The Accounting and Auditing Board of Islamic Financial Institutions (AAOIFI), since its establishment in 1991, has devoted itself to developing and issuing standards for Islamic financial institutions and the industry as a whole. Established as an autonomous not-for-profit organisation, AAOIFI has issued over 114 standards and technical pronouncements with the help of three technical boards, namely Shari’a Board, Accounting Board, Governance and Ethics Board. All the standards within these technical boards complement each other while making sure that Shari’a principles are not overlooked or contradicted in the disclosures and reporting processes of different financial transactions. They also ensure that the issued standards are in line with industry developments and market demands, and are also easy to understand and adopt by Islamic Financial Institutions (IFIs) globally.

AAOIFI is the leading international corporate body based in Bahrain that supervises and regulates IFIs to ensure ethical and Shari’a-compliant activities to support the expansion and growth of the Islamic finance industry. AAOIFI identifies its primary objectives as “…development, advocacy, and promulgation of accounting, auditing, governance, ethics and Shari’a standards for IFIs and Islamic finance transactions and structures…in line with Shari’a principles and rules.”

Apart from this, AAOIFI also focuses on the below-mentioned ancillary objectives;

- Creating awareness of its primary objectives through conferences, public hearings, training programmes, and publications (including the Journal of Islamic Finance Accountancy – JOIFA), etc. This ensures a continuous engagement with the international, regional, and national industry stakeholders, research institutions, and market participants to discuss issues pertinent to the inclusive and sustainable development of the industry.

- Developing human resources and building capacity at the institutional level through professional development, educational and training programmes to support a thorough understanding and application of their standards.

- Providing certification, advisory, and assurance services in furtherance of its primary objectives. They have various certifications and training programmes including, Certified Shari’a Adviser and Auditor (CSAA) and Certified Islamic Professional Accountant (CIPA).

It aims to harmonise and standardise Islamic finance practises in accordance with Shari’a principles so that contradictions and inconsistencies are avoided within the Shari’a boards of the IFIs. All these activities are guided to obtain investors’ confidence and trust in Islamic financial market products and services.

AAOIFI’s organisational structure consists of the General Assembly that includes the Board of Trustees (including the Executive, Nomination, and Audit and Governance Committees and the General Secretariat), and the Technical Board which is spearheaded by tremendous support from its Board of Trustees. The General Assembly is the most supreme authority within AAOIFI and is composed of all the members. It has the power to approve amendments of AAOIFI’s statute, financial statements, and reports. It also appoints the Board of Trustees and approves the admission of new institutional members.

AAOIFI has over 140 member institutions spread across 37 countries, including central banks, regulatory authorities, other IFIs, accounting and auditing firms, Shari’a advisory, and legal firms. Islamic Development Bank (IsDB), Al Rajhi Bank, Kuwait Finance House (KFH) are some of its 6 founding

members. Presently, AAOIFI’s issued standards are followed by leading IFIs globally in over 35 countries. These standards are considered as a market authority on IF practice by a majority of institutions.

