The major features of venture philanthropy

“Give a man a fish; you have fed him for today. Teach a man to fish, and you have fed him for a lifetime”

— Author unknown

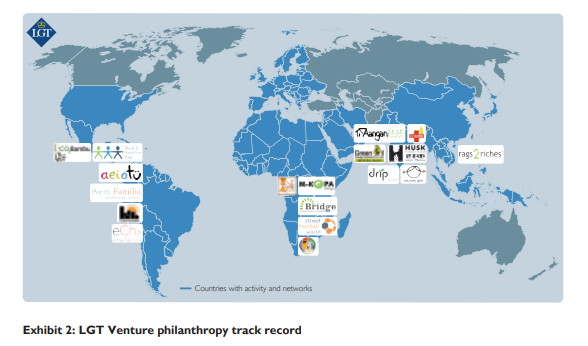

LGT Venture Philanthropy Foundation, set up in 2007 by the Princely Family of Liechtenstein, is an impact investor supporting organizations with outstanding social and environmental impact. Its team of 20 experts on five continents strives to increase the sustainable quality of life of less advantaged people by inspiring clients to active philanthropy and providing individualized philanthropic advice and investment implementation. Its broad range of clients benefits from the experience, systems, processes and networks built by implementing the philanthropic engagement of the Princely Family of Liechtenstein/LGT Group. At the core of its activity lies the venture philanthropy approach.

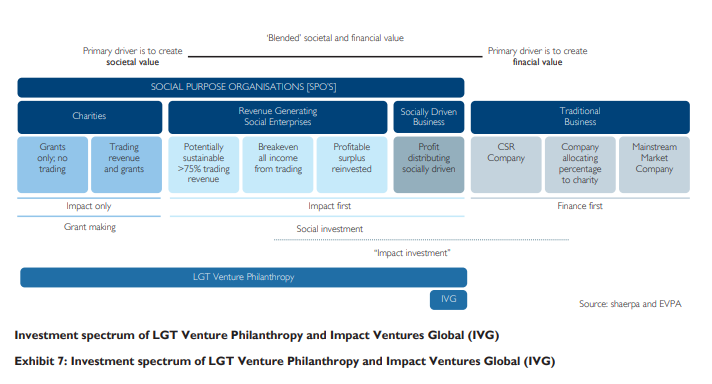

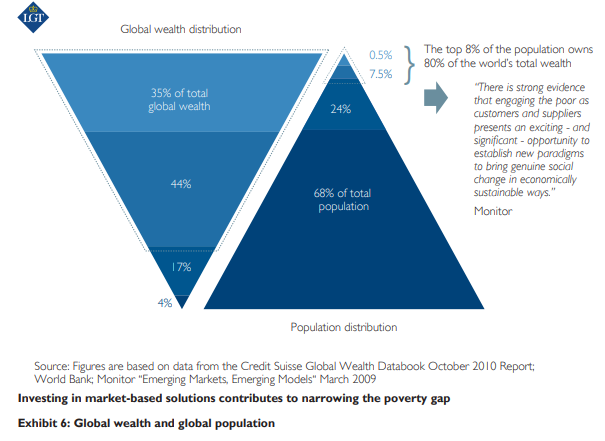

LGT Venture Philanthropy is launching an impact investment fund “Impact Ventures Global (IVG)” which is a Luxembourg-based SICAV SIF fund. The first investors already committed over USD 10m. While seeking positive financial returns, the fund aims above all to achieve a positive societal return through targeted investments into organizations with innovative, market-based solutions for the less advantaged.

Venture philanthropy is a comparatively young discipline within the sphere of philanthropic giving. As with classical charitable foundations, the aim of venture philanthropy is to achieve a high rate of social or environmental return. However, the processes and types of financing used in this approach come from the field of venture capital and, so far, have not been adopted by classical charitable foundations. There are eight major features of the venture philanthropy approach.

The major features of venture philanthropy

What characterises the venture philanthropy approach within the sphere of philanthropic giving? As with many young and dynamic sectors, it is difficult to draw clear division lines in this field. The following remarks are therefore to be understood as snapshots.

