Within the conventional responsible finance bond market, a series of labels has been developed to categories issuances of responsible finance bonds. The label used will depend on the nature of the projects that are funded using the relevant bond issue proceeds. The issue proceeds of ‘green bonds’ are applied to finance or refinance environmentally-beneficial projects. ‘Social bonds’ provide funding for projects that seek to address or mitigate identified social issues or to achieve positive social outcomes. Proceeds from the issue of ‘sustainability bonds’ fund projects having both green and social objectives. ‘Sustainability-linked bonds’ provided funding to help issuers to achieve future improvements in sustainability outcomes. Finally, ‘social impact bonds’ are outcomes-focused, and payments made to investors are contingent on the ability of a service provider to achieve targeted outcomes from a funded project. Alongside this taxonomy, a market-led approach to self-regulation has emerged through the publication of voluntary responsible finance bond standards. There are two sets of voluntary (and aligned) guidelines in place in the green bond market: the Green Bond Principles (the ‘GBPs’) issued by the International Capital Markets Association (the ‘ICMA’) and the Climate Bonds Standard issued by the Climate Bond Initiative. The ICMA’s Social Bond Principles (the ‘SBPs’) have been tailored for issuances of social bonds and the ICMA’s Sustainability Bond Guidelines provide that a bond can be classified as a sustainability bond if it complies with the core components of the GBPs and the SBPs. In June 2020, the ICMA published its Sustainability-linked Bonds Principles for issuances of sustainability-linked bonds.

In the responsible finance sukuk market, projects funded by responsible finance sukuk issued to date have broadly fallen within contemporary notions of what is green, social or sustainable. However, the labelling and structure of these instruments have more frequently been mandated by government or region-specific intergovernmental standards, rather than being voluntary and market-driven. The first responsible finance sukuk standards were published in 2014 by the Securities Commission of Malaysia (the ‘SC’) as part of a revision to its Guidelines on Sukuk. These responsible finance sukuk standards were introduced as part of the SC’s broader goal of promoting responsible finance and investment in Malaysia and compliance with them is mandatory for issuances of responsible finance sukuk within Malaysia. In the 2014 revised edition of the SC’s Guidelines on Sukuk, therefore, a new Part D was added to address the additional requirements to be met for the issue, offering and invitation to subscribe or purchase ‘sustainable and responsible investment (SRI) sukuk’. The Guidelines on Sukuk have since been superseded by the SC’s Guidelines on Unlisted Capital Market Products under the Lodge and Launch Framework and the SC’s Guidelines on Issuance of Corporate Bonds and Sukuk to Retail Investors, each of which has a chapter dedicated to responsible finance sukuk (these chapters together, the ‘SC’s SRI Sukuk Standards’). To be classified as a sukuk complying with the SC’s SRI Sukuk Standards, the use of proceeds from the issue of the sukuk certificates must be directed towards funding eligible projects. The list of eligible projects includes environmentally-friendly projects and projects with a positive social objective.

In 2017, the Association of Southeast Asian Nations (ASEAN) Capital Markets Forum, an intergovernmental forum for regulatory authorities from ASEAN countries, published the ASEAN Green Bond Standards. These standards were revised and republished in 2018, together with the ASEAN Social Bond Standards and the ASEAN Sustainability Bond Standards (together, the ‘ASEAN Responsible Finance Bond and Sukuk Standards’). These three sets of standards provide a framework for issuances of bonds and sukuk15 that have a geographic or economic connection to the ASEAN region. These standards aim to ‘enhance transparency, consistency and uniformity’ of ASEAN responsible finance bonds and sukuk and closely follow the corresponding ICMA guidelines. Unlike the ICMA’s GBPs and SBPs, however, the ASEAN Responsible Finance Bond and Sukuk Standards also indicate what types of projects are ineligible for funding using ASEAN responsible finance bonds or sukuk. Ineligible projects include fossil fuel power generation projects and projects involving activities that ‘pose a negative social impact’ related to alcohol, gambling, tobacco and weaponry.

Responsible Finance Sukuk Market

While a small number of issuances of responsible finance sukuk pre-date the adoption of the SC’s SRI Sukuk Standards and the ASEAN Responsible Finance Bond and Sukuk Standards, since the publication of these standards the responsible finance sukuk market has gained momentum. Recent issuances have largely been localized in the South Asian markets of Malaysia and Indonesia, although the 2019 issuance of green sukuk certificates guaranteed by Gulf Corporation Council (GCC) located entities may indicate a broadening issuer base within the responsible finance sukuk market.