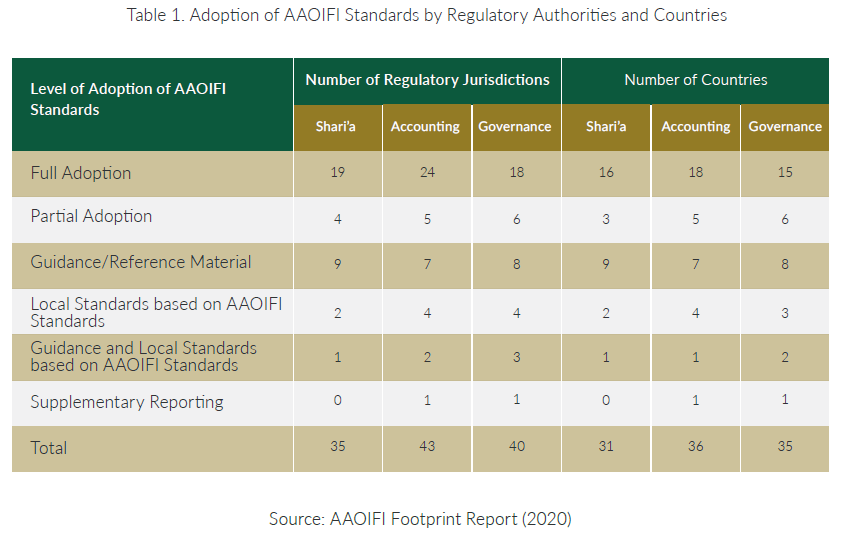

Despite their popularity, these standards are adopted by stakeholders to varying degrees. Some stakeholders have fully adopted the standards as part of the mandatory regulatory requirements or voluntarily, while others prefer a partial adoption. Some institutions or regulatory jurisdictions tend to extract guidance or modify these standards depending on their local Islamic finance market. These standards are also used as references to draft individual jurisdiction-specific standards, laws, and regulations. The reason for the partial or non-adoption of AAOIFI standards by IFIs could be because the reporting and disclosure principles and the financial reporting of conventional international standards do not contradict the principles of Shari’a. In some instances, certain jurisdictions are affiliated to international conventions and treaties

that morally and politically bind them to follow conventional reporting standards. Nonetheless, it has been recognised even by the leading regulatory jurisdictions of the conventional finance industry that the unique nature of Islamic finance requires the adoption of separate standards and reporting (AAOIFI) frameworks to fulfil their Shari’a obligations and to preserve their Shari’a-compliance.

AAOIFI published a footprint report (2020) analysing the level of adoption of AAOIFI standards by Regulatory and Supervisory Authorities (RSA) of IFIs globally. This report observed that the Shari’a, governance, accounting and auditing standards issued by AAOIFI have been adopted by 40 regulatory jurisdictions either fully or partially, or as references and guidelines; out of which 26 have fully adopted these standards. Regulatory jurisdictions that adopt individual AAOIFI Shari’a, accounting and governance standards are 19, 24 and 18 respectively, and the number of countries that have adopted them are 16, 18 and 15, respectively. (Refer to Table 1).

Shari’a Governance Framework

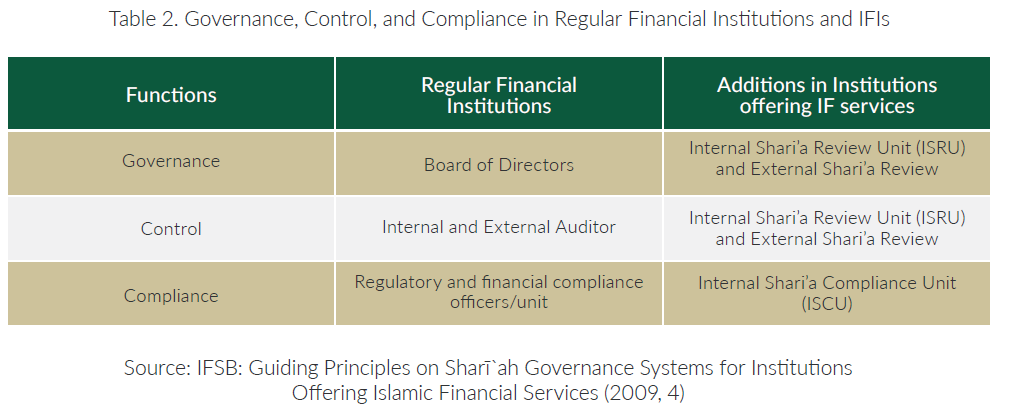

The Islamic Finance industry is witnessing growth at an unprecedented level. In 2018 alone, the industry was valued at US$3.295 trillion, which was approximately 15% higher than the preceding year. Since the present Corporate Governance (CG) structure is limited to fulfilling the unique and diverse need of IFIs, particularly, in upholding compliance to the principles of Shari’a, the need to develop a Shari’a Governance Framework (SGF) that can be adopted by IFIs globally is amplified. (Refer to Table 2).

THE ISLAMIC FINANCE INDUSTRY IS WITNESSING GROWTH AT AN UNPRECEDENTED LEVEL. IN 2018 ALONE, THE INDUSTRY WAS VALUED AT US$3.295 TRILLION, WHICH WAS APPROXIMATELY 15% HIGHER THAN THE PRECEDING YEAR.

