Introduction

Corporate governance is crucial for the sustainable development of any corporate entity including Islamic banks. Theoretically speaking, Islamic ethics, values and governance should be in built in the Islamic bank’s operations. However, current practices may not always be consistent with ideals. In this chapter, we will discuss corporate governance from an Islamic perspective in relation to Islamic banks with a special focus on the issues and challenges. An Islamic financial institution has been defined as banking in consonance with the Islamic ethos and values of governance in addition to the conventional methods of risk management of banking assets through good governance along with the principles laid down by Shari’a. Describing Islamic banking merely as interest-free banking is a narrow concept denoting a number of banking instruments or operations which avoid interest. Islamic banking, a more general term, is esteemed not only to avoid interest-based transactions, which are prohibited in the Shari’a, but also to avoid unethical practices especially suppression of borrowers or partners. In fact, the Islamic concept of banking actively participates in achieving the goals and objectives of an Islamic economy focusing more on human values.

Cases like Enron, Arthur Andersen, Barings Bank, Fannie Mae, WorldCom and many more revealed the failures that could result from weak corporate governance. In organizations – be they banks or business entities, Islamic or otherwise – the importance of corporate governance is the key to good results, a fact that cannot be denied Unlike the conventional banking system, Islamic banks operate under a different corporate governance framework as it is compulsory to appoint a Shari’a supervisory board, and/or a Shari’a advisor as per the jurisdiction requirement in which they operate their business. Power is an important factor in corporate governance. Who holds the power of decision-making in organizations, and how power is delegated, used, and controlled is a crucial question. Although power brings the responsibility of decision-making, if it is absolute power it may corrupt as well. Hence it is worth discussing the issue of power because from Islamic point of view all powers are with Almighty God whereas human beings are mere vicegerents of God. Hence from an Islamic perspective, the one who has power will not only be answerable to the stakeholders but also to God as well.

Dr. Zeti Akhtar Aziz, Governor of Bank Negara Malaysia defines corporate governance as follows: “Corporate governance involves the manner in which the business and affairs of the individual banking institutions are being governed by their board of directors and senior management, how the economic returns are generated to the owners, the day to day running of the operations of the business and the consideration of the interests of recognized stakeholders including depositors; and how they behave in a safe and sound manner, in compliance with applicable laws and regulations”. Transparency, disclosure and accountability are considered three major ingredients for good corporate governance. Meanwhile they also represent some of the issues and challenges.

Corporate Governance from an Islamic Perspective

The Islamic concept of corporate governance is different from its conventional counterpart because it is based on the principle Tawhid, the unity of God. Tawhid is a very complete concept, entailing complete surrender of one- self to the one and ineffable being, who is the creator, sustainer, owner of everything, all-knowing, all-wise, and the most powerful. Another important principle is Risalah, the institution of Prophethood, which is the revealed guidance in all aspects of human life from God in the form of the Holy Quran and its application through the practice of the Prophet Muhammed (the Sunnah). Akhi-rat means the life hereafter. The first point of the hereafter is judgment where man is answerable for all actions including economic activities, and this will determine the direction of man’s condition thereafter. In the imminent world, man is the Khalifa or vicegerent of God on earth and the resources at his disposal are a trust (Amanah). Man is answerable to God for all his deeds and sayings and he must make judicious use of his powers in accordance with the will of God. This is the soul and core foundation of the Islamic way of governance.

Shari’a emphasizes the need for book-keeping and putting all contracts into writing so that there will be no harm and injustice in society. All dealings should be transparent, open and written. This will lead to a society where disputes due to misinterpretation are less. Everyone will be held accountable for his own actions and responsibilities. Once everything is clear, then the duties, responsibilities, functions and accountability of the parties will be transparent. The Prophet Muhammad said that “Each one of you is a guardian, and each guardian is accountable for everything under his guardianship”. If we explain the above statement in terms of business dealings, it explains the ideal conduct of human behavior, i.e. one should behave in a proper way as he will be held accountable for his deeds, decisions, actions and dealings with others. Thus, we find a close link between Islamic teaching and corporate governance since corporate governance is the process in which actions taken by the people are with due diligence and in the best interest of all the related parties. The three main areas of corporate governance stressed in Shari’a are accountability, transparency and trustworthiness.

Islamic Model of Corporate Governance

As explained earlier, the foundation of Islamic corporate governance is tawhid. The corporate governance model of Islam takes into account all stakeholders as well as the human relationship with God. Any employee in an Islamic bank is answerable for his actions and deeds to the management of the bank, board of directors, and customers. At the same time he is also answerable to God. Apart from this all the activities, business and conduct of the Islamic bank should be in compliance with Shari’a. This is why the role of the Shari’a Board/Shari’a Advisor/Shari’a Committee is crucial for the success of an Islamic bank. The Shari’a board of the Islamic bank ensures that all products and services are in accordance to Shari’a. Their presence can be said to be the main pillar and hallmark of any Islamic financial institution. The goal of an Islamic bank is thus broader than profit maximization; it is to provide the financial services in accordance to Shari’a for the benefit of society at large.

