Since 2010, GIFR has reported briefs on the state of affairs of the global Islamic financial services industry as an opening chapter of the annual report. During the last 12 years, the industry has gone through significant changes, particularly with reference to its growth. Following the tradition, this chapter provides an overview of major developments in Islamic banking and finance during the period between the previous 2021 edition and the one at hand.

Last year, we reported that the contribution of FinTech to the growth of Islamic banking and finance (IsBF) has at best been marginal. Despite all the hoo-ha around Islamic FinTech, this sub-sector of the industry has yet to rise to the promise it offered to the technology enthusiasts in the Islamic finance industry. This year’s report has a futuristic approach. As any reasonable notion of future cannot escape technology, this report would necessarily entail discussions on different aspects of Islamic FinTech.

However, it must be asserted right in the beginning that technology is no panacea to all economic ills facing humankind. Those who would like to hang all the problems observed so far in and with IsBF on a technology hanger will have to find another hanger after a while. After all, technology while being a great enabler is only part of a bigger spectrum of solutions. Nevertheless, one should also not underestimate the power of technology.

Those who continue to claim that all the economic problems faced by individuals, businesses, governments and the world at large emanate from the interest-based economic system, have been proven wrong by IsBF itself. After all, there is no credible empirical evidence that has emerged so far, which may confirm this assertion. At least, the data spanned over the last 40-50 years (coinciding with the existence of IsBF) do not support this view.

Consequently, the industry has for some time started witnessing slowdown in its growth and less-than-expected diversification into non-bank segments. Since 2016, we have been reporting various reasons behind this phenomenon. In the 2016 report, we identified four major reasons, namely, [1] political conflicts in several Muslim countries; [2] patches of low oil price tenures; [3] receding interest of Western financial institutions in the IsBF; and [4] natural slowdown in the IsBF due to maturity of the industry. In the 2018 report, we further included some other factors, namely, structural issues, stifled innovation, and wider macroeconomic factors.

This year’s report further elaborates the causes of slowdown, although the industry has once again started picking up in terms of growth.

Despite the impressive progress of the industry, the outlook of Islamic finance industry (IsF), in many ways, is characterised by the following.

Considerably Higher Cost of Transactions

Higher cost of transactions is indeed one of the major unresolved issues in the IsF industry. Some would say that this happens due to the absence of economies of scale, which the industry has not yet attained. Others might contend that the problem arises because of lack of legal and regulatory harmonization which contributed to an uneven playing field, leading to a higher cost of transactions in Islamic financial products. Notwithstanding such arguments, this requires a solid solution to reduce transaction costs, particularly in home financing, which is considerably ubiquitous in many Muslim countries and also for the Muslim communities living in non-Muslim countries. This must add to the popularity of IsF.

Limited Options of Risk Management Instruments, Mitigation Techniques and Quantitative Measurement Models

Despite the prominent initiatives by the Islamic Financial Services Board (IFSB) in issuing guidelines relating to risk management, stress testing and capital adequacy standard; a more detailed technical guidance, featuring the techniques and methodologies of risk assessment considering unique risks in IsFIs, is still required. Furthermore, it was also commonly understood that whilst the definition of risks in IsFIs is not substantially different from the ones in their conventional counterparts, a modification in the identification, measurement and mitigation of risks (due to some Shari’a principles) may be required.

More importantly, there is a dire need to develop a proper legal environment and suitable regulatory framework for the sound practice of risk management in IsFIs. In addition, limited liquidity instruments for Islamic capital markets are another challenge. In response to this, recently, the International Islamic Liquidity Management (IILM) has successfully launched Golden Triangle Sukuk, featuring a connection between financial stability, economic development, and debt management.

Restricted Legal and Regulatory Framework

A daunting task for the IsF industry stakeholders is not only to establish regulatory harmonization between different jurisdictions; but to also conform with the standards and guidance set out by the international standard-setting bodies, such as BCBS, IOSCO and IFRS. Surely, the idea of ‘one size fits all’ is not viable due to the fact that different countries have different institutional and regulatory frameworks.

Lack of Islamic Monetary Policies

At the macro level, the availability of Islamic monetary instruments is indispensable to support the macroeconomic objectives of the Islamic financial system. Another important element of such an instrument is for the purpose of liquidity management. Some countries have initiated the creation of such instruments, such as Indonesia and Malaysia. However, more efforts need to be undertaken to allow inter-jurisdictional transactions and liquidity management between countries implementing the interest-free financial system.

Financial Inclusion Gap

Financial inclusion is a concept that gained importance since the early 2000s, which initially referred to the delivery of financial services to low-income segments of the society at affordable costs. However, distinct features which characterise the concept of financial inclusion from an Islamic perspective are two-fold a) the notions of risk-sharing, and b) redistribution of wealth (Mohieldin et al, 2012).

