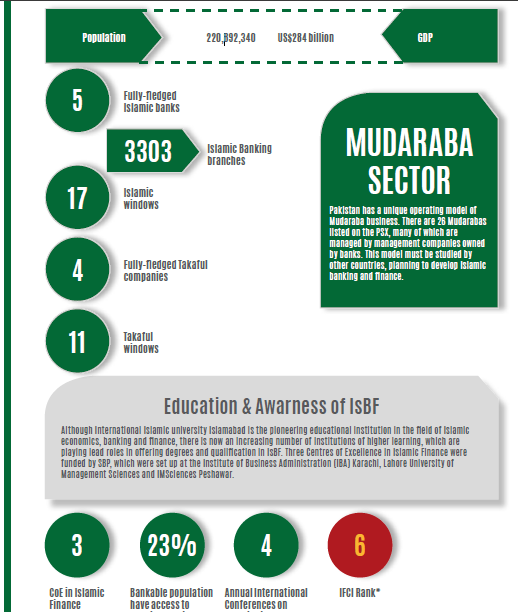

The Islamic Republic of PAKISTAN

Although the history of IsBF in Pakistan goes back to the 1980s (and possibly beyond), the Islamic banking system was rebooted in 2000 with formal introduction of what is known as a dual banking system. Since then, Islamic banking sector has captured 16.6% market share in terms of banking deposits, and a similar share in case of assets (15.2%). There are 22 Islamic banking institutions, comprising of 5 fully-fledged Islamic banks and 17 Islamic windows of conventional banks. There are 3303 Islamic banking branches in the country.

Pakistan is the only country in the world, which has a vibrant Mudaraba2 sector. At present, there are 26 Mudarabas operating in the country, with a wide range of operations ranging from investing in listed stocks to leasing and direct investments. With the tax incentives accorded to Mudarabas in Pakistan at the start, there was rapid growth in this sector, increasing the number of listed Mudarabas to 52. Since 1991-92, there has been visible consolidation in the sector, resulting in an increase in efficiency and profitability. The most successful Mudaraba in Pakistan – First Habib Modaraba – has consistently distributed dividends in the tune of 30% on an annual basis.

In 2019, the assets under management of the Mudaraba sector in Pakistan reached PKR52.67 billion from PKR25.19 a decade ago.

There are other Islamic financial institutions (e.g. Takaful companies) that may be lumped into what is known as non-bank financial institutions (NBFIs) in Pakistan. There are four stand-alone takaful companies and 7 insurance companies providing takaful services through their Takaful window operations.

The Government of Pakistan has been issuing Sukuk, which has allowed Islamic financial institutions, especially Islamic banks, to manage their liquidity in accordance with Shari’a requirements. The private sector organisations have also issued Sukuk on a regular basis.

There is a vibrant Islamic fund management industry. The Pakistan Stock Exchange (PSX) reports and maintains two benchmark Islamic indices, namely KMI 30 Index and PSX-KMI All Shares Index.

Apart from Meezan Bank, which holds about 37% Islamic banking share in Pakistan, other Islamic banks and windows remain small players in the banking sector. In terms of the market structure, Pakistani banking sector offers an example of an oligopoly with a market leader.

The Pakistan Islamic financial market is supervised and regulated by two regulators, the State Bank of Pakistan (SBP) and Securities & Exchange Commission of Pakistan (SECP). Comprehensive regulations exist for Islamic banking and takaful, Sukuk and Islamic fund management and Shari’a governance. The banking regulator – SBP – also maintains a centralised Shari’a board. There is a separate Shari’a board for SECP. Pakistan has also adopted standards issued by Accounting & Auditing Organisation for Islamic Financial Institutions (AAOIFI).

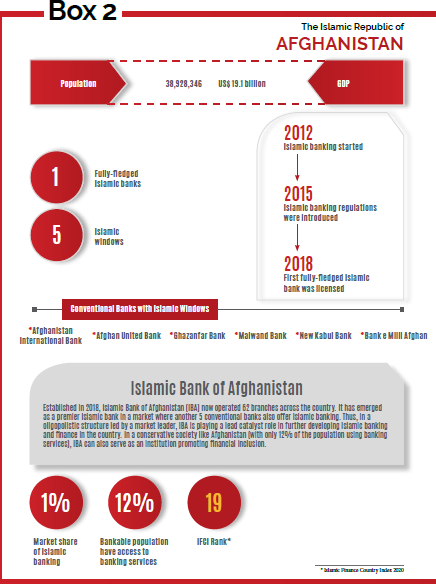

The Islamic Republic of AFGHANISTAN

After multiple decades of war, civil unrest, foreign occupation, terrorism and political turmoil, Afghanistan is now slowly returning to some kind of normalcy, Islamic banking and finance (IsBF) is developing steadily in the fast unfolding story of the post-conflict Afghanistan. Given its geographical location, the country has potential to become a bridge between the South Asian Islamic financial market and the countries in the central Asia.