Initial issuances of sukuk certificates that were marketed as responsible finance provided funding for projects with socially beneficial objectives and were issued through multilateral or government-backed entities. In 2014, 2015 and most recently in 2019, therefore, the International Finance Facility for Immunization Company (IFFIm) sought to raise capital with three standalone issues of sukuk certificates, in each case through a special purpose vehicle (SPV). With the subscription proceeds raised by these issuances, IFFIm provided funding for operational activities related to immunization, vaccine procurement and health system strengthening programmes in developing countries. Periodic distributions made to certificate holders are generated through a sukuk structure based on a commodity murabaha arrangement (a sales agreement where the purchase price of commodities is payable on a deferred and marked-up basis). 2015 also saw the issue of social sukuk by Ihsan Sukuk Bhd, an SPV established by Khazanah Nasional Berhad (the investment fund of the Government of Malaysia). This was the first sukuk programme to be structured under the SC’s SRI Sukuk Standards and the proceeds from the issue of these sukuk certificates were invested in a programme run by a non-profit foundation to address the quality of education in Malaysia’s government schools. Periodic distributions during the tenor of the sukuk were generated through a structure involving wakala (agency), commodity murabaha and istithmar (investment) agreements.

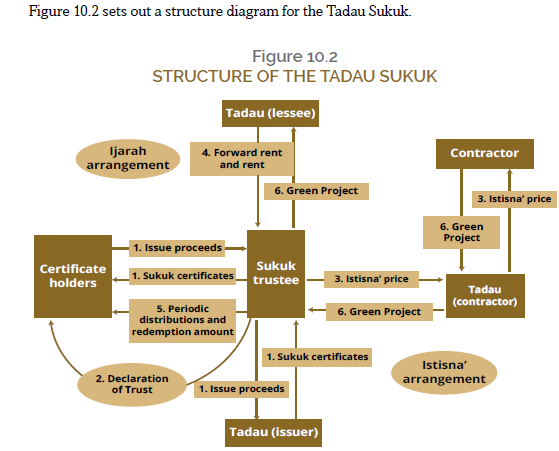

From 2017 onwards, most responsible finance sukuk issuances have been of green or (to a lesser extent) sustainability sukuk, with a noticeable focus on funding projects within the solar energy sector. Tadau Energy Sdn Bhd, a Malaysian company, was amongst the first corporates to issue a responsible finance sukuk with its issue of green sukuk certificates. During the tenor of these sukuk, predetermined periodic distributions are based on a combination of istisna’ (construction) and ijara (lease) agreements. Since the Tadau Energy Sdn Bhd issuance, a succession of green and sustainability sukuk issuances have been undertaken by other Malaysian corporate issuers, most of which have been marketed to domestic Malaysian investors and all of which have been structured to comply with published responsible finance sukuk standards.

The first sovereign responsible finance sukuk issue took place in 2018, with the issue by an SPV established by the Republic of Indonesia of green sukuk under an existing sukuk issuance programme. This issuance, one that followed in 201922 and other in 202023 were structured to comply with the ASEAN Responsible Finance Bond and Sukuk Standards and the ICMA’s GBPs.

Most recently, GCC-located entities have entered the responsible finance sukuk market. In May 2019, an issuance of green sukuk by MAF Sukuk Ltd (an SPV incorporated in the Cayman Islands) was guaranteed by the UAE incorporated Majid Al Futtaim Holding LLC24 and in

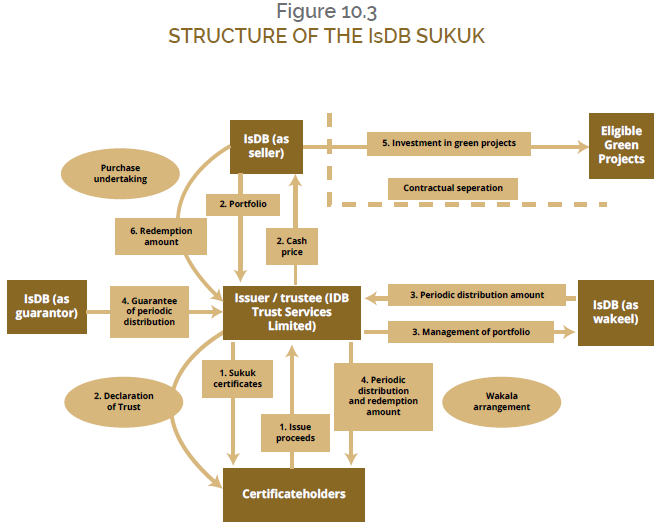

December 2019, IDB Trust Services Limited issued green sukuk guaranteed by the Islamic Development Bank (the ‘IsDB’), the multilateral development bank located in Saudi Arabia.

