Financial policies refers to policies related to the regulation, supervision, and oversight of the financial and payment systems, including markets and institutions, with the view to promote financial stability, market efficiency, and client-asset and consumer protection. It also includes measures intended to encourage the growth of savings in the form of financial assets, to develop money and capital markets, and to allocate credit between different economic sectors. Islamic financial policy addresses all of the aforementioned from an Islamic standpoint and as such Shari’a is the fundamental reference when determining Islamic financial policy. Despite the fact that many jurisdictions have established Islamic finance and offer Shari’a-compliant financial solutions, they have yet to develop holistic regulatory frameworks and legislation that enable smooth functioning of the Islamic financial system. This chapter discusses the development of Islamic financial system in the context of three different case studies: a dual financial system, a full-fledged Islamic financial system and a parallel financial system where there is no dedicated banking act or legislation to control, guide and supervise Islamic financial institutions.

Islamic Financial System and Financial Policy Thrust

A financial system comprises different subsystems of intermediaries (financial institutions), markets (money and capital markets), individuals (savers) and users (borrowers of money and investors). Hence, financial system acts as an intermediary between savers and users by facilitating the flow of funds from the areas of surplus to the areas of deficit. Given its role as a conduit to mobilize resources and provide financing for productive economic activity, the efficient functioning of the financial system is of critical importance. The spectrum of participants and the diversity of instruments, underpinned by legal and commercial infrastructure, are among the key attributes in creating the enabling environment for a dynamic Islamic financial system. Compared to the conventional financial system, an Islamic financial system has two distinctive features: (1) prohibition of riba results in elimination of debt from the system; and (2) risk-sharing modes of transactions designed to share risks and rewards on more equitable grounds.