Shari’a Governance

The Shari’a governance system puts in a supplementary stratum of governance to the existing corporate governance system. Shari’a governance is an ongoing and continuous process. It involves appointment, composition and qualification of the Shari’a board, the Shari’a observance process, Shari’a coordination, Shari’a compliance review, Shari’a audit and the Shari’a report which is part of the annual report of the Islamic bank. One important point to mention is that in case of dispute be- tween the Islamic bank and Shari’a board, the decision of the Shari’a board is considered final. Fatwa issued by the Shari’a board on the bank’s financial dealing or any other relevant matter is binding on the Islamic bank. The Islamic bank can also take the decision of the central Shari’a board of the central bank and in that case the decision of the centralized Shari’a board or committee is also considered binding. According to IFSB’s Guiding Principle on Shari’a Governance System, Shari’a Governance System refers to the set of institutional and organizational arrangements through which an IFI ensures that there is effective independent oversight of Shari’a compliance over each of the following structures and processes:

- Issuance of relevant Shari’a pronouncements/resolutions

- Dissemination of information on such Shari’a pronouncements/resolutions to the operative personnel of the IFI who monitor the day-to-day compliance with the Shari’a pronouncements/resolutions vis-à-vis every level of operations and each transaction

- An internal Shari’a compliance review/audit for verify- ing that Shari’a compliance has been satisfied, during which any incident of non-compliance will be recorded and reported, and as far as possible, addressed and rectified

- An annual Shari’a compliance review/audit for verifying that the internal Shari’a compliance review/audit has been appropriately carried out and its findings have been duly noted by the Shari’a

For IFIs, Shari’a governance is an important and crucial part of corporate governance. This is why the umbrella of Islamic corporate governance is larger than conventional notions of corporate governance. However, we accept that the corporate governance in both a conventional financial institution and an IFI aims to achieve the objectives and create value addition for all the stakeholders and the company itself.

Corporate Governance versus Shari’a Governance

Shari’a governance is one important difference between the conventional and Islamic bank. The Shari’a governance role in an Islamic bank is to make sure that all products and services are in accordance with Shari’a to promote justice and transparency of financial transactions, to keep up the confidence of the customers and stakeholders, to develop risk management tools for the Islamic bank, and most importantly to make sure its employees, management and board of directors in their respective operations comply with Shari’a principles. IFSB Guiding Principle 10 on Shari’a governance mentions that Shari’a governance complements the corporate governance process as a whole. Table 1 shows the additional requirements for the corporate governance of an Islamic bank.

Issues and Challenges in Shari’a Governance

The key issues and challenges along with some proposed solutions are highlighted below:

Corporate Governance and Shari’a Governance

Frequently raised questions about Shari’a governance include: is corporate governance according to the Islamic perspective the same as conventional or is there some difference? If there is a difference, then how does the model of Islamic corporate governance look? Questions are also raised about the nature and scope of Shari’a governance: is it something totally different from the corporate governance or is it a part of it? In fact there is a connection between Shari’a governance and corporate governance; whereas both aim to serve in the best interest of stakeholders, Shari’a governance is broader in that it also makes one responsible towards God. Its theoretical foundations are also different.

The Structure and Model of Shari’a Governance

The conventional corporate governance model has evolved over the years. The issue is to design a well-established model of corporate governance for the IFI in compliance with Islamic precepts. Although there are strong theoretical foundations for corporate governance in Islam, there is a need to clearly identify the features, norms, behaviour and characteristics of Islamic corporate governance. There are some issues and challenges in the proper implementation of corporate governance for Islamic banks. To start with, a universal model has yet to be developed. Different models are devised and followed in different jurisdictions. For illustration purposes, three countries are selected in order to explain the Shari’a governance framework for IFIs: Malaysia, Bahrain, and Pakistan. This can be seen in Box A.

| Functions | Typical Financial Institutions | Additional Requirements for IFI |

| Governance | Board of Directors | Shari’a Board |

| Control | Internal Auditors External Auditors | Internal Shari’a Review Unit/Department (ISRU) External Shari’a Review |

| Compliance | Regulatory and Financial Compliance Officers, Unit or Department | Internal Shari’a Compliance Unit or Department(ISCU) |