In 2020, in response to the Covid-19 pandemic, issuances of sukuk with social objectives have come to market, most notably the issue of sustainability sukuk on behalf of the IsDB to raise capital to assist IsDB member countries as they tackle the pandemic.

The Case Studies section of this chapter discusses the issuances of responsible finance sukuk by Tadau Energy Sdn Bhd and by IDB Trust Services Limited (guaranteed by the IsDB) in more detail.

Table 10.1 provides an overview of recent responsible finance sukuk issuances.

Table 10.1 AN OVERVIEW OF RESPONSIBLE FINANCE SUKUK

| Issuer | Year of Issue | Jurisdiction | Type of responsible finance sukuk | Contractual structure | |

| 1. | IFFIm Sukuk Company Limited | 2014 | England & Wales | Social sukuk | Commodity murabaha |

| 2. | IFFIm Sukuk Company II Limited | 2015 | England & Wales | Social sukuk | Commodity murabaha |

| 3. | Ihsan Sukuk Bhd | 2015 | Malaysia | Social sukuk | Wakala, commodity murabaha and istithmar |

| 4. | Tadau Energy Sdn Bhd | 2017 | Malaysia | Green sukuk | Istisna’ and ijara |

| 5. | Quantum Solar Park (Semenanjung) Sdn Bhd | 2017 | Malaysia | Green sukuk | Commodity murabaha |

| 6. | PNB Merdeka Ventures Sdn Berhad | 2017 | Malaysia | Green and sustainability sukuk | Wakala and commodity murabaha |

| 7. | Sinar Kamiri Sdn Bhd | 2018 | Malaysia | Green sukuk | Wakala and commodity murabaha |

| 8. | UiTM Solar Power Sdn Bhd | 2018 | Malaysia | Green sukuk | Commodity murabaha |

| 9. | Perusahaan Penerbit SBSN Indonesia III | 2018 | Indonesia | Green sukuk | Wakala |

| 10. | HSBC Amanah Malaysia Berhad | 2018 | Malaysia | Sustainability sukuk | Wakala and commodity murabaha |

| 11. | Pasukhas Green Assets Sdn Bhd | 2019 | Malaysia | Green sukuk | Commodity murabaha |

| 12. | IFFIm Sukuk Company III Limited | 2019 | England & Wales | Social sukuk | Private placement |

| 13. | Perusahaan Penerbit SBSN Indonesia III | 2019 | Indonesia | Green sukuk | Wakala |

| 14. | Telekosang Hydro One Sdn Bhd | 2019 | Malaysia | Green sukuk | Wakala and istithmar |

| 15. | Edra Solar Sdn Bhd | 2019 | Malaysia | Green sukuk | Commodity murabaha |

| 16. | MAF Sukuk Ltd (two issuances) | 2019 | United Arab Emirates | Green sukuk | Wakala |

| 17. | IDB Trust Services Limited (IsDB) | 2019 | Saudi Arabia | Green sukuk | Wakala |

| 18. | PNB Merdeka Ventures Sdn Berhad | 2019 | Malaysia | Green and sustainability sukuk | Wakala and commodity murabaha |

| 19. | Republic of Indonesia (Sukuk Tabungan Seri) | 2019 | Indonesia | Green sukuk | Wakala |

| 20. | Zorlu Energy | 2020 | Turkey | Green sukuk | Ijara |

| 21. | Leader Energy Sdn Bhd | 2020 | Malaysia | Green sukuk | Wakala and commodity murabaha |

| 22. | IDB Trust Services Limited (IsDB) | 2020 | Saudi Arabia | Sustainability Sukuk | Wakala |

| 23. | Perusahaan Penerbit SBSN Indonesia III | 2020 | Indonesia | Green Sukuk | Wakala |

| 24. | PNB Merdeka Ventures Sdn Berhad | 2020 | Malaysia | Green and sustainability sukuk | Wakala and commodity murabaha |

| 25. | Saudi Electricity Global Sukuk Company 5 (two issuances) | 2020 | Saudi Arabia | Green Sukuk | Ijara |

| 26. | Republic of Indonesia (Sukuk Tabungan Seri) | 2020 | Indonesia | Green sukuk | Wakala |

| 27. | Unity 1 Sukuk Limited (Etihad Airways PJSC) | 2020 | United Arab Emirates | Sustainability- Linked Sukuk | Private placement |