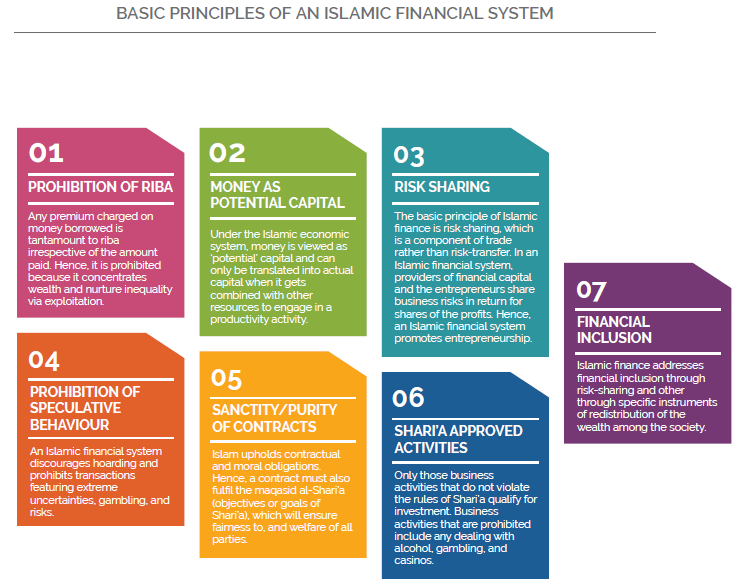

BASIC PRINCIPLES OF AN ISLAMIC FINANCIAL SYSTEM

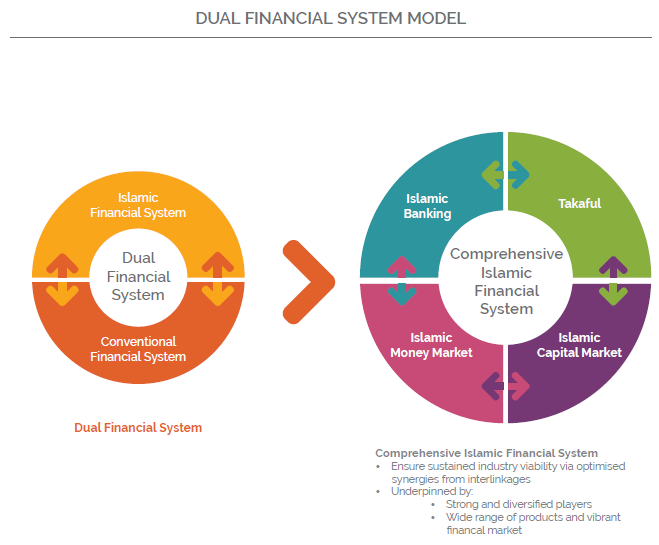

Whilst the conventional financial system focuses primarily on the economic and financial aspects of transactions, the foundation of an Islamic financial system goes beyond these to include ethics, wealth distribution, social and economic justice, and the role of the state. In essence, an Islamic financial system encourages risk sharing, promotes entrepreneurship, discourages speculative behaviour, avoidance of prohibited activities, financial inclusion and the promotion of economic/social development through charity. A comprehensive Islamic financial system includes Islamic banking, takaful, Islamic capital markets, regulatory and supervisory framework as well as Shari’a framework. These are critical components of the Islamic financial infrastructure that is able to contribute effectively to the economic growth process. The intra-dependency of these components creates a comprehensive enabling environment for the Islamic financial system to effectively play its role as an efficient conduit to mobilize resources and provide financing for productive economic activity. This structure also enhances the resilience and robustness of the Islamic financial system to withstand financial shocks and contributes to the overall stability of the Islamic financial system. Most countries where Islamic finance has a presence, Islamic financial institutions operate in dual financial system where Islamic finance operates alongside the conventional financial system. Only Iran and Sudan are two countries that has a full-fledged Islamic financial system. Others including Malaysia, Indonesia, the Gulf Cooperation Council (GCC) countries have adopted a dual financial system. Hence, the financial stability in these markets is now dependent upon the smooth functioning and resilience of their domestic Islamic financial sectors.

Malaysia

Malaysia has the most comprehensive and progressive Islamic financial system in the world through the adoption of a four-pronged strategic approach: regulatory framework development, legal and Shari’a framework, products and markets development, and enhancement of knowledge and expertise. The focus of the Islamic financial policy thrust in the early years of development was directed at further strengthening the fundamental underpinning foundations of the Islamic banking system to support the development of a sound and progressive Islamic banking industry based on these 4 strategic approaches. As outlined in the Financial Sector Master plan (2001- 2010), formulated by Bank Negara Malaysia, Islamic banking was recognized as one of the major potential growth sectors and had set a target for Islamic finance to make up 20% of the finance sector by 2010. The second master plan, the Financial Sector Blueprint (2011 – 2020) builds on the achievements of the first Master plan but with an emphasis on the internationalization of Islamic finance through the diversity of players in the domestic Islamic finance industry, wider range of Islamic financial products and services, innovative financial solutions to meet the more sophisticated investment demands of the increasingly affluent population, particularly in Asia and the Middle East, and greater cross-border financial business.

Malaysia has also been at the forefront in developing an enabling and facilitative legal framework for Islamic finance since the early 1980s. The mandate and capacity of Bank Negara Malaysia to respond to the build-up of imbalances in the financial system and excessive risk-taking by financial institutions has also been significantly strengthened with the introduction of the new legislative and governance framework for Islamic finance under the Central Bank of Malaysia Act 2009, and the Islamic Financial Services Act 2013 (IFSA). The Central Bank of Malaysia Act 2009 provides comprehensive provisions for heightened surveillance, pre-emptive actions and expanded resolution powers to Bank Negara Malaysia to facilitate the swift and orderly resolution of a financial crisis. It also allows Bank Negara Malaysia to take appropriate intervention measures to avert risks that stem from unregulated entities. The

Act also details the functions of the Shari’a Advisory Council (SAC) of Bank Negara Malaysia. The SAC has been declared as the apex Shari’a authority in ascertaining the applicable Shari’a principles in Islamic banking and takaful, and SAC rulings made binding on arbitrators and judges. These laws provide Shari’a certainty to the industry, in particular event where disputes arise from Islamic financial transactions. The Act has also strengthened Bank Negara Malaysia’s independence and authority, and mandated Bank Negara Malaysia and other government agencies to promote Malaysia as a global Islamic Financial Centre and enhance its international status.

The IFSA, which replaces the Islamic Banking Act 1983 and the Takaful Act 1984, is a step jump from the previous legal framework for Islamic finance. It introduces provisions on regulating financial holding companies of IFIs, makes Shari’a risk management a statutory duty, strengthens requirements for end-to-end Shari’a governance, and increases customer protection. The consequence of breach are severe and Bank Negara Malaysia is granted wide powers for intervention. The IFSA, as well as Bank Negara Malaysia’s Shari’a and operational standards issued under it, provide clarity for the application of Shari’a financial contracts for Islamic financial products, requiring the separation of the Islamic deposit account that guarantees deposits of customers, and the investment account which does not. This requirement results in Islamic financial institutions having an expanded role of investment intermediation in addition to their current role of credit intermediation. The increased focus on Shari’a contracts is also expected to spur product innovation and diversification. The IFSA also requires that takaful operators that run dual takaful businesses to split their operations into either family or general takaful businesses. This segregation of family and general takaful licensing and businesses by 2018 is expected to strengthen the takaful sector.

