternative to traditional transactional processes. ETHOS AFP™ encompasses Shari’a and business-focused operational requirements across treasury, capital markets, asset management, client consumer banking portfolios and takaful.

“It is a testament to the significant amount of work that we have conducted over the past twelve months to further evolve our business offerings to ensure we remain considered a market leader. This work was particularly focused on the continued evolvement of our automated financial technology.”

BAZNAS Indonesia has emerged into a professional zakat management organisation in Indonesia and discovered various innovations in helping the poor especially zakat beneficiaries. BAZNAS has carried out zakat distribution and utilisation programmes in the fields of economy, education, health, social and da’wah. Based on the 2020 Zakat Impact Study, BAZNAS has reduced poverty rate by 35% of all zakat beneficiaries assisted through empowerment programmes throughout 2019. Due to the impact of COVID-19, BAZNAS is committed to help lower class society who are affected in social, economic and health aspects by distributing zakat funds worth

IDR43.9 billion. BAZNAS, The Republic of Indonesia has rightly and deservingly won the Best Zakat Distribution Programme award 2020.

“This award is achieved to acknowledge the dedication of all BAZNAS and Amil Zakat Institution throughout Indonesia and all zakat activists in various parts of the world to implement the teachings of zakat for the welfare of the ummah.”

GIFA Championship Award (Shari’a and Islamic Financial Regulations) 2020 has been conferred upon Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), an international Islamic finance industry infrastructure development body that is responsible for the development and issuance of standards on Shari’a, accounting, auditing, governance, and ethics for Islamic financial institutions. As of July 2020, AAOIFI has issued 115 standards and technical pronouncement. This includes 59 Shari’a standards, 32 accounting standards, 8 auditing standards, 13 governance standards, and 3 codes of ethics. The standards are developed and issued to achieve AAOIFI’s overall objectives to standardise and harmonise international Islamic finance practices and financial reporting, in accordance to Shari’a principles and rules.

“At AAOIFI, we are striving towards developing top quality standards for the industry and such an award is a symbol of the industry leaders’ confidence in the work of AAOIFI.”

S&P Global Ratings has won the GIFA Championship Award (Islamic Financial Ratings) 2020. S&P Global Ratings is the world’s leading provider of independent credit ratings. Their ratings are essential to driving growth, providing transparency and helping educate market participants so they can make decisions with confidence.

“We also provide our views on the challenges and opportunities ahead of the Islamic finance industry, as well as recognise trends that are expected to shape its future through our commentary and research. Combining analytical excellence with a clear focus by S&P Global Ratings to proactively communicate our analysis and opinions with all market participants – investors, issuers, regulators, intermediaries and all industry associations.”

PMB Investment Berhad is the proud winner of the GIFA Championship Award (Islamic Asset Management) 2020. PMB Investment Berhad (256439-D) is an Islamic Fund Management Company (IFMC). It offers unit trust and fund management services. PMB Investment offers discretionary portfolio mandates for investments in Shari’a-compliant equity, sukuk and Islamic money market instruments, or a combination of the any of the three asset classes as required by the clients.

“This award makes us even more inspired and determined to continue with our efforts to help Malaysian society achieve financial sustainability through enabling and educating the public on the short and long-term benefits of putting something away for a rainy day.’’

SEDCO Capital won the GIFA Market Leadership Award (Islamic Asset Management) 2020. SEDCO Capital is a leading asset management firm that offers attractive investment opportunities across global markets through carefully engineered public and private funds and special instruments. SEDCO Capital offers advisory, discretionary investment management and asset allocation services that provide access to high-performing public and private equities, real estate assets, commodities and income funds with total assets under management of about USD5.3 billion.

“This continuous recognition reflects SEDCO Capital’s strong track record of innovation and performance, and is underpinned by the dedication of our highly seasoned team of professionals. Every day we strive to provide our clients with superior risk-adjusted returns while generating a positive impact on society.”

