Issues And Role Of The Banking Sector In Managing The Challenges Of The Climate Economy

THE RISE IN THE AVERAGE TEMPERATURES IS CREATING ACUTE HAZARDS SUCH AS HEATWAVES AND FLOODS TO GROW IN FREQUENCY AND SEVERITY, AS WELL AS CHRONIC HAZARDS, SUCH AS DROUGHT AND RISING OF SEA LEVELS.

- The Threatening Aspect of the Issue: An Analytical Perspective

Global warming is an emerging threat. Climate change is not a natural cycle, it is, however, a direct result of human activities. The impact of burning of fossil fuels that has been going on significantly is leading to global warming. From 2000 to 2019, there were 11,000 extreme weather events in which 475,000 people lost their lives, and the world suffered an economic loss of about US$2.56 trillion.

Forecast estimated by various models is apprising that the world will be severally hit by climate change and would face serious and grave damaging economic impact and loss of lives, both human and otherwise, if correct measures are not taken appropriately in an efficient and timely manner. Climate change has profound repercussions as extreme weather can negatively affect financial institutions. One may quote several examples whereby extreme weather impacts the stability of banks and the financial sector as a whole. The category 5 Hurricane Katrina struck Florida and Louisiana in 2005 bringing extensive damage to New Orleans and causing over 1,200 deaths: the deadliest hurricane in the United States since 1928. This hurricane had pervasive economic effects, leading the (FDIC) to report that 10 percent of banks in the area suffered net losses and almost 50 percent felt the brunt of the storm through net losses on loans. The FDIC stated in the aftermath, “From a financial standpoint, the biggest source of uncertainty and concern for Gulf Coast financial institutions is the effect of the post-hurricane damage on credit quality.” Therefore, it is imperative for policymakers and academic researchers to focus their energies on understanding how financial institutions (FI) are being exposed to climate risks and what possible proactive role they may play as responsible FIs.

- Climate-Related Human Inviting Risks:

Global warming, an aspect of climate change, is due to human practices that are leading to an increase in the emissions of greenhouse gases (GHGs), like CO2, CH4 and N2O, which trap heat in the atmosphere, rising the temperature of the earth surface and causing the melting of polar ice caps. This untimely melting of ice would result in an increase in sea levels causing floods.

The rise in the average temperatures is creating acute hazards such as heatwaves and floods to grow in frequency and severity, as well as chronic hazards, such as drought and rising of sea levels. In addition, some of the critical issues related to global warming that are adversely affecting human health are listed below.

Depletion of Ozone Layer: Ozone is a protective shield for life on Earth from harmful UV radiation. Damaging this shield means damaging the environment and ultimately our health. Due to human activities and the emission of heat-trapping gases, the ozone layer is depleting, which could be very disastrous. The depletion of the ozone layer may result in a change in wind pattern, leading to global warming, causing climatic changes worldwide. It also a cause for photochemical smog and acid rain triggering various diseases like skin cancer and asthma. Countries worldwide are on a mission to stop using ozone-depleting substances in an attempt to halt the depletion of the ozone layer.

Economic Downfall and Financial Risks: Global warming is also leading to economic downturn due to floods, crop failures, etc., which result in production and subsequently litigation risks. The failures of obligors to timely honour the financial commitments lead to financial risk. The widening catastrophe may result in a reputational and crisis-like situation.

Melting of Glaciers & Loss of Biodiversity: The intensive rainfall and storms cause floods by increasing the water flow in river, creating typhoons. This is the direct result of an increase in earth’s temperature, which melts glaciers, causing depletion of natural resources and subsequent changes to the Earth’s eco-systems, such as loss of living species and land degradation also known as loss of biodiversity. Global warming is also leading to worldwide water crisis, and it is hinted that a 3rd world war could be fought because of it.