Table 1: Additional Requirments for Corporate Governance in an IFI

Box A: Shari’a Governance Framework Malaysia

Malaysia has developed the support system for Islamic banks by devising the Islamic Financial Services Act 2013, The Central Bank of Malaysia Act 2009, Securities Commission Act 1993 and the Financial Services Act 2013. The Shari’a board of the central bank, Bank Negara Malaysia (BNM), is known as Shari’a Advisory Council (SAC). All banks offering Islamic financial services are bound to establish a Shari’a committee (SC). The main objective of the SC is to advise, monitor and give ruling on a case-to-case basis. The appointment of the SC members will be done by the board of directors of the Islamic bank subject to the approval of the BNM. The requirements for the SC members are prescribed by the BNM. The SC will give Shari’a rulings on the IFI affairs, but in case of dispute between the SC and bank’s management, the matter will be referred to the SAC o and the decision of SAC will be considered final.

Bahrain

Bahrain is known as one of the leading players in Islamic finance. The Central Bank of Bahrain (CBB) is responsible for regulating the Islamic finance industry in the country. Legislation includes the Bahrain Stock Exchange Law 1987, the Commercial Companies Law 2001, the Anti-Money Laundering Law 2001 the Central Bank of Bahrain and Financial Institutions Law 2006, and the Financial Trust Law 2006. The authorized provisions for Islamic finance in Bahrain are given in the CBB Rule Book Volume 2, Islamic Banks. As per CBB, all the Islamic banks are bound to establish a Shari’a board in compliance with AAOIFI’s governance standards. CBB has its own National Shari’a Advisory Board for Shari’a compliance.

Islamic Republic of Pakistan

Pakistan tried to make its economy fully Islamic in 1979, but it was not successful. Islamic banking was reenergized in 2002 with the support of the State Bank of Pakistan (SBP). The Islamic Banking department of SBP issues circulars from time to time for Islamic banking. The Shari’a governance framework, as adopted by the SBP, requires that all Islamic banks have to appoint one Shari’a advisor for their bank with the approval of the SBP. SBP have its own Shari’a board as well. Islamic banks are free to establish their own Shari’a board but with the permission of SBP.

| Malaysia | Bahrain | Pakistan | |

| Central Bank | Bank Negara Malaysia (BNM) | Central Bank of Bahrain (CBB) | State Bank of Pakistan (SBP) |

| Shari’a Regulatory | Shariah Advisory Committee | National Shari’a Board at CBB | Central Shari’a Board at SBP |

| body in Central | (SAC) in BNM | ||

| Bank | |||

| Shari’a governance | Shari’a Committee | Shari’a Supervisory Board | Shari’a Advisor is required but bank can |

| requirement for | have their Shari’a board. | ||

| Islamic Banks | |||

| Appointment of | The Board of Directors of IFI upon | Shari’a Supervisory Board | Appointment of Shari’a advisor shall be |

| Members of Shari’a | nomination from its Nomination | member is to be appointed by the | approved by the Board of Directors of |

| Board/Shari’a | Committee shall appoint Shari’a | shareholders in the AGM upon the | the IBI in case of domestic bank and in |

| Advisor in Islamic | Committee members.The | recommendation of the Board of | case of foreign bank it shall be appointed |

| Bank | appointment and reappointment shall | Directors and taking into account | by the management. Appointment of SA |

| obtain written approval from BNM. | the local legislation and regulations. | requires prior written approval from SBP. | |

| Duties and | Shari’a Advisor (SA) shall ensure that | To advise the Board on Shari’a | SSB must cover ex-ante Shari’a rulings as |

| Responsibilities of | all products and services and policies | matters in its business operations. | well as ex-post Shari’a rulings. |

| Shari’a board of | of IFIs are in compliance with Shari’a | ||

| Islamic Financial | rules and principles. | To endorse Shari’a Compliance | To review and certify the permissibility of |

| Institution | manuals. | all contracts, documentation and products. | |

| SA shall have access to all documents | |||

| and information from all sources. | To endorse and validate relevant | Issuing a Shari’a supervisory report | |

| documentations. | certifying that all transactions conducted | ||

| The SA may provide advice to the | by the IFIs comply with Shari’a. | ||

| legal council, auditor or consultant | To assist related parties on Shari’a | ||

| of an IFI. | matters. | Advising and monitoring the manner | |

| of disposing the non-Shari’a compliant | |||

| The decisions and rulings of SA shall | To advise on matters to be referred | earnings. | |

| be subject to instructions, guidelines | to SAC. | ||

| and directives issued by SBP Shari’a | |||

| Board. | To provide written Shari’a opinion. | ||

| To assist SAC on reference for | |||

| advice. |

Independence

Independence and freedom of the Shari’a board of the Islamic bank and board of directors is a very important issue. Shari’a board members might fear for their job renewal and become a silent or dummy Shari’a board. The issue of independence is also important in the case of Non-Executive directors (NED). The Shari’a Governance Framework (SGF) issued by the central bank of Malaysia has addressed independence in section III. It states that independence of the Shari’a Committee shall be observed at all times in exercising their duties to make objective and informed judgments. The guidelines try to secure a level of independence in the duty and function of the Shari’a committee in making decision and resolutions.