GIFA Market Leadership Award (Islamic Financial Intelligence & Ratings) 2020 was awarded to Moody’s Investors Service, a leading global provider of credit ratings, research, and risk analysis. A rating from Moody’s enables issuers to create timely, go- to-market debt strategies with the ability to capture wider investor focus and deeper liquidity options. As of June 30, 2020, Moody’s rates USD70+ trillion of debt.

“Moody’s currently maintains a wide and increasing rating coverage of the Islamic finance sector, produces frequent and timely research and participates in dedicated outreach initiatives, spanning all geographies and all our rating groups, including sovereign, financial institutions, corporates and structured finance, and remains committed to developing this further.’’

GIFA Market Leadership Award (Developing Islamic Banking in Indonesia) 2020 was conferred upon PT Bank Syariah Mandiri, the largest Islamic Bank in Indonesia.

The Faculty of Islamic Economics and Finance, Universiti Islam Sultan Sharif Ali (UNISSA) won the GIFA Market Leadership Award (Education in Islamic Banking & Finance) 2020. Universiti Islam Sultan Sharif Ali (UNISSA) is a “pure Islamic university” of international standard that offers a variety of undergraduate and postgraduate programmes across disciplines based on al-Quran and al-Sunnah. As the second state university and the first Islamic university in Brunei Darussalam, UNISSA strives to produce Muslim scholars and intellectuals who contribute to the development of the Ummah and the state.

“We are humbly grateful to have reached this important milestone as a university. Receiving this award entails an important recognition to the Faculty of Economics and Islamic Finance (FIEF), UNISSA, for their tireless efforts in striving to reach their vision to be a leading centre of academic excellence in the field of Economics, Islamic Finance and Entrepreneurship.”

GIFA Excellence Award (Islamic Commodity Platform) 2020 was presented to AbleAce Raakin Sdn Bhd, the pioneer and key solutions provider for Commodity Murabahah/Tawarruq transactions in Malaysia. Promoting the use of agricultural-based Commodities as the underlying assets, AAR is the first in the world to have a combination of various types of commodities in its offering. AAR has laid a strong foundation for excellence and growth, especially in key areas such as comprehensive client base, unrivalled access to commodity, proprietary supply chain and industry- leading trading system.

“We at AbleAce Raakin place high importance on technology ever sincewe launched our ARIIMSVersion 1 in 2006. Our latest version V2 now is a very robust platform able to conduct multi-currency, multi-commodity in real-time for high volume liquidity management to per transaction base trade web service and automation using STP/SFTP module.”

Cagamas Berhad won the GIFA Excellence Award (Islamic Securitisation) 2020. Cagamas Berhad (Cagamas), the National Mortgage Corporation of Malaysia, was established in 1986 to promote homeownership and contribute towards national development. It contributes towards the growth of the capital markets, Islamic finance and other priority sectors through the issuance of innovative instruments. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysian sovereign ratings.“This award represents a recognition of Cagamas’ commitment to developing innovative capital market solutions to meet the dynamic needs of Islamic finance in the global financial markets. By effectively leveraging on our position as the largest corporate bonds and sukuk issuer in Malaysia, we are poised to deliver value to our stakeholders in new frontiers of Islamic finance that will benefit the economy, our society, and the environment.”

Fitch Ratings was presented with the GIFA Excellence Awards (Islamic Financial Ratings) 2020. Fitch Ratings is a leading provider of credit ratings, commentary, and research. Dedicated to providing value beyond the rating through independent and prospective credit opinions, Fitch Ratings offers global perspectives shaped by strong local market experience and credit market expertise.

“The award reflects the market recognition of our research and ratings leadership in Islamic finance. It is a testimony to our strong credentials and achievements in this fast- growing and important sector.”

Rumah Zakat won the GIFA Excellence Award (Zakat Management) 2020. Rumah Zakat is a World Digital Philanthropic Charity Organisation that manages zakat, Infaq, sadaqah, waqf and other social funds through a village-empowered approach (Desa Berdaya). An integrated programme in the village area based on mapping of local potential fields of economy, education, health, environment and disaster preparedness.