Although there is a strong demand for Islamic microfinance services in the OIC countries, it is, nevertheless not met by the supply. A study by Mohieldin et al. (2010) shows that although OIC countries have more microfinance deposits and accounts per thousand adults as compared to the non-OIC countries, the values of MFI deposits and loans as percentage of GDP are still much lower in OIC countries (0.61% and 0.79%) compared with the developing countries (0.78% and 0.97%) and low-income countries (0.92% and 1.19%).

The gap of microfinance in OIC is not only demonstrated by its limited scope, but also by the lack of regulation in OIC countries compared to other developing countries. In MENA region for example, only Egypt, Morocco, Syria, Tunisia, and Yemen have specific legislation for microfinance institutions.

Disjointed Alignment Between Industry Needs and Educational Provision

The continuing growth and intensified competition among market players in the IsF industry has certainly posed quantitative and qualitative human resource problems for the industry. It does not come as a surprise, therefore, that IsF industry needs more and better-qualified personnel. However, there is a ubiquitous inverse relationship between a growing number of Islamic finance education programmes with the level of absorption of Islamic finance graduates in the job market.

One observatory answer could be as follows: although the IsF industry has expanded its presence across the globe to a large extent, its institutional logic hasn’t fundamentally changed; namely, it is still essentially a debt-creating institution rather than an equity-based stimulating institution, which implies that the skillset and manpower required to manage such debt-creating institutions, consequently, are not fundamentally different than the required skillsets to manage the conventional counterparts.

In other words, the need for having Islamic finance specialists, who are well versed in Islamic economics and Shari’a-related contractual matters, governance, and fiqh-based financial engineering are not necessarily relevant. Most of the personnel of the banks and capital markets are just obligated to execute what has been prescribed by the verdict of the respective Shari’a boards.

Perceptions About Islamic Finance

Many still think that Islamic finance is basically an industry designed by Muslims and offered solely to the Muslim markets. Although it appears to be partially the case, nonetheless, the key spirit of Islamic finance is totally a lot more profound than what has been stated. As a matter of fact, take an example of the prohibition of interest; it is shared with Judaism and Christianity. It is also interesting to note that charging interest is also prohibited in Buddhism, Hinduism, and many other faiths and philosophies. In addition to the above factors, listed below are some additional reasons why Islamic finance is lagging behind the traditional finance industry:

- Lack of awareness and knowledge of Islamic finance even amongst Muslims;

- Lack of trust amongst Muslims as regards authenticity of Islamic financial products that follow narrow objective of mere Shari’a compliancy;

- Hesitancy to adopt new technology and digitalisation by some Islamic banks who are stuck with the legacy systems and technology;

- Lack of access to capital for small and medium-size companies that are looking to raise funds in a Shari’a-compliant way, to grow their business; and

- Many people believe, for various reasons, that IsBF is not completely interest-free (or riba-free)!

What is/should be deemed as riba/interest-free?

To explicate this point, we must start with an example. Suppose there are two banks/ institutions in a market. One (Bank A) charges its borrowers with interest. The other (Bank B) claims to be interest-free. What would a layman think about the latter bank?

Most of the readers should assume that the layman would take the claim of Bank B to mean that it would offer interest-free loans. This perception is important because if Bank B does not offer interest-free loans, the person in need of money may not find existence of such a bank of any particular use.

Islamic banks offer financing for various activities, against a return (in the form of rent in case of ijara-based products, or profit in case of murabaha-based products). These are recognised forms of earning return in Islam. However, most Muslims do not feel comfortable with the determination of rent or profit by an index or benchmark related with interest rate. Contemporary Shari’a scholarship allows such benchmarking, which has resulted in amazing similarities between the end results of conventional and Islamic financial products. Many critics, therefore, would assert that Islamic banking remains interest-based, a claim strongly and vehemently refuted and rebutted by advocates and practitioners of IsBF.

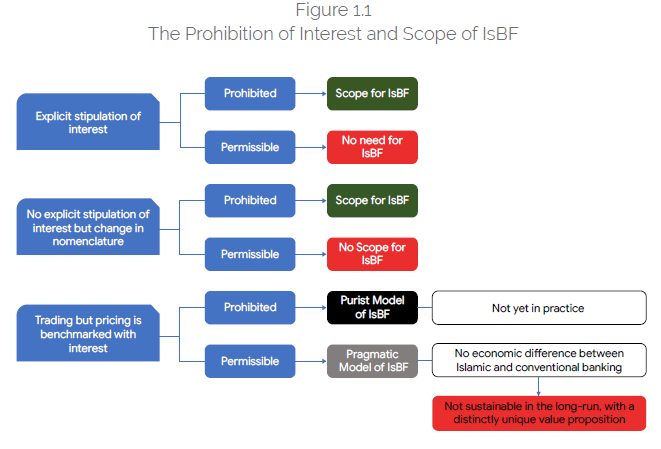

Irrespective of the two opposing views, one must ask the following basic questions before giving a verdict on what constitutes riba/interest.