Bank Negara Malaysia (2010) Guidelines on Shari’a Governance Framework for Islamic Financial Institutions Section III – Independence

- The board (of directors) shall recognise the independence of the Shari’a Committee and ensure that the committee is free from any undue influence that would hamper the Shari’a Committee from exercising objective judgment in deliberating issues brought before them. Correspondingly, the Shari’a Committee is expected to make sound decisions on Shari’a matters in an independent and objective manner.

- The Shari’a Committee shall report directly to the board and regularly inform the board of relevant Shari’a

- The board shall ensure that decisions made by the Shari’a Committee are duly observed and implemented by the IFI. Decisions made by the Shari’a Committee should not be set aside or modified without its

- The Shari’a Committee shall have access to accurate, timely and complete information from the management. If the information provided is insufficient, the Shari’a Committee may request for additional information which shall be duly provided by the

- In the event where the Shari’a Committee is not provided with the required information, the board shall be informed of the fact and appropriate action shall be taken to rectify the Where appropriate, the board shall consider taking the necessary punitive measures against parties who intentionally failed to extend the required information.

- Where the Shari’a Committee has reason to believe that the IFI has been carrying on Shari’a non-compliant activities, the Shari’a Committee shall inform the board and recommend suitable measures to rectify the situation. In cases where Shari’a non-compliant activities are not effectively or adequately addressed or no rectification measures are made by the IFI, the Shari’a Committee shall inform the (central) Bank of the fact.

- All appointment including reappointment, resignation and removal of the Shari’a Committee members shall be made by the board, subject to the approval by the Bank and the SAC.

Competency

Issues related to competency include knowledge and behaviour of the Shari’a board of the Islamic bank and NEDs. The Shari’a Governance Framework issued by the central bank of Malaysia has addressed competency in section IV. It says any person bearing responsibilities outlined in the Shari’a governance framework for an IFI shall possess the necessary competency and continuously enhance their knowledge and understanding on the Shari’a as well as keep abreast on the latest developments in Islamic finance.

Bank Negara Malaysia (2010) Guidelines on Shari’a Governance Framework for Islamic Financial Institutions Section IV – Competency

- The board and management are expected to have reasonable understanding of the principles of the Shari’a and its broad aplication in Islamic finance. The Shari’a Committee is expected to have sufficient knowledge on finance in general, and Islamic finance in particular, to enable the Shari’a Committee to comprehend Shari’a issues brought before them. The Shari’a Committee members are expected to constantly equip themselves with relevant knowledge on Shari’a and finance as well as attend relevant training programs.

- The IFI shall develop a set of fit and proper criteria for the appointment of any Shari’a Committee member, using the minimum criteria set by the Bank as a base to ensure that only competent persons are appointed as Shari’a Committee members. The competency and credibility of the Shari’a Committee members provide the assurance that the IFI’s operations are being monitored by a credible and competent committee. The Bank may prescribe other criteria or requirements in addition to those set by the IFI, as and when the Bank considers it necessary.

- The IFI shall engage other professionals such as lawyers, accountants and economists to provide appropriate assistance and advice to the Shari’a Committee, especially regarding issues on law and finance.

- The IFI is required to adopt a formal process of assessing the performance of the Shari’a Committee The assessment should be designed to evaluate individual performance based on the competence, knowledge, contribution and overall effectiveness of the Shari’a Committee members on Shari’a deliberations. The process should also identify relevant gaps to enable proper training and exposure for the Shari’a Committee members.

- The IFI should develop a succession planning program for the Shari’a Committee members by identifying, hiring and nurturing new members with the view to entrusting them with greater responsibilities as and when appropriate.

Confidentiality

The SGF addressed confidentiality in section V. It says internal and privileged information obtained by the Shari’a Committee members in the course of their duties shall be kept confidential at all times and shall not be misused. The Shari’a Committee will not be regarded as breaching the confidentiality and secrecy code if the sensitive information were disclosed to the bank in good faith when reporting serious breaches of Shari’a by the IFI. The IFI shall not appoint any member of its Shari’a Committee from a Shari’a Committee of another IFI within the same industry. This is to ensure that the committee member would be more focused, avoiding conflict of interest and maintaining the confidentiality of information.