Waste Disposal: The dumping of waste, including fast food and even nuclear waste in oceans is causing health hazards. Disposal companies are dumping waste in the oceans creating health hazard by spoiling drinkable water, etc., besides being a threat to marine life.

Besides these, there are other related issues that are of equal importance, such as, natural disasters causing diseases, deforestation, epidemics, as well as the disruption of the North Atlantic current. Pollution, mainly caused by human waste is one of the apparent known threats to human health.

GLOBAL WARMING: WHO IS CONTRIBUTING WHAT?

The GHGs and the shifts in the proportion of these gases in the stratosphere or the levels of CO2 and other such gases throughout the atmosphere are significant sources of increasing the earth’s temperature and initiating global warming. The primary source that contributes to GHG emissions is coal, which is being used to produce cheap energy priced at an average at about US$2/ton compared to alternate power production through hydro means or renewable energy that is around US$75/ton.

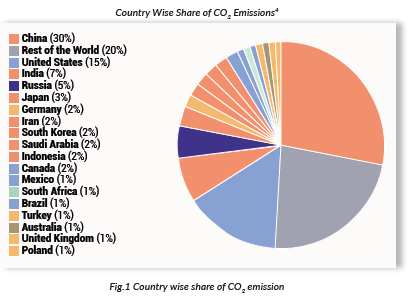

- The World Coal Reserves

The world average temperature may rise to about 6°C if the existing world reserves of fossil fuels are burned completely. Nonetheless, the world agreed in the Paris Agreement 2015 that 80% of its fossil fuel would remain unburned. The top ten (10) countries in the world contribute to 70% of CO2 emissions in the list of 143 (i.e., 30% by the rest of the world). Interestingly, more than half of these emissions (i.e., 52.04%) come from only three (03) countries, namely China, the USA & India.

Table-A: Country-wise List of Coal Reserves3:

- Recent Production of CO2

As per the CNN study report, China has added 360 new coal-powered energy plants between 2015 and 2019. India, the 3rd largest producer of CO2, provides for 55% of its energy needs f m coal and releases 1100 million tons of CO2 every year.

- Top Effected Countries

The world of today is a global village, where the actions of one nation at any part of the world are severally impacting the humans in another region, even as they did not contribute to the course of problem. It is considered a global issue as the impact of human actions using CO2 emitting inputs, like coal, etc. in industries is worldwide, even if the causes can be localised. The climate change is systemic in nature and essentially the actions initiated at localised levels carry far-reaching effects.

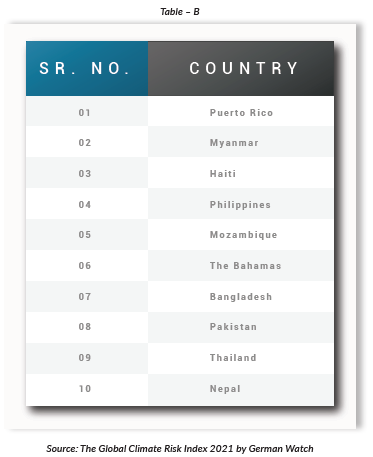

Countries that had almost no contribution in the emission of GHGs are, unfortunately, the most affected from the global warming and the resulting consequences would further deteriorate the conditions if appropriate actions are not taken and due support is not provided to these countries, particularly the least developed or developing countries, like Pakistan.

The Global Climate Risk Index 2021 published by the German Watch lists out the top 10 countries which are seriously affected from global warming. The list is provided in table B.

THE INITIATIVES AT GLOBAL LEVEL

The world eventually realised the harmful effects of these GHGs and is apprehensive of the consequences. It is now aiming to bring the CO2 emissions to the levels the atmosphere had before the industrialization era, as healthier human lives, clean and fair planet and environment are also important with economic prosperity.