- Should a practice/contract be deemed interest-based if it explicitly stipulates interest?

- If a contract explicitly stipulates interest, would it fall under the prohibition of riba?

- Should a practice/contract be considered interest-based if it doesn’t explicitly stipulate interest but refers to it with another name, like ‘benefit,’ ‘mark-up,’ or ‘return’?

- If a practice uses a Shari’a-compliant contract involving sale/purchase of a permissible item that is priced with reference to interest rate or something equivalent?

- Should we accept it permissible if a practice uses an interest-based contract, which offers mutual benefits to the transacting parties?

These are interesting questions that must lead to meaningful conclusions. Figure 1.1 answers the above questions. If the prohibition of interest is rejected, there is no scope for IsBF. The raison d’etre of the existence of IsBF is the prohibition of interest. Hence, it is absolutely imperative to accept the prohibition of interest in letter and spirit. This implies, among other things, to create a unique value proposition of IsBF completely independent of the conventional interest-based banking and finance. Failing to do so will result in IsBF not sustaining itself in the long-run. This implies that not only interest but anything similar to interest, or something that leads to the socio-economic effects of interest, should also be rejected even if it is permissible on purely technical juristic grounds.

The raison d’etre of the existence of IsBF is the prohibition of interest. Hence, it is absolutely imperative to accept the prohibition of interest in letter and spirit. This implies, among other things, to create a unique value proposition of IsBF completely independent of the conventional interest-based banking and finance. Failing to do so will result in IsBF not sustaining itself in the long run.

This should also mean that any practice/contract that explicitly uses interest is nothing but interest, and that any contract that carries the ill-effects of interest and retains its characteristics must also not be deemed completely riba-free. Interest is the amount charged for providing money to someone with no/insufficient funds to let them have access to an (economic) activity.

For example, someone needs to pay the school fee for their child but doesn’t have enough money to do so. This person may borrow from someone to pay the fee and the lender charges them a sum on the amount borrowed. In modern times, the money could be borrowed from a bank: (1) in the form of an overdraft facility; (2) by using a credit card; or (3) as a personal loan. There are some non-bank finance companies (like payday loan companies in the UK) that may lend to such a person. There are some individuals (like friends and family) who may also be called upon to fulfil this need.

Normally, there are no contractual restrictions on how to and on what to spend the money borrowed as an unsecured personal loan, although many lenders would like the borrowers to disclose the purpose. Despite no or limited restrictions on the usage of money, most of the borrowed funds are used to buy goods and services. Hence, they are related with the real economic activity and should not be deemed as purely financial transactions, as argued by many advocates of IsBF.

Both Islamic and conventional banks finance trading activities undertaken by individuals and businesses. Conventional banks do so by way of simply lending money. Islamic banks, however, finance such activities in such a way that they buy, hold (momentarily) and sell goods and services on a profit to the customers in need of cash. The end result of both lending money and financing trades is the same: debt creation and earning return on the loans (interest, in case of conventional banks) and return on the amount used to finance trades (profit, in case of Islamic banks). Given the similar pricing and almost exactly the same end results in both cases, no wonder many observers find it difficult to differentiate between the two.

SIZE AND GROWTH OF THE GLOBAL ISLAMIC FINANCIAL SERVICES

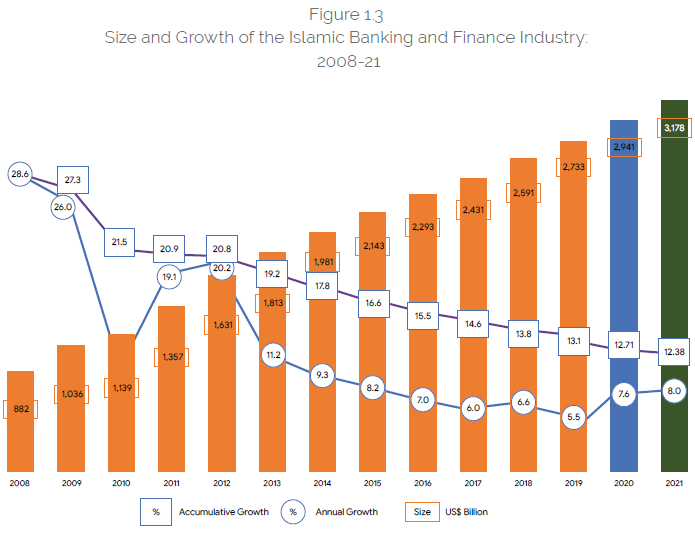

The global Islamic financial services industry surpassed the historical milestone of US$3 trillion at the end of 2021, reaching US$3.178 trillion, exhibiting annual growth of 8.06% (see Table 1.1), which is also the highest annual increase in the last 6 years. This is interesting, as the industry managed to pull up the growth rate from the 2018 growth of 5.48% to 8.06% by the end of 2021, despite the international restrictions on mobility and national lockdowns of economies. This establishes the fact that the pandemic has not affected the industry unfavourably.