In supporting Malaysia’s aspirations to establish itself as a regional leader in Islamic finance, Capital Market Masterplan 2001-2010 and Capital Market Masterplan 2011-2020 was also released by Securities Commission Malaysia. The Plans mapped out strategic direction for establishing Malaysia as the international center for Islamic capital market activities. With greater internationalisation of Islamic finance, it is expected that Malaysia’s Islamic capital market will register a growth rate of 10.6% per annum over the ten-year period. Greater internationalisation would also see more product issuers and service providers expanding beyond their home market. To date, Malaysia remains at the forefront in sukuk issuance and is the world’s largest sukuk market historically contributing more than 50% to total global sukuk issuance. Fiscal and financial incentives including a tax-neutral framework and tax deductions of issuance expenses on qualified Islamic securities has created a conducive environment for sukuk issuance in the country.

The guidelines for sukuk have been revised in 2011 to (i) enhance the regulatory framework relating to debt capital market and Islamic capital market in Malaysia; (ii) expedite time to market for issuance of corporate bonds and sukuk with the introduction of the deemed approved regime that adopts a truly disclosure-based approach and compliance with a set of transaction criteria; and (iii) enhance the level of protection for investors by introducing additional compliance provisions to facilitate a more informed investment decision-making process. The revised Islamic Securities Guidelines of 2011 provided greater clarity on the application of SAC of Securities Commission’s Shari’a rulings and principles in relation to sukuk transactions. The new Private Debt Securities and Sukuk Guidelines of 2015 supersede the previous guidelines and outline (i) the requirements for the issuance of private debt securities.

BOX 3.1:

THE FINANCIAL SECTOR BLUEPRINT FOR THE PERIOD 2011 – 2020 (“FSB”)

This blueprint builds on the objectives achieved under the Financial Sector Master Plan to create a financial ecosystem to support and contribute to the high value-added, high-income-Malaysian economy by 2020 and help in meeting the growing financial needs of emerging Asia. The FSB outlines plans to transform the Malaysian financial services sector through a focus on nine key areas that emphasise internationalization. The internationalization of Islamic finance is a banking focus area with the specific objective of increasing “the diversity of players in the domestic Islamic financial industry to support a wider range of financial products and services that serves the best interest of Malaysia.” This will be done by:

ŀ Issuing new Islamic banking licences to institutions with specialised expertise;

ŀ Expanding the business scope of qualified International Islamic Banks.

ŀ Malaysia also aims to continue to enhance financial linkages between different jurisdictions by:

ŀ Fostering and enhancing strategic alliances with other jurisdictions;

ŀ Encouraging greater participation by Islamic banking institutions in offering trade finance facilities;

ŀ Encouraging Islamic financial institutions to increase international correspondent banking arrangements;

ŀ Supporting and encouraging a regional presence of strong Islamic financial institutions;

ŀ Leveraging on Labuan business structures and institutions to raise funds in multi-currencies.

or sukuk; (ii) approval for the issuance of private debt securities or sukuk; (iii) additional Shari’a requirements for sukuk; and (iv) requirements for an issuance of sustainable and responsible investment sukuk.

A well-functioning and vibrant Islamic financial system can only be guaranteed with a good corporate governance that comply with Shari’a principles. Acknowledging this fact, Malaysia has developed a legal framework for Shari’a governance under the IFSA 2013. Hailed as a landmark act, the Act sets a global benchmark for developing comprehensive regulatory frameworks that promote greater legal and operational certainty in Islamic finance. The Act clarifies regulatory expectations of Board of Directors, management team and Shari’a Committee (SC) to ensure Shari’a compliance in the conduct of Islamic financial business and operation. Accordingly, all transactions undertaken by Islamic financial institutions are aligned with the prudential and business requirements of distinctive elements of the respective Shari’a contracts.

The IFSA 2013 provides the rule relating to Shari’a governance (section 30 to 36), focusing on matters relating to the appointment and qualification of the Shari’a Committee (SC) members in Islamic financial institutions. Unlike the Central Bank of Malaysia Act 2009 which merely touched the surface of the matter, the current provision provides a more specific requirement whereby institutions are now required to apply directly to Bank Negara Malaysia for the establishment of a SC. The requirements for fit and proper of the SC members are also spelled out under section 29(2) (a), which implies that members of SC must be chaired by those who met the requirements as stated by Bank Negara Malaysia. The law also specifies the duty of SC is to perform an oversight function on Shari’a matters related to the Islamic financial institution’s business operations and activities that are ideally achievable via regular Shari’a review and Shari’a audit monitoring.

