COVID-19 pandemic is still the main problem for most countries. According to the WHO data, as of March 8, 2021, approximately 116 million cases have been reported worldwide, with 2,587,225 deaths. Because of its multi-dimensional implications, the impact of COVID-19 has been different from the global financial crisis of 2008. The Coronavirus (COVID-19) induced lockdowns disrupted almost every area of our life, including the financial sector which stagnated throughout 2020. According to the 2020 Islamic Finance

Development Report released by Refinitiv and the Islamic Corporation for the Development of the Private Sector (ICD), Islamic finance’s value is expected to grow at a CAGR of 5%, reaching US$3.69 trillion in 2024. The prospect for conventional financial activities is not different, either. According to the World Economic Outlook (WEO) data released by the International Monetary Fund (IMF), the global economy is projected to grow 5.5 percent in 2021. This will also increase the revenue and margins of Islamic financial institutions.

Islamic Financial Institutions

Before the onslaught of the COVID-19, several new mergers had taken place. Dubai Islamic Bank completed Noor Bank’s acquisition in January 2020, resulting in one of the most prominent Islamic banks globally, with assets exceeding Dh300 billion. Meanwhile, earlier this year, Indonesia launched its biggest Islamic bank. The merged entity named Bank Syariah Indonesia (BRIS) started its operation on February 1, 2021. Similarly, new banking apps Niyah and Rizq were also launched in the UK to facilitate the Muslim community. They offer interest-free products, including digital bank accounts, debit cards, investments, and small and medium enterprise (SME) financing.

Despite these developments, Islamic banks would have to face a liquidity crunch as most Islamic banks have a significant market share in MSMEs and retail financing. This will also affect their low-income or daily-wage employees. Customers might also resist coming to the Islamic banks, which will impact their profitability.

ACCORDING TO THE WHO DATA, AS OF MARCH 8, 2021, APPROXIMATELY 116 MILLION CASES HAVE BEEN REPORTED WORLDWIDE

Islamic banking and finance would have to show a renewed effort towards quality asset management in the near future.

Islamic Insurance

Takaful, the Islamic insurance sector, has been equally affected by the pandemic. It left the sector with new exposure to mortality and morbidity considerations. According to the Global Takaful Market Report and Forecast 2021-2026 published by Expert Market Research (EMR), the takaful market is projected to grow at a CAGR of nearly 13% during 2021-2026. The market is estimated to reach a value of about US$49 billion by 2026. Until the pandemic is over, we may not honestly know the level of decline or growth the sector experienced due to coronavirus-induced glitches.

The pandemic presented unique challenges to Islamic insurance. Like any other sector, digital media proved useful in generating demand for Islamic insurance, resulting in overall industrial growth. Islamic Insurance operators have started embracing new sales and marketing tools to streamline processes (such as claims handling) and execute customers’ demands.

Digitalisationhasbroughtintoquestiontheissuesofdata privacy and cyber risk. The nature of Islamic insurance demands the compilation of large and aggregated data requiring a subscription to an external third-party cloud service provider. This presents risks, including but not limited to the centrality of computing services, of an operational halt in the event of a cyber-attack, data breach and connectivity breakdowns. The perceptual effects of such failures may have implications for public confidence in the technology. Also, there are concerns related to mitigating operational risks emanating from using legacy technology to cope with the latest technological transformation. Therefore, the COVID-19 pandemic provides opportunities as well as challenges to the sector. A proper policy can be a solution for developing Islamic insurance potentials in the post-COVID-19 scenario.

Islamic Capital Market

The spreadof COVID-19 has also taken a toll on the global stock markets. Due to extreme volatility and weak performance, the stock markets’ indexes have dropped on several occasions across the world. Despite the global capital market, including Islamic capital markets’ correction experience in March 2020, we may see indices performing well in 2021. The capital market can pursue in 2021 the polices regulators introduced in 2020 to prohibit short selling and impose trading halt.

Despite all odds the capital market has developed and the biggest feast has been the digitalisation of processes resulting in an increasing number of investors. According to the Indonesian Central Securities Depository (KSEI), the number of investors in the Indonesian capital market, including the Islamic capital market, has increased as of December 29, 2020, by more than 50 percent to 3.8 million from 2.4 million at the end of 2019. The role of financial technology (FinTech) has become significantly important in simplifying the opening of investment accounts and increasing operational control of the capital market.