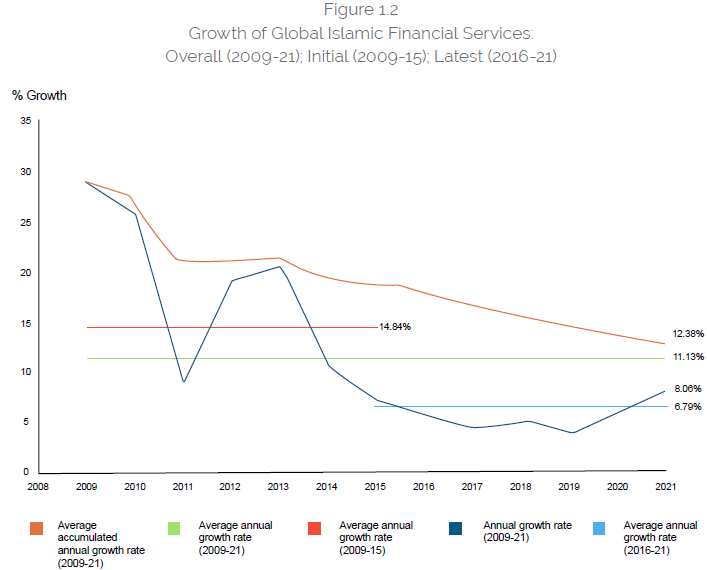

With this renewed confidence in IsBF, it is perhaps the best time to suggest a future path for the industry, with an aim to make it all-inclusive – a financial system relevant to all and not merely to Muslims. In this respect, the role of technology cannot be overemphasised. Figure 1.2 and 1.3 depict an interesting story. Since 2019, the global Islamic financial services industry has on average grown by 11.13% per annum, which itself seems impressive. However, the major contribution to it has come from the earlier years (2009-15 when the average growth was 14.84% per annum). However, the industry has significantly slowed down in the last five years, achieving only 6.79% annually. Is it something to worry about? We have stated above that the previous editions of GIFR have reported various reasons for the slowdown in the growth.

The pandemic has not affected the industry unfavourably

The good news is that there are greater prospects of growth, presented by an increased focus on FinTech and through it on financial inclusion. Despite having become visible segments of financial services sectors in a number of countries, IsBF has yet to become a dominant force in most of the countries where it exists with a degree of significance. Looking at the Islamic financial sectors of the countries comprising the Gulf Cooperation Council (GCC), we find that IsBF in these countries has yet to surpass 50% market share in the region excluding Saudi Arabia. Global Islamic financial services industry is segmented into:

- Islamic banking: Fully-fledged Islamic banks and Islamic windows of conventional banks;

- Islamic capital market: Sukuk and Islamic asset management;

- Takaful and retakaful;

- Islamic microfinance; and

- Others: miscellaneous activities including Islamic financial technology firms (Islamic FinTech)

Table 1.1 The Global Islamic Financial Services Industry: Size & Growth

| AUM (US$ Billion) | Growth (Annual %) | Average Accumulative Growth (%) | |

| 2007 | 639 | ||

| 2008 | 822 | 28.64 | 28.64 |

| 2009 | 1,036 | 26.03 | 27.34 |

| 2010 | 1,139 | 9.94 | 21.54 |

| 2011 | 1,357 | ||

| 2012 | 1,631 | 20.19 | 20.79 |

| 2013 | 1,813 | 11.16 | 19.18 |

| 2014 | 1,981 | 9.27 | 17.77 |

| 2015 | 2,143 | 8.18 | 16.57 |

| 2016 | 2,293 | 7.00 | 15.51 |

| 2017 | 2,431 | 6.02 | 14.56 |

| 2018 | 2,591 | 6.58 | 13.83 |

| 2019 | 2,733 | 5.48 | 13.14 |

| 2020 | 2,941 | 7.61 | 12.71 |

| 2021 | 3,178 | 8.06 | 12.38 |

| Average growth (2009-21) | 11.13 | ||

| Average growth (2009-15) | 14.84 | ||

| Average growth (2016-21) | 6.79 |

Which segment has contributed most to the growth of global Islamic AUM?