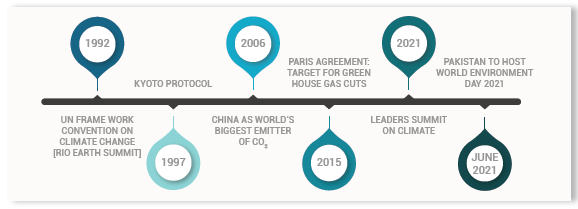

On April 22, 2021, forty (40) heads of state gathered in a Virtual Earth Day Summit where commitments were made to decrease the GHGs by 50% by the end of the current decade and take appropriate measures to keep the climate under 2°C.

Currently, there are about US$12 trillion high carbon emitting assets worldwide. The coal is the cheapest raw material used mostly by developed countries for energy in the power-producing sector as it costs on average US$2/ton whereas its alternate energy source costs about US$75/ton. The challenge, however, is how to convert the carbon-emitting assets into carbon-neutral assets considering the huge cost difference between both the inputs. Nevertheless, this is not only essential for climate control but also for the humanity, as regulating the CO2 emission is crucial to addressing the issue of the climate economy for a better environment and planet for future generations.

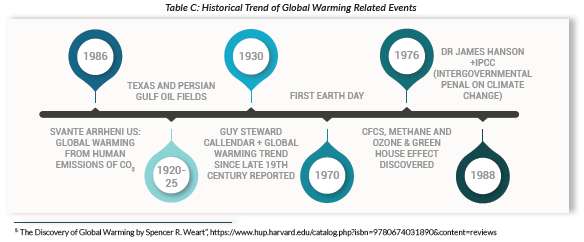

- Global Warming – Historical Review

In 1896, Mr. Svante Arrhenius, a Swedish Nobel laureate physicist, often referred to as a chemist, foresaw the influence of human activity on climate change. In an article, Arrhenius concluded that a reduction in the atmospheric CO2 levels to half the then existing ones would result in a drop in the temperature of the planet between 4 and 5°C. He also warned that if those same levels increased by 50%, the planet would experience an increase in temperature of between 5 and 6°C.

Nevertheless, the world seriously realised the issue for the first time in 1988 when Dr. James Hansen, Director of Space Studies in New York, came up with the notion that global warming is happening, based on his data analysis and findings that made headlines in the USA and global news. He opined that 99% of climate change is due to human actions.

During the same year in 1988, IPCC was established with 195 countries as members. The prime task of this IPCC was to provide the most updated information on Climate Change. IPCC is of the view that the global average temperature is expected to increase between 1.5 to 5 degrees Celsius relative to today in many locations by 2050.

The RIO Earth Summit was held in June 1992. People from across 179 countries sat together to find a solution for climate change, following which a document by the name of UNFCC was signed, which was ratified in March 1994 by 197 countries. The primary goal of the summit was to minimise the emissions of GHGs. Developed Nations were obliged to minimize the GHGs, however, there were some voluntary commitments, and China and India were under no such obligation.

In December 1997, Kyoto Protocol was signed, which was ratified in February 2005 (after 07 years). This protocol was an extension of the UNFCC and its goal was to implement the objectives of UNFCC. During 2008 to 2012, 193 countries signed this protocol. USA did not join and was not the signatory of this protocol. The data reveals that during 1997 USA was the top emitter of the GHGs contributing 25% to the world emission. China and India have also not been part of this protocol.

In December 2015, at the Conference of the Parties 21 (COP 21) in Paris, France, 196 countries came together to forge a climate change agreement that pledged to keep global warming to 2°C or less.

This information right from the inception till to date is provided in a timely order in table C.

International Energy Agency estimates that the cumulative investments needed in energy supply and efficiency is about US$53 trillion.

Based on the IFC analysis, an amount of US$23 trillion is required in climate-smart investment opportunities in emerging markets between 2016 and 2030.