Shari’a Governance Framework (SGF) is an additional layer of governance for IFIs that are already subjected to the conventional corporate governance (CG) requirements for financial institutions as stated by the Organisation for Economic Co-operation and Development (OECD) and additional fiduciary responsibilities. It provides a framework that ensures accountability, responsibility, and effective oversight of IFIs. SGF is vital for assisting IFIs in ensuring Shari’a compliance, public/investor confidence, sustainability, consumer protection, and risk management. It strengthens professionalism and safeguards the reputation of IFIs. SGF is required for

upholding the Islamic identity of these institutions that separates them from other conventional institutions and in assisting Shari’a department officers and Shari’a Supervisory Board (SSB) in performing their functions effectively. SGF provides guidelines for SSB, Board of Directors (BoD), Shari’a auditors and executives, and management within the IFIs. Other than the AAOIFI, SGF has also been developed and issued by the Islamic Finance and Service Board (IFSB). Without a proper SGF in place, IFIs would risk losing investor/customer confidence and Shari’a legitimacy.

The absence of a robust SGF can minimise the public faith and customer confidence in the Islamic finance industry and products. AAOIFI has issued over 13 standards related to Shari’a Governance in IFIs, mentioned below.

GS1: (1997) Shari’a Supervisory Board- Appointment, Composition, and Report: Every IFI is to have an independent SSB to be appointed by the shareholders on the recommendation of the BOD consisting of specialised jurists in Islamic commercial jurisprudence. The SSB directs, reviews and supervises the activities of the IFI to ensure that they are compliant with the principles of the Shari’a and SSB’s rulings are binding on the IFIs.

GS2: (1998) Shari’a Review: Its purpose is to establish standards and provide guidance to assist SSB of the IFIs in performing Shari’a reviews to ensure compliance with Shari’a rules and principles as reflected in the SSB’s fatwas, rulings, and guidelines. It is an examination of the extent of the IFI’s compliance with the Shari’a in all its activities.

GS3: (1999) Internal Shari’a Review: It ensures that the IFI’s management discharges its responsibilities under Shari’a rules and principles as determined by the SSB. It is to be independently carried out by a separate division or be a part of the internal audit report.

GS4: (2001) Audit and Governance Committee (AGC) for Islamic Financial Institutions: The AGC assists the BoD in exercising independent and objective monitoring of the IFI’s financial information. It aims to preserve the integrity of the financial reporting process, safeguards the interests of various parties of the IFIs, gives assurance of the reliability of financial reports and acts as an independent link between the IFI’s management and its stakeholders.

GS5: (2005) Independence of Shari’a Supervisory Board: It provides guidance for the members of the SSB of IFIs pertaining to its independence and objectivity to enhance public confidence and ensure Shari’a compliance.

GS6: (2005) Statement of Governance Principles for Islamic Financial Institutions: It supports the development of sound governance practices with IFIs and establishes the basis for standard-setting by AAOIFI on individual aspects of governance. It lays down 12 principles of governance and explains its structure as well.

GS7: (2009) Corporate Social Responsibility (CSR), Conduct and Disclosure for Islamic Financial Institutions: It prescribes uniform standards on CSR activities and compliance of IFIs and codifies existing principles and rules in a comprehensive structured format. It ensures that the CSR activities and compliance of the IFIs are communicated in a uniform, truthful, transparent and comprehensive manner to the relevant stakeholders to whom the IFI owes a duty of accountability.

SGF IS VITAL FOR ASSISTING IFIS IN ENSURING SHARI’A COMPLIANCE, PUBLIC/INVESTOR CONFIDENCE, SUSTAINABILITY, CONSUMER PROTECTION, AND RISK MANAGEMENT. IT STRENGTHENS PROFESSIONALISM AND SAFEGUARDS THE REPUTATION OF IFIS.

GS8: (2019) Central Shari’a Board: This standard aims to establish an advanced degree of harmonisation and convergence in the work of SSBs of the IFIs to iron out the situations of inconsistencies and differences between the Fatwas, rulings, decisions and applications by such entity-level boards. This allows consistency in the products and services offered by the IFIs and the promotion of standardised practices. It also increases the credibility of the Islamic finance industry and boosts the confidence of its clients and investors in IFIs and their offerings.

GS9: (2018) Shari’a Compliance Function: It defines the role of Shari’a compliance as part of governance, controls and practises of the IFIs and the establishment of a Shari’a compliance department within IFIs and its key functions, responsibilities and structure.

GS10: (2019) Shari’a Compliance and Fiduciary Ratings for Islamic Financial Institutions: It sets principle-based guidance on Shari’a compliance and fiduciary ratings, strengthens stakeholders’ confidence, and improves transparency.