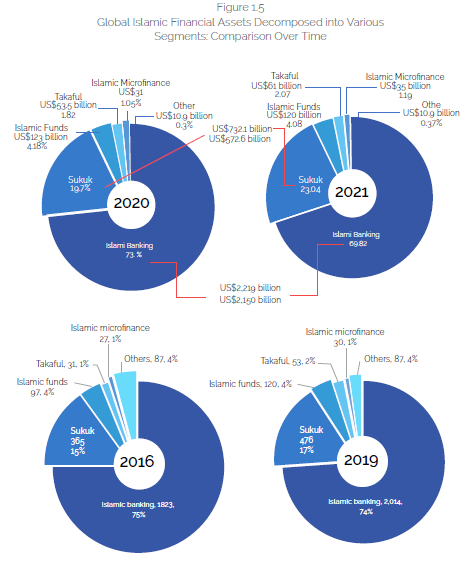

Interestingly, the industry grew more in 2020 and 2021 (during the pandemic) than immediately before the advent of COVID-19. The Islamic capital markets continued to contribute to the growth of Islamic financial assets during 2021, particularly sukuk issuance remained resilient to the pandemic. Improvement in reporting of IsBF in a number of countries (e.g., Indonesia and Pakistan) has contributed to visible increase in share of Islamic capital markets in the global Islamic. The value of sukuk outstanding at the end of 2021 was noted to be US$732.1 billion, up from US$572.6 billion reported for 2019 in GIFR 2020. This has also resulted in the share of sukuk in the global Islamic AUM from 19.47% at the end of 2020 to 24.89% at the end of 2021.

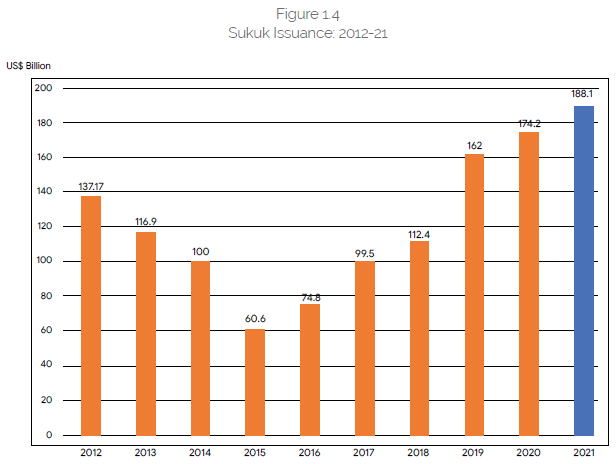

The sukuk issuance experienced another bumper year, following the record volume of issuance in 2020 (US$174.2 billion), making a new record of annual issuance of US$188.1 billion in 2021. This was followed by Islamic banking assets, which totalled US$2,219 billion at the end of 2021 and contributed slightly less than 70% to the global Islamic AUM. Figure 1.4 also shows that the shares of Islamic asset management, takaful and Islamic microfinance remain low or negligible.

While sukuk continue to capture a greater share in the global Islamic AUM, and hence growing importance in the industry, some concrete measures must be taken to grow other sectors. Islamic social finance is a perfect fit in the present environment where there is growing emphasis on social responsibility. GIFR 2020 focused on this aspect, and this year’s theme of the report – Islamic Finance and Futurism – attempts to re-emphasise this point.

How may Islamic Finance be Different after COVID-19?

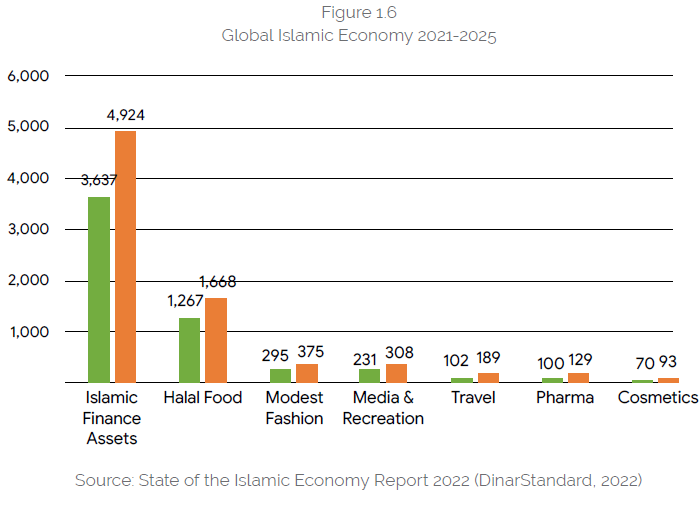

Despite the continued uncertainty related to the COVID-19 pandemic and other factors like the ongoing Ukraine conflict, the global Muslim spending in 2022 is forecasted to grow by 9.1% for the Islamic economy sectors.

All related Islamic economy sectors, except travel, returned to pre-pandemic spending levels by the end of 2021. The Muslim spend is forecasted to reach US$2.8 trillion by 2025 at a four-year Cumulative Annual Growth Rate (CAGR) of 7.5%. Specifically, Islamic finance assets are estimated to have grown to US$3.178 trillion by the end of 2021, up 8.06% (as stated above), from US$2.941 trillion in 2020 (GIFR, 2021). The summary of the overall global Islamic economy, of which Islamic banking and finance is a sub-set, for 2021-2025 is shown in Figure 1.6. We have also updated our own estimates for growth of global Islamic financial assets (see Chapter 1). In terms of the Islamic finance assets distribution in 2021, about 69.82% (US$2,219 billion) is under the Islamic banking sector, followed by 23.04% (USD732.1 billion) under sukuk, and all other sectors still contributing marginally to the global Islamic financial services industry (as stated earlier in this chapter).