Bank Negara Malaysia (2010) Guidelines on Shari’a Governance Framework for Islamic Financial Institutions Section V – Confidentiality

- The Shari’a Committee shall be given the necessary access to files, records, draft materials and conversations, including those categorized as confidential, so long as the information is related to the work undertaken by the committee. The relevant information must be that which is critical for the Shari’a Committee to form its decisions, views and opinions on matters brought to its attention. In this regard, it is the responsibility of the individual Shari’a Committee to observe the principle of confidentiality at all times. Confidential or sensitive information obtained by any member of the Shari’a Committee while serving his or her duties shall not be used in any manner that could be detrimental to theConfidential information is information received by members of the Shari’a Committee that is not public in nature and has not been authorised to be made public. Confi- dential information includes, but is not limited to, the following: information on the development of new products and services; decisions of the board or management;internal memorandums or reports prepared in connection with matters pre- sented, or to be presented to the Shari’a Committee;the content or occurrence of conversations

- among members of the Shari’a Committee concerning matters deliberated in the meeting and representatives of the IFI;

- the progress status on a business transaction or action that has not been made public;

- views expressed by various parties in the course of discussions on a particular matter deliberated by the Shari’a Committee; and

- any subject matter that the IFI has indicated should not be revealed, such as internal policies and procedures.

Professionalism

The Shari’a Governance Framework issued by the central bank of Malaysia has addressed the professionalism in section V which states professional ethics, judgment and consistency shall be maintained in ensuring Shari’a compliance. In ensuring the quality and consistency of the Shari’a decisions, the Shari’a Committee is expected to develop a structured process in arriving at Shari’a decisions which must be documented, adopted and maintained at all times to ensure the credibility of decision-making and protect the committee from undue influences. Members of the Shari’a Committee must not act in a manner that would undermine the rulings and decisions made by the SAC or the committee they represent. They are required to respect and observe the published Shari’a rulings issued by the SAC and shall not go against the decisions of the committee that they represent in public.

Conflict of Interest

Conflict of interest of the bank’s business when it comes to Shari’a resolutions arises as compensation to people responsible for Shari’a compliance is paid by the IFI.The argument is that since the IFI is remunerating the Shari’a board, it may create a conflict of interest should there be a tendency for resolutions of the Shari’a board to satisfy the management of the IFI. Hence the Shari’a board may compromise on their resolutions or get influenced in their decisions under the fear or pressure that they may lose their position as a Shari’a board member in case they don’t satisfy the management of the IFI.

In the Malaysian experience this issue has been addressed and resolved through the process of appointment and termination of the Shari’a board. According to Section 33 Islamic Financial Services Act (IFSA) 2013:

A member of a Shari’a committee shall cease to be a member if

- the member resigns as a member;

- the institution, subject to the central bank’s prior written approval terminates the appointment of such member;

- the member is disqualified pursuant to any standards specified by the BNM or

- the member no longer meets the fit and proper requirements as may be specified by the BNM

Hence there is no absolute power to the IFI to terminate the position of the Shari’a board member without prior approval of the central bank. This procedure provides assurance to Shari’a board members to perform their function and duties in a professional manner without compromising on any Shari’a requirements because the power of dismissal is in the hand of the regulator and not the IFI. Hence being paid a fee by the IFI for the service provided does not create any conflict of interest.

Diversity of Shari’a Resolutions

The Shari’a resolutions given by the Shari’a boards of different IFIs can lead to different practices as a result of the diversity in Shari’a opinions. Some may regard this phenomenon as a challenge as different resolutions lead to different practices which may confuse the industry or public. The said phenomenon rallies against consistency of Shari’a rules which is supposed to be in the form of standards to ensure uniform practices by IFIs globally.

Under Islamic law, there can be a single agreed-upon opinion or a plethora of opinions. Issuing resolutions has to do with ijtihad which is regarded as the legal reasoning undertaken by the Shari’a board to provide a Shari’a ruling. Hence the diversity in the resolutions of the Shari’a board begins when a direct ruling was not mentioned in the Islamic legal text. Where there is more than one opinion, due to the different interpretations provided for a specific case, it will result in different terms, conditions and circumstances for each IFI.

The reasons that led to these differences are that the provisions from Quran and Sunnah are open to different interpretations and accommodate more than one meaning. This fact raises the following implications:

- Establishment of a set of methodologies in Islamic jurisprudence used by different schools of law with the objective to provide an accurate and sound in-

- In addition to the methodology, there are circumstances when drawing conclusions and interpretation may affect the result of

We can conclude this section with the following points that demonstrate the position of Shari’a towards diversity:

- Shari’a recognizes the diversity of Shari’a opinions resulting from sound and authentic

- Diversity existed during the time of Prophet Muhammad, his companions, and Therefore, diversity will prevail and continue until the Day of Judgment.