Case Studies – The Contractual Structures of Responsible Finance Sukuk

Responsible finance sukuk are structured using a combination of classical Islamic contracts. These contracts work together to comply with the prohibitions of Islamic law, while also providing a mechanism for an entity to raise finance in the capital markets and for certificate holders to receive periodic payments. While the market has to date shown a preference for sukuk structures based on, or incorporating, murabaha arrangements, there is no single contractual structure used across responsible finance sukuk issuances. Instead, the Islamic contracts used as the contractual foundations of responsible finance sukuk issuances vary between transactions and depend on applicable regulatory requirements, the underlying assets in which the certificate holders receive an undivided ownership interest and the extent to which transaction parties want the responsible finance sukuk to replicate the economic substance of a conventional bond.

Depending on the contractual structure used, therefore, the responsible finance sukuk’s issue proceeds may be invested directly in an eligible green or social project, and proportionate ownership of that project shared amongst certificate holders. Payments made to certificate holders during the tenor of the sukuk (referred to in this chapter as ‘periodic distributions’) and ultimate return of capital to certificate holders at maturity or early redemption of the sukuk certificates would then derive from the underlying eligible project. More typically, however, while the proceeds from an issue of responsible finance sukuk may be earmarked for investment in eligible projects, this investment typically happens as part of a separate contractual arrangement to which certificate holders are not a party and only after the issue proceeds have moved through the Islamic contractual structure underpinning the sukuk certificates. As a result, certificate holders do not receive an ownership interest in the eligible green or social project and returns paid to certificate holders are not determined by the performance of that project. This contractual separation between certificate holders and the eligible project is designed to protect those certificate holders from project risk and to safeguard their capital.

The following case studies will discuss the contractual structure of two recent responsible finance sukuk issuances, one in which the issue proceeds were invested directly in the eligible project and one where this happened indirectly.

Tadau Energy Sdn Bhd Green Sukuk

In July 2017, Tadau Energy Sdn Bhd (‘Tadau’), a Malaysian incorporated company operating in the electricity sector, issued RM250,000,000 (approximately US$60,000,000) worth of green sukuk (the ‘Tadau Sukuk’) pursuant to an Islamic medium-term notes programme (the ‘Tadau Sukuk Programme’). The Tadau Sukuk were issued in 15 tranches with maturities of between two and 16 years.

Following the issue of each tranche of Tadau Sukuk, the issue proceeds were invested directly in the financing, construction and operation of two solar photovoltaic plants and associated facilities in Malaysia (the ‘Tadau Sukuk Assets’). The energy generated by these Tadau Sukuk Assets was then to be purchased by Sabah Electricity Sdn Bhd, a regional energy company.

In order to connect the certificate holders with the underlying eligible project, the sukuk trustee (Malaysian Trustees Berhad) declared a trust in favour of certificate holders over assets comprising rights, interest and benefit in, to and under the completed Tadau Sukuk Assets and related transaction documents. This gave certificate holders an undivided proportionate beneficial ownership interest in the completed Tadau Sukuk Assets.29 Pursuant to an istisna’ agreement, the sukuk trustee then paid the issuer (as contractor) an amount equal to the issue proceeds to build, construct and deliver the Tadau Sukuk Assets.30 This amount will be payable in instalments during the construction phase of each Tadau Sukuk Asset.31 Using funds received from the istisna’ agreement, the issuer in turn entered into a parallel engineering, procurement and construction arrangement with a contractor to procure the required building, construction and delivery of the Tadau Sukuk Assets.32 To provide certificate holders with periodic distributions during the tenor of the Tadau Sukuk, the sukuk trustee and issuer also entered into an ijarah agreement with respect to each Tadau Sukuk Asset. Under each ijarah agreement, the sukuk trustee agreed to lease each (as yet uncompleted) Tadau Sukuk Asset to the issuer during that asset’s construction phase in exchange for payment of pre-determined advance rent. From the date of completion and delivery of the Tadau Sukuk Assets to the maturity date of the last outstanding tranche of Tadau Sukuk, the sukuk trustee will lease each completed Tadau Sukuk Asset to the issuer for a pre-determined rent. Both forms of rent will be equal in size and timing to the periodic distributions due to certificate holders. The issuer will also be appointed as servicing agent to perform ownership-related obligations and to pay ownership expenses in relation to the Tadau Sukuk Assets.