The Law Harmonization Committee (LHC) was established in 2010 to address and pro- vide solutions for legal and structural anomalies and impediments within the Malaysian legal framework in relation to Islamic finance. There are dichotomies between the Shari’a and the civil law of Malaysia and the LHC is part of Malaysia’s continuous efforts to further strengthen the legal infrastructure for Islamic finance. The LHC aims to ensure laws that apply to Islamic financial transactions accommodate, are compatible with Shari’a requirements, and achieve certainty and enforceability for Islamic finance contracts. The LHC consults the SAC of Bank Negara Malaysia and SAC of Securities Commission Malaysia on the Shari’a aspects of their recommendations.

Sudan

Like Iran, Sudan has a full-fledged Islamic financial system. After several unsuccessful efforts in the 1980s, the country’s financial system became fully Shari’a-compliant in the early 1990s when Bank of Sudan issued the Banking Business (Organization) Act in 1991, which stated that all banking finance transactions for all banks in Sudan must be managed according to Shari’a. However, Islamic banking in Sudan started in 1977 with the establishment of the first Islamic bank in the country, Faisal Islamic Bank. The success of Faisal Islamic Bank encouraged the government to open another 5 Islamic banks in the 1908s – Al-Tadamum Islamic Bank, Sudanese Islamic Bank, Islamic Cooperative Bank, Al-Baraka Bank and Islamic Bank of Western Sudan. In 1992, the Higher Shari’a Control Commission (HSCC) was established as a regulatory body to oversee the implementations of the Islamic banking system and ensure compliance of the financial industry with the Shari’a’ rules and principles. The Banking Business Act 2003 is considered as the backbone of Islamic banking system in Sudan.

In 1992, the government passed a decree on the control and supervision of the insurance sector, making it mandatory for all insurance operations in Sudan to comply with Shari’a principles. With this, the Controller of Insurance Act, 1960 was repealed following the adoption of the Supervision and Control Act, 1992. In 2001, a more detailed legislation was adopted, following the introduction of Insurance Control Act 1992 and in 2003, the government expanded it further and passed the Insurance and Takaful Act. The Act was introduced to define the scope, subject and parties of insurance and takaful contracts so as to be used as a reference in courts. In 2006, the Central Bank of Sudan Act (2002) was amended, changing the fully Islamic financial system into dual one. This move was taken after the signing of the Comprehensive Peace Agreement (CPA) a year earlier. With the signature of the CPA, conventional banks were allowed to operate. However, with the secession of South Sudan in 2011, Sudan’s financial system was reinstated as a fully Islamic system again.

In 1998, Bank of Sudan launched the Central Bank Musharaka Certificates, which is an equity-based instrument used by Bank of Sudan as an indirect instrument to regulate and manage liquidity of the banking system. Hence, these certificates work as open market operations, managing overall liquidity in the economy. The government also issued Government Musharaka Certificates in 1999 to finance their budget. Part of these government certificates were transferred to the Bank of Sudan in 2000 to be used as additional tools for open market operations. The Government Investment Certificate (GIC), on the other hand, are a form of murabaha issued by the government to finance particular outlays for ministries of education, health and department of medical supply.

Saudi Arabia

Saudi Arabia is an example of a country that has adopted a parallel financial system. But unlike some GCC countries where Islamic banking is mentioned in their legislation, there are no specific laws governing Islamic banking and financial activities in Saudi Arabia. The existing regulatory and legal framework does not distinguish between Islamic banking and finance and conventional banking. Articles 1 and 7 of the Basic Law of Rule state that the Qur’an and Sunnah of the Prophet form the Constitution of Saudi Arabia and all state powers originate from those sources shall reign supreme over any other law. The use of interest is prohibited but interest-based transactions are practised in Saudi Arabia, where the term “commission” is used instead of interest.

As Saudi Arabia adopts a single regulatory framework for all financial institutions under a parallel financial system, its legislations make no reference to Islamic banking and finance. Islamic banking and financial activities are regulated and supervised side-by-side with conventional commercial banking businesses by Saudi Arabian Monetary Agency (SAMA) under the Banking Control Law (BCL) of 1966, which was issued under Royal Decree No. M/5 dated 11/6/1966. The BCL is considered the main legislation regulating all banking and financial services in Saudi Arabia, which governs conventional banking and Islamic banking alike. SAMA also regulates and supervise the insurance sector under the Law of Supervision of Cooperative Insurance Companies and its implementing regulations. The Capital Markets Law (Royal Decree No. M/30 dated 2/6/1424H, corresponding to 31/7/2003) established the Capital Markets Authority (CMA), which is the sole regulator and supervisor of capital markets in Saudi Arabia. In addition to the absence of regulatory policies and supervisory harmonization, there is no independent central Shari’a board for overseeing Shari’a compliance of financial transactions and products at a national level. Hence, Shari’a-compliance supervisory rests largely on individual Shari’a boards of respective banks.

