A STORY YET TO BE TOLD

In recent times, it has attracted attention of the global media following the Nobel Peace Prize-winning of its prime minister, Abiy Ahmed Ali, in 2019. In the context of Islamic banking and finance, the Prime Minister Abiy Ahmed Ali hit the media when he became the 12th GIFA Laureate by winning the prestigious Global Islamic Finance Leadership Award 2022 (for more on the Prime Minister Abiy Ahmed Ali, read his interview published as Cover Story of this issue of ISFIRE).

Following a long period of a socialist/communist regime, Ethiopia has recently embarked upon market-based reforms and strengthening of democracy. Modern Ethiopia is a multi-faith society, with majority population subscribing to the Christian faith and with an important large minority of Muslims, estimated to be more than 38 million – one-third of the total headcount in the country. Given the size of its economy and population (second largest in Africa), it is undoubtedly the most important country in the East African region1. Given its advantage in terms of size and it being a peaceful country that has managed conflicts and disputes with its neighbouring countries, Ethiopia is well-positioned to become a regional hub for Islamic banking and finance2. In this respect, it must learn from the likes of Nigeria, which has successfully – albeit gradually – built a comprehensive interest-free banking and finance sector, ranging from retail banking to sophisticated capital markets.

Apart from Eritrea, all the countries in the region have Islamic banks and other financial institutions operating therein. Djibouti has already benefitted from the conflicts in the region (especially in Somalia), but its small size and relatively underdeveloped infrastructure poses limitations. Furthermore, the ongoing political uncertainty in Somalia and geopolitical and strategic status of Somaliland will continue to cloud the prospects of international players to enter these two markets. While Djibouti intends to open herself even more in terms of ease of doing business, there remains a huge scope for Ethiopia to become a regional hub for business and finance. In this respect, liberalisation of financial sector is a top priority of the government.

Table 1 provides an indicator of the size of the wider Horn of Africa (or what may be termed as Sub-East Africa). It is clear from the table that Ethiopia can play an important role in a region comprising significant population, with substantially low GDP and the consequent GDP per capita.

Table 1 Economy of the Wider Horn of Africa (or the Sub-east Africa)

| Country | GDP (US$ billion) | Population (Million) | Per Capita GDP (US$) |

| Ethiopia | 111.27 | 117.88 | 852.01 |

| Kenya | 110.35 | 49.40 | 1,643.57 |

| Somalia | 7.29 | 16.36 | 446.52 |

| Somaliland | 7.2* | 5.74 | 1,530* |

| Djibouti | 3.37 | 1.00 | 3,190.22 |

| Eritrea | 2.07 | 3.21 | 701.00 |

| Total (Average) | 241.55 | 193.59 | (1,677.89) |

* Rough estimate, as independently verifiable statistics for Somaliland are hard to find.

Within the financial sector, interest-free banking may become an important segment in Ethiopia, if it is developed with a strategic view. The reforms based on the concept of Medemer (see p. 12-21 for further details) can be better implemented and benefitted from, if the government opts to use interest-free banking as purely a business phenomenon, without any explicit reference to any religion. In this respect, there is a need to study the Kenyan Islamic banking sector for Ethiopia to play a lead role in the region.

History of Interest-free Banking in Ethiopia

Although Addis Ababa is only a two hours and forty minutes flight from Jeddah, Ethiopia is rather a frontier new market for Islamic banking and finance. The country is teeming with numerous investment opportunities in various sectors of Islamic banking and finance. While Islamic banking and finance is already off the ground, other sectors like microfinance, insurance and asset management present with investment opportunities to those looking for virgin business territories.