- Focus on a few organizations

Unlike traditional charitable donations – that most often support specific projects, programs, initiatives, re- search or counselling – venture philanthropy invests in organizations or social enterprises that create social or environmental value. Careful scrutiny and an extensive understanding of the overall organization and its market are necessary for this. Although time-consuming, such an analysis is a necessary precondition to take accurate decisions with regard to the most appropriate from of funding and to be able to support the organization in an optimal manner. Thus the venture philanthropist focuses on a few, selected organizations. Currently, LGT Venture Philanthropy has invested into 22 high-impact organizations around the world impacting 6.1m people.

- Finance growth

Venture philanthropy invests in young organizations with a high growth rate. That is why established organizations like World Vision or Greenpeace are not considered potential candidates for investment. Furthermore, a venture philanthropist does not invest in small projects without a growth rate, such as the annual financing of an orphanage, or enterprises at the idea stage. Organizations should have a track record of between two to five years and now entering a significant stage of growth or show a high growth potential.

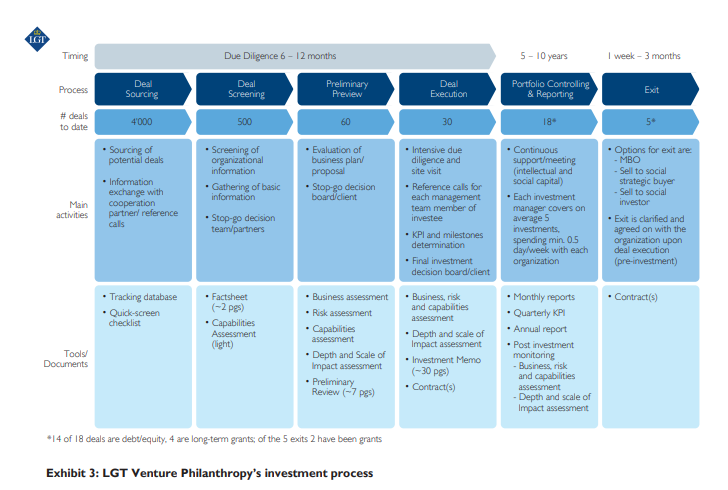

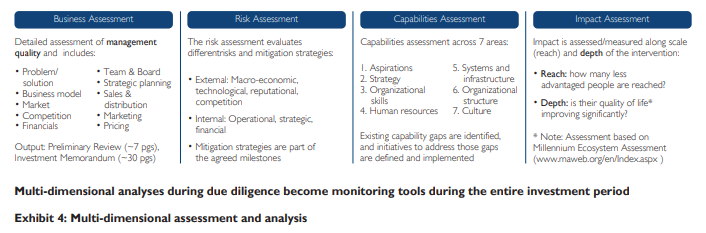

- Extensive due diligence at the local level

Every commitment is preceded by a three- to twelve-month-long examination period as part of the due diligence process. During this time, the venture philanthropist tries to get to know the organization and its staff as closely as possible and seeks to establish a relationship of trust with them. In this phase, it is necessary to examine, analyze and discuss many things directly with the organization on-site. Especially since the support by venture philanthropists goes beyond the provided financial capital, it is essential to have a detailed understanding of the organizational capabilities. Hence, the organization’s business and financing model, its market and competition, sales strategy, marketing and public relations and above all the quality of management are evaluated. During the process of due diligence the venture philanthropist, together with the staff of the organization, tries to get a deep understanding of the following questions: Which problem does the organization solve? Why is this solution relevant to the target group? Why is the organization’s model particularly well suited to solve this problem? How does the organization implement its mode?

Once the venture philanthropist has a good sense of the organization’s track record and strategic plans, the growth plans for the next three to five years are evaluated. He also explores what added value beyond the financial support the organization expects from a venture philanthropy investor. The expected benefit should not be limited to financial support. Normally, such a due diligence process already represents a quasi-consultation for the organization, since important questions and the strategic direction are already discussed at this stage. The venture philanthropist has to have deep knowledge of management but more crucially, truly understand the language and cultural context within which the organization is working.