- Climate Change & Green Banking Initiatives in Pakistan

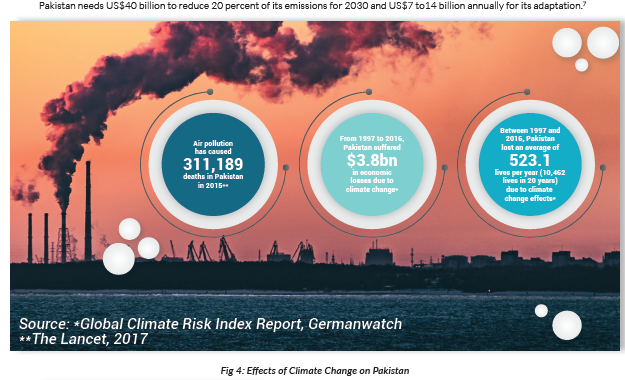

According to German Watch in 2021, Pakistan was ranked 8th in the long-term global climate risk index (CRI). If apt and time necessitating actions are not taken, the annual mean temperature in Pakistan is expected to rise by 3°C to 5°C, and higher global emissions may yield a rise of 4°C to 6°C by 2080. As a result, Pakistan may lose its glaciers by 20356.

Pakistan needs US$40 billion to reduce 20 percent of its emissions for 2030 and US$7 to14 billion annually for its adaptation.

Fig 4: Effects of Climate Change on Pakistan

Pakistan ratified the Paris Agreement in 2016, further the Ministry of Climate Change revised the National Climate Change Policy of 2012 and the Framework for the Implementation of the Climate Change Policy in 2014. Disaster management authorities at the national, provincial, & district levels have also been established. After successful implementation of the Billion Tree Tsunami Afforestation Project in 2014, Pakistan has launched a project by the name of “Plant for Pakistan” (“Plant4Pakistan”), also known as ‘10 Billion Tree Tsunami’, a five-year project to plant 10 billion trees across Pakistan from 2018 to 2023. Pakistan is also a member of “The Green Climate Fund”.

In Pakistan, 50 plus universities are offering graduation in environmental and climate change and about 20 Universities offer doctorate in the field of Environmental Sciences.

THE ROLE OF BANKING SECTOR

The world is a global village and countries that need to sell more use cheaper input to produce more goods. The cheapest energy production input in today’s world is fossil fuels, mainly comprising of coal.

Reportedly, five (05) big banks in the UK have helped finance fossil fuel-producing companies, worth GBP170 billion between 2010 to 2012.

Companies listed on the London Stock Exchange hold more coal reserves than firms of any other Stock Exchange in the world. In addition, it is stated that almost every British Person Pension Fund has cash invested in Coal, Oil, and Gas through London Stock Exchange.

In 2012, an Indonesian metal and energy-producing and coal-exporting company by the name of Borneo had been provided a credit facility worth GBP1 billion by one of the largest banks of UK.

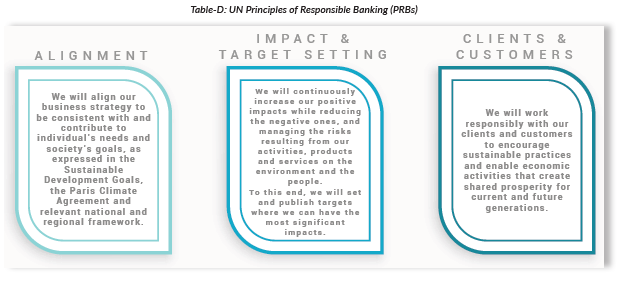

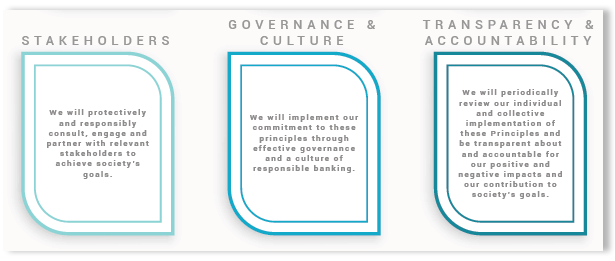

- UN Defined PRBs

The six (06) PRBs are a unique framework set out for the Sustainable Development Goals and in line with the Paris Climate Agreement. The principles provide a framework for sustainable banking system and help the industry demonstrate how it can positively contribute to society.