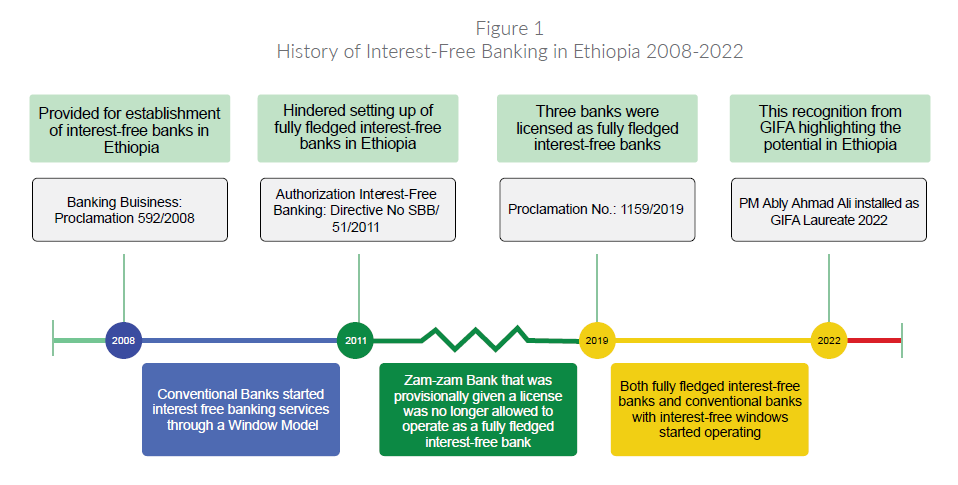

Islamic banking was introduced as ‘interest-free banking’ in the country in 2008 when banks were allowed to start offering faith-based banking products and financial solutions to the statistically important Muslim segment of the Ethiopian society. Although the Banking Business: Proclamation No. 592/2008 was general in nature, it was later interpreted to allow only the incumbent licensed banks to offer ‘interest-free banking’ following a Window model.

During this period, an uncertainty emerged, as the central bank (National Bank of Ethiopia) stopped the first fully-fledged Islamic bank, namely, ZamZam Bank, to proceed with its planned launch (see p. 30-39 in this issue of ISFIRE for a detailed account of this). This was understandable, as any country facing dawn of Islamic banking and finance will take a rather conservative approach to ensure that a comprehensive and coherent regulatory framework existed for the smooth introduction of new institutions.

In 2019, setting up of fully-fledged Islamic banks was also allowed. Since then, three fully-fledged Islamic banks (namely ZamZam Bank, Hijra Bank and Shabelle Bank) have been licensed and they have indeed started their operations.

Is the pace of development of interest-free banking in Ethiopia too slow?

Perhaps yes but understandably so. Ethiopia is a multi-faith, multi-ethnic country, with the majority population subscribing to Christianity. Furthermore, it is a society in transition. From a period of monarchy (from the 13th century to 1975) to the Marxist regime (1975-87) to socialist democracy (1987-91) to now a democracy, there is a lot in the plate of policymakers. Any new developments in a politically fragile country must take time.

Since 2008, the country has come a long way to introduce interest-free banking. The real impetus came in 2018 when the central bank formally allowed establishment of fully-fledged interest-free banks. It is now expected that interest-free banking will further flourish and play an important role if the Medemer-based reforms continue in Ethiopia.

However, it is important for the advocates of interest-free banking to keep it a completely apolitical phenomenon, focusing on institutionalising of interest-free banking as a purely business phenomenon, with no political or religious agenda.

Also, it is important for the stakeholders of the interest-free financial sector in Ethiopia to learn how to grow in a sustainable way. Growing too much with an unsustainably high rate will not benefit the industry in the long-run. The slow and steady win the race.

Given its short history in the country, interest-free banking is understandably still in its infancy. In fact, the entire financial sector in Ethiopia is very small – too small indeed for the size of population it attempts to serve. In the pre-reformed era, there were 18 banks operating in Ethiopia with combined capital base of less then US$3 billion. Consequently, the banking coverage is also limited with no more than 20% of the bankable population having a bank account or an equivalent arrangement.

While three fully-fledged interest-free banks have come into existence since 2019, we understand that the real future of interest-free banking in Ethiopia lies within the conventional banks that are better poised in terms of outreach, risk management and depth and breadth of product offering (see Table 2 for a list of conventional banks offering interest-free banking in Ethiopia)3. 12 out of the 26 conventional banks in the country are involved in offering interest-free banking services. This is an impressive number, which is poised to increase, given that the six newly-licensed conventional banks will also be tempted to offer interest-free banking in their attempts to attract customers from diverse backgrounds.