With our 14 for-profit and 4 non-profit engagements we have gained significant experience in impact investing

- Tailored financing

During the due diligence process, the venture philanthropist analyses whether the business model of the organization can generate revenue. If the beneficiary is capable of paying for the product or service – be it only a small amount – the next step is to determine whether the organization could become financially self-sustaining or even profitable with a growing customer base. If this is the case, the venture philanthropist would not choose to finance the organization with a grant, but with an unsecured loan (unsecured since social organizations seldom have collateral) or an equity investment. The venture philanthropist does not use loans or investments to maximize profit – he carefully chooses the most appropriate funding type. Any earned return is reinvested to support additional organizations. In addition, venture philanthropists aim to create or revive local markets and not negatively influence or distort existing markets. The consequences of indiscriminate grant funding are creating a work culture that focuses on completing individual projects rather than focusing on meeting overall organizational goals and a sub-optimal allocation of available resources. Often this changes as soon as funds need to be paid back. Another argument for deploying loans or equity financing is that it strengthens the organization’s independence. If an organization is able to implement its core competence and adapt its model in a way that enables it to work profitably, it can become independent of donations. That way, it has higher chances of surviving economically difficult times, when there are often fewer donations available. Furthermore, the organization is not forced to align its own strategic direction with the budget and thematic requirements of individual foundations. In spite of the many positive effects of loans and equity investments, venture philanthropists also use grants in cases where a revenue-generating business model is inappropriate or simply cannot be applied.

- Support by means of financial, intellectual and social capital

Adequate funding is seldom sufficient for many organizations that need to tackle the increasing challenges management faces during the growth period. If they are not being assisted in strategic and operational management, organizations often apply the invested financial capital inefficiently or even wastefully without reaching the positive effects they originally aimed for. Internal structure, processes and management are required to take care of fields such as finances, strategy, human resources development and marketing. The same traditional management functions are also necessary for social enterprises and non-profit organizations. Since these deficiencies are encountered frequently, the venture philanthropist contributes his management know-how and experience and strengthens the process with his network and with additional investors, specialists or potential customers. The investment managers of LGT Venture Philanthropy mentor the supported organizations over the course of several years. The iCats Program is another important initiative of LGT Venture Philanthropy, which aims to foster and strengthen management quality within the organizations.

- Long-term commitment

Most processes of transformation and growth need time. For venture philanthropists a commitment of five to seven years is therefore the norm. The build-up of knowledge and a trusted and strong working relationship as described above will often only lead to the de- sired results from the second year of cooperation onwards. This requires that both parties take a long-term perspective and share a common sense of responsibility for the positive development of the organization.

- Ongoing monitoring and performance measurement

Venture philanthropy attaches great importance to measuring the achieved impact. Thus, a final report at the end of an engagement is insufficient. The venture philanthropist requires to be continuously informed about what is being achieved and which problems the organization might have to face. For this reason, in many cases, a structured, monthly report has become a standard. The key performance indicators defined during the due diligence process together with the organization – such as the number of successfully trained youth, the number of households powered by renewable energies or the number of small-size start-up businesses – are the basis for this. Such data provides an important measure to reliably show whether one is on the way to reaching one’s long-term aims. This approach allows for timely corrective and supportive action.

- Optimization of social and environmental returns

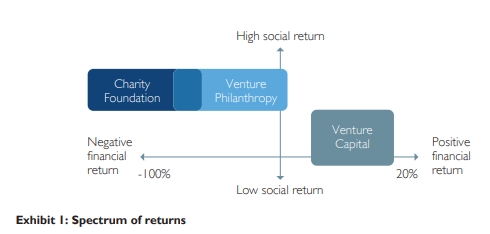

Venture philanthropists apply similar processes and work methods as venture capital funds. However, instead of maximizing financial profits, they seek to optimize social or environmental returns. Venture philanthropy is often an interesting alternative in cases where the financial return is too low to qualify for venture capital funds (i.e. with return rates below twenty percent depending on the country or the industry at hand). Also in cases where risks are too high for banks to bear the financing for example due to the risk of a specific country or currency – venture philanthropy can play an important role. Contrary to conventional donations venture philanthropy favours solutions with lasting financial sustainability.

Summarising the eight features

The eight major features of venture philanthropy described above both outline the approach and highlight what distinguishes this approach from classical charity and venture capital. While venture capital aims to maximize financial returns, the crucial factor for both the venture philanthropist and the charitable foundation is to maximize the positive social or environmental impact. Venture philanthropists, as well as venture capital investors, concentrate their investments on a few, young organizations with high growth rates, while traditional, charitable foundations mainly focus on a large number of projects and programs of varied maturity. The extensive on-site evaluation serves to build up knowledge and relations and is worth the effort only for venture philanthropists and venture capital investors since both have a long-term commitment in mind and offer more than merely financial support. Few charitable foundations systematically provide intellectual or social capital to complement their financial support. Debt and equity investment by venture philanthropists requires ongoing control of the supported organizations.