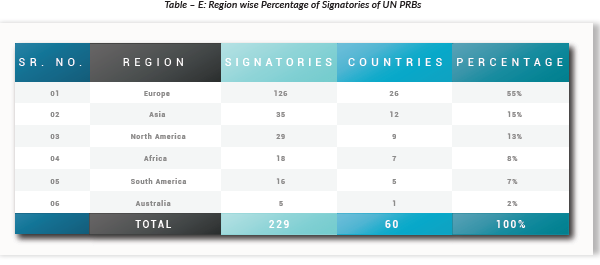

So far, 23 banks have signed the PRBs. These banks represent more than a third of the global banking industry from about 60 countries. However, from the list of 230 signatories of PRBs, it may be astonishing to find that there is only one (01) small bank signatory of PRBs from a country like India, which is the third-largest producer of CO2, releasing 1100 million tons every single year and having severe health impacts through smog, etc. on neighboring countries.

Table – E: Region wise Percentage of Signatories of UN PRBs

After eighteen months of signing the PRBs, the signatory banks would be required to report on following aspects:

- their impact,

- how they are implementing the Principles,

- the targets they have set, and

- the progress that has been made.

Within four years, it is mandatory for all signatory banks to have met all of these requirements.

- The Role of IMF

The IMF is proposing a three (03) layers strategy to accelerate the pace of moving the world towards carbon-neutral economies.

These steps are, i.e.,

- Taxing on Carbon (ToC): Provision of necessary guidelines by IMF through Central Banks to gradually increase the tax rate. IMF is recommending that the tax be put in such a way that today’s carbon producing input which costs at an average of about US$2/ton should be brought to an average of US$75/ton by 2030, equivalent to the price of the alternative input for energy/power-producing industrial plant.

For illustration, if advanced and developing G20 economies were subject to carbon floor prices of US$70 and US$35 a ton, respectively in 2030, mitigation efforts would be well over twice as much as reductions implied by meeting current mitigation pledges. To reduce the emissions to a level consistent with a 2˚C target, however, additional measures—equivalent to a global average carbon price of US$75 a ton—would still be needed.

- Standardisation of Reporting Across Countries (SRAC): IMF has formed a coalition with the CBS of various countries. It is being proposed to CBS to provide necessary guidelines to the financial institutions (FIs) of their respective countries to report the carbon footprint of each of the industries being dealt with as a first step.

The World Bank and IMF recommended that those looking to design and implement carbon pricing follow their six core principles, called the FASTER principles: they contend that all schemes be “fair; aligned with other policies to ensure a level playing field for low carbon alternatives; stable and predictable; transparent; efficient and cost-effective; and reliable to achieve a measurable reduction in greenhouse gas emissions.”

- IMF Funding to Public Investment in the Green Infrastructure (FPIGI): IMF proposes to provide funding facilities in the Greenline project to developing nations.

Global investment requirements for addressing climate change are estimated in trillions of US dollars, with investments in infrastructure alone requiring about US$6 trillion per year up to 2030 (OECD 2017).

- Pakistan Banking Sector

SBP’s issued comprehensive Guidelines on Green Banking (GBG) on October 09, 2017. The objective of the Green Banking Guidelines (GBG) is to reduce the vulnerability of banks/DFIs from risks arising from the environment, fulfill their responsibilities for the protection of the environment, and provide finance to transform the economy into a resource-efficient and climate-resilient one. These guidelines provide the necessary information as a guiding principle for banks/DFIs to reduce the banks’ vulnerability from risks arising from climate change.

