In March 2020, countries started experiencing lockdowns and movement control. We started to adopt the ‘new normal’, the situation for which none of us was fully prepared. On March 4, 2020, we started discussions on the possibility of having online classes in universities. Neither lecturers nor students believed that it would ever happen. March 13, 2020, was the last day we had face-to-face lectures with our students. In the beginning, like any other sector representatives, we believed the situation to be temporary and expected it to continue for a few weeks only before things went back to normal. Instead, we found ourselves soon getting adapted to the ‘new normal’.

Today, more than 1.5 billion students and youths worldwide face school and university closures due to the COVID-19 outbreak

On May 19, 2020, Cambridge University announced to move all lectures online until the summer of 2021. Today, more than 1.5 billion students and youths worldwide face school and university closures due to the COVID-19 outbreak. For countries that rely heavily on international students, COVID-19 meant the loss of rental accommodation income, summer conference income and fewer overseas students. People even discussed the possible bankruptcy of some universities and campuses in the UK, leading to their closure. Australia is the hardest hit because of the loss of international student fees, which is approximately US$3 billion to US$4.6 billion. The higher education institutions are also affected in other ways, such as a reduction in employment opportunities for graduates likely to enter the job market; possible delays in fee payment; the inability of students to pay tuition fee at all, and governments’ failure to meet its commitments to provide public fund.

The Impact of COVID-19 on Islamic Economics and Finance Educators

Since March 2020, with the spread of COVID-19 across the world, 61 countries in Africa, Asia, Europe, the Middle East, and America have announced or implemented school and university closures. As a result, universities worldwide have been experiencing an unprecedented massive flight from traditional in-class face-to-face education to online education. Islamic economics and finance (IEF) education providers also had to adjust to the ‘new normal’.

An online survey among nearly 150 IEF educators from 12 countries, namely Turkey, Pakistan, Malaysia, Indonesia, Nigeria, Jordan, KSA, UAE, Oman, Russia, Thailand and Somalia, was conducted to understand the main challenges faced by students while attending online education during COVID-19.

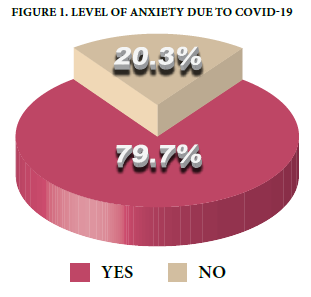

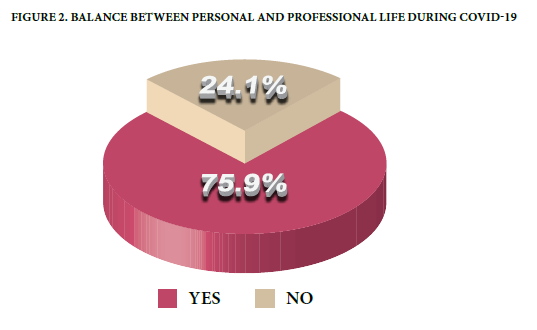

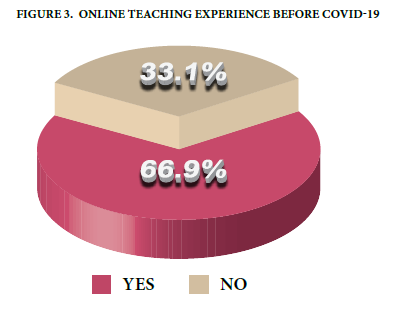

According to the results, almost 75% of IEF educators experienced difficulty balancing their personal and professional life. Almost 70% of educators were teaching online for the first time. The same percentage of lecturers (70%) showed reluctance to continue online education once the pandemic was over. For 83% of the lecturers, preparation for online classes was more time-consuming than for the traditional classes.

The overriding factors leading to IEF educators’ dissatisfaction were limited interaction with students, issues related to technical, infrastructural problems, and students’ low participation. Therefore 90% of lecturers believed that students were more likely to skip online lectures than traditional in-class lectures, and 88% believed that students cheated more during online exams.

The experience gained from teaching online during the pandemic led the ILF educator’s believe that Information & Technology (IT) related subjects should be included in the IEF curriculum. However, a large percentage of lecturers (84%) found the traditional – face-to-face – method of teaching more efficient than online education.