Should a Tadau Sukuk Asset not be completed and delivered, or should a dissolution event triggering early redemption of the Tadau Sukuk be declared prior to completion and delivery, the issuer will refund to the sukuk trustee the istisna’ price, together with compensation equal to the periodic distributions already paid and any accrued but unpaid periodic distributions.36The sukuk trustee will also repay any advance rent paid by the issuer. Should a dissolution event be declared after completion and delivery of a Tadau Sukuk Asset, the issuer will purchase the relevant asset pursuant to a purchase undertaking at a price equal the original istisna’ price for that Tadau Sukuk Asset, together with ownership expenses and all accrued but unpaid periodic distributions. In each case, the Tadau Sukuk certificates will then be redeemed and cancelled. At maturity of each tranche of Tadau Sukuk, the final rental payment will be used to repay certificate holders their capital investment and to pay any accrued but unpaid periodic distributions. Once all tranches of Tadau Sukuk have matured, the Tadau Sukuk Assets will be transferred to the issuer by way of gift.

Ahead of the issue of the Tadau Sukuk certificates, the issuer commissioned an independent assessment (in the form of a second opinion) from the Center for International Climate Research (CICERO). This second opinion followed an established practice in the conventional responsible finance bond market and addressed the adherence of the issuer’s green sukuk framework (underpinning its Tadau Sukuk Programme) to the ICMA’s GBPs.38 CICERO rated the green sukuk framework ‘Dark Green’ meaning that the funded project represented a realisation of the ‘long-term vision of a low carbon and climate resilient future’. The second opinion did, however, highlight shortcomings in the transparency and reporting commitments of the issuer, a lack of substantial environmental policies for the issuer’s operations and potential controversy with respect to land-use and local environmental impact of renewable energy power plants.

The Tadau Sukuk certificates were the first green sukuk to be issued under the SC’s SRI Sukuk Standards. They were also amongst the first corporate issuances of responsible finance sukuk in the capital markets. Notwithstanding this, the contractual structure of the Tadau Sukuk certificates remains relatively unusual amongst responsible finance sukuk currently in issue. This is because certificate holders received a proportionate ownership interest directly in the funded green project. Although supported by credit enhancements to ensure that certificate holders receive periodic distributions and return of capital on redemption, the revenues paid to certificate holders are, therefore, derived from the green project. As a result, Tadau Sukuk connect certificate holders directly to a green project, something that most subsequent responsible finance sukuk issuances do not do.

Green Sukuk Guaranteed by the IsDB

The IsDB has noted that the ‘aspirations for human dignity, and “to leave no one behind”’ within the United Nations’ 2030 Agenda for Sustainable Development and the related Sustainable Development Goals (the ‘SDGs’) are ‘fully in line with the principles and objectives of development from an Islamic perspective’. The IsDB has also highlighted the significant funding requirements needed to meet the SDGs and the potential use of Islamic finance as a vehicle for providing that funding.43 Reflecting this commitment to pursuing the SDGs, in December 2019 the IsDB acted as obligor and guarantor of an issuance of EUR1,000,000,000 (approximately US$1,100,000,000) worth of green sukuk due 2024 (the ‘IsDB Sukuk’) under its sukuk issuance programme (the ‘IsDB Sukuk Programme’). The IsDB Sukuk certificates were issued by an SPV incorporated in Jersey (IDB Trust Services Limited) and were listed on Euronext Dublin, Bursa Malaysia and Nasdaq Dubai. This was the sukuk market’s first euro-denominated responsible finance sukuk issuance and the first issuance of green sukuk by a AAA-rated institution.