There is only one fully-fledged Islamic bank, namely the Islamic Bank of Afghanistan, operating in Afghanistan, which was licensed in the second quarter of 2018. Before this, Islamic banking was offered by a few conventional banks. Maiwand Bank is reported to have introduced Islamic banking in Afghanistan. There are at present five conventional banks offering Islamic financial services through what is known as Islamic windows. The share of Islamic banking in the national banking sector remains less than 1%.

Given the widespread financial exclusion, many banking experts in Afghanistan believe that Islamic banking has a role to play in bringing more people into the banking net in the conservative Islamic state.

The government and state institutions are determined to introduce Islamic banking and finance in a comprehensive way. However, the obvious limitations with respect to security concerns, and the law-and-order situation are the biggest barriers to attracting capital into the war-torn country.

Da Afghanistan Bank, the central bank, has developed a comprehensive range of regulations for Islamic banking, which started with the introduction of Islamic banking regulatory framework in 2015.2 It has also adopted standards developed by Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) and is also an active member of Islamic Financial Services Board (IFSB).

Despite several attempts to introduce Islamic microfinance and Takaful business, Afghanistan has yet to witness emergence of a player of meaningful size.3 It seems as if it will remain a challenge without active and effective involvement and support of multilateral institutions like Islamic Development Bank (IsDB) and other development banks.

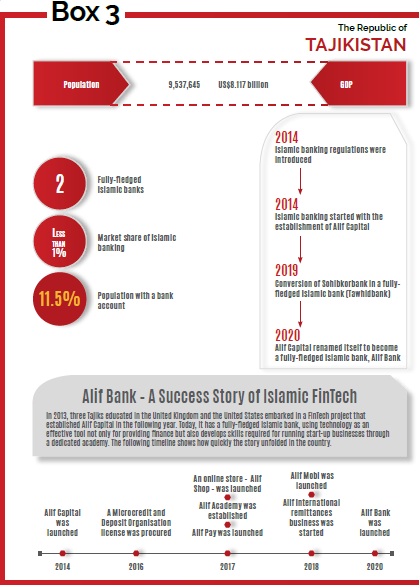

The Republic of TAJIKISTAN

Tajikistan is a small country bordering Afghanistan (South), the Kyrgyz Republic (North), Uzbekistan (West) and China (East). There is a narrow strip of land in Afghanistan (Wakhan) that separates it from Pakistan. Following political turmoil in the country after the initial years of independence and the peacekeeping initiatives of the United Nations, the economy is on track. Tajikistan is now regarded as an emerging market of Islamic banking and finance (IsBF).

Islamic banking got introduced in Tajikistan in 2014, with the establishment of Alif Capital, which was essentially a digital finance platform, when Islamic banking regulations were adopted and implemented. In 2020, it became a fully-fledged Islamic bank and renamed itself as Alif Bank.

After a period of negotiations with the Islamic Corporation for the Development of the Private Sector (ICD), an arm of the Islamic Development Bank (IsDB), Sohibkorbank fully converted itself to become the fully-fledged Islamic bank in the country. In 2019, it was renamed as Tawhidbank.

In January 2019, the National Bank of Tajikistan (NBT) – the central bank – also issued an “Islamic Window” license to the Microloan Fund Imon to Shari’a-complaint microcredit.

This is an impressive start of IsBF, although the market share of Islamic banking remains below 1%. Apparently, there is growing interest in IsBF amongst the general public. The government in general and the central bank in particular have become more open to the establishment of Islamic financial institutions in the country. The IsDB has also been active in the region, with a special focus on Tajikistan.

Despite efforts on multiple fronts to promote IsBF in Tajikistan, awareness amongst general public is rather scant. General knowledge about Islamic banking (i.e. how an Islamic bank is different from a conventional bank?) and uncertainly whether an Islamic bank is truly Islamic are the major factors that have inhibited demand for Islamic banking in the country.