“This award makes us more committed to continue to be a professional and trustworthy institution, especially in providing services and happiness to the people of Indonesia and the world.’’

Al-Farabi Kazakh National University Islamic Finance Centre was named the Best Emerging Islamic Finance Education Provider 2020. Al-Farabi KazNU Islamic Finance Scientific and Educational Centre has been the first in research and education in Islamic finance in the country and in Central Asia offering undergraduate programmes. In cooperation with foreign partner universities, with Islamic financial institutions and Astana International financial Centre, Al-Farabi KazNU Islamic Finance Centre has educational, scientific, innovative and production potential, which is aimed to the training of specialists of the highest qualification, further integration into the global educational space, development of fundamental and applied research, and implementing them in the financial sector.

“We believe in our successful prospects, expand networks for cooperation, actively conduct scientific and educational activities, not only multiplying the best values of Shari’a, but also demonstrating to society the advantages of Islamic financial instruments. We are confident that in the world that has changed after the pandemic, the potential of Islamic finance will become especially important and significant for people.’’

The SP Funds Dow Jones Global Sukuk ETF (SPSK) won the Most Innovative Sukuk Product award for 2020. The SP Funds Dow Jones Global Sukuk ETF (SPSK) was launched in 2020 and is traded on the New York Stock Exchange. This fund is the first to provide targeted exposure to sukuks, which are financial certificates, similar to bonds, issued in the global markets and structured to comply with Islamic religious law and investment principles. SPSK provide investors with the opportunity to invest in fixed-income investments, offering decreased exposure to duration risk and interest rate risk.

“We believe that Shari’a-compliant investing is the best way to hedge against leverage, which may give investors better control at minimizing downside risk, without compromising returns.”

Best Zakat Management in Higher Education Institutions Award 2020 was bestowed upon the Zakat, Sadaqah and Waqf Division (ZAWAF), Universiti Teknologi MARA. Being the largest university in Malaysia in term of population and the number of Muslims, philanthropy is becoming one of the university’s overarching principles. Under the auspices of Shari’a principles and values, ZAWAF plays a vital role in realising UiTM’s aspiration as a globally renowned university while upholding the national agenda in addressing the poverty and educational opportunity among native citizens. With collaboration and support from the local authorities, ZAWAF aims to become the largest network of zakat, waqf and Islamic philanthropy among the university community in Malaysia.

PayZakat is the winner of the GIFA Islamic Social Finance Award 2020. PayZakat is Russia’s only Islamic fintech project that successfully marries benevolence and kind-heartedness with digital technologies. It is a bilingual (Russian and English) digital platform that allows its users to calculate their contribution amount (Zakat and Sadaqah), and channel it to the charity of their choice.“This award shows the appreciation of the relentless work of our team of dedicated professionals that strove to achieve excellence in helping the less fortunate. PayZakat is a socially-oriented fintech project and a part of a large and constantly evolving ecosystem of Sberbank, the largest bank in Russia. It is very important for us to keep working for the benefit of the people.”

Jaiz Bank Plc won the award for the Most Improved Islamic Bank 2020. Jaiz Bank Plc – the premier Non- Interest Bank in Nigeria was established on the foundation of trust, professionalism and excellence to deliver innovative financial solutions and exceptional customer experience. The bank’s core values, Responsibility, Entrepreneurship, Simplicity, Excellence, Customer Focus and Trust, are the guiding forces that empowers the bank to project towards its vision to be the clear leader in ethical banking in Sub- Saharan Africa.

“We are pleased that the world watches and appreciates our modest contributions to the development of Islamic finance. We are deeply appreciative of the contributions of our loyal customers, dedicated staff and committed shareholders.”