The global Islamic finance ecosystem comprises approximately around 1600 IsFIs around the world. Nearly 50 countries in the world (included in our IFCI ranking, as listed in Chapter 2) have established the Islamic finance regulation. Besides, about 1,008 Islamic finance education providers have so far produced 2,878 research papers related to Islamic finance8. Moreover, there are about 1,235 Shari’a scholars representing IsFIs throughout the world and these IsFIs have spent about US$1.28 billion on CSR. Lastly, about 844 Islamic finance events have been organised and more than 11,856 news on Islamic finance had been released.

Incoherent Communications Emanating from Varying Degree of Preferences among Key Stakeholders in Islamic Finance

Why there seems to be a different tone, “language” or even ways of communications among the stakeholders in Islamic financial services industry (IsFSI)?

In order to address this matter, let us, first of all, revisit how the preferences of stakeholders in IsFSI have evolved over time.

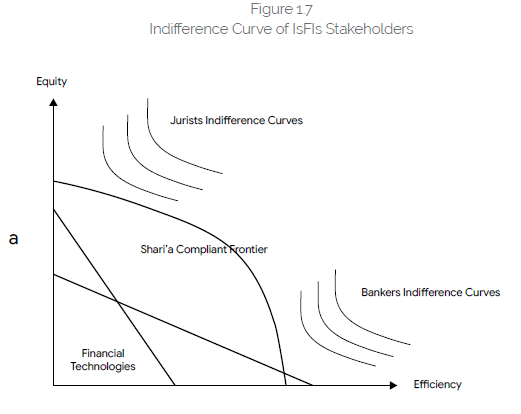

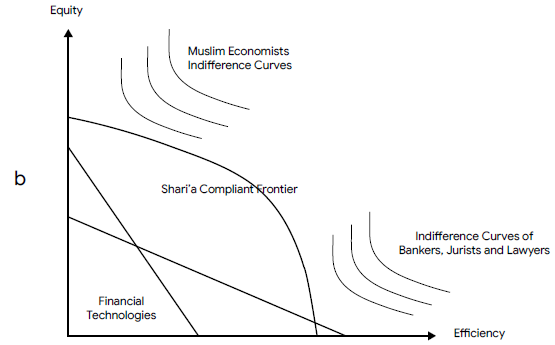

Using a microeconomic analysis, as shown in Figure 1.7, the indifference curves of fuqaha (jurists) are assumed to be geared towards equity relative to the weight given to considerations of economic efficiency. El Gamal contends that such indifference curves by jurists are based on the manifestations of their understanding of the objectives of Islamic law.

In contrast, it is assumed that the preferences of bankers are more biased toward considerations of efficiency relative to those of Islamic jurists. Hence, the latter preferences are drawn more vertical than the former. The nature of different preferences between jurists and bankers are clearly depicted in Figure 1.7 which shows two axes, labeled “efficiency” and “equity”, reflecting the trade-offs in any economic system between efficiency (the size of the economic pie to be shared by economic agents) and equity (how justly, and how equally, the pie shares are determined).

Another element in Figures 1.7a and 1.7b is financial technologies that render certain types of contracts and transactions feasible. Each technology allows for linear trade-offs between efficiency and equity by simply allowing for redistribution schemes. The Shari’a boundary, namely Shari’a Compliant Frontier is drawn as a convex set. This is to signify the Islamically permissible set of allocations within the frontier.

While El-Gamal’s analysis was insightful at the time, such a delineation may no longer reflect the current preferences of IFSI stakeholders. We would argue that the jurists have become more pragmatic in their approach; therefore, their indifference curves, we believe, have shifted towards more efficiency (see Figure 1.7b).

What makes things more interesting now is that the bulk of indifference curves located at the Southeast region of Figure 1.7b do not only correspond to jurists, but also to denote the preferences of bankers and lawyers.

The explanation is very simple and straightforward: the bankers need Shari’a scholars (who also are the employees of the banks) to endorse their products. Subsequently they will need lawyers to make the products legal and to be offered in the market.

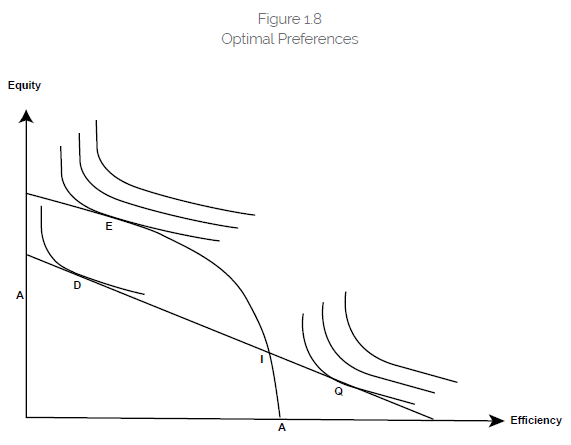

Moreover, since financial technology has evolved in response to the secular financial needs of economies worldwide, it tends to cater to the banker, jurists and lawyers’ preferences, thus producing the status quo tangency point Q, in the Southeast part of the figure, which affords society a high level of economic efficiency, at the expense of low levels of equity (see Figure 1.8).