- The well-established schools of law that have been in existence for centuries until now have demonstrated this fact.

- Diversity exists through all segments of Islamic law, and not in matters concerning Islamic finance only.

- Understanding the reason for diversity in Shari’a makes the process easier, more logical and

- Diversity is related to some branches and details cases which are logically accepted.The upstream process will lead to standardization; the downstream process will lead to diversity.

- Diversity may exist even when there are standards to be followed because there exists what is known as applied ijtihad where the external facts, conditions and circumstances during the implementation of the ijtihad may give different rulings and

There are multilateral attempts to reconcile Shari’a opinions and set rules and standards. The International Islamic Academy of Fiqh, which is a body under the Organization of Islamic Conference (OIC) based in Jeddah, issues resolutions published in the form of rulings and recommendations. These resolutions are greatly respected because they are the outcome of research and debate from competent scholars that represent the OIC countries.

Another organisation involved in setting up rules and standards is AAOIFI. AAOIFI has issued different sets of standards including Shari’a standards, accounting standards, governance standards and code of ethics. These standards are aimed at achieving harmonization in the area of Islamic finance especially standards that are related to Shari’a. This is to avoid contradictions between the resolutions and Islamic finance practices.

Diversity in Shari’a opinions impacts efforts to standardize as standardization produces one single standard (opinion) whereas diversity produces many opinions. Hence, we should consider some criteria and steps that can be part of the standardization process.They are as follows:

- Standardization will be based upon a proper selection and preference of Shari’a opinions as established in Islamic jurisprudence known as qawaid al tarjih or rules of preference.

- Standardization should not be binding; otherwise it will be an enforcement of a preferred Shari’a opinion that overrules other valid Shari’a opinions issued by scholars which would violate the spirit of ijtihad in Shari’a. However, it is left to each jurisdiction to exercise the enforcement of Shari’a standards as they are aware of their own needs, environment and more importantly, the official school of law of that particular jurisdiction. This means the Shari’a standards in the case of enforcement would be self-enforcement by the local authority which is included in their body and panel of Shari’a scholars in the specific jurisdiction.

- The standards issued should recognize other Shari’a opinions because Shari’a recognizes the diversity of opinions resulting from sound and authentic ijtihad. Therefore, the standards and other Shari’a opinions co-exist together. However, since one of the Shari’a opinions has been adopted as a standard, it is because of preference and popularity and does not undermine the other position.

Training and Continuous Development

Lack of training for Shari’a board members, management and employees of the banks can be detrimental to a bank’s success. In order to resolve this issue, the Shari’a board should keep themselves updated through ongoing training and education in many areas of Islamic finance to make sure that their skills and knowledge are up to the required level of competency.

Training Requirements were addressed in Malaysia by BNM Guidelines on Corporate Governance for Licensed Islamic Banks (GP1-i) which mentioned that an Islamic bank is required to develop in-house orientation and education programmes for its newly appointed directors to familiarize them with the industry and the Islamic bank within three months of the appointment. The programme should cover the nature of business, the corporate strategy of the Islamic bank, responsibilities and duties of the board as a whole, an overview of the risks of the businesses, the risk management strategy of the Islamic bank, legal requirements and financial overview of the Islamic bank. The Islamic bank should ensure that it sets up structured training programmes for its directors in order to better enable them to fulfil their responsibilities. The nominating committee should ensure that all directors receive continuous training in order to keep abreast of latest developments in the industry, particularly on relevant new laws, regulations and the changing risk factors from time to time.

The regulator put training under the responsibility of the management of the Islamic bank. SGF mentioned that it is the responsibility of management to allocate adequate resources and manpower to support the Shari’a governance that is commensurate with the size, complexity and nature of the bank’s business. The infrastructure and resources provided shall include among others budget allocation, reference and research materials, training and development. The management is responsible for providing continuous learning and training programs for key internal stakeholders including the board, the Shari’a committee, Shari’a officers and relevant staff in Shari’a and finance matters. This is to ensure that every function in the Shari’a governance structure is sufficiently updated with latest developments in Shari’a-related matters.

This issue can be addressed by providing regular training and workshops provided either by the bank, regulators or some association related to Shari’a advisory. In fact, from the Malaysian experience banks are provided regular training and workshops to keep them in touch with current issues and the development of Islamic finance locally and internationally. Also the regulators are providing regular courses with certificates in different areas of Islamic finance. For example, The Securities Industry Development Corporation under the Securities Commission of Malaysia is providing i-Advisors series in Islamic Capital Market (ICM) which is designed to increase the level of skills of competency of Shari’a advisors.