The IsDB Sukuk Programme provides for a wakala arrangement as the contractual structure underpinning issuances of sukuk under the programme, including the IsDB Sukuk. As part of the issuance of the IsDB Sukuk, therefore, the issuer agreed to apply the IsDB Sukuk issue proceeds towards the purchase of a portfolio of Shari’a-compliant assets from the IsDB. This portfolio of assets does not itself include any eligible green projects, but is rather composed at least 33% of tangible assets (comprising leased assets, istisna’ assets, shares, sukuk and mudaraba (partnership) assets) and no more than 67% of intangible assets (comprising istisna’ receivables, loan receivables and murabaha receivables) and includes, in each case, the right to receive payment of any amounts due with respect to these assets (the ‘IsDB Sukuk Portfolio’). The issuer (as trustee) declared a trust in favor of certificate holders over all of its rights, title, interest and benefit in and to the IsDB Sukuk Portfolio, the related transaction documents, cash standing in certain accounts and connected proceeds.45 This gives certificate holders an undivided beneficial ownership interest in, and the right to receive certain payments arising from, the IsDB Sukuk Portfolio. It does not, however, give them any ownership interest in the green projects ultimately to be funded. Consistent with the trend seen in the majority of other responsible finance sukuk, therefore, certificate holders do not invest directly in the green projects. Instead, with the cash received from the sale of the IsDB Sukuk Portfolio to the issuer, the IsDB will finance or refinance expenditure relating to eligible green projects under a separate contractual arrangement to which the certificate holders are not a party.

Pursuant to a wakala agreement entered into by the issuer and the IsDB, the IsDB was appointed as agent (or wakeel) of the issuer to collect all amounts due in respect of the IsDB Sukuk Portfolio, to hold records and apply collections in respect of the IsDB Sukuk Portfolio and to carry out incidental matters relating thereto.48 During the tenor of the IsDB Sukuk, therefore, the IsDB (as wakeel) will collect income generated by the IsDB Sukuk Portfolio. It will, after paying the expenses of the trust, then use profit received in respect of the IsDB Sukuk Portfolio to pay the periodic distributions due to the certificate holders on the annual periodic distribution dates. Ahead of each periodic distribution date, should there be any shortfall between the profit received in respect of the IsDB Sukuk Portfolio and the agreed periodic distribution due to certificate holders, the IsDB has guaranteed to pay the issuer (as trustee) the amount of such shortfall.49

Concurrently with this payment of periodic distributions, any principal amounts received in respect of the IsDB Sukuk Portfolio will be credited to an account. To the extent that there is a shortfall between the total nominal amount of the IsDB Sukuk and the net asset value of the IsDB Sukuk Portfolio (less any principal amounts already received), or if the value of tangible assets in the IsDB Sukuk Portfolio is less than 33% of the total IsDB Sukuk Portfolio, the principal amounts received in respect of that portfolio will be reinvested by the issuer to acquire further portfolio assets from the IsDB or (if the IsDB does not have sufficient suitable assets on its balance sheet) to acquire shares and/or sukuk on the open market (through the IsDB acting as wakeel). Once acquired, these assets will become part of the IsDB Sukuk Portfolio.

At maturity or early redemption of the IsDB Sukuk, the IsDB has undertaken to purchase the outstanding IsDB Sukuk Portfolio from the issuer at a price equal to the total nominal amount of the IsDB Sukuk, any additional expenses and all accrued but unpaid periodic distributions. This amount will be used to repay certificate holders their capital investment and to redeem the IsDB Sukuk in full. Amounts advanced by the IsDB pursuant to the guarantee will also be repaid. Any excess amounts collected by the IsDB in respect of the IsDB Sukuk Portfolio will be retained by the IsDB as an incentive fee for the performance of its services as wakeel.

The IsDB Sukuk certificates are not specifically referred to in the offering documents as ‘green’ or ‘responsible finance’ sukuk, nor do the offering documents disclose the specific green projects that will be funded using the sukuk issue proceeds. Nevertheless the IsDB Sukuk certificates’ use of proceeds, set out in the final terms dated December 2, 2019, notes that ‘the net proceeds that the IsDB receives from the Issuer will be used by the IsDB to finance or refinance eligible projects in accordance with its Sustainable Finance Framework’ (the ‘Framework’). This Framework emphasizes the IsDB’s commitment to prioritizing the SDGs in accordance with the specific development needs of its member countries and notes the IsDB’s aim of boosting sustainability through the issuance of responsible finance sukuk. Under this Framework, therefore, the IsDB can issue two types of responsible finance sukuk: green sukuk (such as the IsDB Sukuk) and sustainability sukuk (under which an amount equal to the issue proceeds are allocated to green and social projects). Eligible categories of green and social projects are broadly defined and align with those set out in the ICMA’s GBPs and SBPs, including renewable energy, pollution prevention and control, affordable housing and access to essential services. Ineligible projects include those that violate the principles of Islamic law, such as alcohol and gambling, as well as projects involving nuclear power generation, palm oil related activities and oil refining. Within this framework, the IsDB’s ‘Sustainable Finance Task Force’ will evaluate and select eligible projects for funding. An amount equivalent to the responsible finance sukuk issue proceeds will then be invested in those eligible projects, with any amounts not so invested used in accordance with the IsDB’s general funding requirements. As part of the Framework, the IsDB has also undertaken to report annually on the allocation of responsible finance sukuk proceeds and the impact of this allocation until such proceeds have been fully allocated.