GS11: (2019) Internal Shari’a Audit: It is built upon GS3 to provide improved guidance on the Internal Shari’a Audit (ISA) function in IFIs. The objective of this standard is to define and recommend a comprehensive framework for the internal Shari’a audit function of the IFIs as a part of their governance structure.

GS12: (2019) Sukuk Governance: It provides a framework for the governance of sukuk issuances for the entire lifecycle of such instruments. Implementation of such a framework, in turn, shall result in enhanced confidence of the sukuk- holders and other stakeholders on sukuk, and the sukuk market, particularly concerning compliance with Shari’a principles and rules, fair and equitable treatment of stakeholders and transparency.

GS13: (2020) Waqf Governance: It promotes and strengthen the core values of waqf and their governance practices, lays down key principles and prescribes and promotes an effective system of governance. This is in line with good practices of institutional and Shari’a governance, adapted to the specific nature of waqf that enhances the public and stakeholders’ confidence in waqf, promotes the development of the waqf sector, international harmonisation in waqf governance, and enhances the role of waqf as a potential source of investment in Islamic capital markets (for the new trend of waqf- based products) and the social finance sector.

Similarly, the SG standards issued by AAOIFI, IFSB has developed 4 standards that focus on developing a robust SGF for IFIs, including, guiding principles for Corporate Governance of Islamic Banks (IFSB 3), Guiding Principles on Governance of Islamic Collective Investment Scheme (IFSB 6), Guiding Principles on Governance of Takaful Undertakings (IFSB 8) and Guiding Principles on Shari’ah Governance Systems for IIFS (IFSB 10). These standards and guidelines, as a result of their similarity with the AAOIFI’s SGF, led to various overlaps and gaps in the approach and extent of the two frameworks. Also, the presence of two sets of frameworks for the governance of IFIs led to confusion and misunderstanding in the industry.

Consequently, efforts are being made on both fronts to develop a Revised SRF (RSRF) that will smooth these differences, gaps, and overlaps and present a more unified and synced set of SGF for effective Shari’a compliance. The 22nd meeting of the Governance and Ethics Board of AAOIFI held in August-September 2021 discussed the proposed RSGF for IFIs and other institutions offering Islamic finance services. This RSGF will be a collaboration between AAOIFI and IFSB’s SGF that was approved by the IFSB council in its 33rd meeting and the AAOIFI Governance and Ethics Board in 2018.

Subsequently, a working group of 33 members was formed, including members from 21 Regulatory and Supervisory Authorities (RSAs), AAOIFI and IFSB members, and industry practitioners. The purpose of introducing the RSGF as a collaboration between AAOIFI and IFSB is to cater to the needs of the expanding industry of Islamic financial services in a way that is consistent, harmonised, effective, and efficient. The RSGF will focus on providing higher transparency and accountability levels in Shari’a compliance of IFIs, enhance public confidence, and reduce reputational risk of non-compliance with Shari’a principles. It will streamline the issuance, implementation, and audit process of Shari’a rulings. The RSGF follows an approach that is a principle-based and rule-based SG hybrid. Once approved, the RSGF will supersede some of the current regulations and guidelines issued by both IFSB and AAOIFI.

THESE STANDARDS AND GUIDELINES, AS A RESULT OF THEIR SIMILARITY WITH THE AAOIFI’S SGF, LED TO VARIOUS OVERLAPS AND GAPS IN THE APPROACH AND EXTENT OF THE TWO FRAMEWORKS.

The RSGF will be designed on 14 principles of Shari’a governance, including, the scope, need, and significance of an SGF, its key organisations, establishing the role of RSAs, the role of BoD and senior management, Central SSB, SSB, Shari’a compliance function, internal Shari’a audit function independent external Shari’a audit, all of which have already been covered in the earlier SGF. Apart from these, they will include a section of Islamic windows and their governance, Islamic subsidiaries, and other considerations, applicability to sectors like takaful, microfinance, and disclosure and transparency. Since the SRF is paramount for the efficient development of the Islamic finance industry, to reduce reputational risk, maintain customer confidence and trust, and fulfil the principles of the Shari’a, any step in the direction of easing adoption, understanding and implementation of a robust SGF is not only praiseworthy but also a prerequisite for the sustained growth of the Islamic finance industry. An exposure draft of the RSGF is expected soon and it will be a milestone development in the regulatory and supervisory structure of the Islamic financial market.