Table 2 List of Banks in Ethiopia

| No. | Name of the Bank | Interest-free Window | Banking |

| 1 | Commercial Bank of Ethiopia Yes | ||

| 2 | Bank of Abyssinia | Yes | |

| 3 | Awash Bank | Yes | |

| 4 | Dashen Bank | Yes | |

| 5 | Development Bank of Ethiopia | No | |

| 6 | Wegagen Bank | Yes (Wegagan Amana) | |

| 7 | Hibret Bank | Yes | |

| 8 | NIB International Bank | Yes | |

| 9 | Coop Bank of Oromia | Yes (Coopbank Alhuda) | |

| 10 | Lion International Bank | No | |

| 11 | Zemen Bank | No | |

| 12 | Oromia International Bank | Yes | |

| 13 | Bunna Bank | Yes | |

| 14 | Berhan Bank | No | |

| 15 | Abay Bank | Yes (Abay Sadiq Bank) | |

| 16 | Addis International Bank | No | |

| 17 | Debub Global Bank | No | |

| 18 | Enat Bank | No | |

| 19 | ZamZam Bank | Interest-free Bank | |

| 20 | Goh Betoch Bank | No | |

| 21 | Hijra Bank | Interest-free Bank | |

| 22 | Siinqee Bank | Yes | |

| 23 | Shabelle Bank | Interest-free Bank | |

| 24 | Tsedey Bank | New Bank | |

| 25 | Ahadu Bank | New Bank | |

| 26 | Tsehay Bank | New Bank | |

| 27 | Amhara Bank | Under Formation | |

| 28 | Gadaa Bank | Under Formation | |

| 29 | Sidama Bank | New Bank |

This last point deserves qualification. In any country with a Muslim minority, Islamic banking prospers within the conventional infrastructure, at least in the beginning. There is no one-size-fits-all model in this respect though. In Nigeria, for example, interest-free banking has grown rather quickly after Jaiz Bank was set up as a fully-fledged interest-free bank. Since then, two other banks, namely TAJ Bank and Lotus Bank, have also emerged as important market players.

WHILE THREE FULLY-FLEDGED INTEREST-FREE BANKS HAVE COME INTO EXISTENCE SINCE 2019, WE UNDERSTAND THAT THE REAL FUTURE OF INTEREST- FREE BANKING IN ETHIOPIA LIES WITHIN THE CONVENTIONAL BANKS THAT ARE BETTER POISED IN TERMS OF OUTREACH, RISK MANAGEMENT AND DEPTH AND BREADTH OF PRODUCT OFFERING

There is nothing inherently wrong with fully-fledged Islamic banks if they are adequately capitalised. Fully-fledged Islamic banks in Ethiopia have as of now small capital base. This can partially be compensated by developing digital banking solutions

and innovative uses of FinTech. The supremacy of conventional banks in terms of efficiency of product offering will continue till fully-fledged Islamic banks attain a meaningful size.

THE FOREIGN BANKS MAY BE ALLOWED TO ENTER THE MARKET BY WAY OF ACQUIRING OR INVESTING IN THE INCUMBENT BANKS IN ETHIOPIA, INCLUDING THE ISLAMIC BANKS

In the wake of the imminent liberalisation of the Ethiopian financial sector (as alluded earlier), the size factor becomes even more relevant. For the local Ethiopian banks to effectively compete with the soon-to-enter foreign banks, there is a definite need for consolidation of the national banking sector. The scope for mergers and acquisitions cannot be over-estimated or over-emphasised in this respect. The foreign banks may be allowed to enter the market by way of acquiring or investing in the incumbent banks in Ethiopia, including the Islamic banks.

Quantification of Demand for Interest- free Banking in Ethiopia

It is imperative to understand the real demand for interest-free banking in Ethiopia before more players get lured into it. There is some evidence of over-enthusiasm on the supply side in favour of Islamic banking and finance in most of the countries where it has yet to be introduced or where it is at an initial stage. Ethiopia cannot be an exception in this respect. Following the 2019 change in regulations, several applications were submitted to the central bank to open fully-fledged interest-free banks in the country. While this enthusiasm should be welcomed, it is important that a more informed view is taken to decide in favour of such applications.