CICERO provided the second opinion on the Framework, which underpins the IsDB Sukuk. This second opinion confirmed that the Framework aligns with the ICMA’s GBPs, SBPs and Sustainability Bond Guidelines. Noting that it was encouraged by the issuer’s ‘commitment to ensure sustainability of the investments and the integrated assessment of social and environmental aspects of projects’, CICERO assigned the Framework a rating of ‘Medium Green’. This rating reflects projects and solutions that represent steps towards the ‘long-term vision, but are not quite there yet.’60 As part of its assessment, CICERO’s second opinion highlighted the Framework’s inclusion of project categories that could potentially include controversial projects, such as energy efficiency related to fossil fuel elements. The IsDB provided assurances that any potentially controversial projects would undergo in-depth scrutiny ‘to ensure positive climate impacts’. However, CICERO still noted that concerns remained with respect to the transparency of the methodology that will be used by the IsDB. CICERO also emphasized the need for specificity in the IsDB’s definition of eligible projects and the importance of a strong framework on environmental sustainability.63 The documentation supporting the IsDB Sukuk articulates the responsible finance nature of the sukuk certificates and the extent to which this issuance aligns with the IsDB’s broader sustainability agenda. In a market that has been dominated by issuances from Malaysia and Indonesia, the IsDB Sukuk certificates are a step towards the geographic broadening of the responsible finance sukuk market in terms of issuers and targeted investor base. This issuance also indicates a move away from the commodity murabaha dominated responsible finance sukuk issuances within Malaysia. Although the IsDB Sukuk certificate holders did not receive an ownership interest in the funded green projects, nor are their returns determined by the performance of those projects, the contractual structure of the IsDB Sukuk aligns with broader practices in the Islamic capital markets. This issuance, therefore, provides investors with a contractually familiar opportunity to invest in instruments that not only comply with the financial principles of Islamic law, but which are also designed to assist with the delivery of ‘environmentally sustainable growth in a socially responsible and transparent manner.

The Responsible Finance Sukuk Market Going Forward

Since 2017, the responsible finance sukuk market has seen steady growth, both in terms of the number and size of issuances, and the geographic spread of issuers and target investors. The development of this sector is not surprising. It reflects rising global awareness of environmental, social and sustainability concerns and a willingness of investors to invest in capital market instruments that have both financial and non-financial goals. However, while Islamic finance may be highlighted as naturally subjecting financial activity to objectives beyond just monetary gain, the reality of the sukuk market today suggests that a sukuk issuance will not automatically be categorized as ‘responsible finance’ just because of its connection with Islamic law. Instead, transaction participants must actively make this overlap between Islamic finance and responsible finance happen by structuring sukuk issuances that intentionally fulfil prescribed ethical benchmarks, while also complying with Islamic legal principles. As a result, responsible finance sukuk remain a small segment of a much wider sukuk market in which issuances are largely neutral as to their societal impact.

In practice, responsible finance sukuk are unlikely to emerge as a successor to the current sukuk structures used. The need for the proceeds from an issue of responsible finance sukuk to be invested in projects that comply with Islamic law and align with prescribed environmental and/or social benchmarks will inevitably restrict the types of entities that can raise capital through the issue of these instruments. In addition to this, issuers access the capital markets for a variety of reasons, not all of which lend themselves to responsible finance structures. Issuers that issue sukuk in order to raise capital to fund their general corporate purposes may not, therefore, be prepared to channel the issue proceeds from those issuances towards green and social projects. Nevertheless, the growth of the responsible finance sukuk market reflects evolving market appetite for products that pursue targets beyond simply financial returns. Responsible finance sukuk therefore provide issuers and investors with additional choice not just in terms of how they access the capital markets, but why they do so. In this way, they are an important step in the maturation and diversification of the sukuk market.