The Impact of COVID-19 on Islamic Economics and Finance Students

A survey was conducted among IEF undergraduate students to understand their online-study experience and how COVID-19 has impacted their education life.

More than half of the respondents (52%) has experienced online education for the first time. To 60%, the main obstacle faced during online education was difficulty focusing on the lectures. One of the reasons was distraction; such as notifications students received from social media accounts during lectures. Another reason was the environment, which brought family-related distractions. For 42% of respondents, concentration on the lecture was difficult in the absence of class interaction. Among 40 percent of the students, dissatisfaction with online education emanated from lack of proper Internet and other technological gadgets such as laptops or wifi. Loneliness and a sense of isolation inflicted 14% of students. They missed the opportunity of broad discussion face-to-face lecturers offered.

Not everyone was unhappy with the online experience. Some 70% of students viewed the convenience of re-watching recorded lectures as one of the main advantages of online education. Those who skipped class could also benefit. Approximately 30% found no issue with using unfamiliar software such as Zoom, Microsoft Teams and Kahoot. They also enjoyed attending webinars conducted on different platforms from all around the world.

The shocks COVID-19 rendered to almost every sector has also been visible in the realm of education. From student to policymakers, every stakeholder-teachers and the management staff at the academic institutions had to adjust to the new normal.

Opportunity COVID-19 Brought to Islamic Finance Education

COVID-19 pandemic has turned out to be more than a health crisis. The unprecedented socioeconomic crisis emanating from lockdowns has played havoc with every country, which will leave deep and permanent scars behind. Like other sectors, education was hard hit. Unlike the tourism or aviation sector, education, except the subjects that require practical experimentation, does not necessarily require physical presence.

Every sector would eventually have to evolve, and so will education. Now is the time for the higher education sector in general and Islamic finance, in particular, to re-think its future. During the pandemic, many universities proved their capability to conduct online classes successfully. The only obstacle was the inability of students to undergo internships and exchange programmes in other institutions.

As educators in Islamic finance, we need to collaborate to establish platforms for online exchange programmes. However, these collaborations should not be limited to only two universities when the digital platform enables us to interact with scholars at more than one venue with one click only. This would allow the students to have an insight into and discuss the same subject from diverse scholars.

COVID-19 presented Islamic Finance Education Opportunities to have:

• Collaborative programmes

• Online student exchange programmes

• Online industrial training in other jurisdictions

• Establish a global online institute for Islamic finance

Islamic Finance Education Evolution: Online to Hybrid Model

The education sector adapted to the ‘new normal™ faster than any other sector because of technology. We undertook two new teaching models of education in Islamic finance education.

The first is the online model while the second is the hybrid model. Both have been instrumental in keeping academic activities running throughout 2020. There were challenges and opportunities in learning online; however, there is no doubt that new technologies enabled distance learning during lockdowns. However, since many students and lecturers found traditional education more interactive, motivational, and efficient, we launched a hybrid model of teaching in the academic year 2020-2021.

The hybrid model was used for the first time in Islamic finance education. It should not be mistaken for blended learning since both contain many of the same instructional elements. The hybrid-learning model denotes an arrangement where some students attend class in-person, while others virtually. In blended learning, the students work in person on online exercises and watch instructional videos during their own time.

As lecturers, we found the hybrid model more challenging than fully-fledged traditional or fully-fledged online education. Reason being that this model requires a balanced approach towards both online and in-class students.

Helpful Tips for Teachers in Running the Hybrid Model Successfully:

1. Feel free to redesign the course map.

2. Use mobile applications to assess and to stay connected with students.

3. Be open to feedback; learn from the students and colleagues alike.

4. Do not overload students with assignments. Just because they can be completed anywhere does not mean that assignments take any less time than face-to-face work.

5. Integrate online and in-person system. A successful hybrid course is only as strong as the relationship between its two counterparts.

6. Explain the purpose of and expectations from the hybrid class clearly. Keep repeating so that the new format is engrained in the students and lecturers.

In crux, 2020 appeared as a year of novelties for education. As educators and students of Islamic finance, we successfully adapted to this new condition by embracing both the online and hybrid teaching and learning models.

Conclusion

There is no doubt that the online learning experience was challenging, but with technology and required infrastructure, the education sector stood the test of time. The initial hesitation towards online learning was natural because human psyche takes time to adapt to change. However, at the end of the day, technology-aided learning has benefited everyone.