What are the risks associated with a non-quantitative approach to demand-side analysis?

If supply-side players are shown green pastures in interest-free banking, which they later find out do not exist, at least in the perceived size, it will be necessarily disappointing for them. At that point, if they decide to exit the market, it will be damaging for the industry, and will hamper further growth of interest-free banking in the country. There are numerous examples that provide at least anecdotal evidence to explain this point. In the UK, for example, there was huge interest shown by conventional banks

– the likes of HSBC, Lloyds TSB, Yorkshire Building Society and many more – when they started offering Islamic banking and finance. Later, however, all of them found out that they over-estimated demand for Islamic banking from the nearly 3 million Muslims in

the country. Consequently, today we do not find even a single high-street bank in the UK offering Islamic financial services. The market has been taken over by specialised Islamic banks – like Al Rayan Bank4 and HBZ5 – which have taken a very cautious approach to their Islamic offerings.

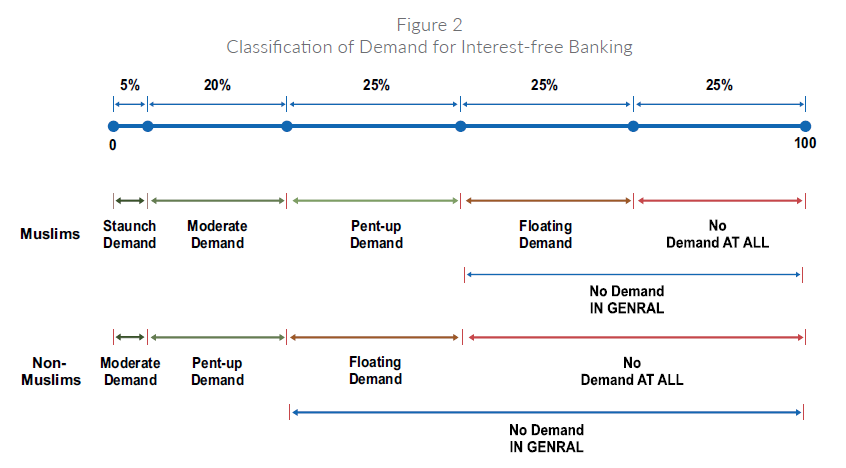

Looking into the effective demand for Islamic banking and finance, and its structure, is one of the key differentiators between sustainable success and failure. Based on a number of surveys in other countries, we would like to classify demand for interest-free banking in Ethiopia into:

- Staunch demand

- Moderate demand

- Pent-up demand

- Floating demand

- No demand at all

Staunch demand is defined as the proportion of people who would like to use interest-free banking services only and in the absence of them would prefer to exclude themselves from the formal financial sector. This is only about 5% of the Muslims. Non-Muslims do not exhibit this kind of demand.

Moderate demand is defined as the proportion of people who would like to use interest-free banking only when they are available in the market, preferably on competitive grounds. Both Muslims and non-Muslims may exhibit this kind of demand. It is estimated that about 20% of Muslims and about 5% of non-Muslims would have this kind of attitude towards interest-free banking.

Pent-up demand is the proportion of people who may use interest-free banking only after they have been educated about it and that they are convinced of its value proposition (after having been made aware of it). Part of this demand is affected by mere existence of interest-free banking in a market. Both Muslims and non-Muslims may show this kind of demand.

Remaining segments of population are principally not interested in interest-free banking and finance, although a proportion of them (floaters) may use interest-free banking purely on secular considerations. The above classification is exhibited in Figure 2.

Who could be interested in interest-free banking and financial services in Ethiopia?

Despite claims of universal appeal of Islamic banking and financial services, the truth of the matter is that only Muslims have a real compelling reason to use such services. Secular demand for interest-free banking and finance is dependent upon a distinct economic value proposition, if there is any.

Financial exclusion is rampantin Ethiopia. Slightly more than one-third of adults have an account with a bank or equivalent (like a mobile phone operator offering transaction banking services). This means there is a huge opportunity for the providers of interest-free banking to tap into the financially excluded segment of the society. Provision of microfinance thus has good scope. It must be emphasised that financial exclusion can only partially be explained with respect to religious beliefs. People out there in the rural areas are looking for any type of help to have access to finance. It is a supply-side failure.