The programme, funded by the Capital Market Development Fund (CMDF) is exclusively developed to integrate the theoretical and practical aspects of industry knowledge. i-Advisor will assist in gaining a holistic knowledge and understanding of the ICM from a local and global perspective. i-Advisor is designed in a structured manner. The knowledge acquisition involves experiential learning comprising case studies, analysis, discussions and video presentations, delivered by trainers who are subject matter experts in ICM, Islamic finance practitioners, Shari’a advisors and/or academicians. Given the exposure on best practices and guidelines that govern ICM in Malaysia, participants will be more competent and innovative in addressing ICM issues after completing the course. Besides i-Advisor there are other programmes provided in the industry as well.

Gap Between Shari’a and Finance

One of the issues and challenges related to Shari’a governance is the gap between understanding Shari’a and finance. A Shari’a board may have knowledge in Shari’a but not in finance. At the same time, a banker who deals with a Shari’a board has knowledge of finance but not Shari’a. Hence there is a gap This issue cannot be resolved immediately; however, it can be resolved in the future through proper planning in education and training and workshop for both parties, meaning providing Shari’a programmes for non-Shari’a experts, and providing finance programmes for non-finance, Shari’a experts. Hence the blended education programme is needed to produce a new generation of practitioners which have the benefit of having both Shari’a and finance knowledge. The Shari’a governance framework of Malaysia has addressed this issue in the qualifications of the Shari’a board. SGF mentioned that the Shari’a committee may have experts with a relevant background in finance and law. However, these members must not form the majority of the Shari’a committee.

The regulator in Malaysia even requires the board of directors and management of the bank to equip themselves with the required knowledge of Islamic finance. SGF states that the board and management shall have reasonable understanding of the principles of Shari’a and its broad application in Islamic finance. Correspondingly, the Shari’a committee should have sufficient knowledge on finance in general, and Islamic finance in particular to enable the Shari’a committee to comprehend Shari’a issues brought before them. The Shari’a committees are expected to constantly equip themselves with relevant knowledge and attend relevant training programs. The objective is to bridge the gap between Shari’a and finance and ensure skill and competency in the needed knowledge in Shari’a and finance to ensure sound decision and resolutions.

Line of Reporting and Communication

Lack of effective communication between the directors, Shari’a board members, management and shareholders, can be an obstacle to an effective corporate governance structure. Lines of reporting and effective communication are key factors that ensure good performance. For effective communication, BNM suggested bridging the gap between the board of directors and the Shari’a board by having each member in the committee of the other. This is highlighted under Principle 2 of the SGF. It says the board is encouraged to consider appointing at least one member of the Shari’a committee as a member of the board that could serve as a ‘bridge’ between the board and the Shari’a committee. The presence of a director with sound Shari’a knowledge would foster greater understanding and appreciation amongst the board members on the decisions made by the Shari’a committee.

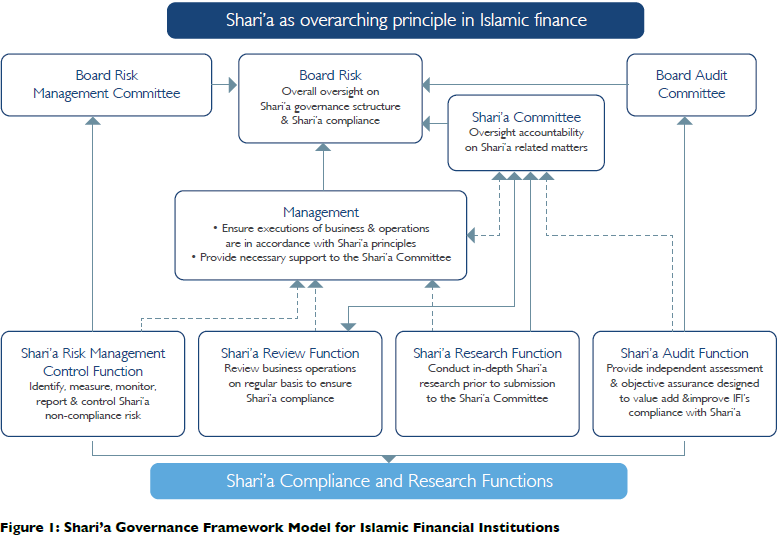

With regards to reporting, the Figure 1 is an example of the line of reporting as suggested by the central bank of Malaysia. Board of directors, the Shari’a committee and Management are well connected. There is a direct line from Shari’a audit to the board of directors to ensure independence and transparency. The same goes to Shari’a risk although the Shari’a Audit Function goes to the Board Audit Committee. Other components report to the Shari’a committee. There is no direct line to the management. The direct line goes either the board of the directors or to the Shari’a committee to ensure independency and transparency.

Financial Liability and Penalties

The recent Islamic Financial Services Act (IFSA) 2013 of Malaysia has strongly emphasized Shari’a compliance. The failure to comply with it will lead to some financial penalty or imprisonment.