Sukuk Deal of the Year 2020 award was presented to Sharjah Islamic Bank for its USD500 million Sukuk. Sharjah Islamic Bank (SIB), one of the leading Islamic banks in the UAE, priced a USD500 million (AED 1.83 billion) 5-year-long sukuk, with a profit rate of

2.85 per cent per annum, fetching it an A- rating by S&P. The bank earned a reputation for pioneering initiatives, adopting and implementing the latest technologies in the banking sector. SIB offers its clients modern Shari’a-compliant services that are in line with the international standards.

“The success of this Sukuk is evidence of the investor’s confidence in the solid foundation of SIB, and their belief in the growing economy of the Emirate of Sharjah and UAE in general. Despite the challenging economic conditions since the outbreak of COVID-19, we are proud of the results of this successful deal.”

The Islamic Corporation for the Insurance of Investment & Export Credit (ICIEC) won the Global Islamic Export Credit and Political Risk Insurance Award 2020. ICIEC provides risk mitigation solutions to Member Country exporters. By protecting them from commercial and political risks, exporters are enabled to sell their products and services across the world. The multilateral credit insurer also provides risk protection to investors from across the world that seeks to invest in ICIEC’s Member Countries. ICIEC is the only multilateral export credit and investment insurance corporation in the world that provides Shari’a-compliant insurance and reinsurance solutions.

“During a year of global economic uncertainty, this award is a testament to the Corporation’s important mission to support our 47 member countries. It is a responsibility we do not take lightly, and of course; we are delighted when there is an opportunity to reflect on and celebrate our achievements in support of our member countries.”

Bank of Khartoum won the Pioneer of Islamic Banking Award 2020. Bank of Khartoum (BOK) is Sudan’s oldest and largest Islamic financial institution. The bank is known to be a pioneer in the introduction and implementation of financial technology and alternative banking channels to the Sudanese market in a continuous aim to reach a larger segment of the beneficiaries, elevate and enhance its services and to continuously keep upgrading its banking products to meet the needs of the clients existing and potential.

“2020 has been a difficult year globally and Sudan is going through a transitional period, which is posing its own challenges. Nevertheless, we have not been fazed by the environment and we continued with the same professionalism, integrity and hard work which we are confident will stand us in good stead.”

Emirates NBD Capital has been named as the Sukuk Lead Manager of the Year 2020. Emirates NBD Capital Ltd. is a leading regional investment bank offering customised advisory and capital financing solutions. We offer cross-divisional and global expertise to deliver bespoke, structured solutions to meet the ever-changing financial needs of our client base, by leveraging our institutional relationships, on-ground experience, together with Emirates NBD’s strong presence and balance-sheet capabilities.

“Emirates NBD Capital has consistently strived to promote and provide Shari’a-compliant financing solutions to our clients.”

Wifak International Bank won the GIFA Power Award (Islamic Banking) 2020. Wifak International Bank: The new Tunisian bank, operating according to Islamic Finance standards! Wifak Bank marked the Tunisian financial system by the first transformation of a leasing company “El Wifack Leasing” to a full-fledged bank specialised in Islamic finance. Wifak Bank is the first Islamic bank in Tunisia in terms of capital (TND150 Million) and the only Tunisian Islamic bank that is listed on the stock exchange market. this international distinction reflects the challenging success of the first transformation from a leasing company to a full-fledged Islamic bank, as well as, a recognition to the entire Wifak Bank team.

The Awards Ceremony was complemented with the Global Islamic Finance Summit 2020, which attracted a number of local and international speakers. There were two high-powered sessions chaired by Dr Jamshaid Anwar Chattha (former Assistant Secretary General of IFSB) and Kamal Mian (a veteran Islamic banking expert).

The panellists discussed a number of issues facing the global Islamic financial services industry, with a special focus on Pakistan. Dr Reza Baqir, Governor of the State Bank of Pakistan, highlighted the lack of awareness of Islamic banking and finance, and asserted that share of Islamic banking in the national sector could be improved by educating the masses on the differences between Islamic and conventional banking.