In Ethiopia where Islamic banking and finance is allowed as ‘interest-free,’ one may assume that many people – Muslims and non-Muslims alike – would be interested in it, if it is truly ‘interest-free.’ As Islamic banking and finance remains interest-linked, a significant proportion of initial potential demand will fizzle away. In the initial phase of development of interest-free financial services in Ethiopia, it is, therefore, important that credible social sector players with a development agenda play a role in popularising the idea.

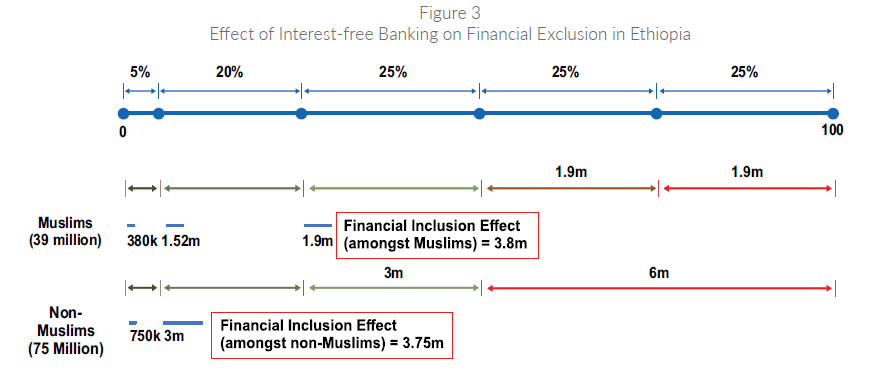

It must be clarified that interest-free banking is expected to decrease financial exclusion not only amongst Muslims but also amongst non-Muslims.

Interest-free banking in Ethiopia is expected to bring only marginal benefits in terms of financial inclusion. In the first phase of introduction of interest-free banking in the country, we expect that it will bring about 380,000 households into the formal financial services net. The maximum financial inclusion effect will at best be no more than 7.55 million households. This means that interest-free banking can potentially reduce financial exclusion by one-fifth (see Figure 3).

It must be clarified that interest-free banking is expected to decrease financial exclusion not only amongst Muslims but also amongst non-Muslims. In fact, our analysis suggests that half of the 20% decrease in financial exclusion will be among non- Muslims.

Capacity-building for the Interest-free Banking in Ethiopia

Adequately trained human resources are required for development and promotion of interest-free banking. The countries that have well-developed Islamic/interest-free finance sectors invested in human capital development. Malaysia, for example, have set up specialised institutions like INCEIF to produce qualified personnel for the Islamic financial services industry. Almost all the universities in the country offer qualifications (degrees, diplomas and certificates) related with Islamic banking and finance.

Level-playing Field for Interest-free Banks in Ethiopia

The provision for operations of interest-free banking in Ethiopia is only what is known as a ‘necessary’ condition for development of a vibrant and well-functioning interest-free sector. A ‘necessary’ condition is to ensure that they are not disadvantaged in any respect as compared to their conventional counterparts.

It is satisfying for the industry stakeholders to understand that the authorities are well aware of some of the challenges, interest-free banks may uniquely face. For example, the Development Bank of Ethiopia is working on creating Shari’a-compliant versions of the bonds to allow interest-free banks to buy the one percent mandatory bond by all the banks in the country.

Nevertheless, it must be highlighted that the needs of interest-free banks are a lot more than that. The National Bank of Ethiopia will have to come up with the liquidity management tools/instruments for the interest-free banks for them to remain within the bounds of Shari’a.

Conclusion

Ethiopia is well-positioned geographically to become a regional hub for interest-free banking. It should use innovative ways of interest-free banking and finance to support its development agenda. In this respect, examples of Indonesia and Nigeria are relevant.

The central bank of Ethiopia must consider becoming member of the multilateral Islamic finance bodies like Islamic Financial Services Board and Accounting & Auditing Organisation for Islamic Financial Institutions to get connected with the global Islamic financial services industry.