- A Case Study – Allied Bank Limited (ABL) of Implementation of Green Banking Guidelines:

Allied Bank Limited (ABL) has developed a “Green Banking Policy” and approved it in 2018. As a result, a GBO was established and permanent staff for Green Banking was appointed. The Bank has also formed EDD & ERR criterion and developed an Environmental Risk Rating Checklist for its relevant officials.

Considering the importance of the subject, the Bank has automated various workflows to reduce paper consumption and put its efforts in making Digital Banking, user friendly with features like, funds transfer facility application, i.e., “myABL”, providing all required needs at a click beside the services of eWallet, NIFT ePay, etc.

The Bank has taken initiatives to develop Green Products, i.e., Allied Renewable Energy and Allied Solar Finance, for its conventional and Islamic banking customers.

The other initiatives taken by the Bank are listed below:

- Installation & replacement of smart energy appliances/equipment,

- Assigned Green Financing Targets to branches/regions,

- Designated 08 branches/offices as Green branches/offices, and

- Converted 48 ATMs to renewable energy sources

GREEN BANKING ACHIEVEMENTS FOR FY – 2020

As far as achievement in this regard is concerned, the bank have prepared specialised checklists for segments, e.g., textile, steel, etc., to check climate impact. “Green Advisory Services Desk” has been established in the bank along with “Green Liaison Officers” deployment. In addition, another entire customer portfolio has been analysed for Environmental Risk in 2019 and 2020.

Banks have closed its books for FY 2020 with a Green Portfolio of PKR 6420.58 million and fresh disbursement of PKR 2986.27 million in green financing. In the tree plantation campaigns, 17,512 trees were planted in 2019 in the Southern Region, while 1,000 large plants in 2020 in various schools in Lahore and 47, 306 saplings in the spring season in 2021, all over Pakistan were planted. Further total of 8,555 staff members were trained on Green Banking during 2019 and 595 in 2020, along with public awareness campaigns at different levels.

MAPPING OF ACTIVITIES BY SDGs

In terms of mapping of SDGs, the bank is engaged in low-cost housing to masses (SDG-11), geographical presence through 1280 conventional and 117 Islamic branches to serve unbanked population across Pakistan (SDG-10), and digitalisation, and automation of processes to reduce the impact on the environment (SDG-9). In addition, the bank has introduced products like IFRE/Solar Finance for affordable & clean energy (SDG-7), reducing carbon footprints of the bank (SDG-13), engaging in different charity initiatives to bring a difference in the poor segments of the society (SGD-10), and making efforts for transparent information to the customer to choosing between products (SDG-12).

RECOMMENDATIONS

- An awareness drive may be launched across all relevant stakeholders to understand and take global warming as a severe issue to provide a safe and healthy environment for today and the future generations.

- Declaration/inclusion of CO2/CFCs usage as ingredients in product packaging. To avoid the use of products produced by the industries using the health-killing fossils like CO2.

- Promote green initiatives such as tree planting and backyard gardening at countries, institutions, and individual levels.

- Use of environmental-friendly fertilizers in the agriculture sector.

- Transfer of technology, i.e., renewable energy, waste recycling machineries, etc. to developing nations at zero cost.

- UNN UN Proposed Mechanism of EIA must be in place to provide NOC for climate-related projects while taking on board the neighboring countries and relevant stakeholders being affected by CO2 emissions.

- Developing and implementing a standardised regulatory framework for Green Banking across the globe.

- Institutions to disclose material climate-related risks. The expected disclosures should include the five critical aspects at a minimum, i.e.:

- Business model & impact of climate/environment risk

- Policies and due diligence processes to access climate risk

- Outcomes of implemented policies

- Climate risks to impact businesses and their management

- KPIs to cater to climate & environmental-related risks

- Provision of long-term concessional financing (refinance) to the Public Sector entities by IMF or the World Bank, particularly to the affected countries for onward refinancing to the industries for Green projects.

- Capacity building & technical support by DCs to LDCs.

- Mapping of climate-related risks with timelines.