The Muslim economists, in contrast, who are now known as being more concerned about the realisation of OS aims to describe and analyse the point that is optimal to Islamic economics and finance, that is the tangency point E in the Northwest region (shown in Figure 1.8).

Nonetheless, recognising the difficulties surrounding the development of a financial technology that passes through the ideal point E, Muslim economists may compromise by turning to point D, at which the preferences are maximized subject to the current financial technology constraints; although this point can easily be viewed as socially inefficient.

Point I, located at the intersection of the current financial technology and the permissibility frontier, is perhaps closer to the current reality of IsFSI, as it may be relatively easy to accomplish. This is due to the increasingly prominent role of Shari’a scholars in driving the era of Islamic financial engineering.

Given the above, it is rather obvious now that coherent initiatives in the development communications have to be solidly put in place to ensure that – sharing of the knowledge aimed at reaching a consensus for action that takes into account the interests, needs and capacities of all concerned stakeholders – can be well aligned.

Islamic Finance’s Outlook

Many are of the view that the industrialisation of Islamic finance commenced with an establishment of Islamic banks in the mid-1970s. In the earlier stage, the operationalization of Islamic banks was underpinned by the principle of two-tier mudaraba; that is on the liabilities side of the balance sheet, the depositor would be the financier and the bank the entrepreneur; and on the assets side, the bank would be the financier and the person seeking funding the entrepreneur.

Currently, however, the bulk of assets and liabilities are predominantly inhabited by murabaha modes of finance. Following ‘a four-stage evolution, that is composed of four distinct phases: 1) the early years (1975-1991); 2) the era of globalization (1991-2001); 3) the post-September 11, 2001 period; and 4) an era after the 2008 global financial crisis.

The Shifting Look of Islamic Finance

Nowadays, innovations are characterised by the use of artificial intelligence (AI), FinTech, and internet of things (IoT), or collectively known as the Fourth Industrial Revolution; Islamic finance is encountered with situations, where such innovations are creating substantial displacements in industry and employment in major economies around the globe.

It is imperative, therefore, that Islamic finance has no other choice but to evolve. Furthermore, there is also a genuine demand and opportunity to redirect innovations towards services and products that create more economic opportunities, jobs and financial inclusion for those who have been on the sidelines of the Islamic finance revolution. Coincidentally, we are witnessing the propagation of Environmental, Social and Governance (ESG) discourse, which refers to the three central factors in measuring the sustainability and ethical impact of an investment in a company or business; combined with the proliferation of the immense potential of Islamic social finance.

A change of the look and direction in the industry is needed. Malaysia’s movement of Value-Based Intermediation (VBI) in Islamic finance can be considered as evidence of such a change. Another one is the issuance of Khazanah sustainable and responsible investment (SRI) sukuk.

Waqf-linked sukuk is another breakthrough championed by the Ministry of Finance Indonesia in partnership with Badan Wakaf Indonesia (BWI) and Bank Indonesia.

It is becoming apparent that the change now is no longer driven by an entirely profit geared motive; rather it emphasises upon creating social and environmental impact. In other words, it is perhaps a subliminal recognition that the deviations caused by the operations of Islamic finance in relation to the expected or aspired paradigmatic knowledge, theory and institutional emergence have to be corrected. One way to do that is, hence, through the introduction of ESG, impact investing and Islamic Social Finance (IsSF).

COVID-19’s Impact on Islamic Finance

Growing anticipation of a cyclical economic downturn accelerated by the impact of COVID-19 has worsened credit quality and limited funding, placing greater pressure on the liquidity of financial institutions, particularly banks. Islamic banks are no exception since they all operate within the same financial ecosystem as their conventional counterparts.

Prior to the COVID-19 pandemic though, the progress of Islamic banks had continued unabated, and could now be humbled in the aftermath of the pandemic. Although Islamic banks are not exactly in the business of lending and borrowing money, they are essentially deposit-taking entities that extend financing to deficit units, yielding returns or margins as a result. In the current climate, the Islamic banking sector could see declining margins, along with a slow financing growth and more problem assets – which combined – are likely to weaken banks’ profitability. If Islamic banks see liquidity dry up, they will struggle to support financing as a result. On a larger scale, Islamic banks, Islamic financial markets and Islamic money markets contribute to providing the financial fuel of the economy. Normally, credit is sustained by the optimistic promise of growth. When credit dissolves, the market subsequently faces a self-reinforcing cycle of collapsing confidence, contracting credit, unemployment and bankruptcy, all of which spread a cloud of pessimism.