Like any other industry, the capital market follows the hybrid work model, in which employees work at the office and remotely if the need arises. This model presents employers with two challenges: how to supervise the workforce to prevent misconduct and fraud and how to maintain communication between sales, traders, and clients while mitigating threats emanating from information barriers, cyberthreats, data stealth, third-party vendors, unapproved communication channels and over-dependence on manual processes.

Sukuk

Sukuk has become one of the most famous Islamic finance instruments in recent years. Despite showing a decrease in the number of issuances in 2020 due to the COVID pandemic, Global Sukuk issuances are expected to rise in 2021. S&P Global Ratings estimates total sukuk issuance of about US$140 billion up to US$155 billion this year, compared with US$139.8 billion in 2020. One of the reasons for the potential rise is the expected recovery of GDP in key Muslim countries such as GCC countries, Malaysia, Indonesia, and Turkey. Another factor contributing to sukuk’s attraction in 2021 is the availability of coronavirus vaccinations and oil price stability at about US$50 per barrel in 2021.

GCC Countries The easing of investment restriction on GCC countries followed by the normalisation of relations between Qatar and its neighbours has contributed to an expected rise of sukuk issuance in several Gulf countries where sukuk has already been actively pursued in 2020. For instance, Saudi lender National Commercial Bank (NCB) has issued the USD- denominated Additional Tier 1 Sukuk at a value of US$1.25 billion (SAR 4.69 billion) in early January 2021. Similarly,

First Abu Dhabi Bank (FAB), the UAE’s largest bank, has also issued the USD-dominated US$500 million worth sukuk at the lowest-ever yield of 1.411% for five-year. Some other Gulf countries such as Oman has also made sukuk deals this year.

DESPITE SHOWING A DECREASE IN THE NUMBER OF ISSUANCES IN 2020 DUE TO THE COVID PANDEMIC, GLOBAL SUKUK ISSUANCES ARE EXPECTED TO RISE IN 2021. S&P GLOBAL RATINGS ESTIMATES TOTAL SUKUK ISSUANCE OF ABOUT $140 BILLION UP TO US$155 BILLION THIS YEAR, COMPARED WITH US$139.8 BILLION IN 2020

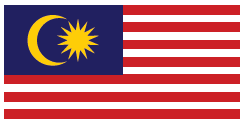

Malaysia

Malaysia has taken the lead in sukuk issuance globally during the pandemic. According to Moody’s, Malaysia had 32% market share followed by Saudi Arabia with 28% market share in sukuk in 2020.

We can expect sukuk issuance to remain strong in Malaysia this year because of the issuance of bonds and sukuk with the total worth of RM70 million by Cagamas Bhd to fund house financing, housing loans and industrial purchases. Malaysia has been an active domestic player in the sukuk market because of having a strong currency.

Indonesia

The Government of Indonesia plans to issue sukuk worth Rp27.58 trillion (US$1.96 billion) to finance the country’s costly infrastructure projects and spur economic growth, according to the official announcement by Finance Ministry. Not only that, but the government is also planning to re-issue Cash-Waqf Linked Sukuk (CWLS) this year.

Besides the sovereign sukuk, Indonesia’s state-owned enterprises such as PT Sarana Multigriya Financial (Persero), also plans to issue debt securities in the form of sukuk worth IDR100.01 billion and bonds with a principal value of IDR1.9 trillion. This sukuk is part of the sustainable sukuk Mudharabah offering with a targeted fund of IDR2 trillion.

Turkey

Turkey is likely to have limited activity in sukuk issuance in the international market. Because there are no competitors of sukuk, it is getting more popular in Turkey. Though the taxation issue has been resolved, the private firms are still hesitant to choose sukuk over bonds. We expect some activity this year from sovereign and participation (Islamic) banks.

Islamic Social Finance Instruments

The pandemic has also opened avenues for Islamic social finance instruments such as zakat, infaq, alms and waqf (ZISWAF). The possibility of raising funds using Islamic social financing has accelerated because of a penchent to help those affected the most during the pandemic. Beside helping in alleviating poverty zakat and waqf funds can also assist Micro and Small Enterprises (MSEs) to survive in the pandemic-induced financial crisis.

The likes of One Endowment Trust, a UK-based charitable foundation, with a target to become a £1 billion waqf fund, have fulled growth in Islamic social financing. Moreover, on the regulatory side, the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) and the UN Refugee Agency have collaborated to strengthen the governance structure of Islamic social finance to create governance standards for zakat, which could also be used by other international humanitarian organisations and Islamic philanthropy institutions.