With the unprecedented outbreak of the COVID-19 pandemic, a ‘new normal’ emerged in 2020, as we witnessed businesses withstanding heavy losses, an increase in the cost of living, as well as a rise in personal debt, and for some, the agony of losing employment, family members and friends. As an agile organization, we empathized with our stakeholders and had reacted swiftly to address their needs. We formed the ‘Pandemic Working Group’, a purpose-driven committee consisting senior management members, to ensure our employees’, as well as our customers’ well-being, were cared for and protected.

This conscious effort included the introduction of work-from-home arrangements, physical distancing in the workplace, distribution of personal protective equipment, financial support for employees in need, and the establishment of sanitization stations and body temperature reading facilities in branches. Special standard operating procedures were established to guide physical transactions conducted at the branches and automated teller machines. Pandemic conditions also led to changes in how the Board and the Senior Management conducted their affairs, including the shift in favour of the virtual space over physical face-to-face meetings.

The ‘new normal’ paved the way for RHB’s first-ever virtual annual general meeting in 2020. This enhanced the level of shareholder participation by allowing them to remotely participate in our annual general meeting and to be able to vote in absentia. As a result, all resolutions at the 54th Annual General Meeting were fully voted on a poll via Remote Participation and Voting (RPV) facilities at the Virtual Meeting Portal in accordance with Paragraph 8.29A of Bursa Malaysia Securities Berhad’s Main Market Listing Requirements. The detailed poll results were also verified by the Independent Scrutineer, Messrs KPMG PLT who was present at the broadcast venue of the virtual general meeting.

ENTERPRISE GOVERNANCE

Creating and sharing value forms a core component of the Board’s agenda. This commitment is carved in the Board Charter where the Board is committed to promote sustainability by embedding Environmental, Social, and Governance (ESG) considerations in the organisation’s business strategies and decision-making process.

The Board is committed to embedding good corporate governance and put in place robust risk management practices which includes integrating sustainability risks as well as assessing the impact of climate risk to the Groups’ business and operations. At RHB, we strive to foster and integrate sustainable practices and responsible behaviour within the Group by upholding high standards of corporate governance and ethical business conduct through our core activities of lending, capital markets and advisory, wealth management, deposits, investment, asset management and insurance businesses. We also promote a workplace culture that is engaging, inclusive and caring, and nurture a sustainable culture within our organisation.

LEADERSHIP BY EXAMPLE

RHB is led by a capable leadership team with expertise stemming from well-diversified membership within the boardroom, setting the tone from the top. This diversity, in terms of gender, skill-set competency and industry experience, enables the Board to provide strong and capable leadership on governance, sustainability and strategy in its effort to create value for all our stakeholders. The Board ensures that adoption of best practices, along with strong governance processes, are continuously practiced within the Group’s business operations as these are integral to the Group’s business strategy, long-term sustainability and alignment of decision-making processes.

The Board recognises the need for the Group’s governance and sustainability agenda to continually adapt to changing risks and regulatory requirements to ensure the Group’s long-term value creation. Policies, frameworks and Guidelines are regularly reviewed and updated to meet the demands of the rapidly changing business environment and regulatory landscape to ensure they remain relevant and effective. As such, the Group operates within a clearly defined Board- approved governance model that provides clear direction on governance practices and direction in relation to the decision-making process across the Group. This delegation of authority is clearly spelt- out within the Terms of References of the respective Board Committees.

The Board manages the affairs of the Group by promoting open and transparent discussions, and not merely following prescribed rules and regulations. In addition, the Board continuously seeks to ensure best practices and strong governance process, which are integral to our strategy and decision-making processes, are maintained for the benefit of our shareholders and other stakeholders.

CULTURAL AND BELIEF SYSTEM

The Board and senior management view good corporate culture as imperative for a financial conglomerate such as RHB Banking Group, as it dictates both the behaviour within RHB and the way RHB communicates with its stakeholders. RHB’s ‘cultural climate’ is measured through the strength of our policies and compliance processes including strong internal controls. This is further supplemented by our formal communication channel for employees, and any external parties, via our authorised whistleblowing channel ‘Speak-Up’, to raise concerns regarding workplace misconduct. Good governance and strong values are the foundation of how we operate at RHB. As such, RHB Bank Berhad is guided by the Group’s core values of P.R.I.D.E. (Professional, Respect, Integrity, Dynamic & Excellence) which are imbued throughout the organisation and its group of companies:

- Professional: We are committed to maintain a high level of proficiency, competency and reliability in all that we do.