Just as various types of financing were developed ac- cording to the differing needs in the financial sector, we anticipate that philanthropy will become more diversified in the future, resulting in new types of financing for social organizations. Success will not only be determined by the approach itself, but rather by the thoughtful selection of the chosen approach, by the required skills and degree to which it is professionally implemented. The personal skills and knowledge the philanthropist is able and willing to employ in his engagement play an important role in choosing the most appropriate approach for his philanthropic commitment and desired impact.

Challenges for the venture philanthropy approach

Venture philanthropy funds face seven major challenges in their everyday work.

- Misuse of donations

Donations have had an extremely positive effect on many fields of philanthropy – they do so now and will continue to do so in the future. However, donations are too often used indiscriminately in areas where support by loans or equity investments would be more appropriate. This leads to scenarios such as unnecessary de- pendency on the receiver’s side, inefficient deployment of financial capital, deterioration of quality of the work performed and – last but not least – a general lack of motivation when it comes to employing the money in the most efficient way. On the donor’s side, this can result in a withdrawal of commitment.

- Lack of professionalism

A lack of professionalism will surface especially when a small project is supposed to turn into a large, efficiently working organization. What is common practice among private sector enterprises has to become a common practice among social enterprises as well: professional management. Serious shortcomings in management are one of the single biggest obstacles to growth.

- Distracting focus on low administration costs

Closely connected to the deficiencies in professional management is the assumption that philanthropic money can only be invested reasonably if the administration costs are negligibly low and most of the money goes directly to the beneficiaries on the ground. In enterprises in the private sector, nobody questions the importance of competent management – indeed, this is as important for non-profit organizations and social enterprises as well as venture philanthropy funds and charitable foundations! The necessity of competent and experienced members in management should also be considered when assessing the administration costs of organizations since experienced employees deserve remuneration that is commensurate with qualifications and experience. It is considerably more important to estimate the ratio of the achieved positive impact to the invested capital, than to compare disbursements with the administration costs.

Too many volunteers in important positions

Every philanthropic organization needs well-trained, salaried employees that take responsibility for the long term. Often the challenges in philanthropic organizations are even bigger than those in normal enterprises and may require even harder efforts and greater talent. Too much is expected and accomplished on a temporary, volunteer basis. It is difficult to see why people that daily bring about so many positive effects on society should not be remunerated appropriately. If salaries were more attractive in the NGO sector, it would improve the degree of professionalism, and ensure that many pressing social problems were solved more efficiently. In addition, this would make it easier for venture philanthropists to find more professionally managed organizations they could support.

- Budget-driven development aid

A major part of the government foreign aid budget is distributed to organizations without sufficient scrutiny – and occasionally it is distributed only to exhaust the prescribed budget. This practice neither facilitates the efficient employment of financial resources nor does it enforce responsibility and accountability. In light of the serious social and ecological problems we face, we can no longer afford such procedures.

- Breeding immaturity

During the past few decades, a considerable portion of the charitable foundation scene has more or less dictated their direction and goals to the organizations they support – thereby relieving these organizations from taking responsibility for their independent long-term plans and strategic direction. When the future plans of organizations are discussed, the involved persons often start thriving, recognizing their original motivation and enthusiasm and the long-term potential of their organization.

- Wasted innovation potential of –100 to

+20 percent return

Until recently it was taken for granted that philanthropic commitments could only be realized with the help of donations and that those financial resources were lost for further use. The practice to recover at least part of the money for further philanthropic commitment through repayment has become more prevalent over the last twenty years. There are many examples of excellent environmental solutions with expected returns of up to 20 percent. Whoever supports these solutions with a philanthropic attitude gets monetary returns that he can reinvest in other sustainable organizations. The tools and processes applied in venture philanthropy do not always make the work easier. In many places, however, they lead to essential improvements in the long term for the disadvantaged. Every approach to philanthropic giving exists in its own right, has its own operational field and – if applied reasonably – has an enormous impact potential.

Conclusion

Despite some of the described challenges, the venture philanthropy approach allows ethical investing with a charitable impact that could be of interest to religious institutions of all three Abrahamic Faiths.