Will COVID-19 Remodel Islamic Finance?

It is perhaps rather premature to provide an affirmative answer as of now. However, there are five dimensions that can possibly play a role in reshaping Islamic finance post-COVID-19.

Social norms and values may evolve

We are likely to observe an entirely different perception about life in general, in which social, economic and financial interactions are parts of the whole spectrum. The pandemic has taught us the novelty of compassion, shared solidarity and shared prosperity, irrespective of nationality, ethnic backgrounds and religions. A heavy reliance on the traditional model of finance and financial system which has resulted in what El-Erian calls inequality trifecta — inequality of income, wealth, and opportunity – needs a reality check. This could ignite the global community to question the relevance of the existing institutional set up of financial intermediaries. If so, this can also consequently challenge the existence of institutions supporting the financial industry, such as Basel, IOSCO, IFSB, and IIFM, amongst others.

Methods of business activities may change

As the social interaction may shift to a new equilibrium, coupled with the pervasiveness of digitalization, the way of doing business, work methodologies and financial dealings may drastically change too. The automation of various processes is inevitable. For Islamic financial transactions, this will surely pose a new territory of challenge. Traditional fiqh rulings may be challenged as a result.

New classification of assets may likely emerge

What constitutes an asset may be revisited. A different characterisation of an asset being fungible and non-fungibles, or a different method in distinguishing a physical asset from a financial asset is a sheer possibility. If this materialises, the set of Shari’a parameters as guiding principles for Shari’a-compliant products will shift to a new equilibrium. Consequently, the building blocks of contracts and landscape of Islamic financial transactions are expected to be different than what we have now.

The birth of new global currency is not to be ruled out

The recent hype of cryptocurrency and the use of Blockchain technology over the past few years, coupled with an increasing prominence of digital economy – should not go unnoticed. In the literature of classic jurisprudence, what the modern society calls now as money was at the time termed as nuqud or ‘umla. While nuqud refers to the money being widely accepted by a large society, the specific meaning of ‘umla is a type of currency that is only valid in a certain jurisdiction, and may not be widely accepted. Going forward, the survival of fiat money still remains to be seen.

Moving from globalisation to regionalisation

The pandemic has unraveled the world’s precarious dependence on China, as it controls one-third share of global supply chains. This can trigger a massive restructuring as production and sourcing move closer to end users and companies localise or regionalise their supply chains. And in the context of Islamic finance and the halal industry, this can pave the way for effective realisation of South-South cooperation among OIC member countries.

Strategy to Bring about the Expected Social Change

Islamic finance has become the mainstream system of financial intermediation which has evolved over the past five decades. After going through a four-stage evolution, the industry has become a real force in some countries’ financial system.

Nevertheless, considering the initial expectation and aspiration on the industry, that it would internalise the social dimension and social justice into its own operational framework, may not materialize fully. Hence, we are witnessing the altering look of the industry, which is more inclusive and aligned with the issues of community banking, microfinance, socially responsible investment, and the like. The role of the Islamic financial industry in supporting the global development agenda will depend on the extent to which stakeholders can influence its direction. The industry has been driven predominantly by supply-side factors and considerations and demand for it dominated by the household sector, with other sectors, such as institutional investors, corporations and governments, showing varying degrees of interest.

There are important factors on the demand side that are likely to change the dynamics of Islamic finance and could link it more profoundly to the SDGs, especially if one of the most distinctive characteristics of Islamic finance – backing financial transactions by real economic activities – is fully operationalized.

Some important demand-side factors include the recent rise in demand for Islamic finance products by enterprises across sectors and sizes, as well as the growing demand by sovereign and quasi-sovereign entities for long-term finance based on Islamic principles. It is worth mentioning that a more effective role for Islamic finance in the implementation of the SDGs would require the supply of an innovative mix of products, adequate governance of Islamic finance intermediaries, and a supportive legal and regulatory framework.

Based on the experience with the MDGs and given the requirements of Islamic finance instruments for better ex-ante and ex-post understanding and scrutiny of transactions, the need for high-quality data cannot be overemphasized. Islamic finance principles support socially inclusive, environment-friendly and development-promoting activities. However, in practice, the industry’s contribution to these objectives has been below its potential. And even though it has been growing, its global share remains small, even in Muslim countries. Practical measures are required to enhance the contribution of the Islamic financial sector to achieve the SDGs.

The five tracks through which Islamic finance could support efforts to achieve the SDGs are: financial stability, financial inclusion, reducing vulnerability, social and environmental activities, and infrastructure finance. Financing for development focuses on four foundational pillars: domestic resource mobilization, better and smarter aid, domestic private finance, and external private finance. In this context, Islamic finance has the potential to play a major role in supporting all four of these pillars. Given the magnitude of the SDGs and the important role that can be played by Islamic finance in supporting their implementation and ensuring more robust and inclusive growth, the opportunity to more closely link Islamic finance with sustainable development cannot be overlooked.