- Respect: We are courteous, humble and we show empathy to everyone through our actions and interactions.

- Integrity: We are honest, ethical and we uphold a high standard of governance.

- Dynamic: We are proactive, responsive and forward-thinking.

- Excellence: We will continuously achieve high standards of performance and service deliverables.

INTERNAL CONTROLS SYSTEMS

The Group is committed to ensuring responsible behaviour by the company and its employees both in the workplace and marketplace. The company takes full responsibility for the effect of its practices and internal policies/procedures/guidelines while continuing to strengthen and embed robust corporate governance and risk management practices throughout its business operations.

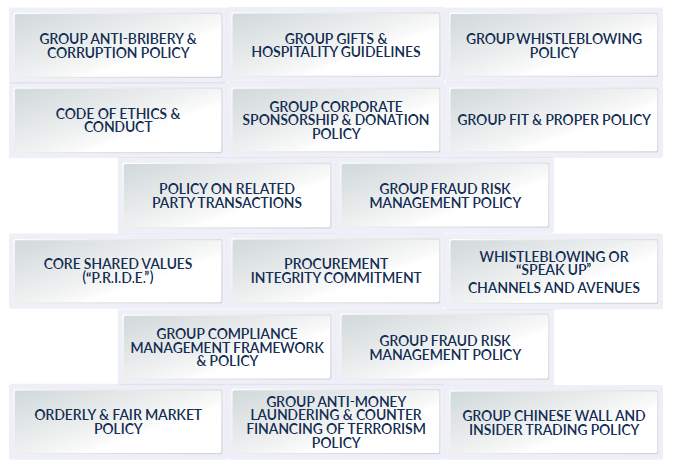

The formulation and continuous enhancement of the Group’s Code of Ethics and Conduct for Employees, Group Anti-Bribery & Corruption Policy, Group Whistleblowing Policy, Group Corporate Sponsorship & Donation Policy and Group Gifts & Hospitality Guideline are reflections of the Board and Senior Management’s enduring commitment in adopting adequate internal controls as part of its comprehensive anti-corruption and anti-fraud programme.

RHB has adopted the following internal control measures to ensure appropriate and responsible behaviour in our workplace and marketplace:

SUSTAINABILITY GOVERNANCE & FRAMEWORK

The Board, together with the Group’s Senior Management, is committed to driving sustainability across the Group’s business and operations by further integrating sustainability as part of its overall corporate strategy and decision-making process.

The Group’s Sustainability Governance structure has been further enhanced with clearer oversight on its sustainability and climate action programme, which includes the following:

- Establishment of Board Sustainability Committee (BSC), effective August 4, 2022, to advise the Board and provide strategic oversight on the Group’s Sustainability Strategy and climate-related matters.

- Group Sustainability Committee (GSC) chaired by the Group Managing Director, to drive and oversee the execution of the Group’s Sustainability strategy and implementation plans.

- Appointed Group Chief Sustainability Officer to manage the overall Sustainability Programme which includes the Net Zero agenda for the Group.

- GSC is supported by 4 Sustainability Councils comprising members of Senior Management;

(i) Sustainable Banking Council, (ii) ESG Capital Markets and Advisory Council, (iii) Sustainable Insurance Council, and (iv) Responsible and Sustainable Practices Council.

- A dedicated Project Steering Committee that oversees the implementation of the Group Climate Action Programme and establishment of a Climate Risk Management team.

In October 2021, RHB established a new 5-Year (2022-2026) Sustainability Strategy and Roadmap, which forms part of the Group’s new corporate strategy. RHB strives towards becoming a sustainably responsible financial services provider by promoting sustainable and inclusive growth and nurturing customers, employees and communities, while upholding good governance to create value. Our sustainability aspirations are:

- Support sustainable development by mobilising RM20 billion in sustainable financial services by 2026.

- Empower more than two million people across ASEAN by 2026.

- Achieve carbon-neutral operations by 2030.