The panellists suggested that an independent think tank must be set up in Pakistan to further develop Islamic banking and finance. Pakistan has all the ingredients of becoming a global centre of excellence. It was in particular mentioned that the model of KNEKS in Indonesia should be looked into to develop Islamic banking and finance in Pakistan. KNEKS is a think tank set up by Joko Widodo, President of Indonesia, to develop infrastructure for Indonesia to become a global leader in this field. On the occasion, KNEKS was presented a Global Islamic Finance Advocacy Award 2020. The award was received by Dr Amin Ma’ruf, Vice President of Indonesia and Co-chairman of KNEKS.

This sentiment was shared by Dr Arif Alvi who said that the real benefits of Islamic banking and finance would be realised if it was clarified to the users that it is really different from interest-based finance. Also, it must be based on the principles of compassion, fairness, transparency, and equal opportunities.

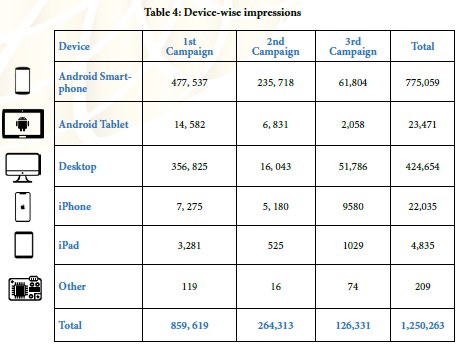

This year the Global Islamic Finance Awards 2020 were held in a hybrid form with the physical ceremony held in Islamabad and the online ceremony viewed by millions on different platforms throughout the globe.

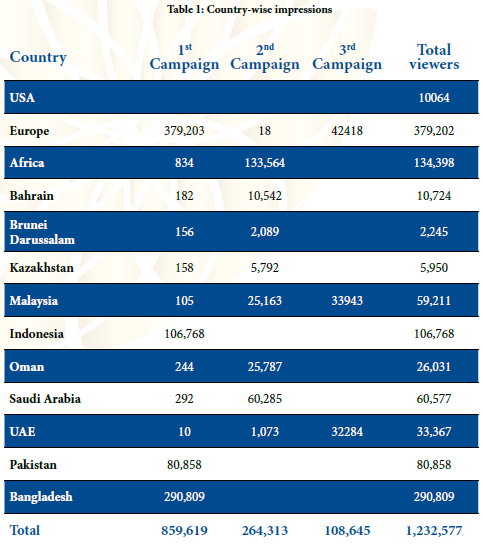

The statistics of the global viewership have been represented in the tables below. Table 1 shows the number of views on the video from each country or region. The highest number of viewers came from Europe, Bangladesh and Africa.

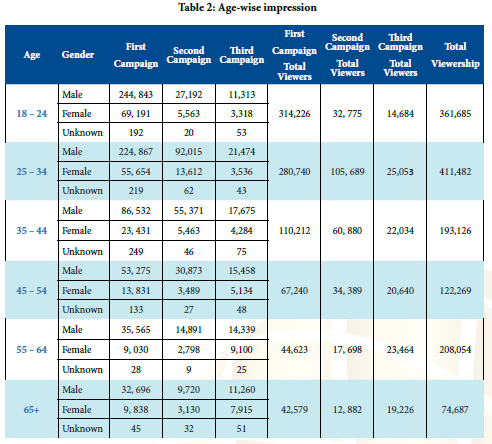

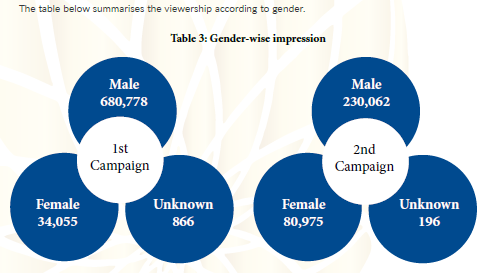

The viewers were then further differentiated with reference to age groups and gender distinguishing between each group, as shown in the table below. The greatest number of viewers belong to the 25 – 34 years age group and majority of them were males.