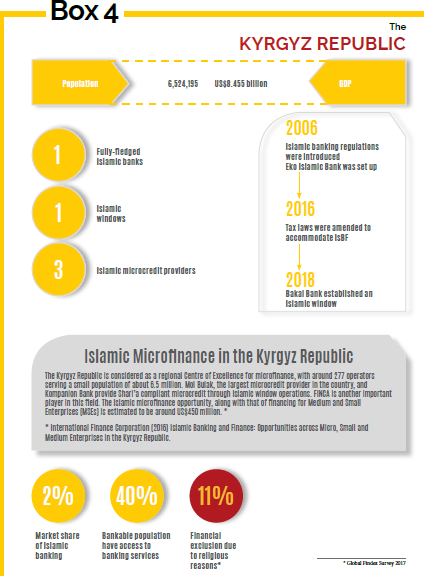

The KYRGYZ REPUBLIC

In the Kyrgyz Republic, there is only one fully-fledged Islamic bank. In addition, there are three microfinance institutions operating in conformity with the Shari’a requirements. The share of Islamic financial assets in the national financial sector is no more than 2% despite numerous indigenous attempts and interest from the Islamic Corporation for the Development of the Private Sector (ICD), a subsidiary of Islamic Development Bank (IsDB). IsDB was instrumental in attempting to set up Eko Islamic Bank in the Kyrgyz Republic, which is the first fully-fledged Islamic bank. Despite the huge publicity, it amounted to no more than conversion of a branch Islamic banking and finance (IsBF) has been rather slow. Having said that, with rather recent growth in IsBF, EKo Islamic Bank has 12 branches operating in different ciites.

Since 2006, when Eko Islamic Bank was established interest in IsBF has certainly grown but supply-side plyers have yet to come up with the financial solutions that must attract a rather conservative Muslim population.

The rather slow growth in IsBF in the Kyrgyz Republic may have attributed to the following factors:

- Human resources for introduction of IsBF have been a major challenge, as the banks have found it extremely difficult to identify local talent specialising in the nuances of Islamic banking principles.

- The first bank, Eko Islamic Bank, has failed to attract further customers [beyond the initial wave of the purist], as the quality of services provided by it have proven to be rather inadequate compared with the other conventional banks operating in the country.

- The necessary amendments to taxation laws and regulation to avoid double taxation on Islamic financial products were only amended in 2016, almost 10 years after the introduction of Islamic banking in the country. This led to the establishment of an Islamic Financial Centre – a kind of Islamic window – by Bakai Bank, a conventional bank.

- There is no separate regulatory framework for Islamic banks, as the conventional regulations are applicable to Islamic banks as well.

- The public understanding of Islamic banking is low. Many people take Islamic as no more than offering of charitable loans, which is obviously not Islamic banks can practise as their main banking product.

Despite slow growth in IsBF in Kazakhstan, there is a strong interest in Shari’a-compliant financing. The share of Islamic banking can jump from the current 2% to 5% rather quickly of the central bank introduces separate detailed regulatory framework for Islamic banks and microfinance institutions.

The Republic of KAZAKHSTAN

Kazakhstan (the largest country in the CIS block and the third largest in the Caspian region) has proven to be a serious and persistent contender to become a regional Centre of Excellence for Islamic banking and finance (IsBF). There are two fully-fledged Islamic banks operating in the country, but the share of Islamic banking remains less than 1%.

There are a number of individuals and institutions that have championed the cause of IsBF in the country, it is, however, the Astana International Financial Centre (AIFC), which has emerged as a champion of Islamic banking and finance.

The government has tried on many fronts to promote IsBF in the country through the central bank and later with the help of AIFC. Despite these efforts, it remains curious to determine whether there exists a meaningful quantum of demand for Islamic banking in the country, which has a significant non-Muslim population.

There are at present two fully-fledged Islamic banks, one set up back in 2020 and the other one recently converted from a conventional bank, with the help of ICD. In addition, there is an Islamic leasing company, an Islamic mutual insurance company and an Islamic finance company operating in the country. Despite the limitations, Kazakhstan is the largest Islamic infrastructure bodies like Accounting and Auditing Organisation for Islamic Financial Institutions (AAOIFI) and Islamic Financial Services Board (IFSB).

This institutional development followed three sets of legislative amendments in 1009, 2011 and 2015. Furthermore, an Association of Islamic Finance Development (ADIF), established in 2009, is now preparing to go regional to provide a platform for advocacy, promotion and development of Islamic finance in the CIS region.

Following are the major challenges to development of IsBF in Kazakhstan:

- Lack of awareness and understanding of IsBF;

- Less than required technical assistance from the multilateral institutions for capacity building; and

- Complex and slow legal processes and procedures.