The above 3 Aspirations support the following UN SDGs:

- 4-Quality Education

- 5-Gender Equality

- 8-Decent Work & Economic Growth

- 9-Industry, Innovation & Infrastructure

- 12-Responsible Consumption & Production

- 13-Climate Action

Our approach to sustainability is anchored on the Group’s Sustainability Framework which comprises three (3) key pillars. The framework was established with the aim of embedding Environmental, Social and Governance (“ESG”) considerations in our business and operations.

The framework acts as a guide for us to identify opportunities and mitigate risks as we seek to ensure sustainable growth and continue creating value for all our stakeholders.

RHB’s sustainability vision is ‘Building a Sustainable Future’ and contributing to sustainable development through impactful actions centered on three thematic pillars, namely:

PILLAR 1: SUSTAINABLE & RESPONSIBLE

BANKING encapsulates the Group’s role as a financial institution by integrating ESG considerations into our business strategies and decision-making processes, while nurturing customers and communities towards achieving sustainable growth;

PILLAR 2: EMBEDDING GOOD PRACTICES

aims to foster responsible practices and nurture a sustainable culture within our organisation;

PILLAR 3: ENRICHING & EMPOWERING

COMMUNITIES strive to create long-term positive impacts on the communities, focusing on nurturing children and young adults and lifting communities through meaningful initiatives that build capacity, develop skills and promote volunteerism.

Our shareholders, customers, employees and all our stakeholders are kept informed on the development and impacts (positive and negative) of the Group’s sustainability/ESG initiatives and contributions to sustainable development through our Integrated Report, Sustainability Report as well as corporate website.

At RHB, we continue to invest time and effort towards delivering innovative solutions and sustainable financial services that will support the nation’s transition towards a sustainable and low-carbon economy. As of December 2021, we have extended a total of RM 4.32 billion under our Green Financing Commitment in non-retail business activities. In September 2021 we launched our Sustainable Financing Programme (SFP), a green financing product bundling programme aimed at meeting the needs of Retail and SME customers. The four (4) types of green financing under the SFP are Green Energy, Green Buildings, Green Products and Green Processes.

The Group continues to engage with clients and customers in advocating for the transition to clean energy and green activities, as well as nurturing the integration of ESG/sustainable practices into their respective businesses and operations.

ENRICHING AND EMPOWERING COMMUNITIES

True to our brand promise of Together We Progress, we aim to create long-lasting positive impacts within the communities in which we operate by enriching and empowering them. We reach out to people in need, in particular the underprivileged from low-income and the underserved members of the communities/ B40 community. Focusing on children and youth, our programmes are aimed at nurturing future generations and developing holistic individuals through our Academic Excellence and Scholarship Programmes for B40 youths.

As a financial services provider, we believe in promoting financial literacy to the younger generation and our customers to help shape a financially-literate society and promote responsible financial behaviour, which will contribute to the economic health of the nation in the long run. One such educational programme, RHB Money Master, has benefitted a total of more than 100,000 engagements/participants since it began in 2018.

FY2022-2026 Targets for enriching & empowering community (Empower more than two million people across ASEAN by 2026) are as follows:

- FY2026: On-board 51,000 SMEs on SME e-Solution digital platform. Target FY2022: on- board 7,000 SMEs

- FY2026: Empower 3,500 MSMEs through a capability-building programme. Target FY2022: empower 500 MSMEs

- FY2026: Engage 880,600 young to workforce through financial education. Target FY2022: engage 230,070 young to workforce

- FY2026: On-board 20,000 youths through academic excellence programme. Target FY2022: on-board 3,000 youths

EXTERNAL VALIDATION AND RECOGNITION

RHB Bank Berhad was recognised as a recipient of the ASEAN Corporate Governance Award by the ASEAN Capital Market Forum, as Top 50 (2015), Top 30 (2018) and Top 20 (2019) among Public Listed Companies in Southeast Asia for its good corporate governance practices and disclosure. In addition to this, the value creation and its impact to the community is also reflected by the recognition it had received throughout the past years:

- Remained a constituent in the FTSE4Good Bursa Malaysia Index since 2016.

- Top 25% by ESG Ratings among public-listed companies in FTSE Bursa Malaysia EMAS as at June 2021.

- Scored 47/100 in the 2021 S&P Global Corporate Sustainability Assessment reflecting an improvement of 4 clear points compared to the previous year.

Maintained AA rating (Leader) for MSCI ESG Ratings since September 2019.