Section 28 of IFSA 2013 highlights the duty of the institution to ensure compliance with Shari’a. “An institution shall at all times ensure that its aims and operations, business, affairs and activities are in compliance with Shari’a.” For the purposes of this Act, compliance with any ruling of the Shari’a Advisory Council in respect of any particular aim and operation, business, affair or activity shall be deemed to be compliance with Shari’a in respect of its aims and operations, business, affair or activity. With regards to Shari’a non-compliance and the process of rectification, the Act has highlighted that Shari’a cases should be reported to regulators. Where an institution becomes aware that it is carrying on any of its business, affair or activity in a manner which is not in compliance with Shari’a or the advice of its Shari’a committee or the advice or ruling of the SAC, the institution shall:

- immediately notify the central bank and its Shari’a committee of the fact;

- immediately cease from carrying on such business, affair or activity and from taking on any other similar business, affair or activity; and

- within thirty days of becoming aware of such non-compliance or such further period as may be specified by the central bank, submit to the central bank a plan on the rectification of the non-compliance.

The central Bank may carry out an assessment as it thinks necessary to determine whether the institution has rectified the non-compliance.

As a summary, Section 28 determines the duty of IFI to ensure compliance with Shari’a rules and principles. An institution shall at all times ensure that its aims and operations, business, affairs and activities are in compliance with Shari’a. This can be shown in the vision, mission, and tag line statement of the IFI and demonstrated in their practices and operations. Compliance with the resolutions of SAC shall be deemed to be compliance with Shari’a. There has been no such case yet under this Act but the Act has put the Shari’a compliance status in the IFI under the purview of the state law.

Concentration Risk

The lack of experts to oversee operations of IFIs has led to concentration risk. There are only a small number of experts that serve on the board of a majority of the IFIs. This situation also poses challenges for confidentiality, because same persons serving on boards of different financial institutions might result in leakage of information across mutually competing organizations. In order to resolve this issue some regulators have taken control of the membership of the Shari’a board in the market. In the case of Pakistan the regulator has addressed it by restricting the board membership of the Shari’a scholars. In the case of Malaysia, the regulator has restricted the seating of a Shari’a board member to one single seat for a takaful operator and one single seat in banking. Meanwhile, it has increased the minimum number of Shari’a board members for each IFI to 5 seats at least. This gives wider participation to the Shari’a board members in the industry. However the restriction will not prevent the Shari’a board members to be active outside Malaysia where they can be involved actively in foreign IFIs.

Due Diligence

This issue is related to the previous one. The issue of concentration may put a question mark on the ability of individuals serving multiple boards as to whether they are able to do justice to their job and perform it with due diligence. It seems unlikely that they would be able to read all the relevant legal and other documents in detail. A project/product detail might consist of hundreds of pages consisting of legal and all other necessary documentation. Hence, those responsible for Shari’a compliance might not have enough time to go into detail and ensure compliance of all related areas. Instead, they might opt either to rely on the summary of the documents or put most of the task on the shoulders of their juniors who assist them. This situation becomes more complex by the fact that multiple board representation leaves scholars with little time to go into detail and peronally ensure the required compliance. However the issues can be addressed by putting a limit to the membership of the Shari’a board. In addition, putting in place a two tier structure of approval, whereby the Shari’a department of the IFI will actively screen and examine the relevant documents of the product and instrument, and they put their comments and the key issues along with their recommendations to the Shari’a board who makes the final approval. The Shari’a board will focus on key issues highlighted by the Shari’a department and evaluate recommendations.

Conclusion

Shari’a governance facilitates the prevention of fraudulent activities and corporate scandals in any organization. Islam prohibits activities like dishonesty, fraud, corruption, interest, gharar, that bring harm to people. The Islamic concept of corporate governance uses the stake-holder approach by which all stakeholders are taken care of. The Islamic rules of corporate governance are based on mutual help, mutual accountability, transparency and honesty, protection of minorities, disclosure and equitable distribution of wealth, brotherhood and responsibility. The Islamic banks have a very strong theoretical Shari’a governance framework. However there are some issues and challenges in the development of strong Islamic corporate governance implementation like the communication barriers between the Shari’a board, board of directors and management in the Islamic banks, but things are moving in a positive direction through the ongoing improvement and enhancement of Shari’a governance. It is worth noting that the Islamic corporate governance system is a comprehensive and focused governing system when compared to the Western corporate governance models. The Shari’a governance system varies from country to country and from organization to organization on the basis of jurisdiction and regulation. There is a need for more regulation and guidelines from the central banks. AAOIFI and IFSB represent a good platform to address the different issues and challenges related to Shari’a governance.