The Committee for the Settlement of Banking Disputes was established by SAMA in 1987 for the resolution of disputes concerning banking and finance matters. Prior to this, such disputes fell within the purview of the Shari’a courts being the ‘competent court holding original jurisdiction power’. Although Islamic financial institutions are governed by completely different principles than their conventional counterparts, they must arbitrate their disputes in the same form as conventional financial institutions. In the event that the Committee fails to reach a satisfactory settlement, the dispute shall be referred to the Shari’a courts, which generally

- A relevant feature of the Sudanese financial system during 2005-2011 is the Islamisation of the financial system of Northern Sudan while Southern Sudan operated on the conventional banking system during the Interim Period of the Comprehensive Peace Agreement (CPA).

- enforces strict Islamic law. There is no specific set-up for Islamic financial institutions or other Islamic banking and finance-related disputes.

In 2012, the Real Estate and Financial Laws were enacted, marking a major reform of its finance law by introducing a system for the provision of mortgages as other financing arrangements by financial companies. These laws are the Mortgage Law, Enforcement Law, Real Estate Financing Regulations, Finance Licensing Regulations and Finance Companies Control Regulations. The laws establish nationwide standards for mortgage issuance that are compatible with Islamic law, and codify Shari’a principles in relation to mortgages. These reforms are expected to increase access to finance options for home ownership and further spur the progress of Islamic finance in the Kingdom.

Global Integration of Islamic Financial System

The significant progress achieved by Islamic financial system at the domestic front has set the stage for its integration with the global financial system. With the internationalization of Islamic finance, Islamic financial institutions have become an integral part of the global financial system. As such, they cannot avoid being affected by the continuing developments in the global financial system and by reforms introduced by international regulatory bodies in light of the global financial crisis and global economic slowdown. Hence, developing a sound and effective regulatory and legal framework for Islamic finance is a key priority for regulators as it provides greater certainty and builds public confidence in the system. A key prerequisite for the development of a dynamic and progressive Islamic financial system is the strengthening of the financial infrastructure.

An important feature of a comprehensive and well-developed financial infrastructure is the diversity of the players and institutions in the system that have been developed based on their distinctive capabilities and competitive advantage thus raising their performance level, valued addition and contribution to overall growth and development. Having a distinct global infrastructure for Islamic financial industry to spur and sustain growth is imperative to ensure the sustainability and competitiveness of the players. Furthermore, developing a sound and effective legal framework for Islamic finance is a key priority area for regulators as it pro- vides greater certainty and builds public confidence in the Islamic financial system. Such a framework should define and enforce end-to-end Shari’a compliance in Islamic banking and finance through legal provisions that regulate the conduct and governance of Islamic financial institutions.

Many international and multinational organizations have emerged that aim at developing a conducive and standardized regulatory framework for the development of Islamic finance industry. Multilateral institutions have played an important role in the development of Islamic finance by building an enabling environment for Islamic finance to flourish, and ensuring a level playing field with conventional finance. In response to the rapid regulatory reforms and development in the global financial industry, international standard-setting organizations for Islamic finance have undertaken various initiatives to review the existing and/or introduce new standards so as to further strengthen the industry and ensure its sustainability in the global environment that has, and will continue, to become more challenging.

In 1990, the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), was established to develop accounting and auditing standards for the global Islamic finance industry. In the 1990s, the first AAOIFI standards, towards a unified approach on capital adequacy, were issued. The 2000s witnessed the establishment of International Islamic

financial infrastructure institutions such as the Islamic Financial Services Board (IFSB), International Islamic Financial Market (IIFM), General Council for Islamic Banks and Financial Institutions (CIBAFI), and the Arbitration and Reconciliation Centre for Islamic Financial Institutions (ARCIFI), as well as other commercial support institutions such as the International Islamic Rating Agency (IIRA) and the Liquidity Management Centre (LMC).

However, lack of a comprehensive international regulatory and governance framework for Islamic finance products and institutions remains a challenge for the Islamic finance industry as greater internationalization takes shape. Great strides have been achieved by standard-setting bodies and multilateral organizations to establish an internationally recognizable framework for the regulation, supervision, governance and financial reporting of practices of Islamic financial institutions. Nonetheless, the industry is still plagued with gaps in the standardization of products and conduct of business as not all countries are complying to standards or resolutions published by these international standard-setting bodies.